Stainless Insights in China from April 7th to April 11th.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,050 | -32 | -1.61% |

| Foshan | 2,095 | -32 | -1.58% | ||

| Hongwang | Wuxi | 1,950 | -44 | -2.34% | |

| Foshan | 1,970 | -48 | -2.50% | ||

| 304/NO.1 | ESS | Wuxi | 1,895 | -40 | -2.18% |

| Foshan | 1,895 | -41 | -2.27% | ||

| 316L/2B | TISCO | Wuxi | 3,465 | -21 | -0.62% |

| Foshan | 3,535 | -17 | -0.48% | ||

| 316L/NO.1 | ESS | Wuxi | 3,320 | -33 | -1.02% |

| Foshan | 3,340 | -17 | -0.51% | ||

| 201J1/2B | Hongwang | Wuxi | 1,270 | -15 | -1.27% |

| Foshan | 1,260 | -35 | -2.97% | ||

| J5/2B | Hongwang | Wuxi | 1,165 | -26 | -2.39% |

| Foshan | 1,160 | -37 | -3.37% | ||

| 430/2B | TISCO | Wuxi | 1,155 | 0 | 0.00% |

| Foshan | 1,140 | -6 | -0.53% |

TREND || Stainless Steel Prices Retrace Over Half Gains Amid Trade War, Price Stabilization Remains Uncertain

Stainless steel futures prices plummeted last week. Affected by the China-US trade war, financial markets experienced severe turbulence, with commodity markets also dragged into the downturn. Prices weakened across the board amid pessimistic market sentiment. After the recent sharp decline, stainless steel futures prices have breached previous lows and remain vulnerable to macroeconomic developments, particularly the potential escalation of the trade war. Trading activity was brisk during the week, though open interest saw a slight decrease. The main stainless steel futures contract closed at US$1880/ton last week, down 4.95% weekly, with an intraweek low of US$1835/ton. In the spot market, stainless steel prices fell by US$48-US$75.8/ton. The nosedive in futures prices dragged spot prices lower, exacerbating bearish sentiment. Transactions remained sluggish as downstream buyers adopted a cautious stance, reducing procurement volumes to avoid potential inventory accumulation.

300 Series: Tariff Escalation Spurs Low-Price Purchasing

Last week, 304 stainless steel spot prices fluctuated downward. As of Friday, the mainstream base price for 304 cold-rolled 4-foot stainless steel from private mills in Wuxi stood at US$1890/ton, down US62/ton week-on-week. Hot-rolled products from private mills were quoted at US$1870/ton, a US$69/ton WoW decline. Following Trump's announcement of sweeping tariff hikes last week, market risk aversion intensified, triggering a rapid plunge in stainless steel prices. With escalating tariff policies and the reignition of trade war tensions, futures prices oscillated near multi-year lows, hitting US$1805/ton—the lowest level in five years. After Tsingshan lifted its price restrictions, merchants successively slashed offers. The market remained dominated by wait-and-see sentiment, resulting in weak transactions throughout the week.

200 Series: Spot Prices Continue Downward Trajectory

201 series prices extended losses last week, with cold-rolled 201J2 products quoted at US$1120/ton and cold-rolled 201J1 at US$1215/ton. 201J1 hot-rolled prices stood at US$1200/ton.

Affected by macro pessimism, futures prices remained range-bound at low levels. Mainstream 201 series underwent multiple downward revisions during the week, with significant declines across 201J1/J2 cold-rolled and 201J1 hot-rolled products. On Thursday, Qingshan Group's sharp opening price cuts prompted agents and traders to follow suit with discounted offers, flooding the market with low-priced resources.

400 Series: Rising Raw Material Costs Underpin Price Stability

Despite the turmoil from "tariff wars" and consecutive declines in 300 series prices, 400 series stainless steel maintained stable operations. In Wuxi, 430/2B prices held firm at US$1160/ton, while 430/NO.1 mainstream quotes remained unchanged at US$1065/ton, both flat from last weekend.

