Stainless Insights in China from November 18th to November 22nd.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,085 | -14 | -0.70% |

| Foshan | 2,130 | -14 | -0.69% | ||

| Hongwang | Wuxi | 1,980 | -14 | -0.74% | |

| Foshan | 1,990 | -21 | -1.11% | ||

| 304/NO.1 | ESS | Wuxi | 1,910 | -14 | -0.77% |

| Foshan | 1,915 | -21 | -1.15% | ||

| 316L/2B | TISCO | Wuxi | 3,590 | -36 | -1.04% |

| Foshan | 3,675 | -33 | -0.94% | ||

| 316L/NO.1 | ESS | Wuxi | 3,420 | -45 | -1.34% |

| Foshan | 3,430 | -47 | -1.42% | ||

| 201J1/2B | Hongwang | Wuxi | 1,255 | -10 | -0.85% |

| Foshan | 1,225 | -20 | -1.73% | ||

| J5/2B | Hongwang | Wuxi | 1,115 | -18 | -1.77% |

| Foshan | 1,125 | -20 | -1.89% | ||

| 430/2B | TISCO | Wuxi | 1,145 | 0 | 0.00% |

| Foshan | 1,150 | -7 | -0.67% |

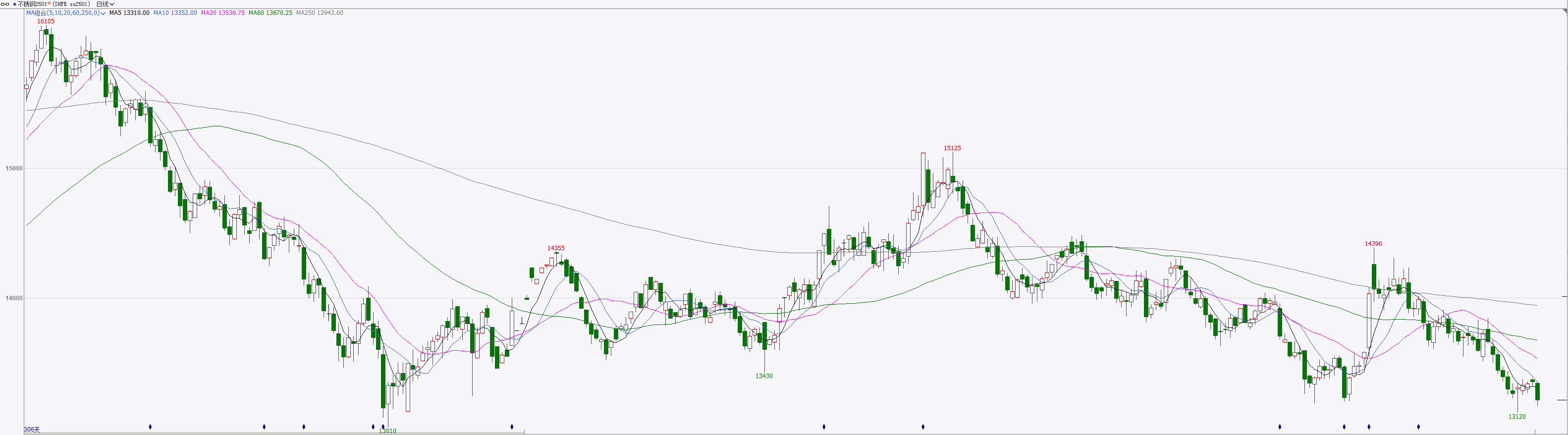

TREND|| Market activity is low, and prices continue to decline.

Last week, the stainless steel spot market in Wuxi fluctuated, and industry speculation was weak. During the week, Tsingshan lowered prices to seize the market, and transactions improved during some periods. With the current low valuation, some speculative demand was released, low-priced resources were gradually consumed, and coupled with the decrease in hot-rolled arrivals, inventory decreased for four consecutive weeks, boosting consumer sentiment. As of the end of last week, the main contract price of stainless steel had decreased by US$7 to US$1955/MT compared to the previous week.

