Stainless Insights in China from December 2nd to December 6th.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,035 | -22 | -1.15% |

| Foshan | 2,080 | -22 | -1.12% | ||

| Hongwang | Wuxi | 1,945 | -13 | -0.68% | |

| Foshan | 1,955 | -4 | -0.23% | ||

| 304/NO.1 | ESS | Wuxi | 1,860 | -18 | -1.03% |

| Foshan | 1,880 | -13 | -0.70% | ||

| 316L/2B | TISCO | Wuxi | 3,480 | -36 | -1.07% |

| Foshan | 3,560 | -36 | -1.04% | ||

| 316L/NO.1 | ESS | Wuxi | 3,310 | -42 | -1.29% |

| Foshan | 3,345 | -13 | -0.39% | ||

| 201J1/2B | Hongwang | Wuxi | 1,240 | -3 | -0.25% |

| Foshan | 1,205 | -3 | -0.25% | ||

| J5/2B | Hongwang | Wuxi | 1,100 | -4 | -0.42% |

| Foshan | 1,110 | -3 | -0.28% | ||

| 430/2B | TISCO | Wuxi | 1,140 | -1 | -0.14% |

| Foshan | 1,140 | -3 | -0.27% |

TREND|| Stainless Steel Prices Hit a New Low in Nearly Four Years, Three Major Steel Mills Announce Production Cuts.

Stainless steel futures prices fell to a new low this year, and industry speculation is weak. Steel mills lowered their opening prices, and agents followed suit by offering discounts to ship goods; downstream merchants were cautious and held onto their orders, with transactions mainly focused on low-priced resources, and inventories declined slightly. As of the end of last week, the main stainless steel contract price had decreased by US$21/MT to US$1905/MT compared to the previous week.

300 Series: Futures and spot prices declined, agents offered discounts to reduce inventory.

Last week, the spot price of 304 fluctuated downward. As of Friday, the mainstream base price of cold-rolled four-foot 304 in Wuxi was US$1895/MT, and the price of hot-rolled stainless steel was US$1855/MT, both down US$21 from Friday last week. At the beginning of the week, steel mills opened with lower prices, and the futures market rebounded in the first half of the week, and spot prices stabilized somewhat.

Downstream end-users maintained rigid demand, and intraday transactions were acceptable. In the second half of the week, the futures market stagnated and fell to a new low for the year, and market panic spread, with agents lowering their prices to ship goods, but the actual effect was not good, and trading was thin.

200 Series: Prices trended steadily upwards.

The price of 201 trended steadily upwards last week. cold-rolled 201J2 increased by US$7 to US$1075/MT; cold-rolled 201J1 remained flat at US$1210/MT, and hot-rolled 201J1 was quoted at US$1180/MT. With both bullish and bearish factors, the price of 201 is likely to remain stable.

400 Series: Inventory continues to accumulate, prices under pressure.

Last week, the price of 430 in the Wuxi market trended weakly, with cold-rolled prices at US$1135 to US$1140/MT; hot-rolled remained stable at US$1085/MT. Last week, the inventory of the 400 series in the Wuxi market accumulated to 124,600 tons. The repeated fluctuations in the futures market last week affected market trading confidence, downstream purchases were cautious, and the wait-and-see sentiment was strong, with transactions mainly driven by rigid demand. Spot market inventory digestion was slow, and the accumulation pattern continued.

RAW MATERIAL || Steel Tender Prices Plunge, Raw Material Production Cut.

Last week, the London Metal Exchange (LME) nickel price fluctuated. The week opened at $15,840, reaching a high of US$16,205 and a low of US$15,645, eventually closing at US$16,035, representing a week-on-week increase of 0.22%.

The SHFE nickel 2501 main contract fluctuated last week. Overall, the week opened at US$17501, reaching a high of US$17841 and a low of US$17230, eventually closing at US$17544, up US$43 from the previous week, representing a week-on-week increase of 0.25%. Technically, the SHFE nickel 2501 main contract remains in a weak range-bound trend in the short term.

