From June 24th to 28th, the last week of the first half of 2024, the stainless steel demand-supply relation improved as inventory declined. Stainless steel average prices dropped slightly because China's domestic demand remained weak, resulting in the steel mills losing profit. Although stainless steel futures price increased for 5 days in a row, stock prices did not recover. The small reduction last week in the inventory at least released the stress of stock overload. As for the ore side, the cost remained stable with slight drops, but the production cost is still too high for the current stainless steel prices. Take a step back to watch the larger picture, China's manufacturing PMI in June remained in the contraction zone, 49.5 same figure as last month. Based on the export indicators, we can see that external demand remains the main factor supporting the manufacturing sector. Sea liners from Shanghai to Europe/ Mediterranean and North America remain robust, increasing by over 10% from a week before. Officially entering the second half of 2024 now, the political changes will be important to the industry. Meanwhile, we believe international trading won't stop under any circumstance. We will keep focusing on the industry for you, and you are free to keep reading our Stainless Steel Market Summary in China regularly.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,140 | 8 | 0.41% |

| Foshan | 2,185 | 8 | 0.41% | ||

| Hongwang | Wuxi | 2,035 | -1 | -0.07% | |

| Foshan | 2,050 | 4 | 0.22% | ||

| 304/NO.1 | ESS | Wuxi | 1,970 | -1 | -0.07% |

| Foshan | 1,970 | -1 | -0.07% | ||

| 316L/2B | TISCO | Wuxi | 3,665 | -8 | -0.24% |

| Foshan | 3,725 | -6 | -0.15% | ||

| 316L/NO.1 | ESS | Wuxi | 3,515 | -19 | -0.57% |

| Foshan | 3,510 | -6 | -0.16% | ||

| 201J1/2B | Hongwang | Wuxi | 1,370 | -6 | -0.44% |

| Foshan | 1,370 | -10 | -0.77% | ||

| J5/2B | Hongwang | Wuxi | 1,270 | -10 | -0.83% |

| Foshan | 1,270 | -10 | -0.83% | ||

| 430/2B | TISCO | Wuxi | 1,225 | -2 | -0.15% |

| Foshan | 1,230 | -6 | -0.49% |

TREND || Futures Rise, Peak Season Expectations Boost, Fundamentals Improve.

This week, the stainless steel spot market in Wuxi remained stable. Non-ferrous metals and the broader market stopped falling and rebounded, and stainless steel followed suit. Market transactions improved, inventories decreased, and fundamentals improved. Macro expectations are heating up, awaiting further policy direction. As of this Friday, the main stainless steel contract price increased by US$26.3/MT from last Friday to US$2070/MT, a rise of 1.37%.

300 series: Mixed Performance, Weak Market Transactions.

This week, 304 market prices were adjusted downward. As of Friday, the main futures contract closed at US$2070/MT, up US$26.3 from last week, an increase of 1.37%. In Wuxi, the mainstream base price for privately-owned 304 cold-rolled four-foot coils remained at US$1995/MT, and the price for privately-owned hot-rolled coils stayed at US$1975/MT, both unchanged from last Friday. The market bottomed out and rebounded this week, reaching a low of around US$2025/MT, with five consecutive days of gains. Spot prices changed little, with terminal demand still weak and unimproved. Although raw material prices showed slight loosening, cost support remained strong, and steel mills continued to experience losses. This week, Tsingshan opened with steady prices, market sentiment was cautious, and heavy rain in some areas further reduced terminal consumption, making it difficult for merchants to ship goods, and transactions were unsatisfactory. Currently, the market has rebounded and broken above US$2065/MT, making the atmosphere more active, but speculative demand remains weak, focusing mainly on low-priced resources.

200 series: Continuous Price Decline, 201 Keeps Falling.

This week, the price of 201 mainly declined. The price for Hongwang 201J2/2B 1.0 four-foot coils was around US$1265/MT the price for Hongwang 201J1/2B 1.0 four-foot coils was around US$1365/MT; the price for 201J1 five-foot hot-rolled coils was around US$1365/MT.

400 series: Inventory Turns from Increase to Decrease, Driven by Just-in-Need Sales.

As of Friday, this week TISCO’s guiding price for 430 cold-rolled coils was US$1450/MT, down US$21/MT from last week; JISCO's guiding price for 430 cold-rolled coils remained at US$1600/MT. In the Wuxi market, the spot price for state-owned 430 cold-rolled coils was US$1235/MT, and the price for state-owned 430 hot-rolled coils remained around US$1125/MT, both unchanged from last week.

