Stainless Insights in China from October 21st to October 25th

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,175 | -25 | -1.22% |

| Foshan | 2,220 | -25 | -1.20% | ||

| Hongwang | Wuxi | 2,055 | -27 | -1.37% | |

| Foshan | 2,065 | -21 | -1.08% | ||

| 304/NO.1 | ESS | Wuxi | 1,985 | -34 | -1.79% |

| Foshan | 2,000 | -34 | -1.77% | ||

| 316L/2B | TISCO | Wuxi | 3,725 | -3 | -0.08% |

| Foshan | 3,800 | -17 | -0.46% | ||

| 316L/NO.1 | ESS | Wuxi | 3,560 | -8 | -0.25% |

| Foshan | 3,580 | -8 | -0.25% | ||

| 201J1/2B | Hongwang | Wuxi | 1,320 | -11 | -0.93% |

| Foshan | 1,290 | -21 | -1.77% | ||

| J5/2B | Hongwang | Wuxi | 1,195 | -34 | -3.04% |

| Foshan | 1,190 | -17 | -1.55% | ||

| 430/2B | TISCO | Wuxi | 1,170 | -21 | -1.97% |

| Foshan | 1,175 | -8 | -0.79% |

TREND || Macroeconomic Benefits Fade, Stainless Steel Prices Cool Down.

Last week, the spot and futures prices of stainless steel in the Wuxi market have both declined slightly, and industry speculation is weak. Although the interest rate cut at the beginning of the week boosted market sentiment, the spot market transactions were poor, and downstream demand was weak. Coupled with the weakening of import and export data, the end-users adopted a wait-and-see attitude; supply pressure did not decrease, and demand was mainly for low-priced resources, leading to an accumulation of inventory. As of the end of last week, the main contract price of stainless steel had decreased by US$7 to US$2050/MT compared to the previous week, a decrease of 0.73%.

300 Series: Basis Narrowed, Inventory Accumulated Under Weak Supply and Demand.

Last week, the spot price of 304 has declined slightly. As of Friday, the main base price of cold-rolled four-foot 304 in the Wuxi region was US$2005/MT, down US$21 from the previous Friday; the price of private hot-rolled stainless steel was US$1975/MT, down US$28 from the previous Friday. The futures market fluctuated up and down last week. In the first half of the week, spot prices fell sharply, and market purchasing sentiment cooled down, with many adopting a cautious wait-and-see attitude. At the beginning of the week, the central bank lowered the LPR, exceeding market expectations, which boosted market sentiment; however, as the peak season of demand has come to an end, terminal procurement demand is weak, and spot transactions have not improved significantly. In the second half of the week, the futures market rebounded from the bottom, and some traders slightly increased their prices by US$7/MT for shipments. Overall, transactions were poor during the week, and inventory accumulated.

200 Series: Demand Awaits Boost, High Supply Leads to Increased Inventory.

The main base price of cold-rolled 201J1 in the Wuxi market fell to US$1285/MT, cold-rolled J2/J5 fell to US$1140/MT, and five-foot hot-rolled 201J1 fell to US$1235/MT. The spot price of 201 fluctuated downward during the week, with low-priced resources emerging in the market, and traders offered discounts of US$7. Downstream demand was dominated by a wait-and-see attitude, and overall transactions were limited.

400 Series: Increased Arrivals & Cost Decline, Inventory Increased.

In the Wuxi spot market, the price of state-owned 430 cold-rolled was US$1165-US$1180/MT, down US$21 from the previous week's quotation; the price of state-owned hot-rolled 430 was around US$1115/MT, down US$7 from the previous Thursday's quotation. The guiding price of TISCO 430/2B was US$1485/MT, down US$7/MT from the previous week; the plate price of JISCO 430 was US$1650/MT, unchanged from the previous week's quotation. Ningbo Baoxin's ex-factory price notice for October 2024 (including tax): cold-rolled 304 negotiated on a case-by-case basis; cold-rolled 430 US$1485/MT, a decrease of US$57 compared to September 2024.

