How does it feel witnessing the rare strong increase in stainless steel prices? From the ore end, LME nickel still processes a great effect on the stainless steel price trend. Rumor has it that China is going to buy the raw material in large quantities and store it for the state. This led to speculation that nickel could become scarce overall. LME Nickel Hits 7-Month High, pushing up the stainless steel futures and spots prices to grow. Besides, from the perspective of demand, the global manufacturers give us some positive signs—— that the global manufacturing index increased and remained above 50% in the first quarter of 2024. Is that an indicator of recovering demand in the world? As the world manufacturing industries are recovering, it is hopeful that the demand for raw materials will rise, and so will the macro commodities. Chinese stainless steel mills are seeking to prop up the market prices. In the short term, the stainless steel spot prices trend to remain and have a petite rise. It is vital to keep up with the dynamics when the market is changing quickly. It will be helpful for you to have a quick and thorough understanding of the market, please keep scrolling to out Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,145 | 29 | 1.47% |

| Foshan | 2,185 | 29 | 1.44% | ||

| Hongwang | Wuxi | 2,060 | 33 | 1.75% | |

| Foshan | 2,055 | 31 | 1.61% | ||

| 304/NO.1 | ESS | Wuxi | 1,990 | 35 | 1.89% |

| Foshan | 1,980 | 28 | 1.52% | ||

| 316L/2B | TISCO | Wuxi | 3,585 | 84 | 2.48% |

| Foshan | 3,660 | 70 | 2.01% | ||

| 316L/NO.1 | ESS | Wuxi | 3,475 | 114 | 3.53% |

| Foshan | 3,475 | 84 | 2.56% | ||

| 201J1/2B | Hongwang | Wuxi | 1,380 | 11 | 0.89% |

| Foshan | 1,375 | 6 | 0.44% | ||

| J5/2B | Hongwang | Wuxi | 1,295 | 11 | 0.95% |

| Foshan | 1,290 | 6 | 0.48% | ||

| 430/2B | TISCO | Wuxi | 1,230 | -6 | -0.50% |

| Foshan | 1,235 | -7 | 0.62% |

Trend|| Stainless Steel Futures Rise by $65 Per Ton.

Last week, spot prices for stainless steel in the Wuxi market exhibited stability with slight increases across all three series. Prices for the 300 and 200 series rose, while the 400 series remained flat. Positive economic sentiment boosted both futures and spot prices, with the main contract price of stainless steel reaching a yearly high of US$2130/MT before settling at US$2125/MT by last Friday, a 3.37% increase compared to the previous week.

300 Series:

Prices in the 304 market fluctuated upwards throughout the week. By Friday, base prices for private cold-rolled and hot-rolled four-foot plates in Wuxi increased by US$56/MT to US$2040/MT and US$2015/MT, respectively. Tsingshan’s price increase for plates at the beginning of the week boosted market sentiment, leading to improved transactions alongside the rise in futures and spot prices. Steel mills strengthened their pricing stance due to rising raw material prices, prompting active short position replenishment as prices continued to climb.

200 Series:

Spot prices for 201 in the Wuxi market primarily saw slight increases last week. Base prices for J1, cold-rolled J2/J5, and hot-rolled plates all rose by US$7/MT compared to the previous Friday, reaching US$1355/MT, US$1270/MT, and US$1335/MT, respectively. The 201 series closely followed the price increase of the 300 series, maintaining an active trading atmosphere.

400 Series:

Guiding prices for cold-rolled 430 from TISCO and JISCO increased by US$7/MT to US$1465/MT and US$1585/MT, respectively. However, the mainstream quoted price for cold-rolled stainless steel 430 in Wuxi declined by US$7/MT to US$1225/MT to US$1235/MT, while the price of hot-rolled 430 remained unchanged at US$1130/MT.