300 Series: Rebound from low levels in the futures market.

Last week, the spot market price of stainless steel 304 fluctuated. As of Friday, the mainstream base price of cold-rolled four-foot 304 in the Wuxi area was US$1925/MT, down US$7 from the previous Friday; the price of hot-rolled was US$1905/MT, up US$7 from the previous Friday. At the beginning of the week, the futures market rebounded from low levels, and the release of positive news boosted market sentiment, leading to some downstream replenishment demand. As the positive news was gradually digested, futures prices stabilized and fluctuated, and market sentiment returned to caution, with low-priced resources gradually being digested; on Friday, futures prices dived, and spot market prices followed suit, with merchants being cautious and mostly maintaining low inventory production, and their willingness to purchase weakened. With the digestion of low-priced warehouse receipts and a decrease in market arrivals, inventory continued to decrease during the week, but the overall decline slowed down.

200 Series: Supply pressure still exists, spot merchants remain cautious.

The mainstream base price of cold-rolled 201J1 in the Wuxi market reached US$1225/MT, the mainstream base price of cold-rolled J2/J5 reached US$1085/MT, and the five-foot hot-rolled 201J1 reached US$1200/MT. During the week, the spot price of 201 fluctuated with the futures market. At the beginning of the week, market sentiment was pessimistic, and traders mainly lowered prices to ship goods, and the transaction atmosphere was light; after the futures market continued to rise, downstream purchases increased, and transactions improved. In the second half of the week, prices weakened, and transaction volume decreased.

400 Series: Prices remain stable.

In the Wuxi spot market, the quoted price of cold-rolled 430 was US$1150/MT, and the quoted price of state-owned 430 hot-rolled was around US$1085, both of which remained flat compared to the previous week's quotations.