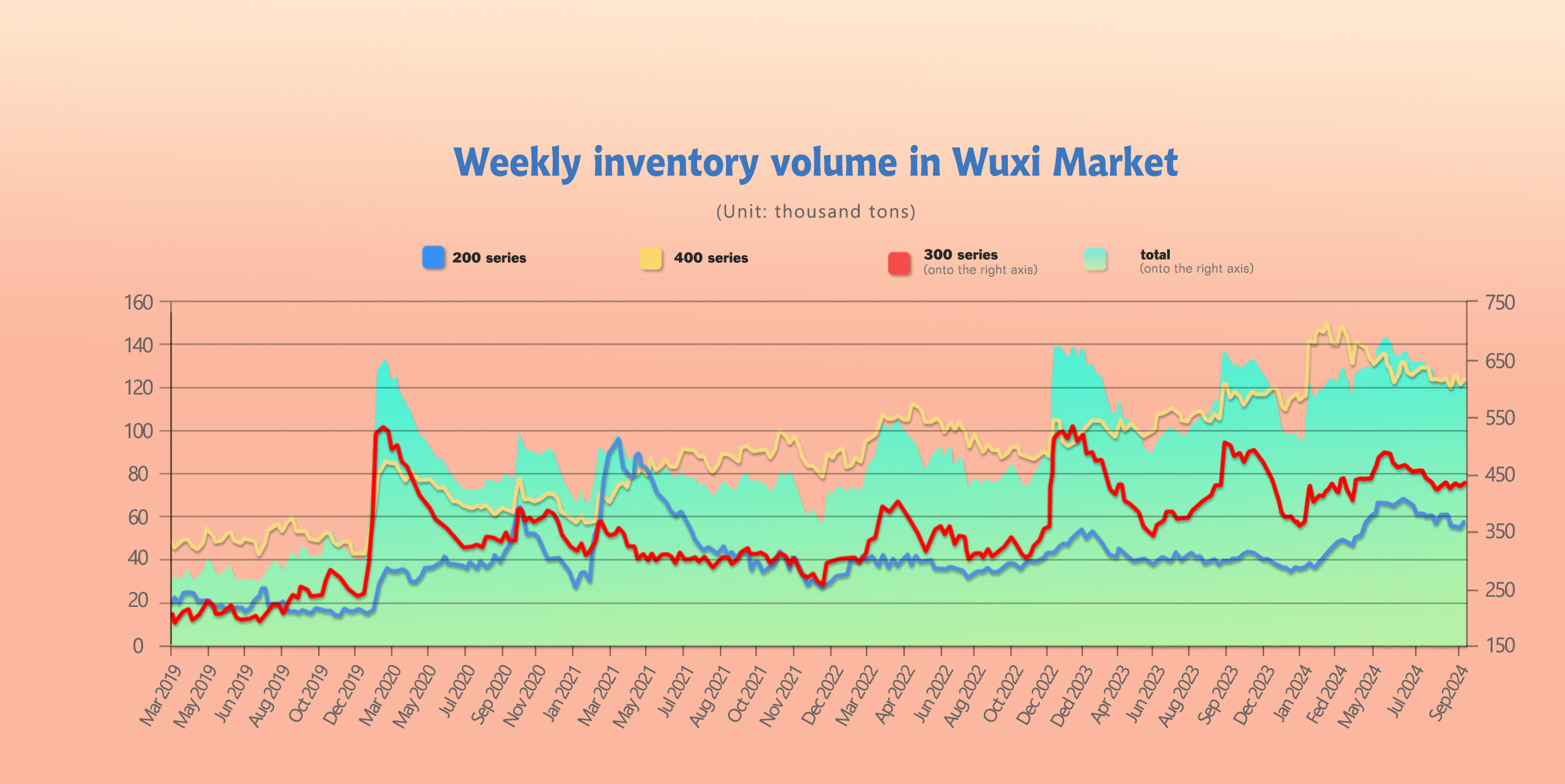

Inventory || Inventory Increased by 10,400 Tons.

The total inventory at the Wuxi sample warehouse up by 10,397 tons to 614,362 tons (as of 24th October).

the breakdown is as followed:

200 series: 2,610 tons up to 57,263 tons,

300 Series: 5,594 tons up to 433,489 tons,

400 series: 2,193 tons up to 123,610 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Oct 17th | 54,653 | 427,895 | 121,417 | 603,965 |