Last week, the high-nickel iron market was under pressure and declined, and the mainstream domestic quotation for high-nickel iron fell by US$2/nickel point for the week. At the beginning of the week, there were frequent rumors in the market that large steel mills had traded high-nickel iron at a low price of US$130/nickel point, coupled with the poor performance of stainless steel, steel mills inquired about price reductions, and the market was bearish on high-nickel iron. On Wednesday, Tsingshan announced the first round of bidding price for high-nickel iron in December at US$131/nickel point (EXW), a decrease of US$1.3/nickel point compared with the previous round, which was in line with market expectations.

However, the current production cost of high-nickel iron is around US$144/50 reference ton, and the production cost of high-nickel iron continues to decline. Although steel mills maintain high production in December, stainless steel continues to bottom out, and steel mills are suppressing raw material prices. It is expected that the price of high-nickel iron will be under pressure in the short term.

Last week, the price of high-carbon ferrochrome continued to be weak, and the mainstream domestic price of high-carbon ferrochrome fell by US$7 to US$1027/50 reference ton for the week. The production cost of high-carbon ferrochrome has dropped to around US$1072/reference ton, and the significant decline in the cost of ferrochrome has led to losses for iron plants. Currently, high-carbon ferrochrome has fallen to a nearly three-year low, and domestic ferrochrome plants have been widely shut down to cope with losses, which is expected to significantly reduce the output of high-carbon ferrochrome this month, providing some support for the price of high-carbon ferrochrome. The atmosphere in the ferrochrome market is depressed, and it is expected that high-carbon ferrochrome will mainly fluctuate weakly in the short term.