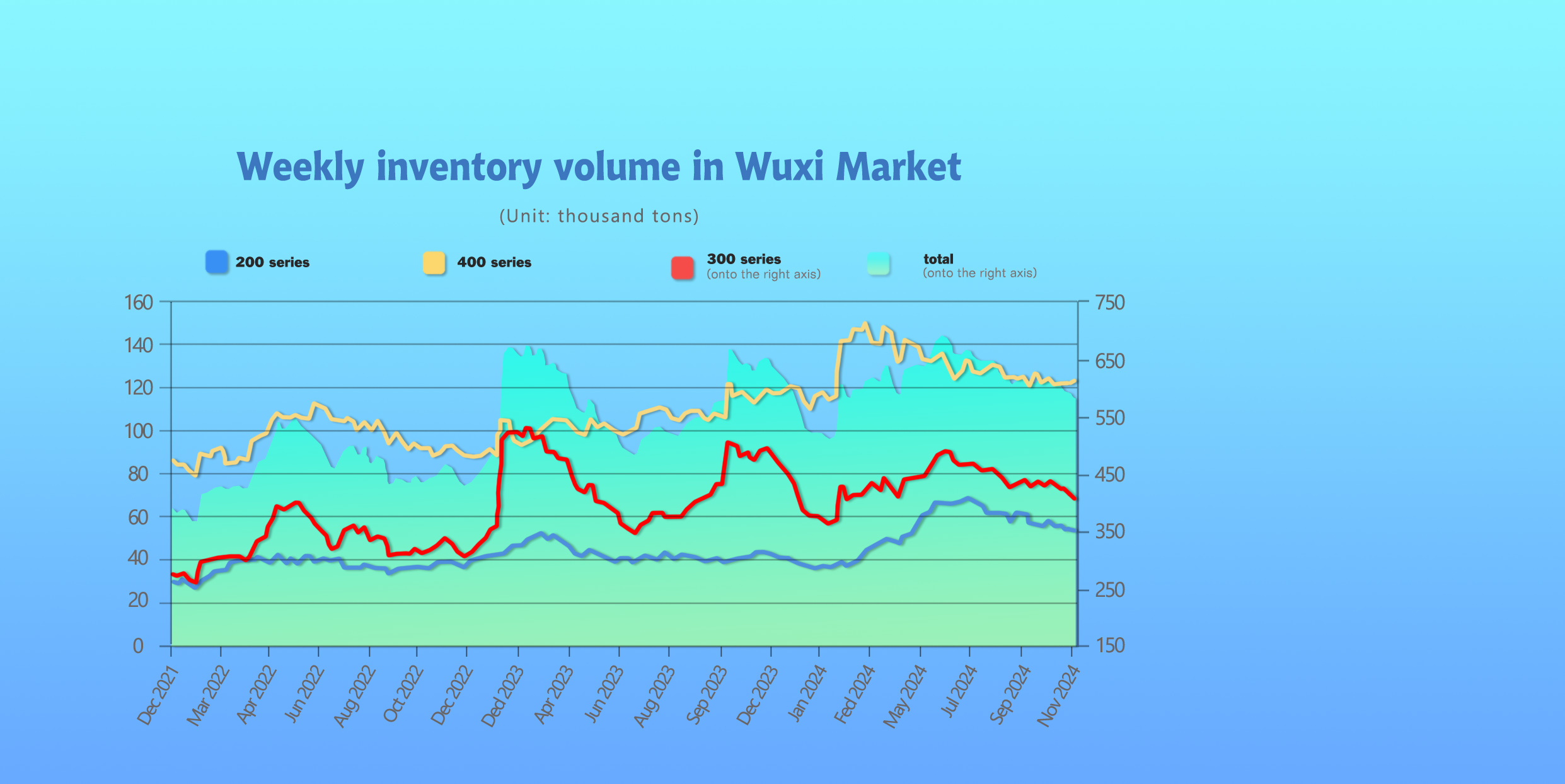

INVENTORY || Four consecutive weeks of inventory decline.

The total inventory at the Wuxi sample warehouse down by 5,876 tons to 579,990 tons (as of 21st November).

The breakdown is as followed:

200 series: 401 tons up to 53,468 tons,

300 Series: 8,110 tons down to 403,815 tons,

400 series: 1,833 tons up to 122,707 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Nov 14th | 53,067 | 411,925 | 120,874 | 585,866 |

| Nov 21st | 53,468 | 403,815 | 122,707 | 579,990 |

| Difference | 401 | -8,110 | 1,833 | -5,876 |

300 Series: Agents lower prices, hot-rolled resources accelerate destocking.

During last week, futures prices rebounded from the bottom, and the price spread narrowed during the week, expanding the advantage of point-price resources. From the inventory structure, the arrival of Jiangyin hot-rolled resources decreased significantly, and the inventory of 300 series hot-rolled turned from increasing to decreasing. Import and export data weakened, imported resources increased significantly month-on-month, and export demand weakened month-on-month, continuing to put pressure on the supply side. Peak season demand is not obvious, and the off-season is gradually coming, coupled with low price valuations, market confidence in the future is insufficient, and the supply and demand pattern remains weak. At present, the fundamentals are weak. Trump's coming to power has cooled expectations for future import and export tariffs, and domestic macroeconomic policies have been fluctuating, with overall macroeconomic sentiment being neutral. It is expected that subsequent inventory may increase slightly.

200 Series: Inventory is at a high level compared to the same period last year.

Last week, the price of 201 fluctuated. From the perspective of spot inventory structure, market arrivals increased. Downstream consumers have a low acceptance of high-priced resources, and the overall transaction volume is limited. Compared with the same period last year, the inventory of the 200 series is at a high level, and supply pressure still exists. In the short term, the upside and downside of the price of 201J2 are limited. It is expected that inventory may continue to accumulate next week.

400 Series: Supply pressure increases, inventory accumulates again.

During last inventory period, the arrival of JISCO resources increased, and the market's available resources increased; the rebound of the futures market last week boosted market sentiment, and traders' quotations were firm, and low-priced resources in the market decreased significantly, but downstream purchasing was cautious, and the overall transaction volume was limited, and the spot market inventory increased slightly. In November, the output of steel mills increased significantly, the supply of stainless steel continued to maintain a high level, and the high base of inventory was difficult to effectively digest, and the overall supply and demand fundamentals remained under pressure. It is expected that inventory will continue to accumulate next week, and the focus will be on subsequent steel mill production and market transaction conditions.

