Stainless Insights in China from November 4th to November 8th.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,135 | -17 | -0.83% |

| Foshan | 2,175 | -17 | -0.81% | ||

| Hongwang | Wuxi | 2,035 | -3 | -0.15% | |

| Foshan | 2,055 | -4 | -0.22% | ||

| 304/NO.1 | ESS | Wuxi | 1,970 | -7 | -0.38% |

| Foshan | 1,990 | -1 | -0.08% | ||

| 316L/2B | TISCO | Wuxi | 3,670 | -23 | -0.63% |

| Foshan | 3,755 | -20 | -0.54% | ||

| 316L/NO.1 | ESS | Wuxi | 3,520 | -15 | -0.45% |

| Foshan | 3,530 | -20 | -0.58% | ||

| 201J1/2B | Hongwang | Wuxi | 1,280 | -11 | -0.95% |

| Foshan | 1,275 | -8 | -0.72% | ||

| J5/2B | Hongwang | Wuxi | 1,155 | -20 | -1.85% |

| Foshan | 1,175 | -8 | -0.79% | ||

| 430/2B | TISCO | Wuxi | 1,155 | -3 | -0.27% |

| Foshan | 1,170 | 0 | 0.00% |

TREND || A 25BP Interest Rate Cut and 10 Trillion Yuan in Stimulus! Can Macroeconomic Benefits Break the Stalemate?

Last week, the spot market for stainless steel in Wuxi saw a slight price increase, and industry speculation was generally low. As prices rebounded, market transactions improved, and low-priced resources were gradually consumed, with inventory continuing to decrease during the week. Supply-side pressure did not decrease, as steel mills increased production in November. With the peak season approaching, demand was weak, and the supply-demand situation was weak, leading to fluctuating prices. On Friday, the Federal Reserve cut interest rates by 25 basis points, boosting market sentiment and causing prices to rebound. The Standing Committee of the 14th National People's Congress issued positive policies, increasing local government debt resources by 10 trillion yuan (approximately 140 Billion USD), and more supportive fiscal policies may be implemented in the future. As of last Friday, the main contract price of stainless steel remained flat compared to the previous week at US$2025/MT.

300 Series: Inventory Reduction, Spot and Futures Prices Fluctuate Weakly.

Last week, the spot market price of stainless steel 304 fluctuated downward. As of Friday, the mainstream base price of cold-rolled four-foot 304 in the Wuxi area was US$1995/MT, and the price of private hot-rolled was US$1975/MT, both increasing by US$14/MT compared to the previous Friday. The futures market fluctuated in both directions last week. In the first half of the week, the futures market fluctuated narrowly. Currently, the market is gradually entering the off-season, and downstream purchasing intentions have weakened. Some agents have started to reduce prices to sell, and the market atmosphere is relatively weak. In the second half of the week, the futures market first fell and then rose. After the futures price dropped sharply on Wednesday, low-priced resources emerged in the market, and the next day, the futures market rebounded and continued to rise, leading to increased acceptance of low-priced resources by downstream buyers, and terminal purchases began to improve, with transactions showing improvement.

200 Series: Increased Steel Mill Production, Macro Factors Lead to Frequent Fluctuations in Raw Materials.

The mainstream base price of cold-rolled 201J1 in the Wuxi market reached US$1255/MT, the mainstream base price of cold-rolled J2/J5 reached US$1135/MT, and the five-foot hot-rolled 201J1 reached US$1220/MT. The spot price of 201 was mainly stable and weak during the week, and the futures market fluctuated in both directions, with market sentiment mostly cautious and overall transaction atmosphere generally weak.

400 Series: Increased Supply Pressure, Inventory Accumulates Again.

In the Wuxi spot market, the quoted price of state-owned cold-rolled 430 was US$1160/MT-US$1175/MT, a decrease of US$21/MT from the previous week's quoted price; the quoted price of state-owned hot-rolled 430 was around US$1110/MT, a decrease of US$7/MT from the quoted price on Thursday last week.