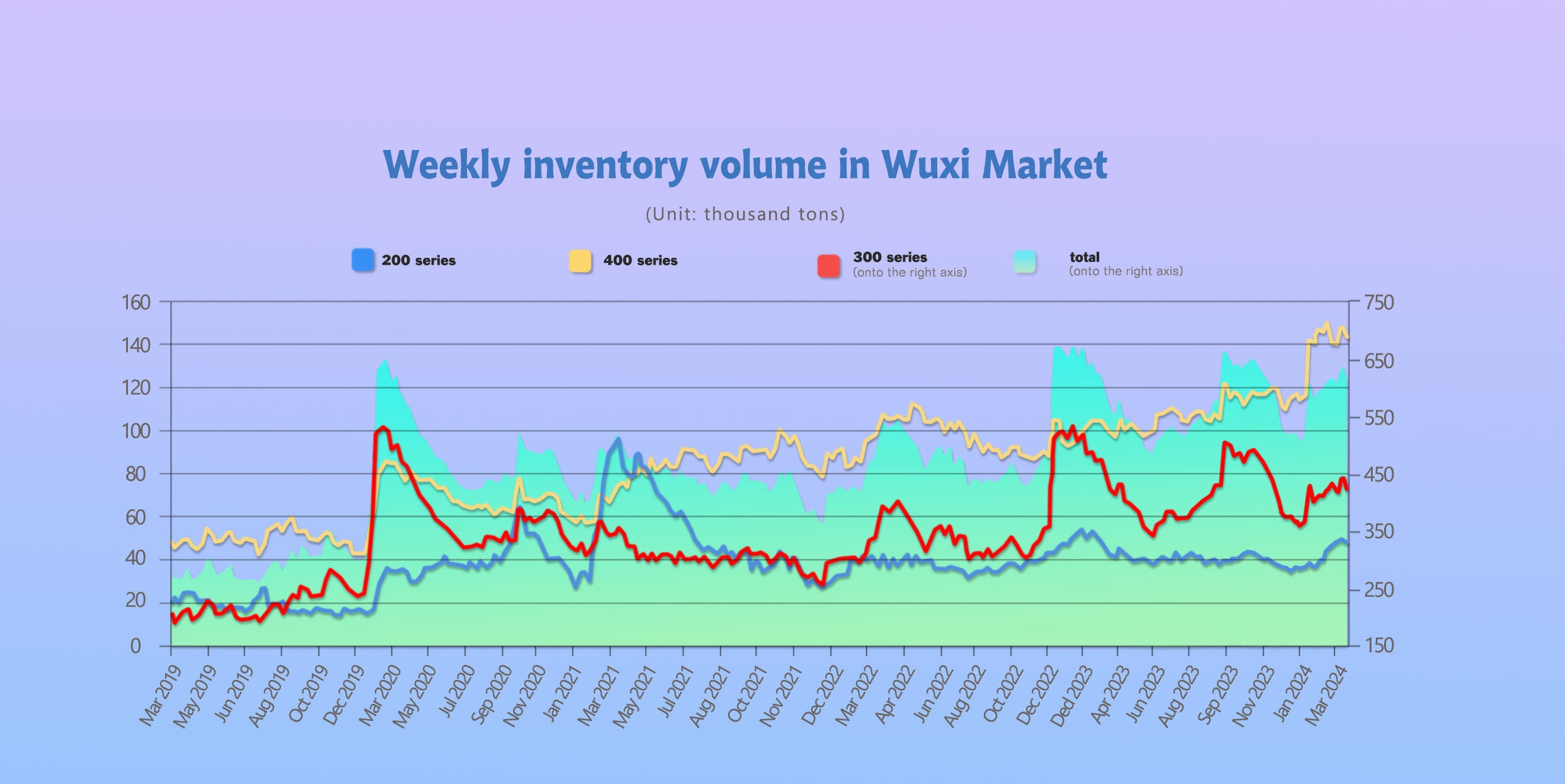

INVENTORY|| Downed by 23,900 tons.