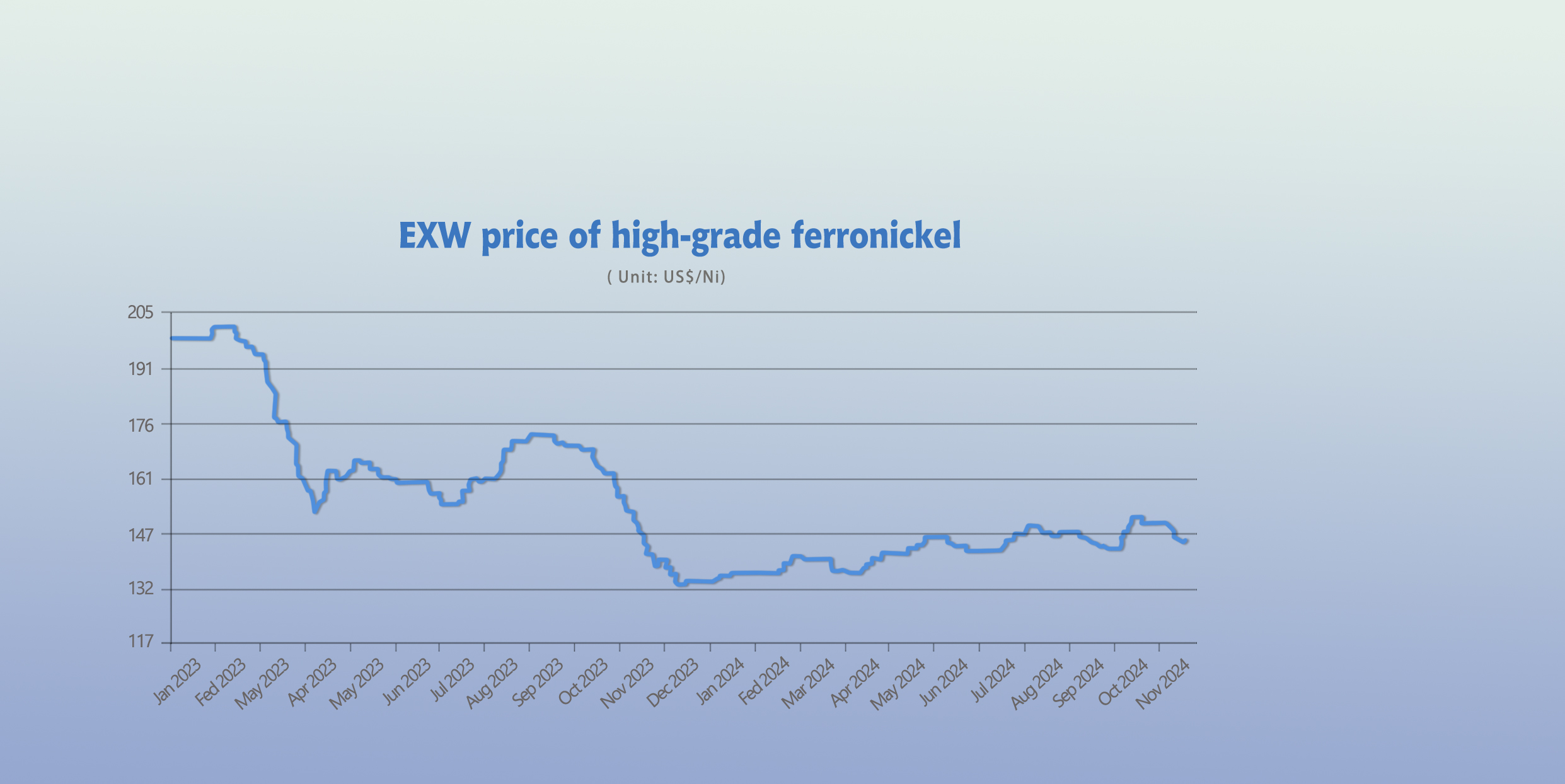

RAW MATERIAL|| Market transactions are light, and raw materials are under pressure.

The mainstream ex-factory price of high-chromium is around US$1099/50 reference ton, down US$21/50 reference ton from the previous weekend. TISCO’s high-chromium steel procurement price in December decreased by US$42 to US$1063/50 reference ton compared to the previous month. The decrease in the procurement price in December exceeded market expectations, and the subsequent decline in high-chromium prices led to a further increase in losses for high-chromium production enterprises, and production enthusiasm decreased. Given the continued oversupply situation in the high-chromium market, market sentiment remains cautious, and it is expected that high-chromium prices will mainly run weakly in the short term.

