Stainless Insights in China from June 23rd to June 29th.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 1,990 | -20 | -1.04% |

| Foshan | 2,030 | -20 | -1.02% | ||

| Hongwang | Wuxi | 1,890 | -17 | -0.94% | |

| Foshan | 1,905 | -17 | -0.94% | ||

| 304/NO.1 | ESS | Wuxi | 1,810 | -15 | -0.91% |

| Foshan | 1,830 | -11 | -0.65% | ||

| 316L/2B | TISCO | Wuxi | 3,470 | -34 | -1.00% |

| Foshan | 3,530 | -31 | -0.90% | ||

| 316L/NO.1 | ESS | Wuxi | 3,315 | -56 | -1.73% |

| Foshan | 3,355 | -34 | -1.04% | ||

| 201J1/2B | Hongwang | Wuxi | 1,175 | -6 | -0.53% |

| Foshan | 1,175 | -8 | -0.79% | ||

| J5/2B | Hongwang | Wuxi | 1,065 | -10 | -1.02% |

| Foshan | 1,075 | -8 | -0.89% | ||

| 430/2B | TISCO | Wuxi | 1,135 | -6 | -0.55% |

| Foshan | 1,125 | -6 | -0.55% |

TREND || Tsingshan's Production Cuts Boost Market Sentiment

Last week, stainless steel prices showed a down-then-up trend, with market sentiment swinging sharply between pessimism and optimism. At the beginning of the week, prices continued to decline due to falling raw material prices, weak terminal demand, and trade policy impacts, all of which weighed on market confidence. As expectations of production cuts by steel mills grew, the futures market rebounded, and cost support strengthened, sentiment gradually recovered and prices rebounded from the bottom.

Last week, the main stainless steel futures contract SS2508 hit a low of US$1850/MT and rebounded. As of Friday, June 27, it closed at US$1895/MT, up US$16 from the previous week, a weekly gain of 0.92%.

300 Series: Increased Output Cuts by Tsingshan Eases Supply Pressure

Last week, 304 stainless steel prices saw a slight pullback. As of Friday, the mainstream base price for private 304 cold-rolled four-foot coils in Wuxi was US$1850/MT, down US$14 from last Friday. Private hot-rolled prices were US$1815/MT, unchanged from the previous week.

At the start of the week, Tsingshan lifted price restrictions, and agents reduced prices to destock. Futures prices fell to new lows with increased open interest, triggering panic among end-users and cautious buying, leading to a slight inventory buildup. Later, news of increased production cuts by Tsingshan began to circulate, boosting market sentiment and triggering a price rebound. Agents tested the waters with slight price hikes, and influenced by the typical "buy on the rise, not on the fall" mentality, downstream procurement activity picked up, with some periods seeing improved transactions.

200 Series: Positive Signals Restore Confidence, Prices Rebound

During the week, 201 prices fluctuated.

201J2 cold-rolled: US$1050/MT, up US$7/MT week-on-week.

201J1 cold-rolled: US$1155/MT, up US$14/MT.

201J1 hot-rolled: US$1135/MT, down US$7/MT.

At the start of the week, both spot and futures prices were under pressure, with some 201J2 cold-rolled traders offering as low as US$1025/MT. Following Tuesday’s news of Tsingshan’s production cuts in July, market sentiment improved and low-end quotes rebounded by US$7/MT. On Thursday, the three major 201 mills aligned their pricing for J2 cold and hot-rolled products, which boosted confidence in transactions. Low-priced inventory began to disappear, and downstream procurement turned more active.

400 Series: Spot Inventory Increases Slightly, 430 Prices Continue to Fall

Last week, 430 prices remained weak. In the Wuxi spot market, state-owned 430 cold-rolled was quoted at US$1140/MT, State-owned 430 hot-rolled dropped to US$1050/MT — both down US$7/MT compared to last weekend.