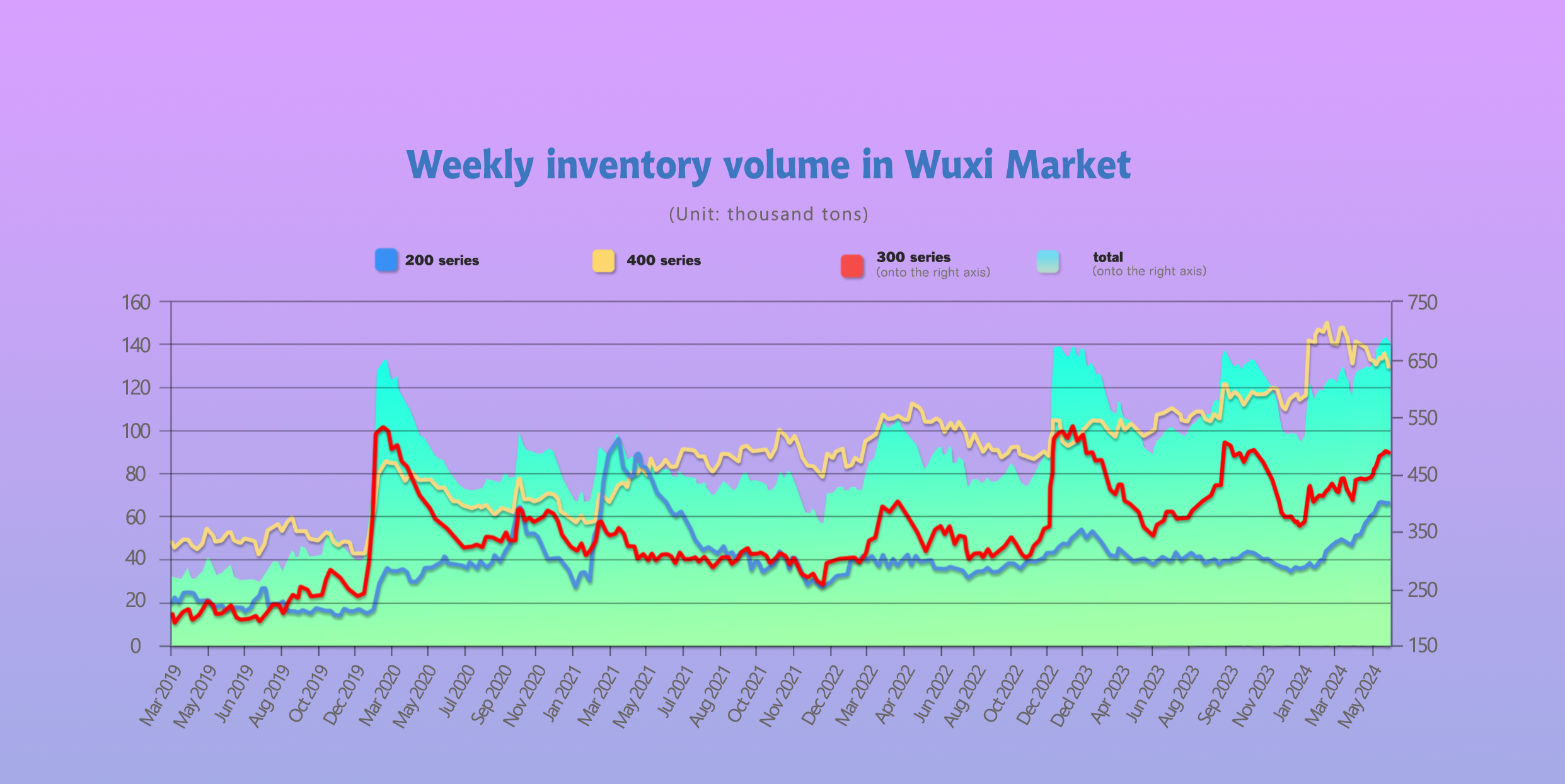

INVENTORY|| The second quarter is wrapped up with destocking.

The total inventory at the Wuxi sample warehouse dived by 8,777 tons to 677,587 tons (as of 27th June).

the breakdown is as followed:

200 series: 499 tons down to 65,011 tons,

300 Series: 1,976 tons down to 483,531 tons,

400 series: 6,302 tons down to 129,045 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Jun 20th | 65,510 | 485,507 | 135,347 | 686,364 |

| Jun 27th | 65,011 | 483,531 | 129,045 | 677,587 |

| Difference | -499 | -1,976 | -6,302 | -8,777 |

300 Series: Prices Bottom Out, Inventory Decreases.

During last week, the main futures price bottomed out and rebounded, with spot prices maintaining a range-bound fluctuation and a slight divergence between futures and spot prices. Market arrivals were normal, and steel mill production remained high. As hot weather and the rainy season approach, market confidence is affected, and most spot purchases are for immediate needs, leading to a slight increase in cold-rolled inventory. Hot-rolled inventory saw improvement in transactions due to low prices, resulting in inventory reduction. Steel mill production plans for June remain high, with weak demand during the off-season, and fundamentals have not yet improved. It is expected that inventory will slightly increase next week.