| Oct 24th | 57,263 | 433,489 | 123,610 | 614,362 |

| Difference | 2,610 | 5,594 | 2,193 | 10,397 |

300 Series: Inventory Accumulated Under Weak Supply and Demand.

During last week, futures prices declined weakly, and spot prices followed suit with slight decreases. The basis narrowed, and the advantage of spot pricing resources expanded, while the digestion of traditional resources was slow. Imports increased, and resources from the Indonesian Yongwang plant gradually flowed into the domestic market, coupled with increased production from domestic steel mills, pushing up supply pressure and increasing market arrivals. Last week, macro sentiment cooled down, coupled with a US$57 price reduction at the beginning of the week for Tsingshan, traders followed suit and adjusted their quotations downward for shipments, and there was still room for concessions in actual transactions. As prices fell, market confidence in the future declined. The demand for replenishing inventories in the previous period has been fully released, and downstream market purchases are now mainly based on rigid demand or low-priced resources, and transactions have not met expectations. At present, the fundamentals are weak, macro sentiment has weakened, and market inventory digestion is slow. It is expected that inventory may continue to accumulate in the future, and we will continue to pay attention to subsequent steel mill production and market transactions.

200 Series: Demand Awaits Boost, High Supply Leads to Increased Inventory.

Last week, the spot price of 201 has been operating weakly. Market sentiment has softened, and traders have offered preferential shipments. Terminal demand has not improved, and as the mainstream price has continued to decline in recent days, consumer sentiment has become more cautious, and transactions have been quiet during the week, with slow inventory consumption. In October, some steel mills increased the crude steel output of the 200 series, and the market arrivals of resources increased, leading to an accumulation of 200 series inventory. The market is waiting for guidance from subsequent plate prices, and in the short term, the price of 201J2 will fluctuate around US$1140/MT gross basis. It is expected that the inventory of the 200 series may continue to increase next week, and the focus will be on the dynamics of steel mills and market transactions.

400 Series: Increased Arrivals & Cost Decline, Inventory Increased.

During last inventory period, there were more arrivals of TISCO resources in the market, increasing the available resources in the market; coupled with the downward fluctuation of the futures market in the previous period, traders lacked confidence in the future, leading to increased difficulty in market shipments. During the week, traders offered discounts to ship goods, and there was a significant increase in low-priced resources in the market, but downstream inquiries for purchases were less active, and purchases were cautious, leading to a slight accumulation of spot market inventory. On the raw material side, the bidding prices for high-chromium of TISCO and Tsingshan in November continued to decline, and the cost support for the 400 series gradually shifted downward. In October, the output of steel mills further contracted, but the overall contraction was limited, coupled with the fact that the inventory of the 400 series is still at a high level, and the supply pressure in the market has not decreased, highlighting the supply-demand contradiction. It is expected that inventory will continue to accumulate next week, and the focus will be on the production of steel mills and market transactions.