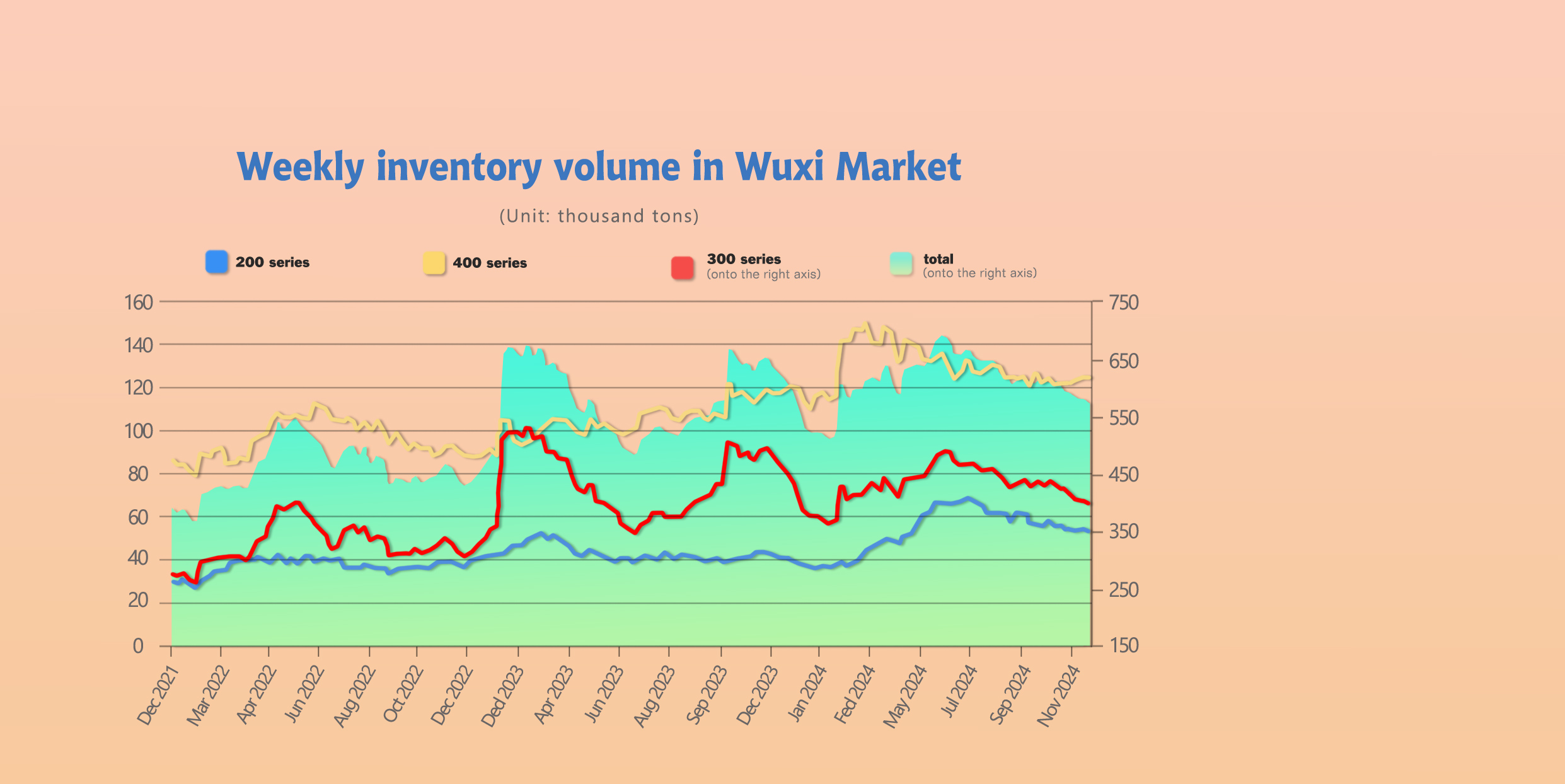

INVENTORY|| Six Consecutive Weeks of Inventory Decline.

The total inventory at the Wuxi sample warehouse down by 3,302 tons to 573,531 tons (as of 5th December).

The breakdown is as followed:

200 series: 458 tons up to 53,154 tons,

300 Series: 4,343 tons down to 395,823 tons,

400 series: 583 tons up to 124,554 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Nov 28th | 52,696 | 400,166 | 123,971 | 576,833 |

| Dec 5th | 53,154 | 395,823 | 124,554 | 573,531 |

| Difference | 458 | -4,343 | 583 | -3,302 |

200 Series: Overhaul, Market Fluctuations, Cold Roll Inventory Decreases and Hot Roll Inventory Increases.

Due to the reduced arrival of cold-rolled resources from Baosteel Desheng, cold-rolled inventory decreased slightly, while hot-rolled inventory increased slightly. Baosteel, Beigang New Material, and three major steel mills have announced production overhaul plans for January next year, which will alleviate the supply pressure in the future, boosting market sentiment. On Tuesday, the price of 201J2 cold-rolled increased, and cold-rolled inventory decreased slightly. Hot-rolled quotations were relatively firm, and the consumer end was cautious and observed, with purchases mainly driven by rigid demand, and hot-rolled inventory accumulated.

After prices fell to a new low in nearly four years, steel mills jointly issued a production overhaul plan for January, reducing the supply pressure of the 200 series in the future. In the short term, the price of 201J2 is expected to remain stable, and it is expected that inventory will decrease slightly next week. The focus is on steel mill pricing and market transactions.

300 Series: Agents Reduce Prices to Reduce Inventory, Sentiment is Poor and Warehouse Receipts Increase.

At the beginning of last week, steel mills lowered their opening prices, and market panic spread, with agents following suit by lowering their prices to ship goods. Downstream merchants were more willing to purchase at low prices, and transactions improved, and inventory continued to decline.

400 Series: Cost Support Shifts Down, Inventory Continues to Accumulate.

During last week, the market had normal arrivals, and the fluctuations in the futures market affected market trading confidence. Downstream purchases were cautious, and the wait-and-see sentiment was strong, with transactions mainly focused on low-priced resources. The digestion of spot market inventory was slow, and the accumulation pattern continued. However, due to the fact that steel mills are still in a loss-making state, production may decrease in the future. Weak downstream demand in the off-season has increased the pressure to ship goods in the market, and the digestion of spot inventory has been slow, and the supply-demand contradiction may further intensify. It is expected that inventory will continue to accumulate next week, and the focus will be on steel mill production and market transactions.

