Stainless Insights in China from November 25th to November 29th.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,050 | -19 | -0.99% |

| Foshan | 2,095 | -19 | -0.97% | ||

| Hongwang | Wuxi | 1,950 | -15 | -0.82% | |

| Foshan | 1,950 | -22 | -1.19% | ||

| 304/NO.1 | ESS | Wuxi | 1,875 | -22 | -1.25% |

| Foshan | 1,885 | -17 | -0.93% | ||

| 316L/2B | TISCO | Wuxi | 3,505 | -58 | -1.69% |

| Foshan | 3,590 | -61 | -1.73% | ||

| 316L/NO.1 | ESS | Wuxi | 3,345 | -54 | -1.65% |

| Foshan | 3,350 | -55 | -1.69% | ||

| 201J1/2B | Hongwang | Wuxi | 1,235 | -11 | -0.98% |

| Foshan | 1,205 | -10 | -0.88% | ||

| J5/2B | Hongwang | Wuxi | 1,105 | -6 | -0.56% |

| Foshan | 1,110 | -10 | -0.96% | ||

| 430/2B | TISCO | Wuxi | 1,135 | 0 | 0.00% |

| Foshan | 1,140 | -4 | -0.40% |

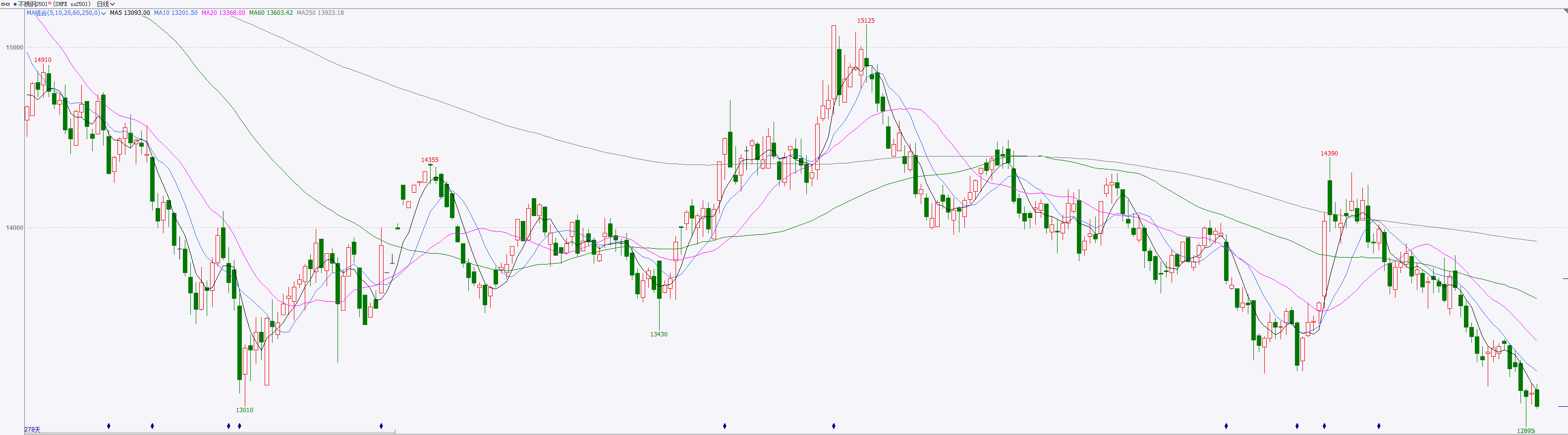

TREND|| Stainless Steel Prices Hit a New Low for the Year.

Stainless steel futures prices operated weakly last week. The pace of domestic macroeconomic policy implementation has been slow, and the stainless steel market is currently in the off-season. Market transactions have focused on fundamentals, and overall market confidence has been weak. Stainless steel prices have been weak for nearly a month and are still in a downward trend. Intra-week stainless steel trading volume increased significantly, mainly due to a rebound after hitting a low on Wednesday, but the price failed to maintain the rebound momentum at the end of the week and weakened again. Intra-week holdings increased slightly, and market speculation increased at low levels. The main focus in the future remains on the implementation of domestic policies. The main stainless steel futures contract closed at US$1920/MT last week, with a weekly price decrease of 1.59% and a weekly low of US$1905/MT.

