Stainless Insights in China from June 9th to June 15th.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,025 | -23 | -1.17% |

| Foshan | 2,065 | -23 | -1.14% | ||

| Hongwang | Wuxi | 1,925 | -23 | -1.23% | |

| Foshan | 1,940 | -23 | -1.22% | ||

| 304/NO.1 | ESS | Wuxi | 1,855 | -24 | -1.36% |

| Foshan | 1,865 | -24 | -1.35% | ||

| 316L/2B | TISCO | Wuxi | 3,520 | -17 | -0.50% |

| Foshan | 3,585 | -20 | -0.57% | ||

| 316L/NO.1 | ESS | Wuxi | 3,390 | -20 | -0.62% |

| Foshan | 3,400 | -20 | -0.60% | ||

| 201J1/2B | Hongwang | Wuxi | 1,200 | -15 | -1.40% |

| Foshan | 1,200 | -16 | -1.47% | ||

| J5/2B | Hongwang | Wuxi | 1,090 | -18 | -1.77% |

| Foshan | 1,100 | -16 | -1.61% | ||

| 430/2B | TISCO | Wuxi | 1,145 | -7 | -0.68% |

| Foshan | 1,135 | -4 | -0.34% |

TREND || Tsingshan Lifts Price Cap, Stainless Steel Futures Tumble

Last week, spot stainless steel prices in the Wuxi market dipped slightly in line with futures. The price of ferronickel dropped during the week, weakening cost support and opening further downside potential for stainless steel. Steel production remained at high levels, market arrivals continued, and inventory increased for a third consecutive week, leaving little momentum for price rebounds. As of Friday, the main stainless steel futures contract closed at US$1885/MT, down US$22.5/MT (1.26%) from previous week, with an intraweek low of US$1870/MT.

300 Series: Futures and Spot Prices Decline, Inventories Continue to Climb

304 spot prices continued to fall slightly last week. As of Friday, the mainstream base price for private 304 cold-rolled four-foot coils in Wuxi was US$1875/MT, down US$28/MT from previous Friday. Private hot-rolled prices were quoted at US$1840/MT, down US$35/MT week-on-week.

On June 10, 2025, Tsingshan Group announced the complete removal of price controls on its 304 cold-rolled, hot-rolled, coil, and sheet products.

Following the removal of pricing controls, supply expectations quickly turned loose. To compete for orders, agents cut prices for 304 hot-rolled twice in succession, with a total drop of US$28/MT, while cold-rolled prices followed with a US$14/MT decline. Traders in major markets like Wuxi and Foshan adjusted prices accordingly, bringing the base price for private 304 cold-rolled down to US$1875/MT and hot-rolled to US$1850/MT.

The announcement triggered a wave of panic-driven price cuts across the market. The stainless steel 2508 futures contract dropped 1.46%, falling below US$1875/MT and hitting a nearly four-year low. However, on the morning of June 11, Tsingshan reinstated price controls on 304 coils, calming the market and helping spot prices stabilize. That day, the 2508 contract rebounded to close at US$1890/MT.

As the off-season sets in, spot market activity remains sluggish, while finished product inventories at mills continue to pile up, increasing pressure on mills to lower prices. With stainless steel prices still weak and mills facing losses, they’re negotiating lower raw material procurement prices. This has put pressure on ferronickel prices, leading to a supply-demand standoff and weakening cost support.

200 Series: Spot Prices Hit New Lows, Inventories Rebuild Again

Prices for 201 continued to weaken last week. 201J2 cold-rolled was quoted at US$1055/MT, down US$21/MT week-on-week. 201J1 cold-rolled was quoted at US$1170/MT, down US$14/MT, while 201J1 hot-rolled dropped US$7/MT to US$1150/MY.

The futures market saw mixed performance throughout the week, and market sentiment turned more cautious. On Monday, 201J2 cold-rolled was mainly quoted at US$1075/MT, but demand-side acceptance of higher prices remained limited, with overall transactions subdued. As futures continued to decline, spot quotes followed suit. Low-priced resources emerged in the market, and cold- and hot-rolled inventories saw modest increases.