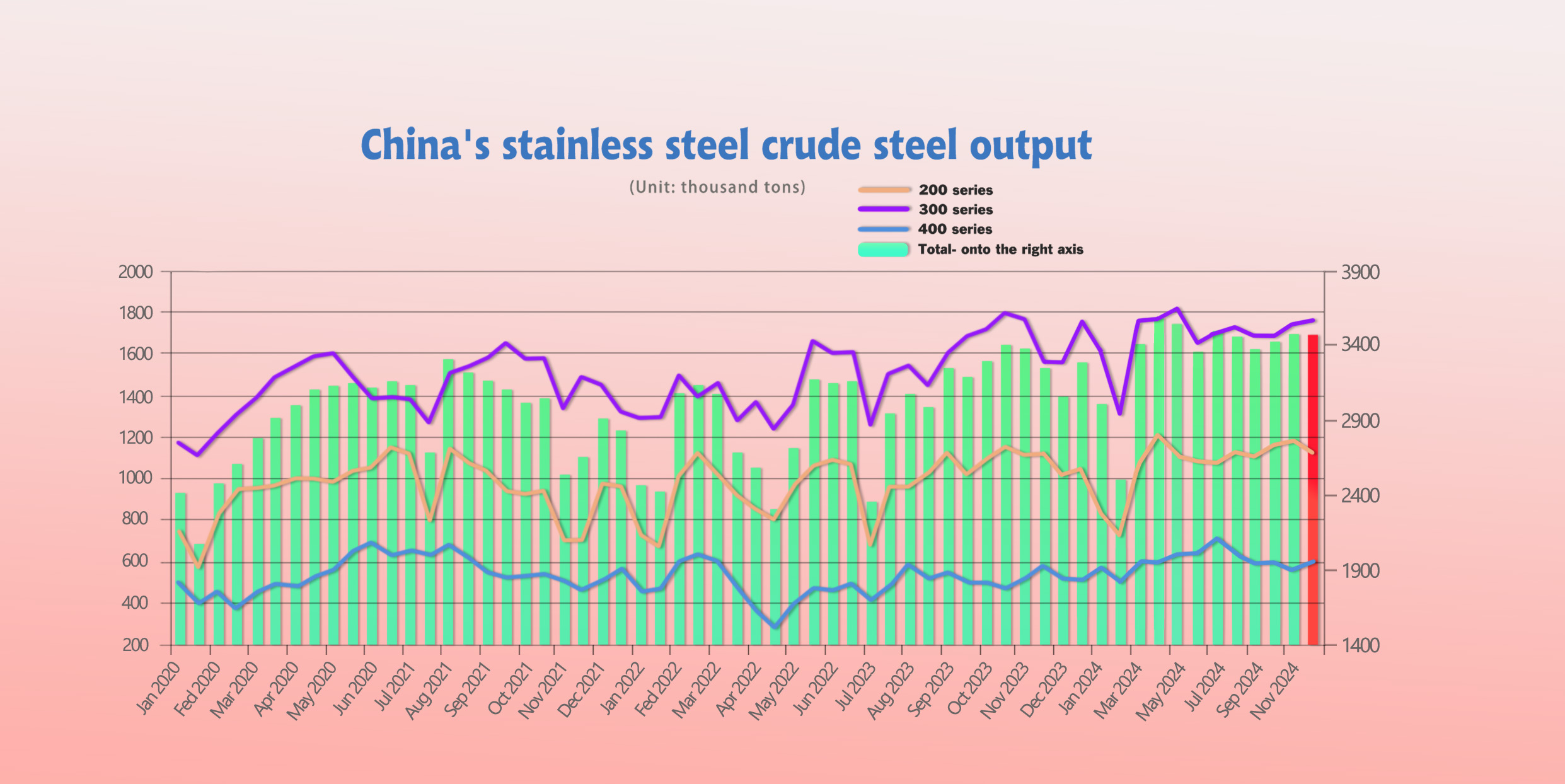

PRODUCTION || Steel Mills Initially Hesitant to Cut Production Begin to Adjust Output Downward.