The total inventory at the Wuxi sample warehouse decrease by 23,912 tons to 612,060 tons (as of 18th April).

the breakdown is as followed:

200 series: 1,191 tons down to 48,657 tons,

300 Series: 18,562 tons down to 412,638 tons,

400 series: 4,159 tons down to 142,956 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| April 11th | 48,657 | 440,200 | 147,115 | 635,972 |

| April 18th | 47,466 | 421,638 | 142,956 | 612,060 |

| Difference | -1,191 | -18,562 | -4,159 | -23,912 |

300 Series: Improved Sentiment & Inventory Reduction.

Last week, positive developments boosted both futures and spot prices for 300 series stainless steel. A surge in London nickel prices and overall market sentiment led to a decrease in arrival resources and a significant drop in social inventory. Deliveries from previous orders further aided the decline. With steel mills now profitable due to the improved market conditions, production has decreased in April. As demand recovers, inventory is expected to continue falling in the coming week. Continued monitoring of production levels and market demand is crucial.

200 Series: 12,000 Tons Reduction, First Decrease in 200 Series Inventory.

The 200 series saw its first inventory decrease in 2023. Sanctions on Russian metals triggered a futures price rebound, followed by improved spot market sentiment and transactions. Downstream customers entered the market for fear of missing out on price increases and pre-holiday stocking. This, combined with decreased production plans for April and rising purchase intentions, suggests continued inventory reduction. Short-term spot prices for 201 are likely to trend upwards, with market transactions and future steel mill arrivals being key factors to watch.

400 Series: Profit Reduction to Reduce Inventory.

For the 400 series, both traders offering discounts and steel mills urging settlement led to a decrease in inventory levels. This strategy aimed to clear stock and recover funds.

RAW MATERIAL|| Rumors of China's Nickel Reserve Re-emerge, LME Nickel Hits 7-Month High.

A rumor that made the rounds in Asia on Monday suggested, according to media reports, that the Chinese government could be planning to buy the raw material in large quantities and store it for the state. This led to speculation that nickel could become scarce overall. Prices on the SHFE reacted strongly to the rumors and jumped by more than 6.5% in Monday’s trading and closed well up.

It remains to be seen whether the rumors of government stockpiles in China are actually true. We will continue to monitor this for you over the next few days.

Three-month nickel CMNI3 on the London Metal Exchange (LME) was up 3.7% at $19,250 a metric ton at y 1358 GMT. The metal, used in stainless steel and electric vehicle batteries, earlier hit $19,440, its highest since September.

A nickel industry insider said that they heard Chinese stockpilers are seeking 200,000 tons of NPI. The anonymous source said they do not know how much China will pay or which companies will provide the nickel.

However, two other industry insiders stated that this figure is much lower, with China seeking 20,000 tons of NPI. NPI typically contains about 10% nickel.

The National Food and Strategic Reserves Administration did not immediately respond to requests for comment.

Meanwhile, Indonesia, as the world's largest nickel producer and a major supplier to China, is still reviewing mining quota approval applications and has not issued all permits yet.

High Carbon Ferrochrome: Down by $200/50 basis tons in April, Joint Reduction of Production by 10%.

Since April 2024, the mainstream price of high carbon ferrochrome has been continuously declining at a slow pace, with a cumulative decrease of $28, and the mainstream quotation reaching $1310 per 50 reference tons. In recent days, the production cost of high carbon ferrochrome has increased instead of decreasing. After the first round of price increases of coke completed a rise of $100/ton last week, the second round of price increases has quickly unfolded. Moreover, the electricity prices in Inner Mongolia, the main producing area, have also been adjusted upwards recently, leading to a significant increase in the comprehensive production cost of high chrome. In response to the adverse situation of low product prices in the local ferroalloy industry, the local Ferroalloy Industry Association has decided to implement production restrictions to stabilize prices in the local market. It mentioned that "restricting production and stabilizing prices for association enterprises, reducing production by 10% based on existing production capacity."

SUMMARY|| Short-Term Still Supported: Prices Oscillate Strongly to the Upside.