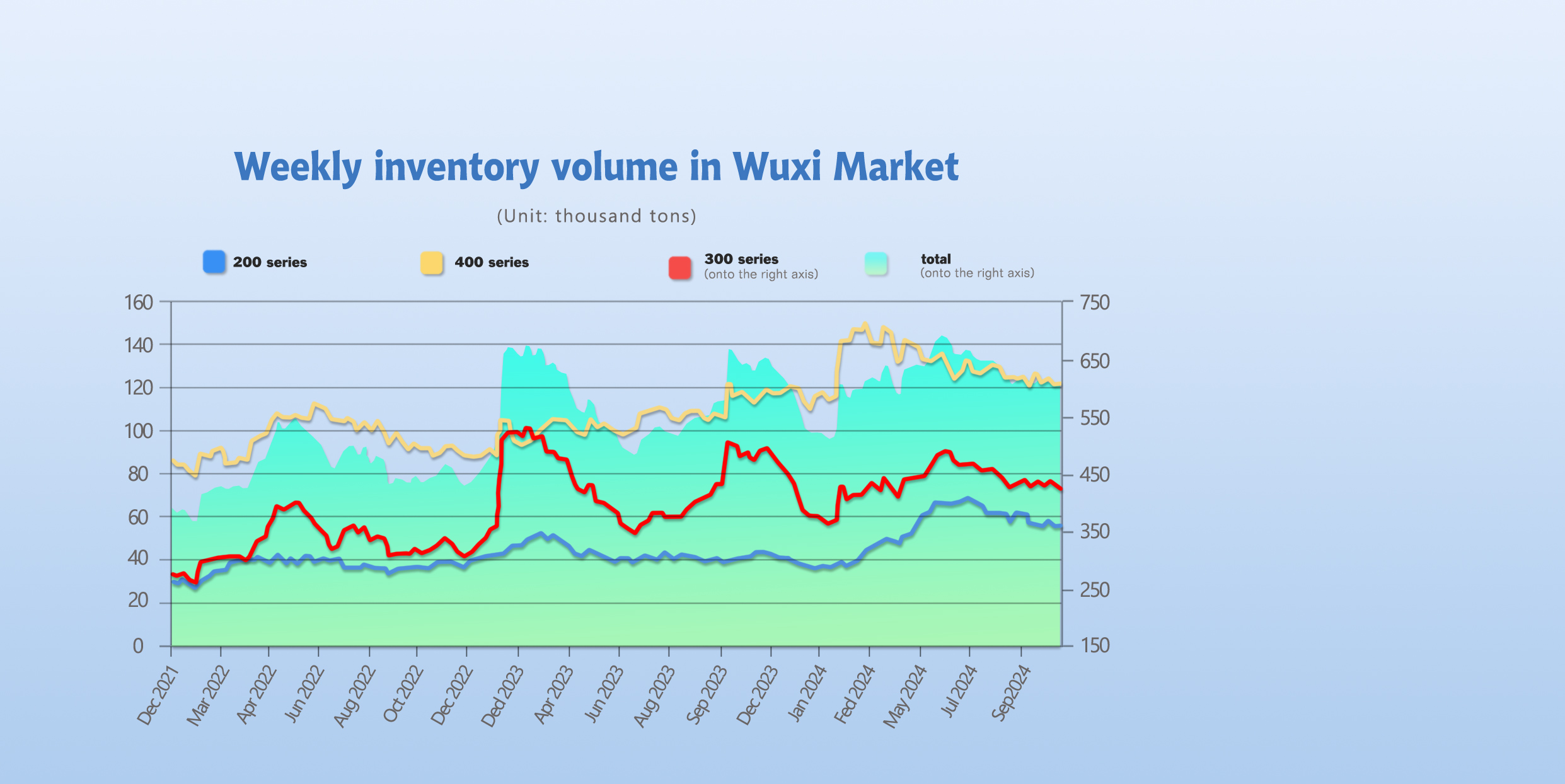

INVENTORY || Inventory Declines for Two Consecutive Periods.

The total inventory at the Wuxi sample warehouse down by 3,587 tons to 596,762 tons (as of 7th November).