Two factors supported this stability: First, the price of high-carbon ferrochrome—a key raw material—surged by US$55/50 reference ton week on week to US$1172/50 reference ton at mainstream plants. Second, reduced inventory levels alleviated supply pressure, providing fundamental support for 430 series price resilience.

INVENTORY || Domestic Stainless Steel Capacity Under Pressure, April Output Sees Minor Reduction

As of April 10th, total inventory in Wuxi sample warehouses increased by 14,203 tons to 648,036 tons. Breakdown:

200 Series: 2,941 tons up to 54,503 tons.

300 Series: 11,943 tons up to 454,106 tons.

400 Series: 681 tons down to 139,427 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Apr 3rd | 51,562 | 442,163 | 140,108 | 633,833 |

| Apr 10th | 54,503 | 454,106 | 139,427 | 648,036 |

| Difference | 2,941 | 11,943 | -681 | 14,203 |

200 Series: Inbound Resources Drive Mild Inventory Accumulation

Futures price declines during the week dampened market sentiment, with downstream buyers remaining cautious. Trading activity stayed sluggish.

In the short term, 201J2 prices may stabilize weakly, with inventories likely to accumulate slightly next week.

300 Series: Overcapacity Persists

304 prices fell due to macroeconomic headwinds, particularly intensified China-US tariff tensions, with further policy risks looming. Market participants adopted a wait-and-see approach, while downstream procurement remained limited to rigid demand. As arrivals gradually increase, inventories are expected to continue rising.

400 Series: Stable Prices Amid Gradual Inventory Drawdown

From a structural perspective, TISCO’s cold- and hot-rolled inventories continued to decline, while JISCO’s cold-rolled stocks rose notably. Overall spot inventories maintained a slow reduction pace.

Downstream procurement demand for stainless steel showed no significant improvement. Coupled with increased mill arrivals, overall inventory drawdown slowed, resulting in only a marginal decline. 430 cold-rolled prices held steady, supported by decent downstream demand and slight inventory reductions. Cost pressures are intensifying, with ongoing monitoring of tariff policy impacts.

April Domestic Stainless Steel Output: Minor MoM Decline Amid Persistent Overcapacity

China’s April crude stainless steel production is planned at 3.637 million tons, down 25,100 tons (or 0.69% MoM) but up 67,600 tons year-on-year (1.89%). While April output shows a negligible MoM dip, YoY growth persists. High production volumes combined with weakening exports sustain domestic overcapacity, suppressing price rebounds.

RAW MATERIAL || Chromium Ore Supply Tightens, Prices Rally

Recent declines in nickel prices and falling nickel pig iron (NPI) procurement costs—driven by Indonesia’s second-round April nickel ore benchmark price drop—have weakened cost support for stainless steel. This has further dampened market expectations for cost and price trends, heightening caution across the supply chain. Current NPI procurement prices hover near US$138/Nickel point, while high-carbon ferrochrome prices rose to US$1172/50 reference ton. 304 scrap stainless steel prices also softened.

High-carbon ferrochrome has maintained a relatively strong operation under the dual impetus of rising costs and tight supply. The chromite ore has shown a strong upward trend. The long-term contract spot offer of chromium concentrate (40-42%) from a large South African chromite ore supplier is US$295/MT(CIF), an increase of 10 US dollars compared with the previous month.

Reduced South African chromium ore shipments in first quarter will lead to significantly lower arrivals in March-April, providing strong short-term support for ore prices and lifting ferrochrome costs. Meanwhile, March high-carbon ferrochrome output fell YoY, while April stainless steel production remains elevated, further tightening the ferrochrome supply-demand balance. However, stainless steel’s downtrend under trade war pressures has curbed raw material market optimism. Ferrochrome trading sentiment turned cautious, with expectations that the price rally will slow in the near term.