300 Series: Spot and Futures Prices Decline in Sync.

Last week, the spot market price of stainless steel 304 fluctuated downward. As of Friday, the mainstream base price of cold-rolled four-foot 304 in the Wuxi area was US$1905/MT, down US$14//MT from the previous Friday; the price of hot-rolled stainless steel was US$1865/MT, down US$35/MT from the previous Friday. Tsingshan agents reduced their prices by US$28/MT during the week, and industry sentiment was poor, with panic spreading. Futures prices dived for several consecutive days to a new low for the year, and spot prices were lowered. Low-priced resources frequently appeared in the market, speculative purchasing demand was released, and transactions improved. Inventories have continued to decrease for five consecutive weeks. In the second half of the week, with the futures market rebounding from the bottom, merchants' quotations stabilized, and end-users became more cautious, with a lower willingness to purchase. Transactions mainly maintained rigid demand and low-priced resources, and speculative replenishment demand was insufficient.

200 Series: Weakened Support, Downward Market.

The mainstream base price of cold-rolled 201J1 in the Wuxi market reached US$1205/MT, the mainstream base price of cold-rolled J2/J5 reached US$1075/MT, and the five-foot hot-rolled 201J1 reached US$1185/MT. The spot price of 201 fluctuated with the futures market during the week. At the beginning of the week, market sentiment was pessimistic, and low-priced resources emerged, with downstream customers replenishing their stocks at low prices. As the futures market rose in the second half of the week, traders' quotations tended to be firm.

400 Series: Continued Inventory Accumulation, Price Under Pressure.

In the Wuxi spot market, the quoted price of state-owned cold-rolled 430 was US$1145/MT, and the quoted price of state-owned hot-rolled 430 was around US$1080/MT, both of which remained flat compared to the previous week's quotations.