Recently, stainless steel factory prices have continued to rise. In addition, recent news about nickel iron collection has further stimulated the price increase sentiment for stainless steel and nickel iron. Trading activities in the trading sector have been relatively active, with overall moderate terminal demand. The rise in nickel iron prices has strengthened the cost support for stainless steel. Spot prices have also increased significantly, leading to the recovery of steel mill profits. In the short term, spot prices are passively following the rise, but prices reaching high levels may affect the pace of subsequent stocking. Steel mill production remains at high levels, and the supply-demand imbalance issue still exists. Therefore, it is expected that the market situation will remain relatively strong and volatile in the short term, and attention should continue to be paid to the pre-holiday stocking situation.

300 Series: Last week, the arrival resources decreased compared to the previous period, combined with the realization of some early orders in the terminal, resulting in significant destocking and strong market consumption sentiment. Recently, the trend of strong rebound in futures and spot prices has been evident, with bears actively replenishing positions and downstream actively entering the market for purchases, leading to a very enthusiastic trading atmosphere. It is expected that in the short term, the spot price of cold-rolled 304 will continue to fluctuate with strength. We need to closely monitor the transaction situation and inventory digestion progress after the price rebound.

200 Series: Currently, the overall demand from downstream customers for 201 has not shown a significant increase and remains stable overall. The recent price increase tests the strength of downstream demand. Whether the trend can be maintained depends on market transaction conditions. In the short term, the spot price of cold-rolled 201J2 is expected to fluctuate with strength around $1270-1300 per ton.

400 Series: According to calculations, the current cost of cold-rolled 430 is $1265 per ton, and most steel mills are still in a state of production loss. Steel mills have a strong stance on price increases, but substantial improvement in downstream demand has not yet appeared. Demand recovery is slow, and terminals are still buying on a need basis. It is expected that in the short term, the price of 430 will remain weak and stable.