The breakdown is as followed:

200 series: 443 tons down to 54,561 tons,

300 Series: 4,146 tons down to 420,943 tons,

400 series: 1,002 tons up to 121,258 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Oct 31st | 55,004 | 425,089 | 120,256 | 600,349 |

| Nov 7th | 54,561 | 420,943 | 121,258 | 596,762 |

| Difference | -443 | -4,146 | 1,002 | -3,587 |

300 Series: Warehouse Receipts Continue to Increase, Spot Inventory Decreases.

During last week, futures prices fluctuated downward, spot prices followed with slight decreases, the basis narrowed, and the advantage of spot pricing resources expanded. At the beginning of the month, Taiyuan Iron & Steel's agents increased their deliveries, and front-end inventory decreased significantly. Qingshan's agents adjusted the flat price to the market low, and the price advantage improved order taking and inventory reduction. Market arrivals decreased, Jiangyin port arrivals continued to shrink, and available circulating resources decreased, with some hot-rolled specifications in short supply. Warehouse receipts in the Wuxi area continued to rise. As spot and futures prices weakened, the conversion of cold-rolled registered warehouse receipt resources increased, and spot circulating resources decreased. Raw material costs remained flat compared to the previous week, and the cost end stabilized, with steel mills still in a loss-making state. Subsequent production may decrease, and supply is expected to decline, helping to reduce inventory. The current fundamentals are weak. Trump's coming to power has cooled expectations for future interest rate cuts, and domestic macroeconomic policies have been fluctuating, with overall macroeconomic sentiment being neutral. It is expected that inventory will continue to decrease in the future. We will continue to pay attention to subsequent steel mill production and market transaction conditions.

200 Series: Increased Steel Mill Production, Slowdown in 201 Destocking.

During this inventory period, steel mills arrived as usual. The increase in cold-rolled inventory was mainly due to Hongwang resources, while the decrease in hot-rolled inventory was mainly due to Beigang resources. The futures market declined, market sentiment weakened, and the spot price of 201 operated weakly and steadily. Traders offered discounts of US$4/MT, and downstream rigid demand purchases led to generally average transactions and slow inventory consumption. With the recovery of steel mill profits, steel mills increased the crude steel output of the 200 series in November, increasing market supply pressure. In the short term, the price of 201J2 will operate around the US$1125/MT-US$1135/MT gross base range. It is expected that the inventory of the 200 series will continue to increase next week. The focus will be on steel mill prices and downstream demand.

400 Series: Cautious Downstream Purchasing, Inventory Turns from Decrease to Increase.

During this inventory period, the market arrived as usual during the week, but the downward fluctuation of the futures market affected market trading confidence, and downstream purchasing was cautious, with limited overall transaction volume. As the demand for the stainless steel market gradually entered the off-season, downstream demand release was slow, and at the beginning of the month, traders mainly replenished inventory on demand, and the inventory of the spot market was digested relatively slowly. The price of high-chromium raw materials stabilized, and cost support still existed, with limited downward price space. With the resumption of production by steel mills, the output of steel mills continued to increase in November, and the supply pressure in the market increased later, while terminal demand was weak, and the high base of inventory was difficult to effectively digest. The overall supply and demand fundamentals remained under pressure. It is expected that inventory will increase slightly next week. The focus will be on subsequent steel mill production and market transaction conditions.