According to statistics, the crude steel output of large-scale domestic stainless steel enterprises in November 2024 was 3.4591 million tons, a month-on-month increase of 36,200 tons or 1.06%, and a year-on-year increase of 382,600 tons or 12.44%. The output of various series in November varied. The specific output of each series is as follows:

The output of the 200 series was 1.1691 million tons, a month-on-month increase of 16,900 tons or 1.46%, and a year-on-year increase of 155,800 tons or 15.38%.

The output of the 300 series was 1.7301 million tons, a month-on-month increase of 49,800 tons or 2.97%, and a year-on-year increase of 178,600 tons or 11.51%.

The output of the 400 series was 559,900 tons, a month-on-month decrease of 30,500 tons or 5.17%, and a year-on-year increase of 48,300 tons or 9.43%.

In December, the current price of the 300 series continued to decline, and some steel mills slightly reduced their output in December. Delong Steel Mill reduced production by 30,000-40,000 tons due to power issues, and the output of many other steel mills also decreased slightly. However, with the expectation of a continued increase in newly commissioned steelmaking capacity in November, Delong Xiangshui Base maintained an upward trend in production in December. Overall, the output of the 300 series in December increased slightly to around 1.75 million tons.

In November, the price of the 200 series continued to decline, completely erasing the gains since late September. The improved orders in the previous period led to a slight increase in output in November. Looking ahead to December, three major steel mills held a "meeting" at the beginning of the month, and news of overhaul and production cuts was released. Overhaul plans will be launched successively from December to January. It is estimated that the output of the 200 series in December will decrease by 40,000 tons to around 1.13 million tons month-on-month.

Due to the continuous decline in prices, most of the steel mills in China slightly reduced production, and the output continued to fall to 560,000 tons in November. In December, the bidding price of ferrochrome fell, and the cost of the 400 series eased, alleviating the losses of steel mills. According to preliminary understanding, the output of the 400 series in December is around 590,000 tons.

Overall, while new production capacity of steel mills continues to increase, the increase in stainless steel supply has been suppressed after the continuous decline in prices.

Currently, low prices have stimulated end-user demand, and inventory pressure in Wuxi and Foshan has been lower than the same period last year. With the tug-of-war between supply and demand, prices in December will fluctuate and bottom out.

SUMMARY || Insufficient Raw Material Support for Stainless Steel Prices, Weak Outlook.

Under the current situation where raw material prices are still under pressure and downstream terminal demand is limited, the stainless steel market is expected to continue a volatile and weak trend in the short term. Continue to pay attention to changes in steel mill policies and raw material prices.

300 Series: The increase in imported resources and high domestic production levels continue to put pressure on supply; weak off-season demand, and market transactions are mainly driven by rigid demand. Weak raw material prices and downward cost support have led steel mills to reduce prices and actively reduce inventory. It is expected that pre-year winter storage will drive demand release and help prices rebound.

200 Series: After prices fell to a new low in nearly four years, steel mills jointly issued a production overhaul plan for January, reducing the supply pressure of the 200 series in the future. Raw material prices fluctuate due to the impact of macroeconomic policies, and the cost support for 201 weakens. With both bullish and bearish factors, the price of 201 is likely to remain stable.

400 Series: Weak downstream demand in the off-season has increased the pressure to ship goods in the market, and the digestion of spot inventory has been slow, and the supply-demand contradiction may further intensify. Given the market's expectations for macroeconomic policies, the price of 430 is expected to fluctuate weakly in the short term under the tug-of-war between supply and demand.