400 Series: Inventory Builds Up, Weak Demand, Prices Slide

430 prices weakened last week. In the Wuxi spot market, the price for state-owned 430 cold-rolled dropped to US$1155/MT, down US$7/MT from last weekend. The price for state-owned 430 hot-rolled remained steady at US$1055/MT, unchanged from last week.

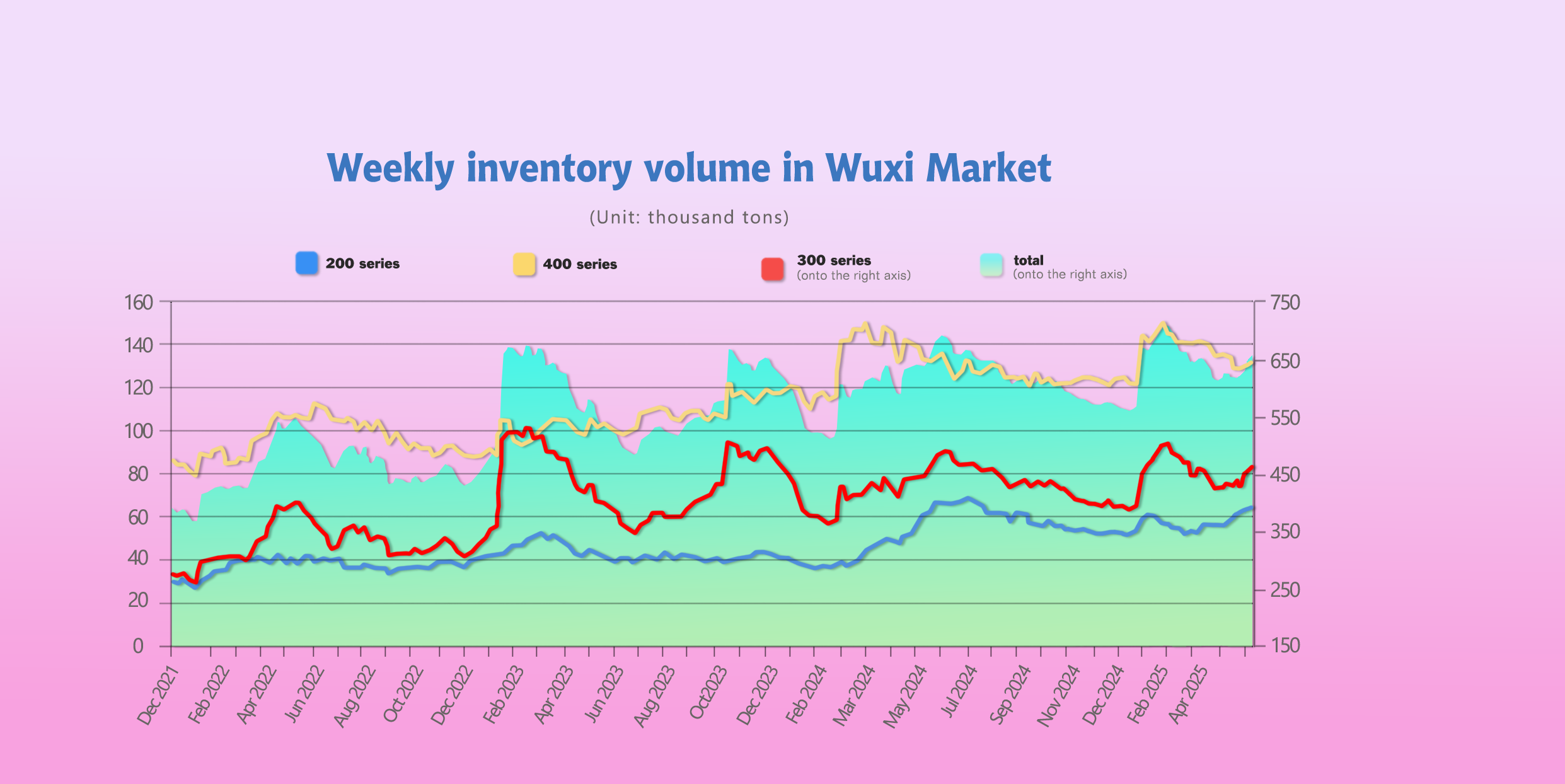

INVENTORY || Will June Production Cuts Materialize? Weekly Inventory Rises for Third Consecutive Week