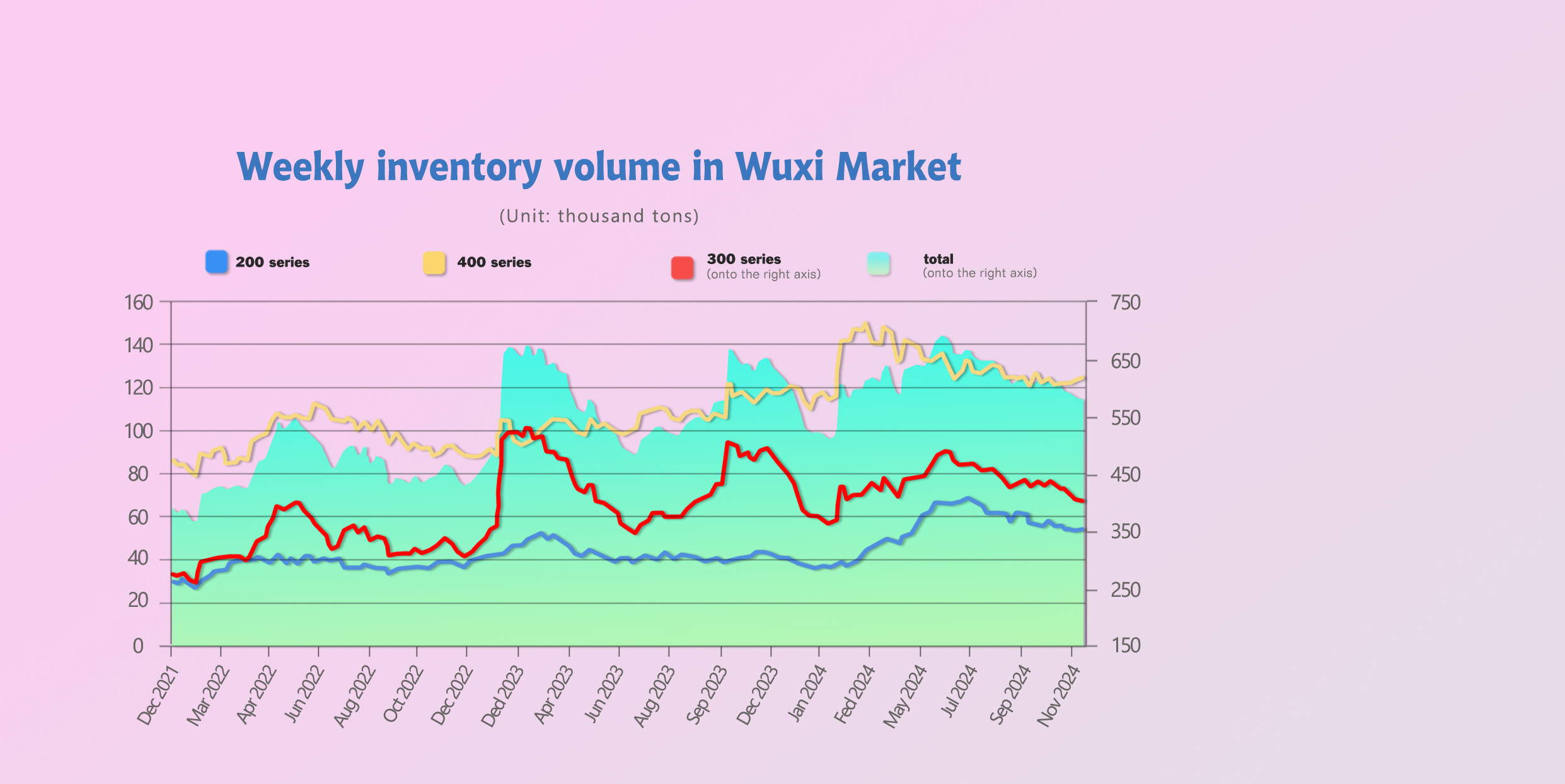

INVENTORY|| Five Consecutive Weeks of Inventory Decline, Low Prices to Stimulate Sales.

The total inventory at the Wuxi sample warehouse down by 3,157 tons to 576,833 tons (as of 28th November).

The breakdown is as followed:

200 series: 772 tons down to 52,696 tons,

300 Series: 3,649 tons down to 400,166 tons,

400 series: 1,264 tons up to 123,971 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Nov 21st | 53,468 | 403,815 | 122,707 | 579,990 |

| Nov 28th | 52,696 | 400,166 | 123,971 | 576,833 |

| Difference | -722 | -3,649 | 1,264 | -3,157 |

300 Series: Simultaneous Decline in Futures and Spot Prices, Agents Lower Prices to Reduce Inventory.

During last week, futures prices continued to decline to a new low for the year, the advantage of point-price resources expanded, and the destocking of traditional inventory resources slowed down.

From the inventory structure, the arrival of Jiangyin hot-rolled resources continued to decline, but the overall decline narrowed. During the week, Qingshan agents once again lowered their prices by US$28, spreading panic in the market. Agents followed suit and lowered their prices to ship goods, and end-users' willingness to purchase at low prices increased, improving transactions in some periods. The inventory of relevant forward warehouses continued to decline.

Import and export data weakened, imported resources increased significantly month-on-month, and export demand weakened month-on-month, continuing to put pressure on the supply side. The lack of off-season demand coupled with low price valuations has led to a lack of market confidence in the future, and the supply and demand pattern remains weak. Trump's coming to power has cooled expectations for future import and export tariffs, and domestic macroeconomic policies have been fluctuating, with overall macroeconomic sentiment being neutral. It is expected that subsequent inventory may increase slightly, and continued attention should be paid to subsequent steel mill production and market transaction conditions.

