Stainless Insights in China from March 31st to April 6th.

Trend|| LME Nickel Dropped Sharply; Stainless Steel Index Followed Lower

Last Thursday and Friday, LME nickel closed down by a combined US$1,350, settling at US$14,645/MT. LME nickel inventory increased by 1,380 tons, reaching 200,400 tons.

Over the same two days, the Liyang Zhonglianjin 304 Stainless Steel Index fell by US$23.44/MT to US$1895/MT, while the Liyang Zhonglianjin Nickel Price Index dropped US$731 to US$1970/MT.

On April 3, the SHFE nickel main contract closed down US$277/MT to US$17800/MT; the SHFE stainless steel main contract fell US$17.24/MT, closing at US$17260/MT.

LME Closing Summary

LME nickel fell US$1,075 from the previous trading day to settle at US$14,640/MT. Inventory increased by 1,230 tons, reaching 200,250 tons. The session opened at $15,730, reached an intraday high of $15,735, and dropped to a low of $14,595 before closing at $14,640, down 6.84% from the previous session.

The broad sell-off across the LME on Friday was driven by concerns over a potential economic recession, triggered by U.S. President Trump's sweeping tariff plans. All base metals suffered sharp declines, with copper recording its biggest single-day drop since the onset of the COVID-19 pandemic in 2020. During the session, LME nickel touched its lowest point since October 2020.

2025 Q1 Market Review

In Q1 2025, stainless steel futures exhibited volatile trends. Early in the quarter, prices fluctuated within a range due to macroeconomic uncertainties and raw material cost swings. Confidence in economic recovery later boosted capital inflows into futures, lifting prices modestly. However, sluggish spot demand and cautious sentiment capped gains.

In the Wuxi spot market (Jiangsu), 304 cold-rolled prices peaked at US$2010/MT on March 17. Despite mills’ efforts to raise prices, downstream buyers remained hesitant, leading to narrow price movements. The 200 series saw upward momentum driven by mill maintenance, with improved post-hike transactions amid tight supply.