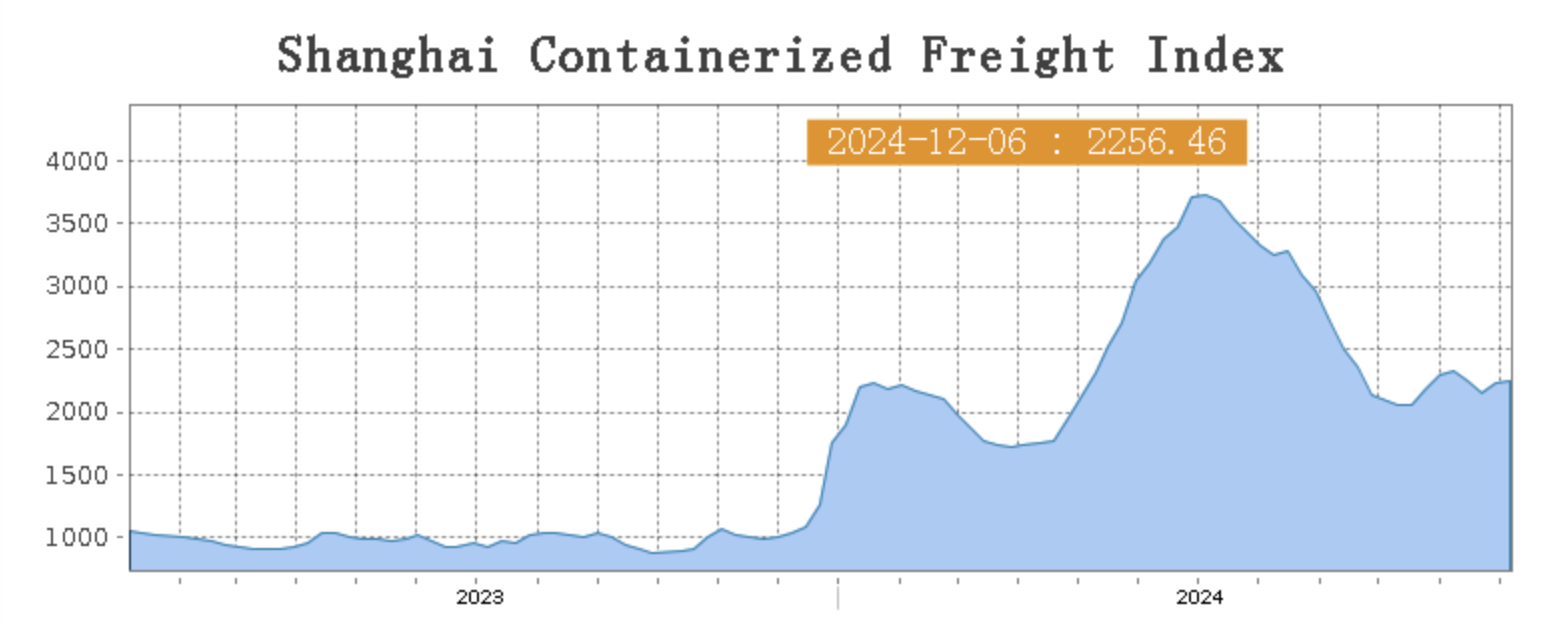

SEA FREIGHT||Overall Stable Shipping Market.

Last week, the Chinese export container shipping market was generally stable, with different routes showing divergent trends, and the composite index rose slightly. China's Caixin Composite PMI rose to 52.3 in November, the highest in 6 months. Among them, the manufacturing PMI rose to 51.5, a 5-month high, which supported the continued steady development of China's export shipping market.

On 6th December, the Shanghai Shipping Exchange released the Shanghai Containerized Freight Index (SCFI) at 2256.46 points, up 1% from the previous week.

Europe/ Mediterranean:

Last week, overall transportation demand was stable, and market freight rates remained at the previous week's level, with spot market booking prices fluctuating slightly.

On 6th December, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$3030TEU, which slid by 0.3%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3761/TEU, which lifted by 2.1%.

North America:

Last week, transportation demand growth was weak, and the transportation market continued to weaken, with spot market booking prices continuing to decline.

On 6th December, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$3309/FEU and US$4924/FEU, both reporting a 1.1% and 0.6% fall accordingly.

The Persian Gulf and the Red Sea:

On the Persian Gulf route, the ongoing local tensions continued to support the transportation market, and spot market booking prices continued to rise.

On 6th December, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf went up by 8.2% from last week's posted US$1474/TEU.

Australia/ New Zealand:

On 6th December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1769/TEU, a 4.4% fall from the previous week.

South America:

On 6th December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$5711/TEU, an 6.8% increase from the previous week.