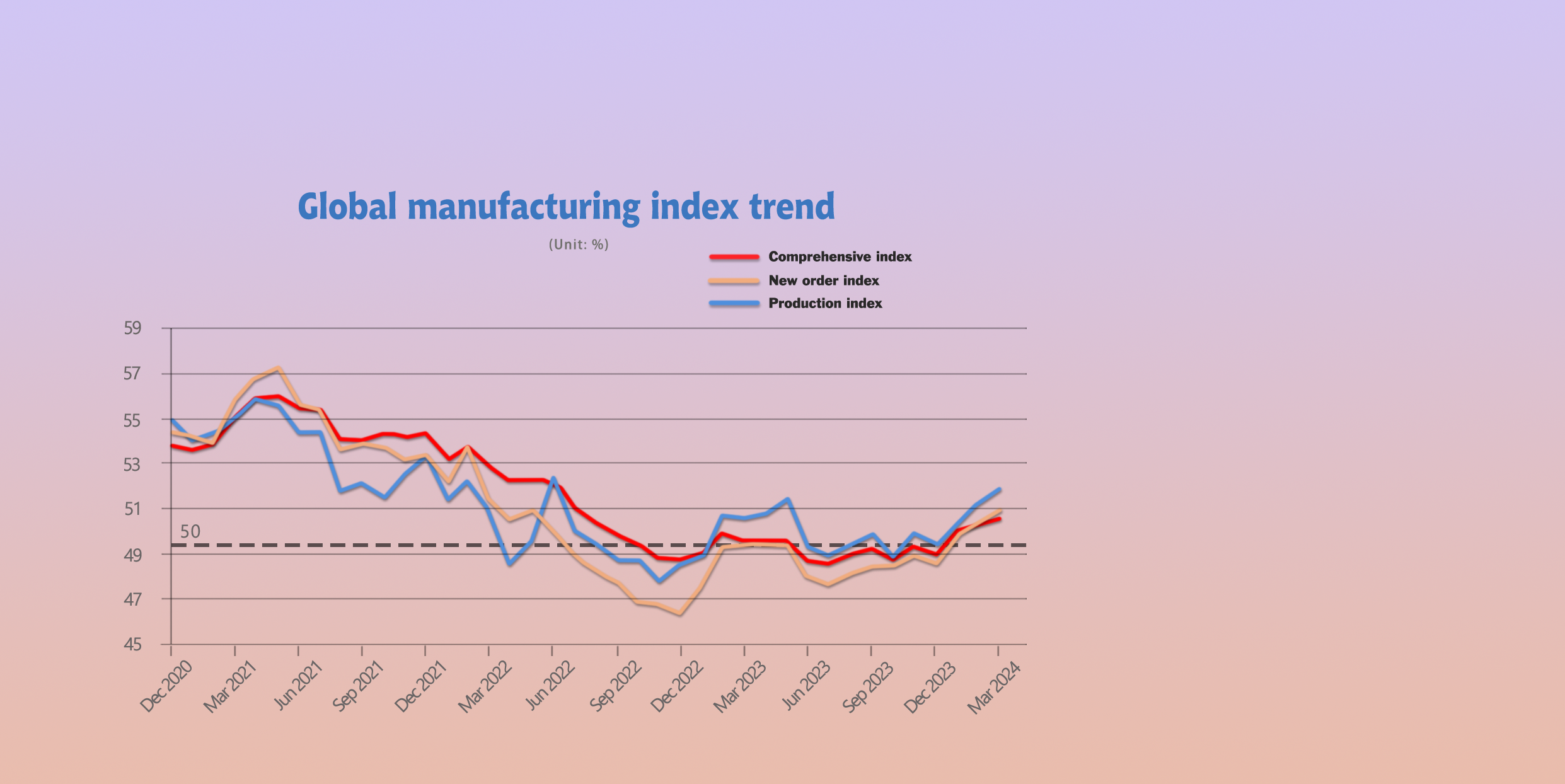

MARCO|| Global Manufacturing Recovery Expected to Drive Demand for Raw Materials, Commodity Prices Poised to Rise.

The comprehensive index of global manufacturing industry in the first 3 months of 2024 was 50, 50.3 and 50.6 respectively, ending the long-term trend below 50 since September 2022 and showing continuous growth throughout the first quarter. From the perspective of sub-indices, the production index jumped above 50 in January and kept rising afterwards; the new order index recovered to above 50 in February with a slight lag, staying above the boom-or-bust line for two consecutive months.

A wave of interest rate cuts is expected globally in 2024, bringing a revival to the manufacturing industry. Emerging economies like Brazil, Mexico, Chile and Peru have already begun the process of lowering interest rates. The Swiss National Bank reduced its interest rate by 25 basis points to 1.50% on March 21st. The president of the European Central Bank (ECB) indicated on April 11th that conditions for a rate cut would be present at the next meeting in June unless inflation unexpectedly rebounds in the spring. The inflation rate in the eurozone was 2.4% in March, and the core inflation rate excluding energy, food and tobacco prices dropped to 2.9%. As the inflation rate in the eurozone has shown a significant decline, approaching the target of 2%, a rate cut in June becomes more likely.

The global manufacturing recovery will lead to an increase in demand for raw materials as companies begin restocking cycles.