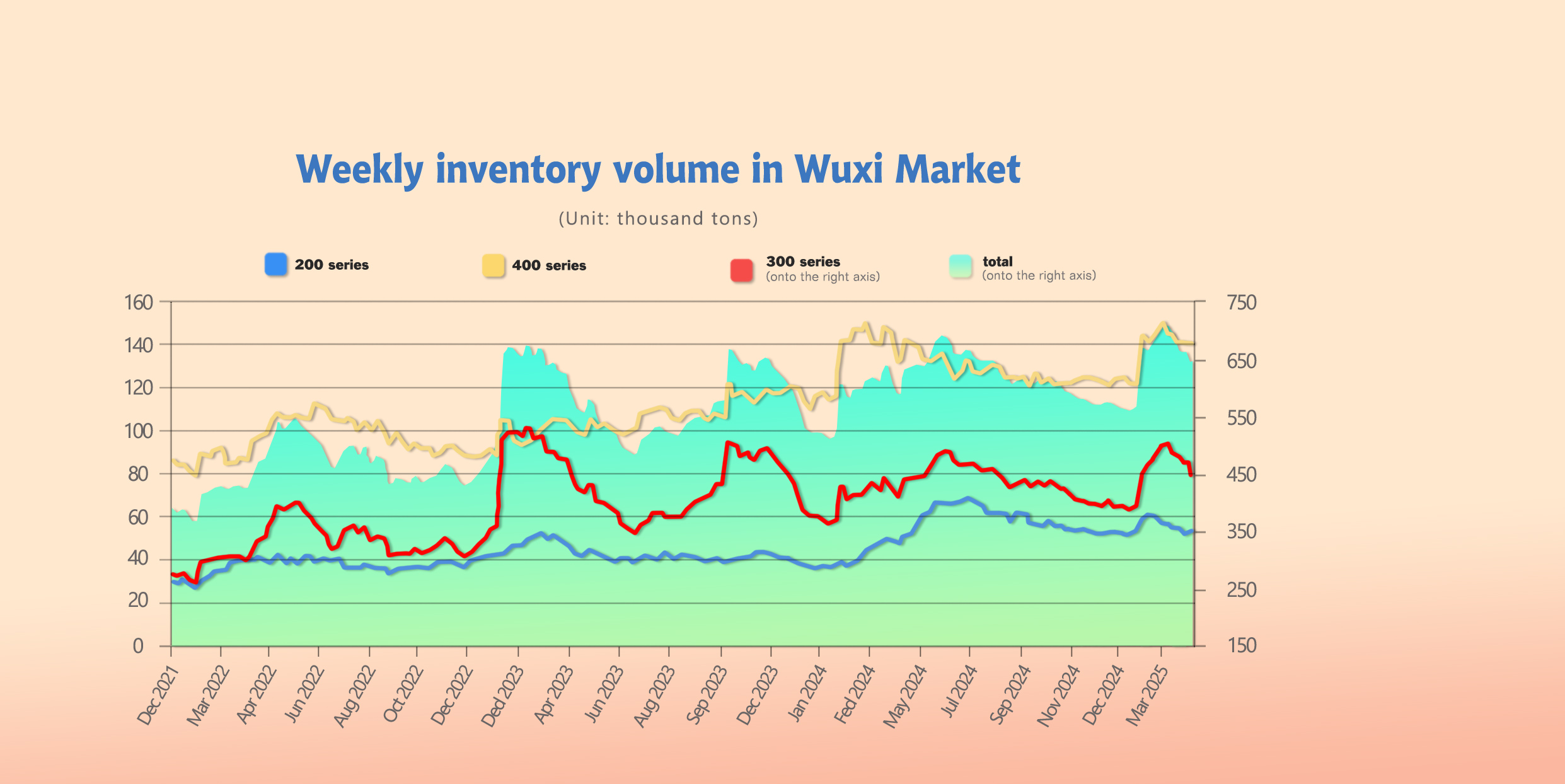

INVENTORY|| Five Consecutive Weeks of Drawdowns

As of April 3rd, total inventory in Wuxi sample warehouses decreased by 22,044 tons to 633,833 tons. Breakdown:

200 Series: 724 tons down to 51,562 tons.

300 Series: 222,407 tons down to 442,163 tons.

400 Series: 1,087 tons up to 140,108 tons.

200 Series: Reduced arrivals due to rotating maintenance at Beigang Xincai supported price stability. Holiday effects may lead to slight inventory accumulation next week.

300 Series: Trump’s tariffs threaten exports, while rising mill output pressures supply. Weak speculative demand may lead to future inventory builds.

400 Series: Sluggish demand and slower inventory depletion drove accumulation.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Mar 27th | 52,286 | 464,570 | 139,021 | 655,877 |

| Apr 3rd | 51,562 | 442,163 | 140,108 | 633,833 |

| Difference | -724 | -22,407 | 1,087 | -22,044 |

Raw Material || Active Trading in the Nickel Pig Iron Market, Prices Remain Firm with Slight Uptrend

Last week, nickel pig iron (NPI) ex-works prices remained stable with a slight upward trend. As of Thursday, prices were quoted at US$142.76/nickel point, up US$0.68 from previous Thursday.

Meanwhile, SHFE nickel showed a weaker performance. By Thursday’s close, the main SHFE nickel contract settled at US$17800/MT, down US$322.7/MT from last Thursday, a 1.8% decline.

Throughout the week, trading activity in the NPI market was frequent. A steel mill in East China (referred to as “S Steel”) purchased over 10,000 tons of high-grade NPI at US$141.3/Nickel point. Domestic NPI producers sold several thousand tons at US$142/Nickel point (tax-included, EXW).

It’s reported that a steel mill in Jiangsu has resolved its NPI supply issues for April, although high-carbon ferrochrome remains in short supply. The cost-pressure inversion for domestic NPI producers has eased, and production is slowly recovering. In Indonesia, nickel ore supply remains tight, with premiums staying high. One NPI producer’s third-phase operations have not yet resumed, though new production lines are gradually ramping up, leading to a slight increase in Indonesian NPI supply.

With domestic stainless steel output staying at high levels, raw material demand is increasing. In the short term, NPI prices are expected to remain firm with slight upward momentum, with market players keeping a close watch on policy developments in Indonesia.