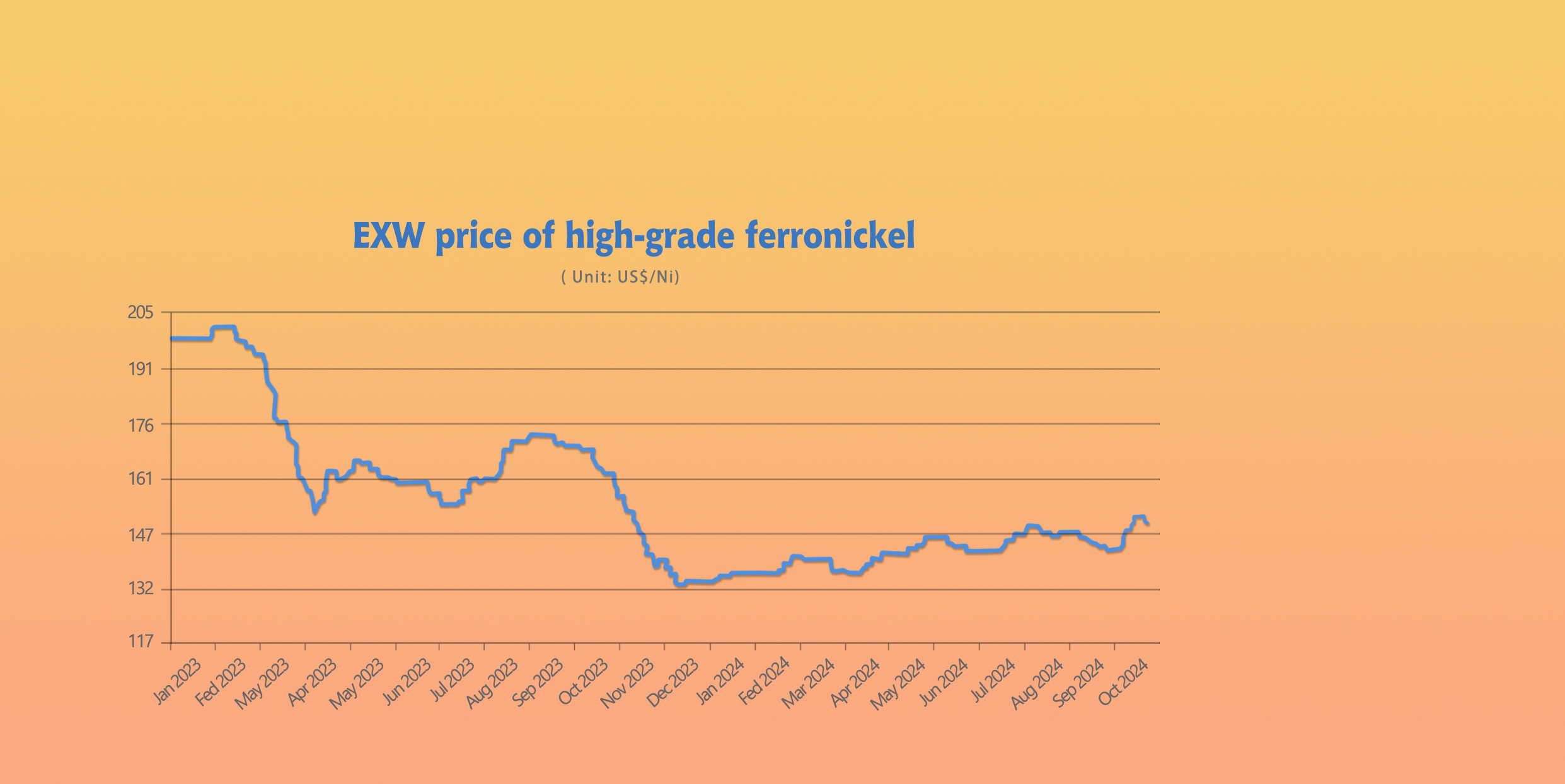

RAW MATERIAL || Insufficient Stainless Steel Demand, Raw Material Prices Under Pressure.

NICKEL: Nickel Pig Iron Prices Under Pressure and Declining In terms of costs, the mainstream ex-factory price of high-nickel pig iron decreased to US$143/nickel point last week. Last week, the London Metal Exchange (LME) nickel price fluctuated downward. It opened at 17,030 US dollars last week, reached a high of 17,135 US dollars, and a low of 16,150 US dollars, closing at 16,230 US dollars, a week-on-week decrease of 4.53%. The Shanghai nickel price declined weakly. As of the close of trading on Thursday, the main contract of SHFE nickel closed at US$17,905/MT, a decrease of US$303/MT from the previous trading day, a decrease of 1.66%.

Last week, a steel mill in South China significantly lowered its plate prices, leading to a downward pressure on nickel pig iron prices. The inverted production costs of steel mills made them more cautious about raw material purchases. In terms of supply, after the continuous rise in nickel pig iron prices after the holiday, the profits of domestic nickel iron plants have recovered, and production enthusiasm has increased. New quotas for Indonesian nickel mines have improved the tight supply of mines, coupled with the commissioning of new production capacity, and there is an expectation of increased nickel iron supply in the future. It is expected that nickel pig iron prices will run relatively weakly in the short term.

Chrome: Oversupply Last week, the price of ferrochrome remained flat at US$1144/50 reference tons. Currently, the mainstream ex-factory price of high-chromium is between US$1144/MT and US$1172/50 reference tons. The price of coke declined slightly during the week, and the comprehensive production cost of high-chromium decreased slightly, but the loss-making state of high-chromium enterprises has not improved significantly. The bidding price of high-chromium steel for steel mills such as Tai Steel and Tsingshan in November continued the downward trend, and the center of gravity of the cost of ferrochrome continued to shift downward. On the other hand, the supply of high-chromium in the market is still under "great pressure". According to statistics, in September 2024, the domestic output of high-chromium decreased by about 12,400 tons month-on-month, but it still remained at around 787,100 tons. Moreover, the import volume of ferrochrome has also increased. According to customs statistics, in September 2024, China's import volume of ferrochrome reached 305,200 tons, a month-on-month increase of 8.41% and a year-on-year increase of 1.1%; from January to September 2024, China's cumulative import volume of ferrochrome was 2.8376 million tons, a year-on-year increase of 17.29%. Currently, the supply exceeds demand in the high-chromium market, and it is expected that the price of high-chromium will remain weak and stable in the short term.