200 Series: Poor Market Sentiment, Agents Offer Discounts to Ship Goods.

Last week, the price of 201 fluctuated downward. From the perspective of spot inventory structure, the market received normal arrivals, and the destocking of cold-rolled products was mainly from Hongwang resources. The weakening of the futures market at the beginning of the week led to a pessimistic market outlook. On Tuesday, the price of cold-rolled 201J1 decreased by US$7/MT, and on Wednesday, the prices of both cold-rolled 201J2 and hot-rolled 201J1 decreased by US$7/MT. Traders had a large margin for price concessions, and low-priced resources emerged in the market, with downstream customers choosing to replenish stocks at low prices. Overall transactions were generally average. The implementation of future macroeconomic policies remains uncertain, and market investors are cautious and wait-and-see. The prices of raw materials such as copper and manganese continued to decline, weakening the cost support for 201. In the short term, the price of 201J2 will maintain a weak and stable operation. It is expected that inventory may increase slightly next week, and the focus will be on steel mill dynamics and market transactions.

400 Series: Cost Support Declines, Increased Supply and Weak Demand Lead to Continuous Inventory Accumulation.

Last week, TISCO resources arrived in batches at the end of the month, increasing the market's available resources; coupled with the downward fluctuation of the futures market last week, traders had insufficient confidence in the future, leading to increased difficulty in shipping goods in the market. At the end of the month, traders increased their willingness to sell at a discount, and downstream actual transactions had a large margin for price concessions. Low-priced resources increased in the market, but downstream demand was cautious, and purchases were mainly rigid, resulting in slow digestion of spot market inventory and a continued accumulation pattern. The price of high-chromium raw materials continued to decline following the procurement price of steel mills, further weakening the cost support for the 400 series. In November, the output of steel mills increased significantly, and the supply of stainless steel continued to maintain a high level, while traditional off-season demand could not be significantly improved, and the high base of inventory was difficult to effectively digest. It is expected that inventory will continue to accumulate next week, and the focus will be on subsequent steel mill production and market transaction conditions.

RAW MATERIAL|| Pressure on raw materials drags down finished product prices.

Stainless steel prices continued to decline last week. Following Tsingshan's purchase price of high-nickel pig iron falling to US$133.5/MT last week, Tsingshan announced another significant reduction in its December purchase price of high-carbon ferrochrome by US$97/MT to US$1024/50 reference ton at the beginning of last week, exceeding expectations and further dampening market sentiment. Scrap, molybdenum iron, and other raw material prices also declined simultaneously.

High-carbon ferrochrome fell sharply to US$1032/50 reference ton due to the steel tender. Due to the significant decline in nickel-chromium prices, the price of scrap stainless steel fell to US$1265/MT (excluding tax). Based on current prices, the cash cost of cold-rolled products is around US$1930/MT, compared to the spot price of 304 coils at US$1930/MT to US$1940/MT, which has restored the profits of steel mills. The tender price of molybdenum iron remained weak last week, and the domestic spot price of molybdenum iron fell to US$32409/MT to US$32686/MT. The mainstream quotation for electrolytic manganese rose to US$1655/MT to US$1669/MT.

The overall supply of nickel iron in December remained stable with a slight increase. Although steel mills continue to maintain high production levels, after the continuous decline in stainless steel prices, steel mills will inevitably continue to lower their purchase prices for high-nickel pig iron to reduce production costs. It is expected that the price of high-nickel pig iron will continue to decline in the short term.

SUMMARY|| Raw material pressures persist, stainless steel remains weak.

Stainless steel prices operated weakly last week, with insufficient macroeconomic confidence and slow domestic policy implementation. Stainless steel prices traded on fundamentals. Market transactions were weak, with downstream demand mainly driven by rigid demand. Social inventories decreased but remained at high levels, and warrants continued to be withdrawn. In the spot market, stainless steel spot prices declined last week. The sharp decline in raw material prices during the week dragged down market sentiment, leading to a decline in stainless steel prices. High steel mill production in December will put some pressure on future supply. Currently, in the off-season of demand, the fundamentals of stainless steel will remain weak. The current market fundamentals are still in a state of oversupply, and the market needs to closely monitor the production plans of upstream steel mills, raw material prices, and the destocking speed of social inventories.