Last week, the EXW price of high-nickel pig iron continued to decline, reaching US$138/MT by Thursday, down US$1.3 from Thursday last week. SHFE nickel continued to rise last week, closing at US$17769/MT on Thursday, up US$401/MT from Thursday last week, an increase of 2.31%. The continuous decline in nickel iron prices has led to renewed losses for domestic nickel iron plants, and production motivation has weakened. The tight supply of Indonesian nickel ore has eased, coupled with the commissioning of new production capacity, and the supply of nickel iron has increased steadily. The Philippines has entered the rainy season, and the return of nickel ore to China has decreased, and the price of nickel ore at the mine end has remained firm, providing some support on the cost side. Recently, stainless steel prices have fluctuated at a low level, and domestic steel mills have been operating at a loss, and raw materials have been purchased on demand. It is expected that nickel iron prices will be under pressure in the short term.

SUMMARY|| Confidence is held hostage by expectations, stainless steel is still suppressed by fundamentals.

Stainless steel futures prices fluctuated weakly last week. After the capital market rebounded and then dived during the week, market confidence in macroeconomic policies declined, and the commodity market also retreated accordingly. Stainless steel trading continued to return to fundamentals. Stainless steel prices have been weak for nearly a month and are currently in a downward trend. Intra-week stainless steel trading volume did not change much compared to last week, and holding volumes were relatively stable. The market was mainly in a wait-and-see mode, and the main focus in the future remains on the implementation of domestic policies.

300 Series: Domestic imports have increased, and steel mill production in November has increased slightly, with expectations for future increases. Short-term supply-side pressure has increased. Current spot inventories have been continuously destocked, and the fundamentals are still weak. In the traditional off-season, market transactions have maintained rigid demand, but there may be a wave of winter storage demand in the future. It is expected that the spot price of 304 cold-rolled will fluctuate in the short term.

200 Series: The uncertainty of future macroeconomic policies has caused raw material prices to fluctuate repeatedly. Copper and manganese prices fluctuated last week, weakening the cost support for 201. Inventories and production are both at high levels, and supply pressure still exists. However, in the short term, the futures market has been boosted, and the price of 201 is affected by multiple factors, with limited upside and downside. It is expected that the price of cold-rolled 201J2/J5 will fluctuate around US$1115/MT.

400 Series: With the gradual resumption of production by steel mills, stainless steel supply remains at a high level. Coupled with a slight increase in inventories of both cold-rolled and hot-rolled resources in the 400 series spot market last week, market supply pressure will continue to increase in the future. Although steel mills' profits have recovered, they are still in a loss-making state, and the mentality of firming prices still exists. Under the game of supply and demand, it is expected that the price of 430 will fluctuate weakly in the short term.