SUMMARY || Macroeconomic sentiment has weakened, and stainless steel has returned to fundamentals.

Last week, stainless steel prices fluctuated weakly, raw material prices were relatively under pressure, steel mills were in an inverted production state, the overall market transaction atmosphere was generally weak, traders maintained relatively low inventories, social inventories began to accumulate again, and warehouse receipts also decreased slightly. It is expected that stainless steel prices will fluctuate in the future.

300 Series: With the resumption of production at Yongwang, Indonesia in late August, resources flowed into China in September, and domestic imports rebounded, which may increase short-term supply-side pressure. On the demand side, the traditional peak season is coming to an end, export demand has decreased, and downstream purchasing intentions are relatively low, which may slow down the pace of inventory digestion. It is expected that the spot price of 304 cold-rolled will fluctuate with the futures market in the short term.

200 Series: Frequent fluctuations in the bulk commodity sector, with copper and manganese prices fluctuating, have weakened the cost support for 201. In the second half of the week, spot prices stabilized and rebounded slightly, and market sentiment recovered slightly, but both traders and downstream buyers were cautious. In the short term, the price of 201 will run relatively weakly, and it is expected that the price of 201J2 will fluctuate around US$1160-US$1260/MT.

400 Series: Given the high production costs of steel mills at present and the market's expectations for macroeconomic policies, it is expected that the price of 430 will run weakly and steadily in the short term.

MACRO || China's Manufacturing PMI Ends 5-Month Decline, Returns to Expansion in October.

The Purchasing Managers' Index (PMI) for manufacturing stood at 50.1% in October, up 0.3 percentage points from the previous month, ending five consecutive months below the 50% mark and indicating a recovery in manufacturing activity. Of the five sub-indices that make up the manufacturing PMI, the production index was above the critical point, the new orders index was at the critical point, and the raw material inventories index, employment index, and supplier delivery time index were all below the critical point.

Combined with other relevant indicators, the production index, new orders index, purchasing volume index, factory gate price index, and production and business activity expectations index all rebounded compared to the previous month. The new export orders index was 47.3%, down 0.2 percentage points from the previous month, marking six consecutive months below the critical point. The employment index was 48.4%, up 0.2 percentage points from the previous month, but still below the critical point for 20 consecutive months. Driven by government policies, the production and business activity expectations index was 54%, up 2 percentage points from the previous month, indicating a recovery in business confidence.

In terms of corporate expectations, the production and business activity expectations index for industries such as food and beverage, ferrous metal smelting and rolling, non-ferrous metal smelting and rolling, automobiles, and electrical machinery and equipment were all above 57.0%, indicating a high level of optimism among enterprises about industry development.

There are some events worth watching in the future that may affect market trends, such as the start of the US presidential election on November 5th; the Federal Reserve's interest rate meeting on November 8th, with a current estimate of a 25bp increase; and the meeting of the Standing Committee of the National People's Congress from November 4th to 8th.