300 Series: Raw material prices have continued to decline, shifting the cost support for stainless steel downwards, and both futures and spot prices have declined simultaneously. Domestic imports have increased, coupled with a slight increase in domestic steel mill production, increasing short-term supply-side pressure. Spot inventories have been continuously destocked, and inventory pressure is manageable. In the off-season, market transactions have been weak, and the news of additional tariffs imposed by Trump may affect exports. However, there may be a wave of winter storage demand before the end of the year. It is expected that the spot price of cold-rolled 304 will fluctuate in the short term.

200 Series: Steel mill production has increased slightly, and supply pressure still exists; the simultaneous fluctuation of the futures market and raw materials during the week has led to the weak operation of 201 prices. Downstream demand has not improved significantly, and the supply-demand contradiction has further intensified. It is expected that the price of 201 will mainly operate weakly in the short term.

400 Series: The price of high-chromium raw materials has continued to decline last week, collapsing the cost support for 400 series stainless steel. With the commissioning of new production capacity by steel mills, the output of the 400 series has increased significantly month-on-month, and inventories have accumulated for two consecutive weeks, and market supply pressure will continue to increase in the future. Stainless steel has now entered the traditional off-season, and downstream demand is difficult to improve significantly. Fundamentals are likely to continue to weaken. Given that steel mills still maintain a firm price stance, it is expected that the price of 430 will be under pressure in the short term.