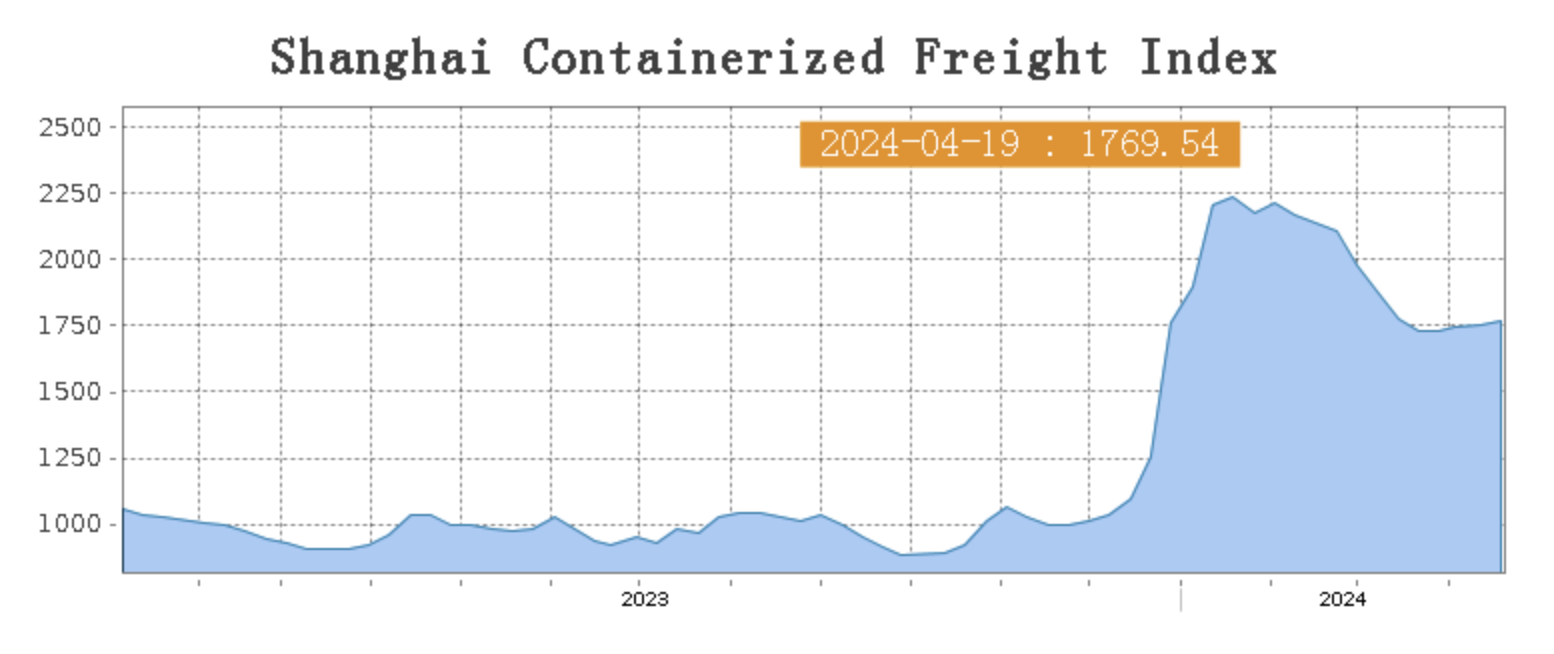

SEA FREIGHT|| Market Generally Stable: South American Routes Increase.

China’s Containerized Freight market continued to be interrupted by the regional fluctuation. On 19th April, the Shanghai Containerized Freight Index rose by 0.7% to 1769.54.

Europe/ Mediterranean:

Since mid-March, freight rates have remained relatively stable, with market cargo volumes staying steady. The supply-demand relationship has remained favorable, with average vessel capacity utilization staying at high levels.

On 19th April, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1971/TEU, which remined stable. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3048/TEU, which surged by 1.3%.

North America:

As we enter the peak season for air cargo contracts, rates have remained generally stable. Last week, cabin utilization rates across flights stayed above 95%, with some flights fully booked. While some airlines had previously announced plans for mid-month rate increases, most have kept their initial pricing unchanged. A few carriers have implemented slight price reductions to attract cargo, leading to a small decline in spot booking rates for certain routes.

On 19th April, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$3175/FEU and US$4071/FEU, reporting a 0.9% and 2.6% slide accordingly.

The Persian Gulf and the Red Sea:

On 19th April, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 0.9% from last week's posted US$2032/TEU.

Australia/ New Zealand:

On 19th April, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$853/TEU, a 3.5% jump from the previous week.

South America:

On 19th April, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$4153/TEU, an 14.5% growth from the previous week.