As of June 12th, total inventory in Wuxi sample warehouses increased by 12,580 tons to 660,074 tons. Breakdown:

200 Series: 1,276 tons up to 64,768 tons.

300 Series: 9,416 tons up to 463,358 tons.

400 Series: 1,888 tons up to 131,948 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Jun 5th | 63,492 | 453,942 | 130,060 | 647,494 |

| Jun 12th | 64,768 | 463,358 | 131,948 | 660,074 |

| Difference | 1,276 | 9,416 | 1,888 | 12,580 |

300 Series: Supply Arrivals Continue, No Relief in Pressure

Last week, futures and spot prices hit new lows during the week, market sentiment turned cautious, and downstream buyers mostly made low-priced, essential purchases, with little speculative demand. As off-season demand remains weak and supply pressure persists, the imbalance between supply and demand continues, leading to sustained inventory accumulation.

200 Series: Steel Mills Cut Prices, Purchasing Picks Up

Prices for 201 continued to weaken, and the market outlook turned pessimistic. Although steel mills reduced 200-series crude steel production in June, downstream demand has yet to materialize. As a result, inventories may continue to build up in the coming period.

400 Series: High Inventory Triggers Price Decline

The main factor was the continued arrival of mill supplies, while downstream procurement growth fell short of expectations, resulting in a significant inventory buildup. In the short term, there is limited upward momentum for prices.

RAW MATERIAL || China's Environmental Inspections Suppress Output Growth

Chrome: Prices Find Support in June

In early June, major high-chrome production areas in Inner Mongolia began undergoing environmental inspections, which led to a drop in output at some local producers. These inspections are still ongoing and are expected to conclude by late June.

Recently, China’s domestic high-chrome output has been climbing steadily, with notable month-on-month growth for three consecutive months, totaling an increase of 150,400 tons. In May alone, high-chrome monthly output hit a new yearly high, surpassing 730,000 tons.

According to statistics, total national high-chrome output across the main production regions and other areas in May 2025 reached 732,300 tons, up 30,200 tons from April’s 702,100 tons, marking a 4.3% increase.

In June 2025, chrome ore prices have declined, easing cost pressures on high-chrome producers, which has improved profit margins and boosted production enthusiasm. However, due to the ongoing environmental inspections, high-chrome output growth may fall short of expectations this month. As a result, high-chrome prices have shown some recovery and are expected to remain stable in the short term.

Nickel: Stainless Steel Prices Fall, Putting Pressure on Ferronickel

Last week, high-grade ferronickel ex-plant prices fell, quoted at US$133/nickel point by Thursday, down US$2.1 from last week.

Meanwhile, SHFE nickel prices trended down. As of Thursday’s close, the most-traded SHFE nickel contract settled at US$16,877/MT, down US$220/MT from the previous week, a 1.29% decline.

Slight declines in major raw material prices have lowered production costs for the 200 and 400 series. However, current prices for 201 and 430 stainless steel are still below breakeven levels, resulting in ongoing losses.

SUMMARY || Stainless Steel Inventory Remains High, Passive Destocking Puts Pressure on Prices

Stainless steel prices fell again last week.

Demand remains primarily driven by essential purchases, while steel mill output, though slightly reduced, is still at high levels. The persistent supply surplus remains difficult to resolve.

Social inventory is being digested slowly, and spot availability remains ample.

The market is watching closely for signs of improved downstream demand, changes in mill production schedules, and inventory drawdowns. In the near term, stainless steel is expected to remain in a weak and volatile trend.