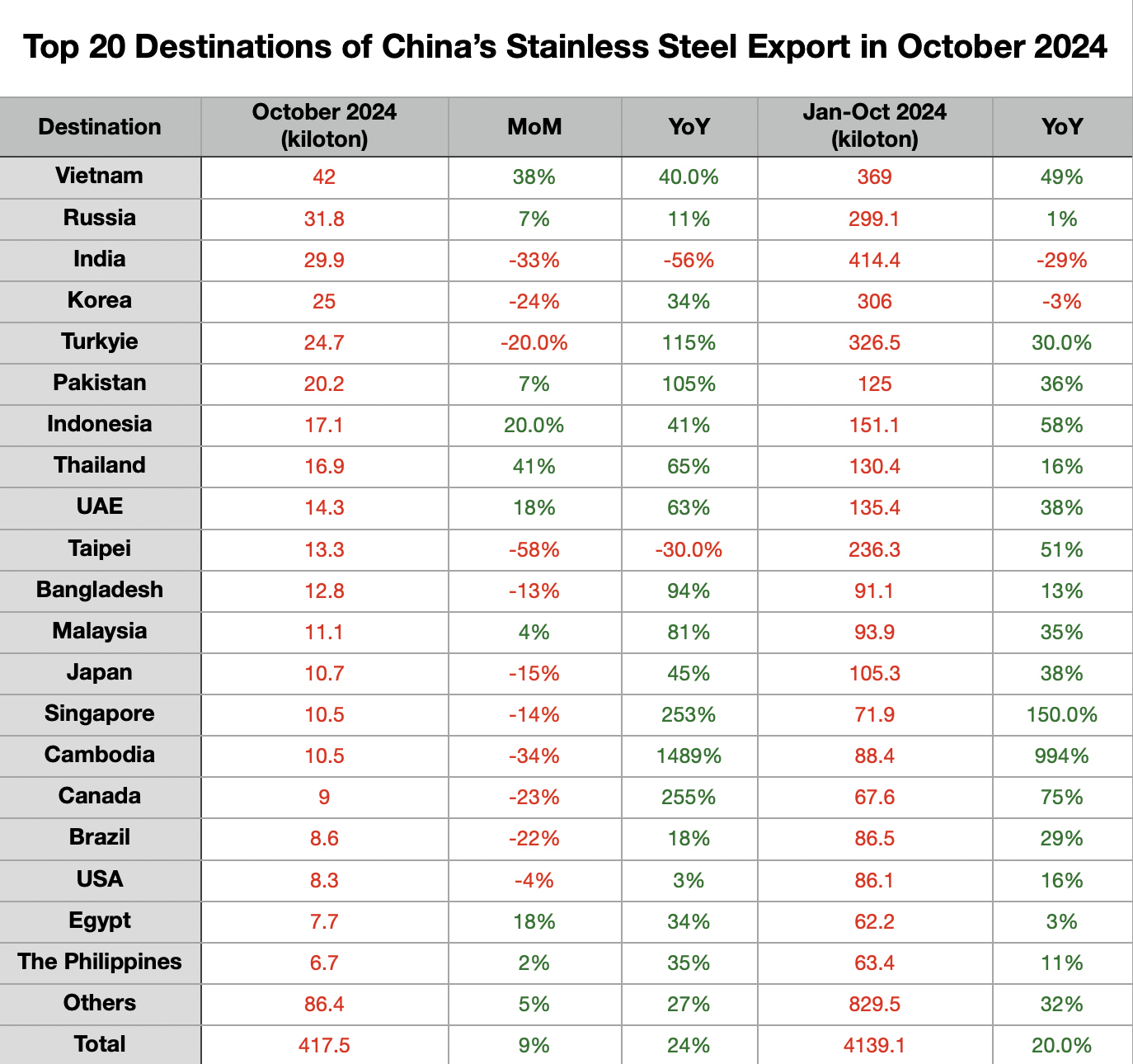

EXPORT|| China's Stainless Steel Export Data for October 2024.

In October 2024, China's stainless steel exports amounted to approximately 417,400 tons, a month-on-month decrease of 41,100 tons or 9%, and a year-on-year increase of 80,900 tons or 24%. From January to October 2024, China's cumulative stainless steel exports totaled approximately 4,139,200 tons, a year-on-year increase of 694,700 tons or 20.2%.

In October 2024, China's stainless steel exports to many destinations showed a downward trend, with significant decreases to Taiwan and India, falling by 18,300 tons and 14,600 tons month-on-month, respectively. Vietnam was China's largest export destination for stainless steel that month. From January to October 2024, China's cumulative stainless steel exports to Vietnam totaled approximately 369,000 tons, a year-on-year increase of 120,500 tons or 49%.

In October 2024, the top 20 export destinations accounted for approximately 331,000 tons, or 79.3% of total exports. From January to October 2024, the cumulative exports of the top 20 destinations totaled approximately 3,309,700 tons, accounting for about 79.96%.