200 Series: Steel Mills Lower Prices, Transactions Improve.

During last inventory period, steel mill arrivals were normal, and low-priced resources saw more transactions. Price reductions led to improved transactions compared to the previous period, but factors such as poor terminal enterprise orders and unenthusiastic purchasing still constrained the inventory at high levels, limiting price increases.

400 Series: Reduced Arrivals, Improved Transactions Lower Inventory.

Last week, nearing the end of the month, trade merchants faced significant pressure to collect payments, leading some to lower prices to boost transactions, with significant concessions in actual transactions, resulting in improved weekly transactions. Additionally, due to the rainy season, market arrivals were fewer, leading to a noticeable reduction in 400 series spot inventory. Steel mill production plans for June saw a slight decline but overall production levels remained high. Future market supply pressure will not ease, and it is expected that inventory might increase next week.

RAW MATERIALS || Stable Costs, Slight Decline.

In terms of costs, this week the mainstream ex-factory price of high nickel iron fell by 1.3 US dollar to US$134/nickel point, and the price of ferrochrome fell by US$14/MT to US$1236/50 reference ton. The mainstream ex-factory price of high chrome ranged between US$1250/50 reference ton, down by US$14/50 reference ton compared to last week's price. Chromium ore prices were relatively stable this week, while coke prices increased slightly by US$7/MT. The production cost of high chrome remains high, adding pressure on production enterprises' costs. With the drop in high chrome retail prices, enterprises' profit margins are being squeezed, and the weak market conditions may spread to the chromium ore raw material market.

The slight decrease in high chrome prices on the raw material end has led to a weakening of stainless steel cost support. Based on current raw material prices, the production cost of 430 cold-rolled stainless steel was US$1270/MT, with steel mills still operating at a loss of US$37.78/MT. The inverted cost structure continues, and the inclination to maintain prices remains.

SUMMARY || Limited Arrivals from Steel Mills, Alleviated Pressure on Stainless Steel Social Inventory.

Last week, the arrival of goods from steel mills was limited, and traders offered discounts to promote sales, easing the pressure on social inventory. There are expectations of reduced production in July, which might alleviate future supply pressure. The main focus will be on the production and delivery schedule of steel mills and the stimulus intensity of domestic macroeconomic policies.

300 Series: Currently entering the off-season for demand, compounded by adverse weather conditions, downstream purchasing remains weak. Market inventory and warehouse receipts continue to accumulate, costs remain high, and prices are weak, with steel mills facing significant losses. However, there has been no news of production cuts from the supply side of the steel mills, leading to an intensified supply-demand contradiction due to insufficient terminal demand. It is expected that in the short term, the price of 304 cold-rolled spot goods will maintain a weak and fluctuating trend. Future attention will be on inventory changes and the production schedule adjustments of steel mills.

200 Series: The production volume of the 200 series remained high in June, with continued supply pressure. The weak demand from terminal enterprises during the off-season, coupled with price reductions from Tsinghsan to benefit the market, led to continuous market price declines. It is expected that the price of 201 will continue to operate weakly in the short term.

400 Series: This week, the inventory of the 400 series fell slightly, easing market supply pressure. However, the production schedule of steel mills in June remained at a high level, and the weak downstream demand is unlikely to improve in the short term. It is expected that the price of 430 will continue to operate weakly and fluctuate in the short term.

MACRO || China's June PMI Unchanged from Previous Month, Exports Remain a Strong Support.

The June Caixin Manufacturing PMI remained unchanged month-on-month at 49.5%, matching market expectations and consistent with Bloomberg's median forecast (49.5%). Supply and demand both weakened slightly month-on-month, while supplier delivery times lengthened. External demand remains the main factor supporting the manufacturing sector. Changes in finished goods and raw material inventories diverged, with marginal price declines.

External demand remains the main factor supporting the manufacturing sector. Although the June PMI new export orders were unchanged month-on-month at 48.3%, remaining in the contraction zone, it still supported new orders marginally, considering the overall PMI new orders declined.

Changes in finished goods and raw material inventories diverged, with marginal price declines. Against a backdrop of weak overall demand, June PMI inventory showed a divergent trend: raw material inventories fell by 0.2 percentage points month-on-month to 47.6%, while finished goods inventories rose by 1.8 percentage points month-on-month to 48.3%. The purchase prices of major raw materials and ex-factory prices decreased by 5.2 and 2.5 percentage points month-on-month to 51.7% and 47.9%, respectively.