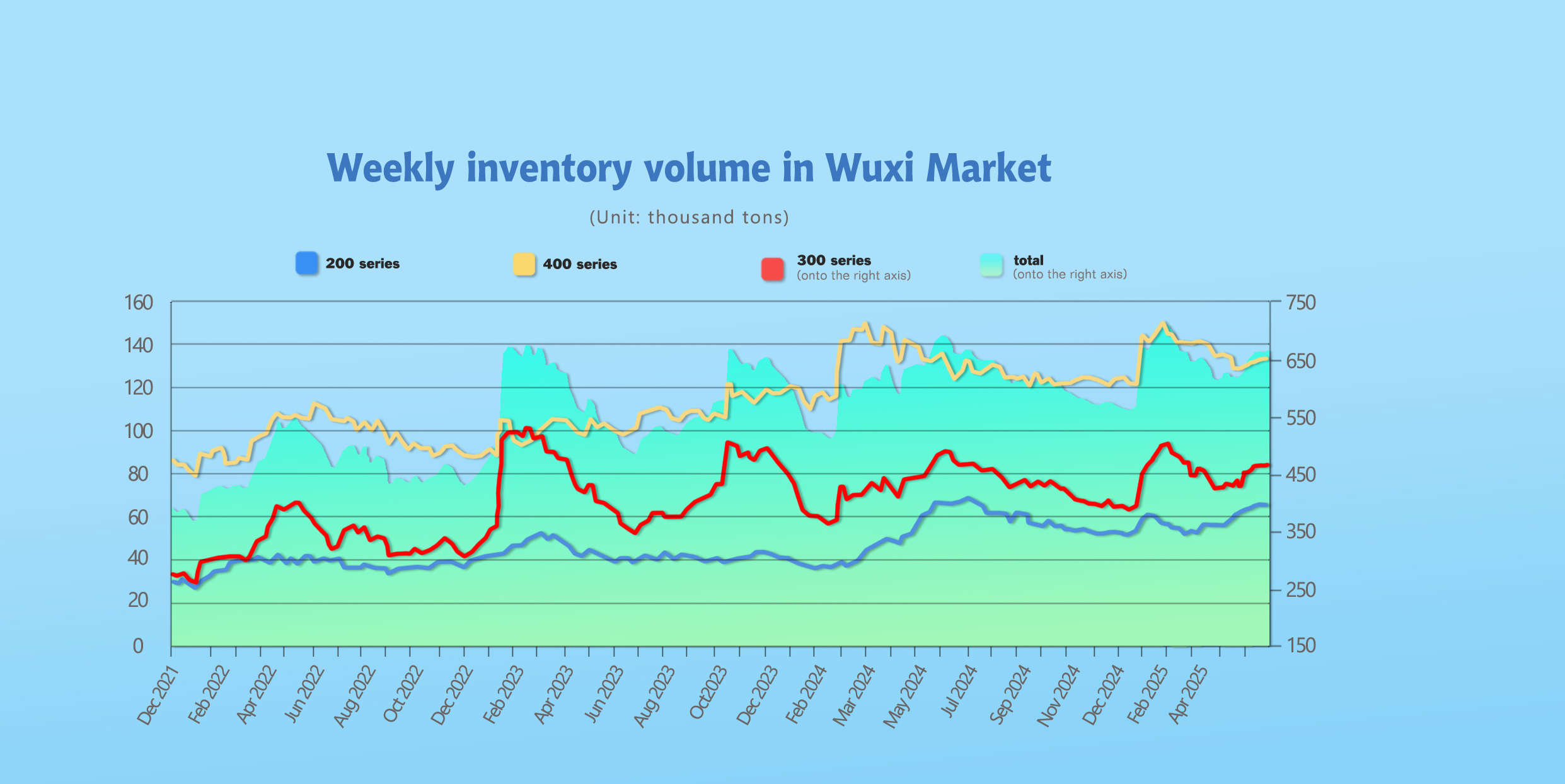

INVENTORY || Ongoing Inventory Buildup

As of June 26th, total inventory in Wuxi sample warehouses increased by 2,647 tons to 663,705 tons. Breakdown:

200 Series: 583 tons up to 65,708 tons.

300 Series: 1,664 tons up to 464,535 tons.

400 Series: 400 tons up to 133,462 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Jun 19th | 65,125 | 462,871 | 133,062 | 661,058 |

| Jun 26th | 65,708 | 464,535 | 133,462 | 663,705 |

| Difference | 583 | 1,664 | 400 | 2,647 |

300 Series: Tsingshan Cuts Production Again, Divergence in Cold and Hot Rolled Inventory

Following a new low in futures prices midweek, a rebound occurred. Tsingshan’s spot prices dropped and then rose, while the spot market showed fluctuating prices. Downstream buyers remained cautious, focusing on essential needs. Low-priced goods were consumed, but higher-priced stock struggled to move, causing a slight overall inventory buildup.

200 Series: Market Arrivals Increase, Prices Rebound from the Bottom

Although 201 prices rebounded from low levels and downstream sentiment improved somewhat, the market still faces significant destocking pressure. Steel mills have announced July production cut plans, which should reduce future supply. A slight inventory drawdown is expected next week, depending on transaction performance.