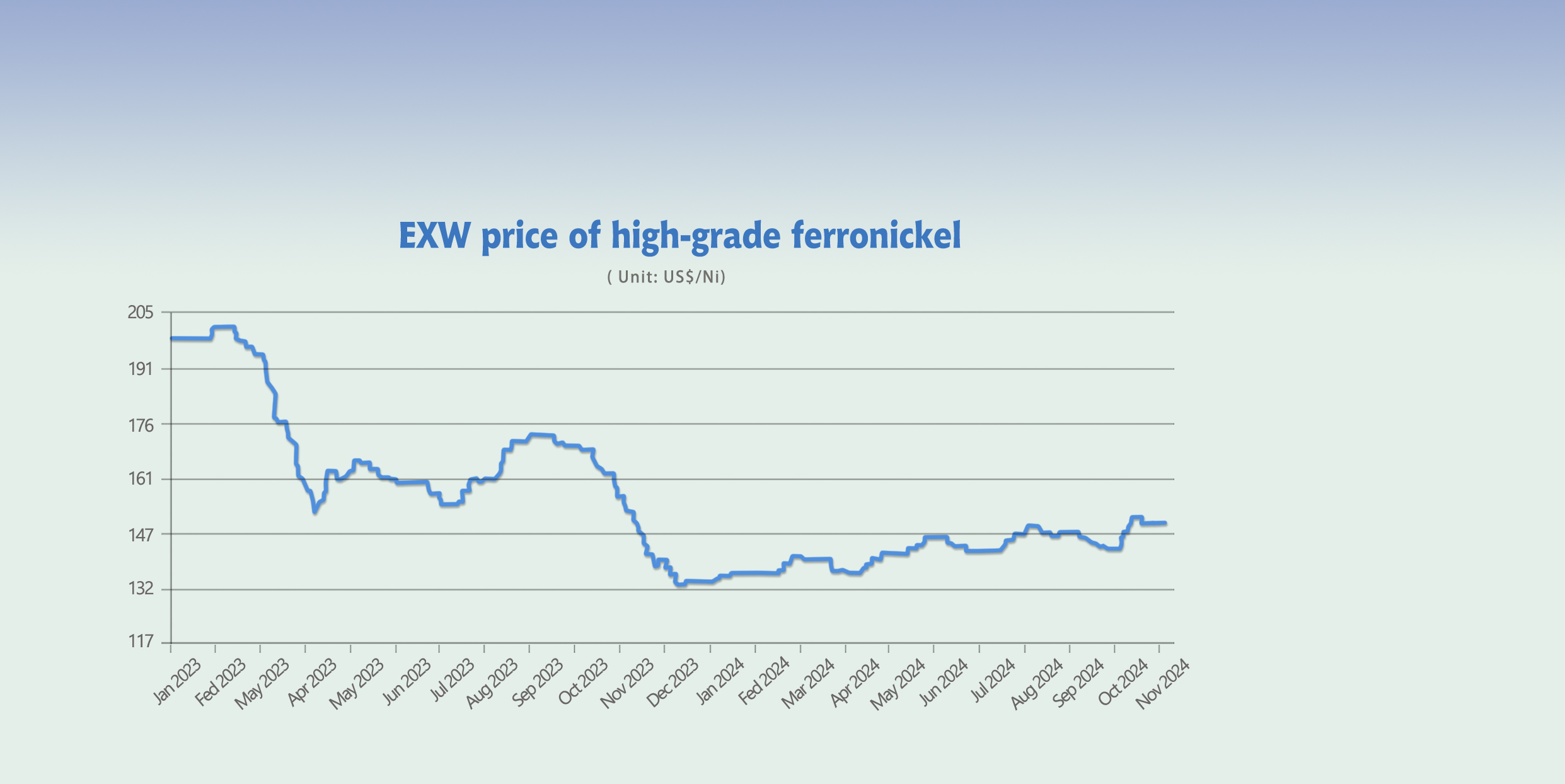

RAW MATERIAL || Increased Supply, Sluggish Transactions, Nickel Pig Iron Under Pressure.

Last week, Shanghai Nickel operated relatively strongly. As of the close of trading on Thursday, the main Shanghai Nickel contract closed at US$17898/MT, up US$455/MT or 2.76% from the previous Thursday. Domestic stainless steel mills continued to operate at a loss and were cautious about raw material purchases, leading to sluggish transactions in the nickel iron market. In terms of supply, domestic iron production was profitable and output continued to grow. Indonesian nickel ore quotas increased, and the production capacity of new production lines was ramping up. In addition, with the recent low profits of matte, some production lines switched back to producing nickel iron, leading to expectations of increased nickel iron supply. It is expected that nickel iron prices will be under pressure in the short term. LME Nickel followed suit, closing 315 points lower at US$16,310 per ton on Friday, with inventories increasing by 3,078 to 150,336 tons. On Friday, the Liyang Zhonglianjin 304 stainless steel index closed US$19 lower at US$1832/MT; the Liyang Zhonglianjin nickel price index closed US$84/MT lower at US$18087/MT. Overnight, the main Shanghai Nickel contract closed US$144/MT lower at US$18078/MT; the main Shanghai stainless steel contract closed US$31 lower at US$1886/MT.

NICKEL

Last week, high-nickel pig iron operated under pressure, with prices falling back from high levels. The mainstream quotation fell to US$143/point. During the week, factories still had a firm pricing sentiment, but the stainless steel market has been relatively weak recently, and steel mills have been putting pressure on raw material purchases at US$141/nickel point, and inquiries have been cold. During the week, Jiangsu Delong Steel Mill's transaction price for high-nickel pig iron was alsoUS$143/nickel point. There is still a gap between the target prices of both supply and demand, and the market supply-demand game continues.