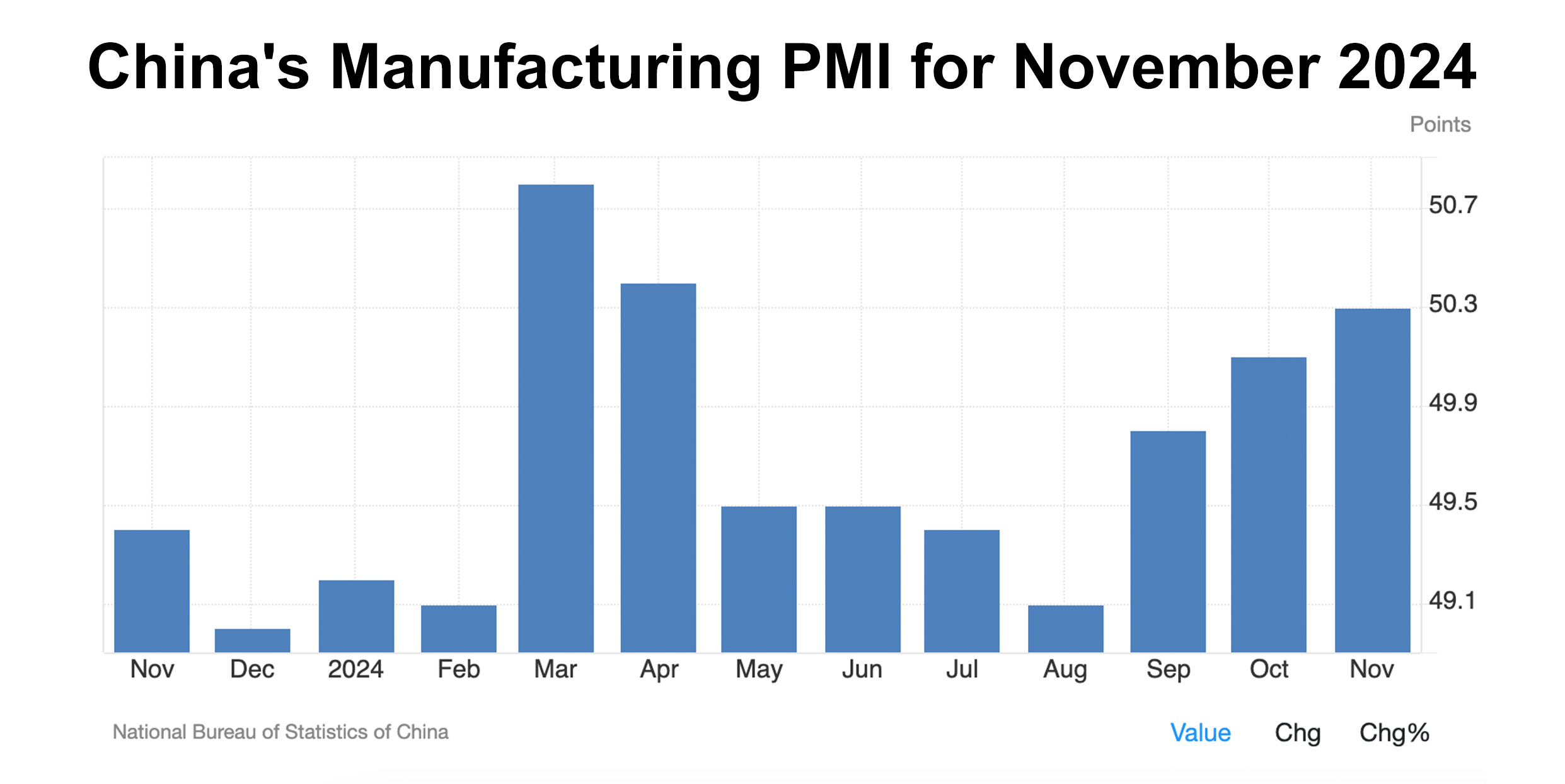

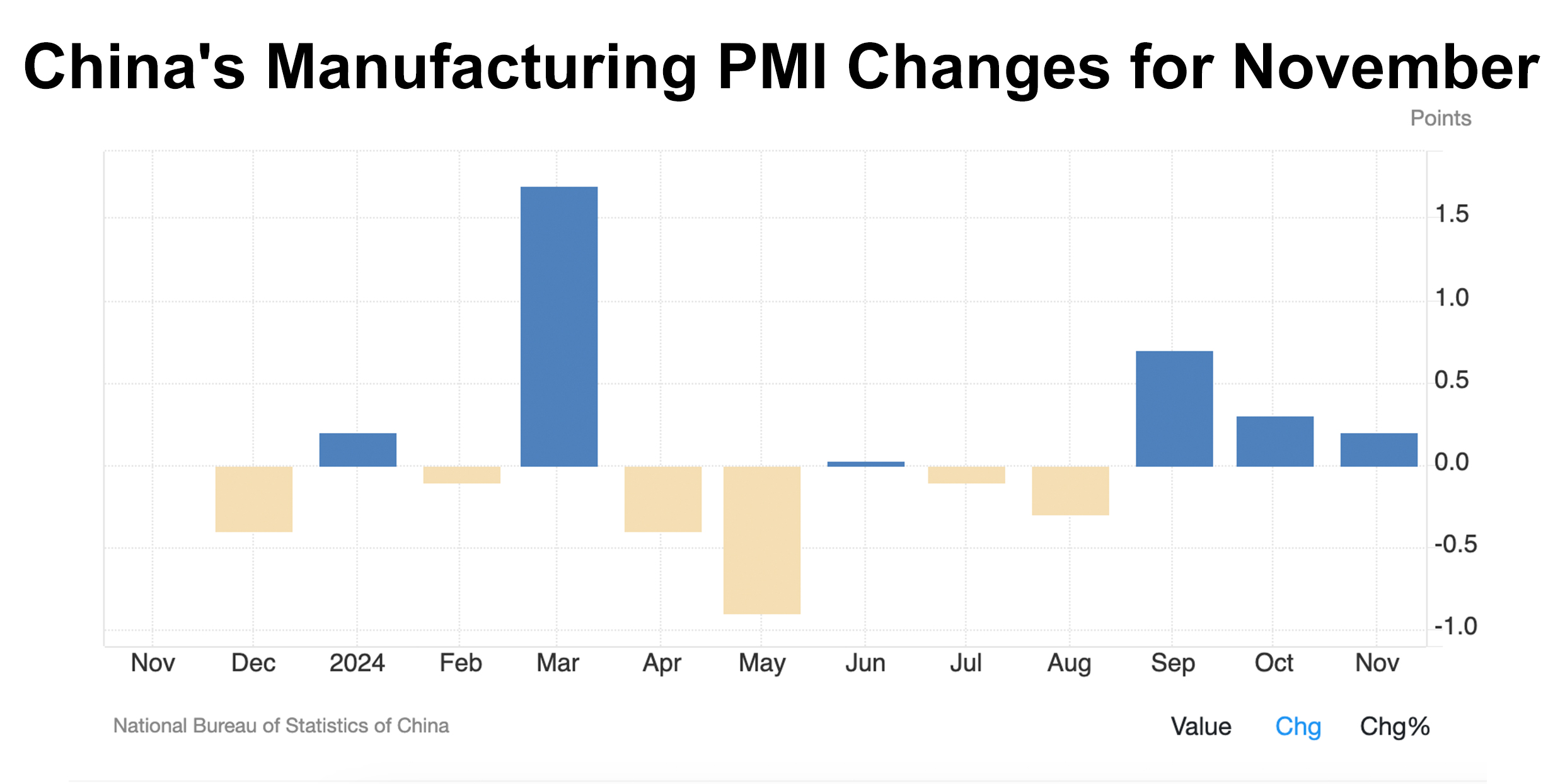

MACRO|| China's Manufacturing PMI Reenters Expansionary Range After Three Consecutive Monthly Increases in November.

The Caixin China General Manufacturing Purchasing Managers' Index (PMI) rose by 0.2 percentage points month-on-month to 50.3% in November, exceeding market expectations (the Bloomberg consensus forecast was 50.2%). The effects of short-term policies have become apparent, reflected in the month-on-month improvement of industries such as electrical machinery and equipment manufacturing and automobile manufacturing, which have benefited from trade-in policies. However, the sustainability of the improvement in economic momentum still requires further policy support. On the one hand, the uncertainty of external demand has increased. On the other hand, the structural differentiation in the November PMI data is still significant, as prices have once again fallen into the contractionary range, there is a divergence in enterprise size, the construction industry has fallen into the contractionary range, and the expansion rate of the service sector is slower than the historical average.

The manufacturing PMI has increased month-on-month for the third consecutive month, with a month-on-month increase of 0.2 percentage points, slightly higher than the average for the same period from 2013 to 2019 (0.1 percentage points). New orders stood at 50.8%, returning to the expansionary range since May 2024, and increased by 0.8 percentage points month-on-month, higher than the average for the same period from 2013 to 2019 (0.1 percentage points), making it the main contributor to the month-on-month improvement in the PMI. Production stood at 52.4%, up 0.4 percentage points month-on-month, slightly higher than the average for the same period from 2013 to 2019 (0.3 percentage points), showing a steady expansionary trend. Expectations for production and business activities increased by 0.7 percentage points month-on-month to 54.7%.

The sustainability of the improvement in economic momentum still requires further policy support. On the one hand, the uncertainty of external demand has increased. New export orders in November were 48.1%, although they improved by 0.8 percentage points month-on-month, higher than the average for the same period from 2013 to 2019 (0.2 percentage points), but the absolute level remains relatively low. In the future, external demand not only faces certain downward pressure, but the preliminary Markit Manufacturing PMI in November showed a decline in Japan and Europe and an increase in the United States, with the Eurozone, Japan, and the United States standing at 45.2%, 49.0%, and 48.8%, respectively (compared to 46.0%, 49.2%, and 48.5% in October), and with the end of the US election in November, the uncertainty of the external trade environment has increased.