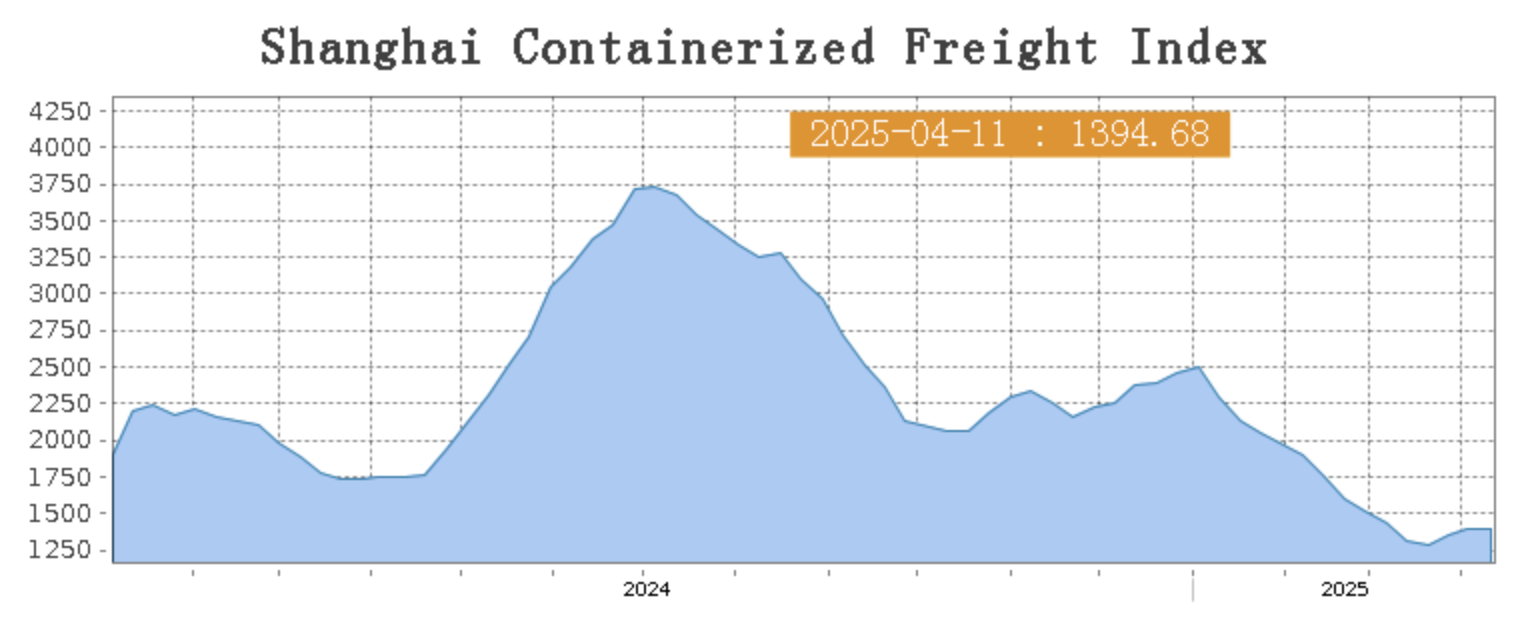

SEA FREIGHT|| North America Route Rates Decline

China’s export container shipping market remained generally stable last week, with the composite index edging slightly.

On April 11th, the Shanghai Containerized Freight Index (SCFI) rose 0.1% to 1394.68 points.

Europe/ Mediterranean:

China and the EU have initiated negotiations on price commitments for electric vehicles (EVs), signaling potential deeper collaboration in trade, investment, and industrial sectors.

On April 11th, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1356/TEU, which increased by 1.5%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$2144/TEU, which grew by 5.7%.

North America:

The "reciprocal tariff" escalation threatens global economic growth and supply chain stability, with the "tariff war" already impacting the China-US shipping market. Last week, some cargo shipments were canceled, spot market bookings declined noticeably, and freight rates saw modest adjustments.

On April 11th, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$2202/FEU and US$3226/FEU, reporting 4.8% and 2.4% drop accordingly.

The Persian Gulf and the Red Sea:

On April 11th, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf rose 1.5% to US$1309/TEU.

Australia&New Zealand:

On April 11th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand rose 6.1% to US$890/TEU.

South America:

On April 11th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports rose 9.1% to US$1566/TEU.