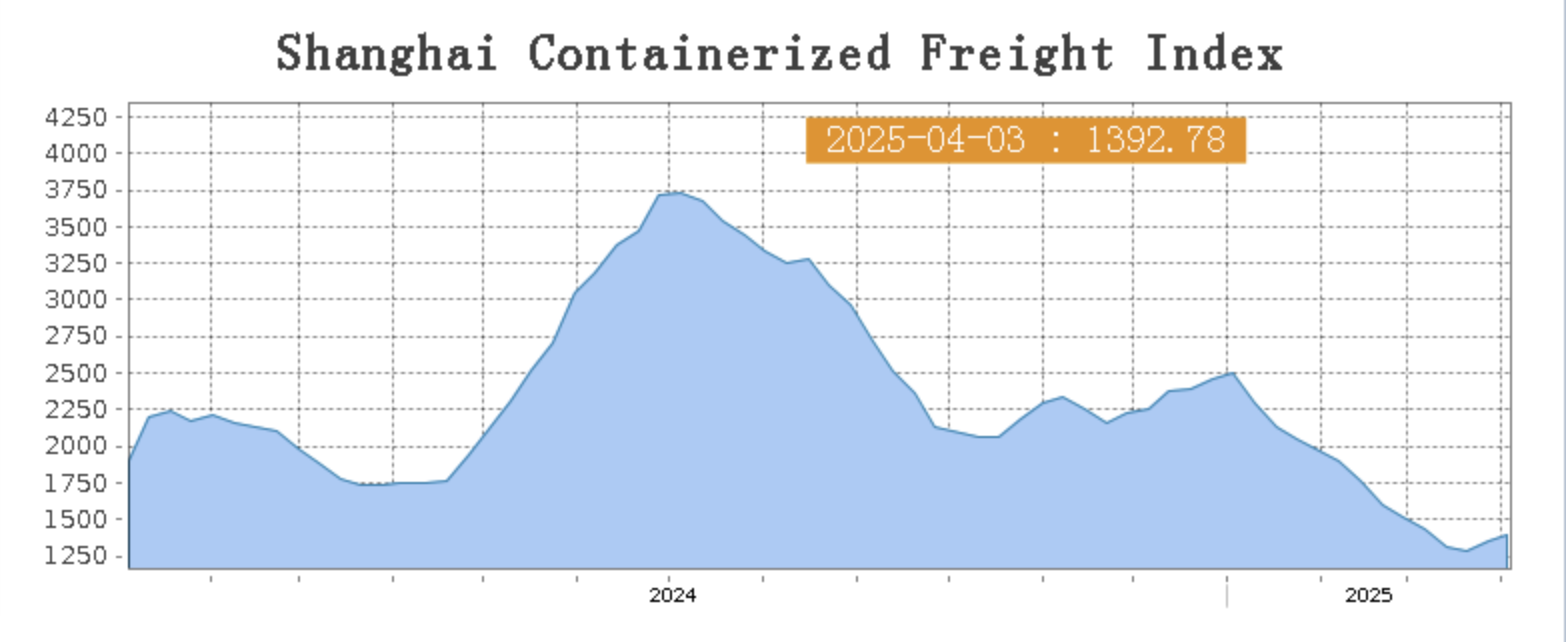

SEA FREIGHT|| Stable Demand, Rate Hikes on Major Routes

Last week, China’s export container shipping market continued its downward adjustment, with weaker transportation demand and declining freight rates across most routes, leading to a drop in the composite index. On April 3rd, the Shanghai Containerized Freight Index (SCFI) rose 2.8% to 1392.78 points.

Europe/ Mediterranean:

On April 3rd, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1336/TEU, which increased by 1.4%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$2028/TEU, which dropped by 2.3%

North America:

The U.S. announced plans to impose additional tariffs on imported vehicles early next month, raising risks of intensified trade conflicts. North American routes are likely to face heightened volatility. With the contract renewal season approaching, shipping demand showed no significant growth, but freight rates edged up.

On April 3rd, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$2313/FEU and US$3306/FEU, reporting 6.2% and 3.5% lift accordingly.

The Persian Gulf and the Red Sea:

On April 3rd, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf rose 8.6% to US$1290/TEU.

Australia&New Zealand:

On April 3rd, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand rose 1.3% to US$839/TEU.

South America:

On April 3rd, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports dropped 14% to US$1436/TEU.