300 Series: Steel mill production has slightly decreased, and market arrivals are expected to decline. On the demand side, as prices fall, low-priced material is gradually being absorbed, mainly through essential purchases.

On the macro front, domestic conditions remain supportive, while strong overseas economic data and delayed U.S. Fed rate cut expectations intensify long-short competition.

Fundamentals are playing a greater role in price setting, and due to the weak market structure, spot prices for 304 cold-rolled and hot-rolled are expected to follow the futures trend downward. Pay attention to transaction volumes and inventory digestion.

200 Series: Mills such as Baosteel Desheng and Beigang Xincai have begun production cuts and maintenance, reducing June output of 200-series crude steel slightly and easing supply-side pressure.

However, as the industry enters the off-season, downstream demand remains sluggish. With weak supply and demand fundamentals, spot prices lack upward drivers and are expected to continue trending weakly for 201 in the short term.

400 Series: Last week, retail prices of high-chrome raw materials were stable to slightly weak, providing moderate cost support to 400-series stainless steel.

However, downstream demand in the 400-series spot market has shown little improvement, and inventories continue to build up. As a result, price support remains weak, and 430 prices are expected to maintain a weak-to-stable trend next week.

MACRO || Tariffs Shake Market Confidence Again

President Trump unexpectedly announced a sharp increase in Section 232 tariffs on imported steel and aluminum—from 25% to 50%—effective June 4. The sudden move caught the market off guard and sparked widespread controversy.

Industry experts expressed concerns over the decision. Stainless steel analyst Katie Benshina Olson noted that the U.S. flat-rolled stainless market has long depended on imports, with import penetration exceeding 30% in some years and maintaining around 18% even during stable periods.

Thus, the rapid implementation of a 50% tariff has had a severe impact on the stainless steel industry, with price shocks inevitable.

On June 12, the U.S. Department of Commerce announced it will impose additional tariffs on various steel-made home appliances—including dishwashers, washing machines, and refrigerators—starting June 23, 2025.

A 50% tariff will be applied to most countries, potentially affecting China’s exports of these steel products.

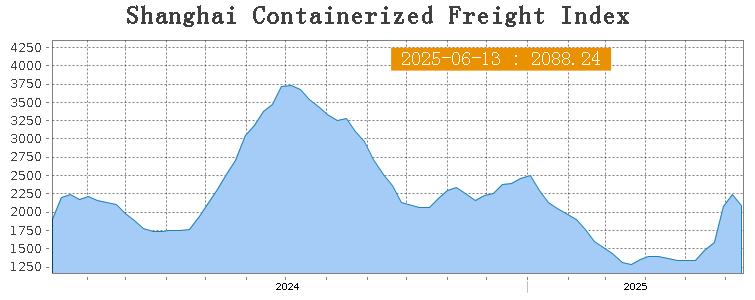

SEA FREIGHT || Shipping Market Rates Retreat from High Levels

Last week, after several rounds of increases, China's container export shipping market experienced a pullback, with diverging trends across different trade routes and a decline in the overall composite index. On June 13th, the Shanghai Containerized Freight Index (SCFI) rose 8.1% to 2088.24 points.

Europe/ Mediterranean:

In May, China’s exports to the European Union grew by 12% year-on-year, maintaining a strong growth rate, which contrasts sharply with the decline in exports to the United States. Last week, shipping demand remained stable, and market freight rates continued to rise.

On June 13th, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1844/TEU, which increased by 10.6%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3190/TEU, which dip 3.4% from previous week.

North America:

Although transportation demand stayed steady, the supply of shipping capacity continued to increase, easing the previously tight space availability. As a result, spot booking prices in the immediate market retreated from recent highs.

On June 13th, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$4120/FEU and US$6745/FEU, reporting 26.5% and 2.8% slide accordingly.

The Persian Gulf and the Red Sea:

On June 13th, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf grew 8% to US$2083/TEU.

Australia & New Zealand:

On June 13th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand gained 8.6% to US$745/TEU.

South America:

On June 13th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports surged 19.3% to US$4724/TEU.