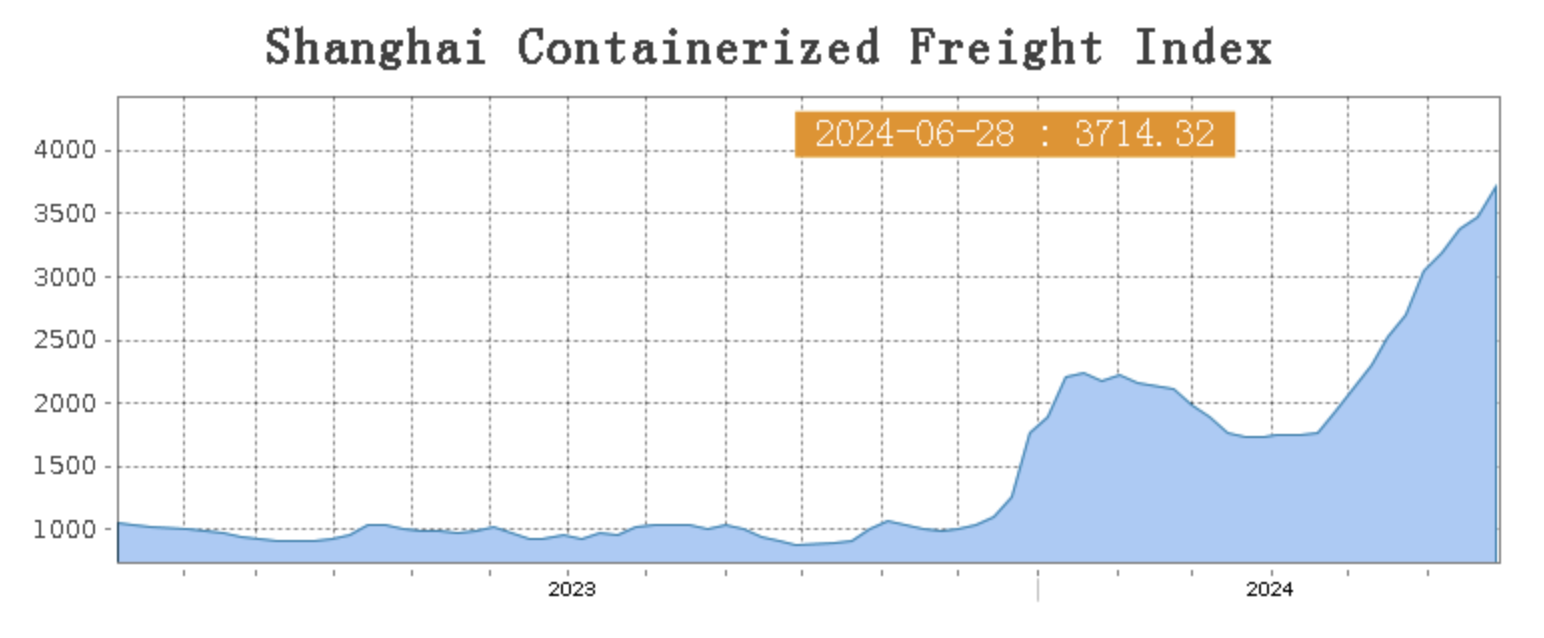

Sea Freight|| Composite Index Continues to Rise.

The Chinese Export Container Shipping Market Continues to Show a Steady and Upward Trend, overall shipping demand remained stable this week, and freight rates on most sea routes increased. The comprehensive index continued to rise. On 28th June, the Shanghai Containerized Freight Index rose by 6.9% to 3714.32.

Europe/ Mediterranean:

At present, there are many risk events in the Asia-Europe shipping market. The trade dispute between China and Europe has led to uncertainty about future trade, but the geopolitical situation in the Red Sea has not eased, and most ships have detoured, resulting in temporary congestion due to changes in ports of call, and the supply of capacity is relatively tight. As a result, shipping rates have risen in the market this week.

On 28th June, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$4880/TEU, which rose by 12.5%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$5387/TEU, which jumped by 11%.

North America:

On 28th June, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$7830/FEU and US$9274/FEU, reporting a 9.2% and 12% lift accordingly.

The Persian Gulf and the Red Sea:

On 28th June, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 6.3% from last week's posted US$2711/TEU.

Australia/ New Zealand:

On 28th June, the freight rate (shipping and shipping surc-harges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1397/TEU, a .6% slide from the previous week.

South America:

On 28th June, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$8854/TEU, an 3.5% growth from the previous week.