Top 20 Export Destinations

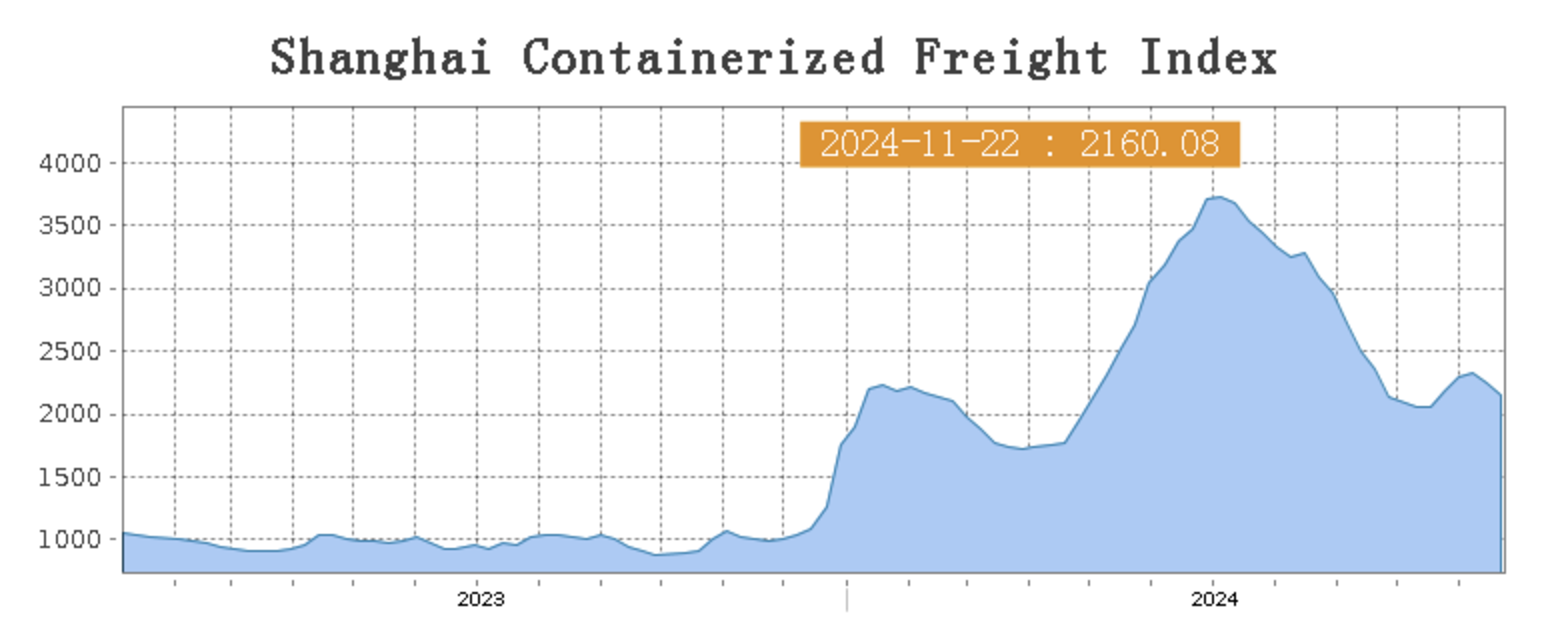

SEA FREIGHT|| Transportation Market Slightly Weak, Sea Freight Rates Decline.

Last week, China's export container transportation market showed signs of weakness. Transportation demand growth was sluggish, ocean freight rates declined, and the composite index fell. On November 22nd, the Shanghai Shipping Exchange released the Shanghai Containerized Freight Index (SCFI) at 2160.08 points, down 4.1% from the previous period.

Europe/ Mediterranean:

According to data released by the European Commission, the Eurozone's consumer confidence index for November was -13.7, lower than the previous value and market expectations. Last week, the overall supply and demand fundamentals of the market were stable, and market freight rates declined slightly.

On 22nd November, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2481/TEU, which dropped by 1.2%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3080/TEU, which fell by 0.3%.

North America:

Currently, the market continues to focus on the policies that the new US government will implement, and the North American shipping market is facing the test of uncertainty. Last week, the lack of further growth in transportation demand and the weakening of supply and demand fundamentals led to a continued decline in market freight rates.

On 22nd November, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$3821/FEU and US$4997/FEU, both reporting an 18.6% and 1.3% fall accordingly.

The Persian Gulf and the Red Sea:

On the Persian Gulf route, the ongoing local tensions continued to support the transportation market, and spot market booking prices continued to rise.

On 22nd November, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf slid by 7.3% from last week's posted US$1317/TEU.

Australia/ New Zealand:

On 22nd November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$2038/TEU, a 5.6% drop from the previous week.

South America:

On 22nd November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$5259/TEU, an 4.6% decrease from the previous week.