400 Series: Cost Support Weakens, Sluggish Demand Leads to Inventory Buildup

Key factor: continued deliveries from mills and some increase in downstream demand. However, the net effect was a slight inventory increase in spot markets overall.

On June 20, the World Stainless Association released global crude stainless steel production data for the first quarter of 2025. The data shows that global stainless steel output reached 15.547 million tons, representing a 6.2% year-on-year increase but a 6% decrease from the previous quarter.

Breakdown by region:

China: 9.624 million tons, up 11.2% YoY, down 10.4% QoQ

Europe: 1.608 million tons, up 2.9% YoY, up 15.4% QoQ

Americas: 553,000 tons, up 8.6% YoY, up 25.4% QoQ

Asia (excluding China and South Korea): 1.78 million tons, down 3.3% YoY, down 7.7% QoQ

Others (Brazil, Russia, South Africa, South Korea, Indonesia): 1.982 million tons, down 4.5% YoY, down 3% QoQ

RAW MATERIALS || Stainless Steel Prices Near Cost Line, Strengthening Cost Support

Tsingshan has announced its July long-term purchase price for high-carbon ferrochrome, holding steady at US$1138/50 reference ton (tax-included, cash price to factory), which provides support for the ferrochrome market.

Last week, nickel prices on the London Metal Exchange (LME) fluctuated but closed higher:

Opening: $15,070

High: $15,270

Low: $14,780

Close: $15,160

Weekly gain: 0.66%

Meanwhile, high-nickel pig iron (NPI) ex-factory prices continued to decline, quoted at US$129.4/nickel point as of Thursday, down US$2.1 from the previous week. Early in the week, Tsingshan purchased tens of thousands of tons of NPI at US$128/nickel point (tax-included, warehouse bottom) — US$4.2 lower than the previous round.

On the supply side:

Nickel ore prices remain firm, but Chinese NPI producers are seeing worsening losses, keeping production at low levels.

Indonesian nickel ore premiums remain high, offering strong cost support.

Some local plants have already begun to cut production due to losses.

At the start of the week, stainless steel prices fell sharply, dragging down NPI prices.

However, as mills announced production cuts and increased spot quotes, stainless steel prices stabilized and rebounded.

For now, demand for raw materials from mills is weak, NPI market transactions are light, and prices are expected to remain weak but stable in the short term.

SUMMARY || Output Cuts Aimed at Easing High Inventory Pressure

Last week, spot stainless steel prices remained relatively firm, while raw material prices saw slight declines.

Although steel mill production schedules have declined somewhat, they still remain at high levels, and the oversupply situation is hard to reverse.

Demand-side procurement remains cautious, and while there is adequate availability in the spot market, inventories remain high despite slight destocking.

Warehouse warrant volume continues to decline.

Currently, the market is focused on production cuts by steel mills. Moving forward, attention should be paid to the pace of destocking and the recovery of demand and production planning. The stainless steel market is expected to remain volatile.

300 Series: Production of 300-series stainless steel has slightly decreased.

Tsingshan has intensified production cuts due to high inventory, which helps relieve supply-side pressure.

On the demand side, downstream buying has picked up slightly as prices rebounded, helping accelerate inventory digestion.

However, inventories still remain high, and the supply-demand balance is unlikely to improve significantly in the short term, limiting the momentum for a strong price rebound.

304 cold and hot-rolled spot prices are expected to fluctuate on the stronger side, following the futures market. Watch for trading volume and inventory drawdown.

200 Series: Steel mills including Tsingshan and Baosteel plan to continue production cuts in July, reducing 200-series crude steel output and easing supply pressure.

Recent multiple favorable signals have improved market sentiment, and the overall transaction atmosphere has improved.

However, market inventories remain high, and with bullish and bearish factors interwoven, future transaction performance remains key.

In the short term, 201J2 cold-rolled prices are expected to range between US$1025/MT-US$195/MT.

400 Series: Last week, retail prices for high-carbon ferrochrome remained weak, providing only limited cost support for 400-series stainless steel.

However, downstream procurement demand improved noticeably in the 400-series spot market.

Due to concentrated arrivals from mills, supply pressure remains, and price support is insufficient.

In the short term, 430 prices are expected to range between US$1125/MT-US$1140/MT.