On the nickel ore side, according to market news, the benchmark price of Indonesian nickel ore may decouple from the LME nickel price, and there are plans to impose taxes on nickel ore. This move may drive up nickel ore prices. However, the tight supply situation of Indonesian nickel ore has eased, and there are significant differences in market opinions on the future trend of nickel ore. In terms of price, Indonesian domestic nickel ore with a 1.6% grade was traded at HPM+17 to HPM+18, and the mainstream transaction price of Philippine to Chinese nickel ore (1.3% grade) was 38-40 US dollars/wet ton. The Surigao region of the Philippines entered the rainy season, and the supply of Philippine nickel ore faced tightening. Currently, the production cost of high-nickel pig iron is around US148/50 reference ton. It is expected that high-nickel pig iron will operate under pressure in the short term.

CHROME

According to industry feedback, transactions in the high-chromium market were relatively quiet last week, and high-chromium plants continued to operate at a loss with no significant changes. Overall production decreased significantly, and the mainstream price remained at US$1118/50 reference tons. However, the Inner Mongolia region mainly underwent rotational overhauls, and the overall production change was not large. It is expected that with the end of the southern rainy season in late November, production at southern production enterprises may decrease, and the contraction of high-chromium production will be conducive to the stabilization of high-chromium prices. It is expected that the price of high-chromium will remain stable to weak next week. On the raw material side, the price of chromite continued to weaken last week. The futures price of South African 40-42% chromite concentrate remained at 270 US dollars/ton, with a decline of about 5 US dollars in some mainstream production areas, and the port spot price also declined slightly. Currently, the port price of 40-42% chromite in South Africa is US$8/dry metric ton, and the price of coking coal has slightly drop US$7/50 metric tons during the week. The prices of raw materials have all declined slightly, but the decline in the cost of ferrochrome is limited. The current production cost of high-carbon ferrochrome has decreased to around US$1159/50 reference tons, and factories are still facing an inverted situation. The supply of the chromium market is still relatively abundant, and steel mills are mainly digesting previous inventories. The liquidity of market resources is relatively weak. As stainless steel enters the downward channel of demand, the chromium market has insufficient confidence in the future. Recently, the general election in Mozambique has led to strikes, and port operations such as loading and reporting inspections at Maputo Port have been suspended, and warehouses are basically closed. The land border crossing between South Africa and Mozambique is closed, and logistics transportation services are suspended. The shipment of chromite is currently restricted, and the duration of the impact will continue to be monitored. It is expected that the quoted price of high-carbon ferrochrome will operate weakly and steadily.

SUMMARY || stainless steel trading light as the price still remains weak.

300 Series: In October, steel mill production increased, and the production plan for November maintained a growth trend. Coupled with the influx of resources from overseas restarted production, the market's available circulating resources increased. As the peak consumption season is about to end and the off-season arrives, downstream purchasing intentions have weakened, with most purchases being low-priced resources or just-in-time needs, and speculative replenishment demand remains weak. Raw material prices have declined slightly, and cost support has declined but remains at a high level. Macroeconomic sentiment at home and abroad has fluctuated, and interest rate cut expectations have once again affected commodity pricing power. It is expected that the spot price of 304 cold-rolled will fluctuate with the futures market in the short term, and attention should be paid to market transactions and inventory digestion.

200 Series: Macroeconomic policies have led to frequent fluctuations in raw material prices, and the prices of raw materials such as copper and manganese have fluctuated, weakening the cost support for 201. After the downward trend in the futures market in the first half of the week, market sentiment turned weak, and traders offered discounts of US$4/MT. As the market warmed up on Thursday, quotations tended to be firm. However, downstream customers are cautious and pay more attention to the dynamics of steel mills. In the short term, the price of 201 is expected to remain stable, and the price range of 201J2 is expected to fluctuate around US$1125-US$1170/MT.

400 Series: In November, a new production capacity of a large-scale steel mill in South China will be put into operation, and the output of the 400 series will increase significantly. It is estimated that the production plan will increase by 40,000 tons to about 630,000 tons. Coupled with the slight increase in inventory in the 400 series spot market last week, the supply pressure in the market will increase in the future, and the supply-demand contradiction will become prominent. Given the high production costs of steel mills and market expectations for macroeconomic policies, it is expected that the price of 430 will run weakly and steadily in the short term. In the future, the focus will be on changes in inventory and market transactions.

MACRO || Trump's Election Win May Exert Downward Pressure on China's Steel Prices.

Domestic steel manufacturers in China could face more severe losses than this year, according to Ge Xin, a Chinese steel industry expert. He explains that this is due to Trump's anticipated aggressive policies toward China. Although only a small portion of steel products are directly exported to the United States—limiting the impact on China's direct steel exports—Trump may impose higher tariffs on key downstream steel-using products originating from China, such as construction machinery, home appliances, and new energy vehicles.