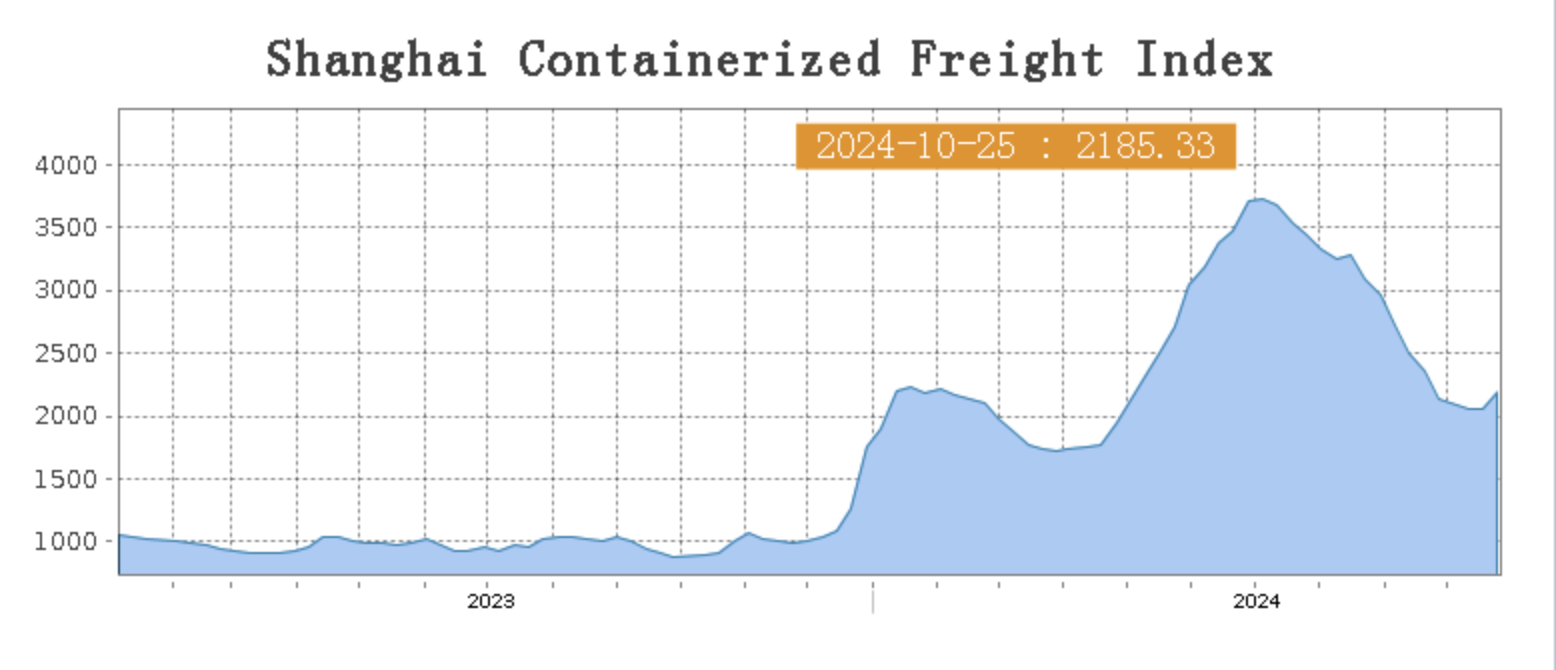

Sea Freight || Freight Rates Rise Across the Board! SCFI Index Ends Eight-Week Decline.

After eight consecutive weeks of decline, shipping rates have finally rebounded, with freight rates on major routes rising across the board. According to the latest data released by the Shanghai Shipping Exchange on October 25th, the Shanghai Containerized Freight Index (SCFI) rose 123.18 points to 2185.33 points last week, a weekly increase of 5.97%.

On 25th October, the Shanghai Containerized Freight Index lifted by 6% to 2185.33.

Europe/ Mediterranean:

Freight rates on the four major ocean routes to Europe and the United States have all stopped falling and rebounded, with the European route seeing a larger increase. Industry insiders pointed out that the successful price increase during the off-season shows the determination of shipping companies to push for price increases. Since early July, freight rates have been declining, and shipping companies have continued to adopt technical adjustments to cabin capacity, including reducing the number of voyages, slowing down sailing speeds, and combining with a strategy of raising prices to stop the decline, in an attempt to stimulate cargo volume and stabilize freight rates.

On 25th October, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2226/TEU, which soared by 14.2%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$2555/TEU, which increased by 10.5%.

North America:

Due to sluggish market demand in the previous two months, coupled with the impact of the Red Sea and U.S. East Coast port strikes on ship scheduling, shipping companies adjusted their market capacity. The main east-west round-trip routes have announced the cancellation of 100 voyages from the 40th week (September 30th to October 6th) to the 44th week (October 28th to November 3rd), with a cancellation rate of 14%.

With shipping companies actively stabilizing freight rates, it is expected that freight rates will rebound by 500-800 US dollars from November onwards. However, the industry believes that it remains to be seen how long this round of rally can be sustained. From the second half of November to the first half of December, there will be no year-end holiday cargo for ships to transport, and whether the reduced cargo volume can support freight rates is the key. It may not be until the second half of December, when pre-holiday stocking demand from Europe and the United States emerges before the Chinese New Year holiday, that there may be a small peak season.

On 25th October, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$4783/FEU and US$5099/FEU, both reporting an 1.2% and 2.6% growth accordingly.

The Persian Gulf and the Red Sea:

On 25th October, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf bounced by 19.6% from last week's posted US$1427/TEU.

Australia/ New Zealand:

On 25th October, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$2058/TEU, a 1.6% lift from the previous week.

South America:

On 25th October, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$6285/TEU, an 0.8% increase from the previous week.