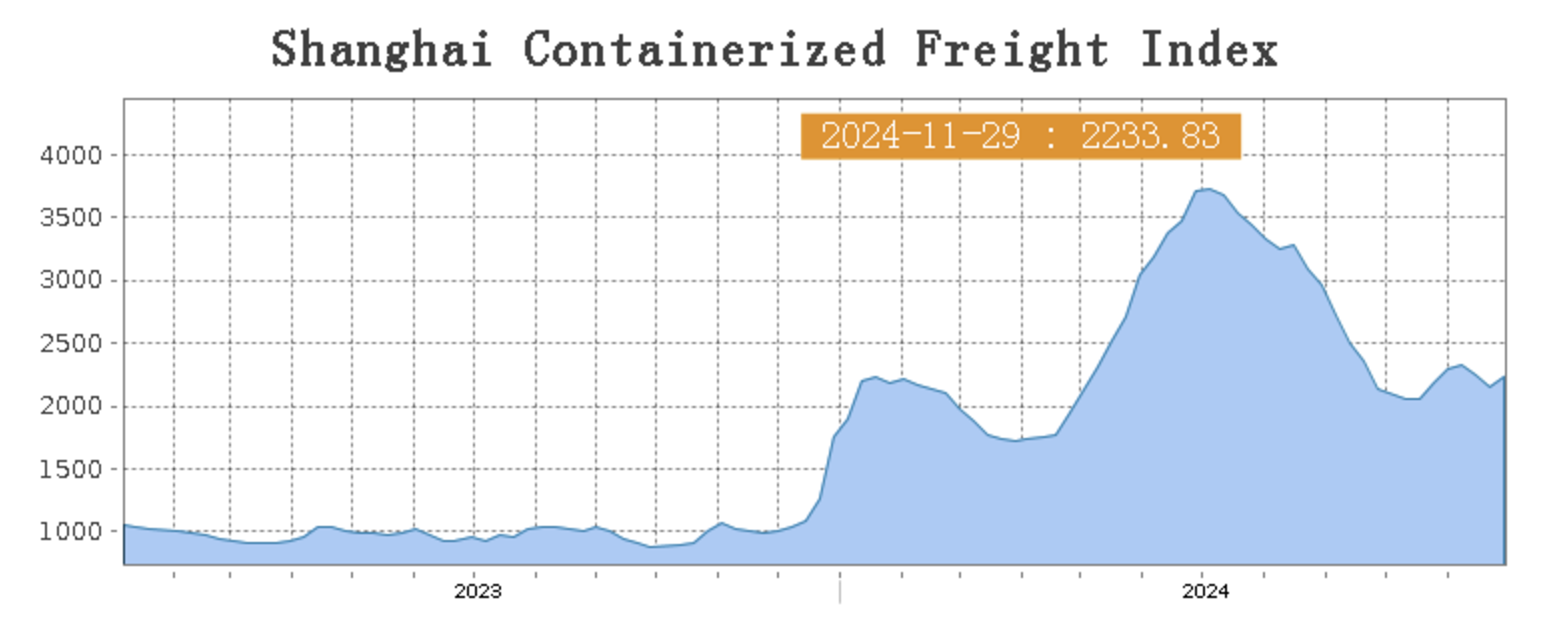

SEA FREIGHT|| Shanghai to Mediterranean market surged 19.9% last week.

Last week, the Chinese export container transportation market saw a divergence. Due to the differences in supply and demand fundamentals among different shipping routes, freight rates diverged, and the composite index rose. On November 29th, the Shanghai Shipping Exchange released the Shanghai Containerized Freight Index (SCFI) at 2233.83 points, up 3.4% from the previous week.

Europe/ Mediterranean:

The European market may also face the impact of future Trump administration tariff policies, and its economic outlook will be tested. Last week, transportation demand remained stable, supply and demand fundamentals were solid, and shipping companies implemented price increase plans at the end of the month, pushing up spot market booking prices.

On 29th November, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$3039TEU, which spiked by 1.1%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3682/TEU, which surged by 19.9%.

North America:

Last week, transportation demand growth was weak, and the supply-demand balance was unsatisfactory, leading to a continued decline in market freight rates, with the US West Coast route experiencing a larger decline.

On 29th November, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$3345/FEU and US$4954/FEU, both reporting an 12.5% and 0.9% fall accordingly.

The Persian Gulf and the Red Sea:

On the Persian Gulf route, the ongoing local tensions continued to support the transportation market, and spot market booking prices continued to rise.

On 29th November, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf went up by 3.4% from last week's posted US$1362/TEU.

Australia/ New Zealand:

On 29th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1850/TEU, a 9.2.% fall from the previous week.

South America:

On 29th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$5346/TEU, an 1.7% increase from the previous week.