Since the start of this year, domestic demand for steel has remained sluggish, putting immense strain on steel production and distribution companies. From January to September, the total profit amounted to 29.18 billion yuan, a year-over-year decline of 55.82%, with a profit margin of just 0.70%. In contrast, steel exports have fared relatively well, with robust export demand helping offset some of the negative factors affecting the domestic market. Notably, exports to ASEAN and GCC countries have seen significant growth.

It's also worth noting that in the first half of this year, then-U.S. President Biden announced increased tariffs on various Chinese imports, including semiconductors, batteries, solar cells, and steel. Specifically, tariffs on steel and aluminum products were raised from a range of 0-17% to 25%.

"China's steel exports to the United States have been on a downward trend in recent years, with direct exports to the U.S. now accounting for only a small fraction of China's total exports, around less than 1%. In 2023, China exported a total of just 815,000 tons of steel to the U.S., while the country's total steel exports reached 95 million tons," Ge Xin noted. He added that the recent tariff hikes in the U.S. have a more substantial effect on indirect steel exports, as they also cover high-steel-use products like electric vehicles and port cranes.

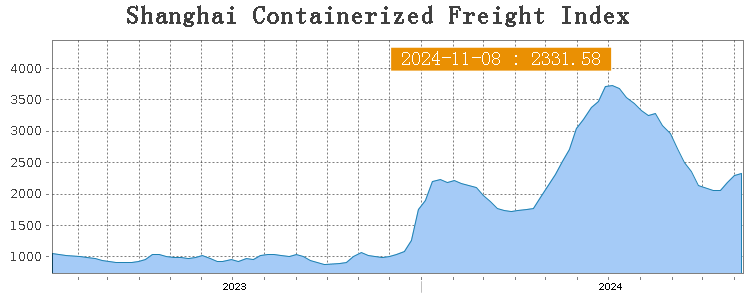

SEA FREIGHT || The transportation market is generally stable, and ocean routes are diverging.

Last week, the Chinese export container transportation market was generally stable, and ocean routes showed divergent trends due to differences in their respective supply and demand fundamentals, with the comprehensive index rising slightly. According to the latest data released by the General Administration of Customs, China's exports in US dollar terms increased by 12.7% year-on-year in October, reaching a 27-month high. In the face of an increasingly complex international trade environment, China's exports continue to grow steadily, which is conducive to maintaining a stable and improving situation in China's export container shipping market.

Last week, the Chinese export container transportation market continued to maintain a stable and improving trend, with ocean freight rates continuing to rise, driving the comprehensive index upward. On 8th November, the Shanghai Containerized Freight Index lifted by 1.2% to 2331.58.

Europe/ Mediterranean:

According to data released by the General Administration of Customs, in the first ten months of 2024, China's exports to the EU reached 3.04 trillion yuan, an increase of 3.5% year-on-year, continuing to maintain steady growth. It is expected that Sino-European trade will continue to develop steadily in the future. Last week, transportation demand remained at a high level, pushing spot market freight rates to continue to rise.

On 8th November, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2541/TEU, which grew by 4.1%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3055/TEU, which increased by 5.1%.

North America:

According to data released by the US Department of Labor, the number of initial jobless claims in the United States was 221,000 for the week ended November 2nd, a slight increase week-on-week, and the number of continuing jobless claims rose to 1.89 million, the highest level since the end of 2021, indicating that the US employment situation continues to slow down. The US election concluded last week, and the future impact of changes in US trade policy on the North American shipping market needs to be closely monitored. Last week, transportation demand was basically stable, and the US West Coast and East Coast routes diverged. Among them, freight rates on the US West Coast fell, while those on the US East Coast rose slightly.

On 8th November, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$4729/FEU and US$5258/FEU, both reporting an 2.0% fall and 0.4% growth accordingly.

The Persian Gulf and the Red Sea:

On the Persian Gulf route, the ongoing local tensions continued to support the transportation market, and spot market booking prices continued to rise.

On 8th November, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf slid by 1.8% from last week's posted US$1480/TEU.

Australia/ New Zealand:

On 8th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$2190/TEU, a 2.1.% lift from the previous week.

South America:

On 8th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$5931/TEU, an 6.7% increase from the previous week.