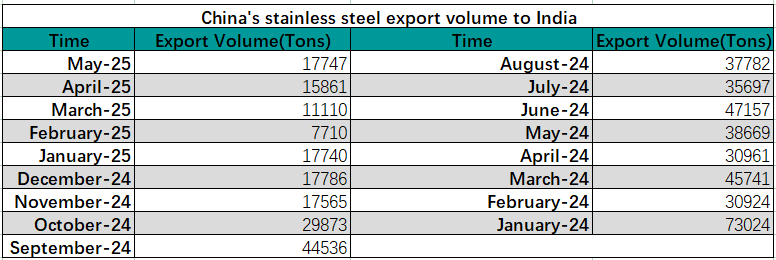

MACRO || China’s Stainless Steel Exports to India Plunge Over 50% YoY in May

Recently, India abruptly upgraded its BIS (Bureau of Indian Standards) certification rules, mandating traceability certification all the way up to upstream raw material suppliers.

This sudden regulatory shift has immediately frozen stainless steel orders from Taiwan to India for June and caused a dramatic collapse in exports from mainland China—May exports plummeted 54% year-on-year. This policy-driven “cold front” is now sweeping across the entire Asian stainless steel supply chain.

According to Chinese customs data, China’s stainless steel exports to India reached a record monthly high of 73,024 tons in January 2024. However, volumes have since come under sustained pressure, falling sharply to just 17,747 tons in May 2025—a 54% plunge compared to May 2024 (38,669 tons), far exceeding the range of normal market fluctuations.

India’s new requirement that all stainless steel products and their upstream raw material suppliers be BIS-certified has struck a critical blow to China’s position as a global hub for stainless steel raw materials.

Taiwanese media report that Taiwan’s steel orders to India have completely frozen in June, mainly because the mainland suppliers they rely on are unable to meet the new traceability certification requirements.

Taiwan’s exports of stainless steel plates to India fell steeply from 24,414 tons in 2023 to just 6,802 tons in 2024—a 72% drop. Although exports recovered somewhat to 7,368 tons between January and May 2025 (including 2,648 tons in May alone), the June regulation instantly erased that momentum.

After facing setbacks in exports to India, South Korean companies have begun offloading their steel products at lower prices in mainland China and Southeast Asian markets, further intensifying regional competition.

A large volume of stainless steel products intended for India—either directly from Chinese mills or indirectly from Taiwanese companies processing mainland raw materials—are now stuck in warehouses. This has led to mounting financial and storage pressures.

Market confidence has been deeply shaken. Combined with the sudden policy shift and its high associated risks, companies are now significantly less willing to take on new orders from India. Some have already suspended negotiations for new Indian orders and are redirecting excess capacity toward the domestic market or third countries, which is further heightening competitive pressures in those regions.

In the short term, the new regulation has triggered order delays, inventory backlogs, and regional price wars. In the long term, the barrier for Chinese stainless steel exports to India has been permanently raised.

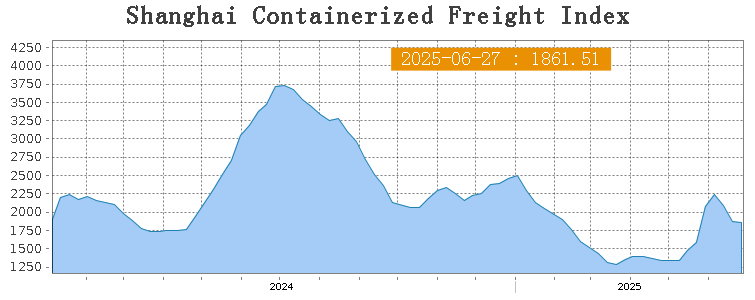

SEA FREIGHT || Container Shipping Market Remains Stable Overall

Last week, China’s container shipping market remained broadly stable. Due to differences in supply-demand fundamentals across various long-haul routes, market trends diverged, and the composite index edged down slightly.

On June 27th, the Shanghai Containerized Freight Index (SCFI) fell 0.4% to 1861.51 points.

Europe/ Mediterranean:

On June 27th, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2030/TEU, which increased by 10.6%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$2985/TEU, which dip 2.5% from previous week.

North America:

On June 27th, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$2578/FEU and US$4717/FEU, reporting 7% and 11.9% slide accordingly.

The Persian Gulf and the Red Sea:

On June 27th, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf shrank 2.9% to US$2060/TEU.

Australia & New Zealand:

On June 27th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand gained 9.6% to US$836/TEU.

South America:

On June 27th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports surged 13.9% to US$6220/TEU.