Stainless Insights in China from April 14th to April 18th.

TREND || Macroeconomic Influences Weaken, Market Volatility Eases

Last week, stainless steel spot and futures prices in the Wuxi market remained stable. The futures market fluctuated within a narrow 200-point range—less than 2%. On the cost side, raw material prices rose and then fell back, leading to a slight decrease in production costs. Delong’s agents lowered prices to facilitate sales, and with continuous arrivals of new stock, supply pressure persists. The supply-demand balance has yet to show clear improvement. As of Friday, the main stainless steel futures contract closed at US$1880/MT, up 0.12% for the week, with a weekly high of US$1900.

300 Series: Macroeconomic Easing Boosts Confidence in Supply-Demand Dynamics

The 304 stainless steel spot market held steady last week. As of Friday, the mainstream base price for privately-produced cold-rolled four-foot 304 coils in Wuxi stood at US$1890/MT, and hot-rolled was quoted at US$1870/MT—both unchanged from previous Friday. Futures prices fluctuated within a stable range. The impact of tariff policy escalations eased, and China’s Q1 GDP data showed strong performance, improving overall market sentiment. As macroeconomic expectations improved, low-priced inventories saw better movement, resulting in a slight reduction in stock levels.

200 Series: Mills Raise Opening Prices, Market Demand Remains Weak

Prices for 201 stainless steel were mixed last week. cold-rolled 201J2 was quoted at US$1130/MT (tax-inclusive base price), cold-rolled 201J1 at US$1230, and 201J1 hot-rolled at US$1195/MT.

As Sino-US tariff tensions eased, futures prices recovered early in the week, lifting market sentiment and prompting price increases for both 201J1 and J2. On Wednesday, Tsingshan raised its opening price, and 201 cold-rolled prices increased by another US$7/MT. However, market feedback indicates limited acceptance of higher prices, with downstream buying sentiment remaining weak and overall trading activity fairly subdued.

400 Series: Weaker Cost Support Prompts Cautious Downstream Buying

Last week, Wuxi market prices for 430/2B moved slightly lower, falling by US$7/MT to around US$1145-US$1155/MT. The mainstream price for 430/NO.1 remained steady at US$1065/MT.

During the week, the mainstream ex-factory price for high-carbon ferrochrome, a key raw material, stayed weak at US$1144-US$1172/50 reference ton. Weaker cost support for the 400 series and lackluster downstream demand led to a modest build-up in spot inventory. As a result, price support remains fragile.

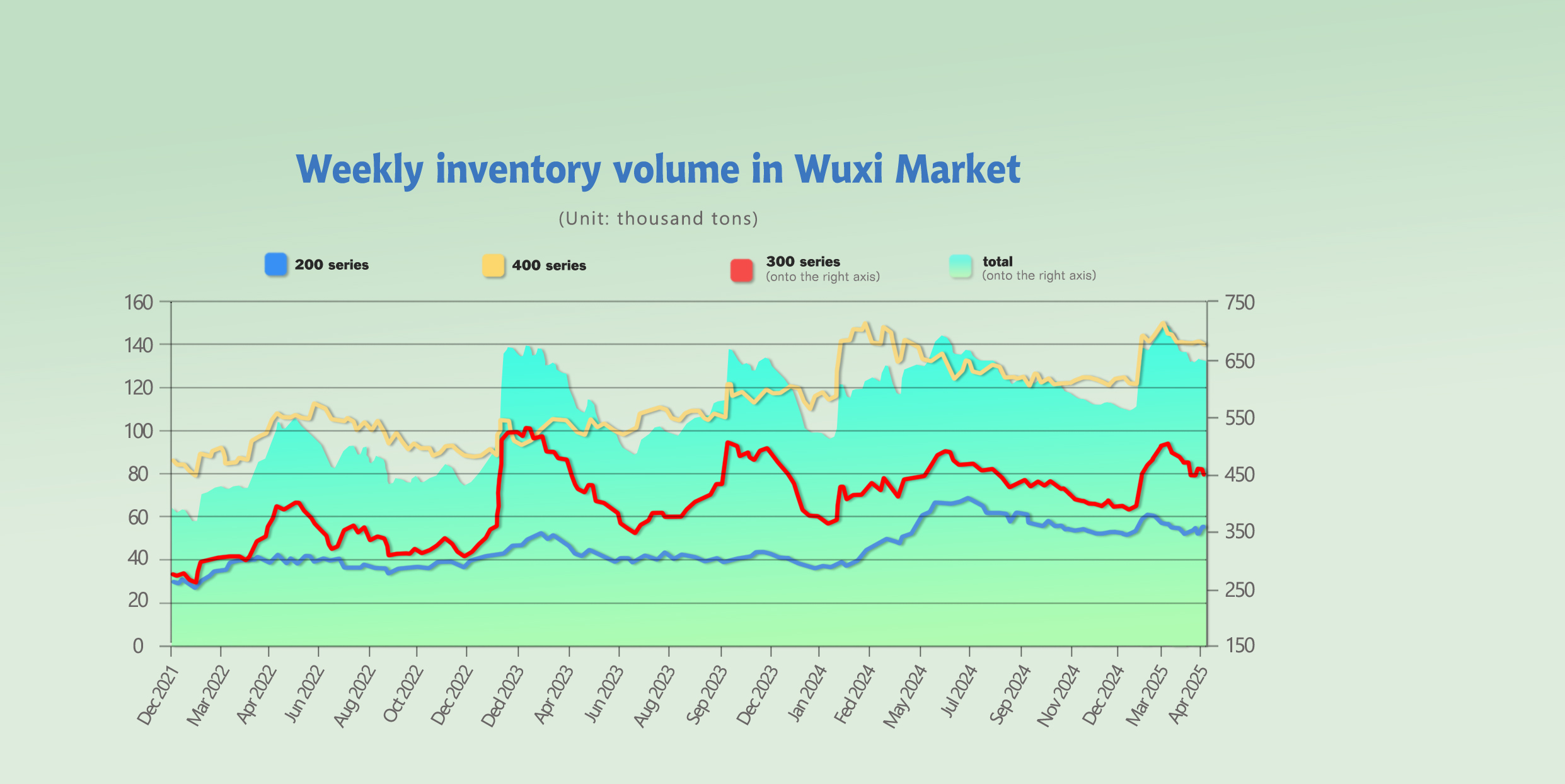

INVENTORY || 7000 Tons De-stocked Last Week

As of April 17th, total inventory in Wuxi sample warehouses decreased by 22,044 tons to 633,833 tons. Breakdown:

200 Series: 724 tons down to 51,562 tons.

300 Series: 222,407 tons down to 442,163 tons.

400 Series: 1,087 tons up to 140,108 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Apr 10th | 54,503 | 454,106 | 139,427 | 648,036 |

| Apr 17th | 55,481 | 445,912 | 139,633 | 641,026 |

| Difference | 978 | -8,194 | 206 | -7,010 |

200 Series: Rising Arrivals, Ongoing Supply Pressure

With mills raising their list prices, market sentiment has slightly improved. A minor inventory reduction is expected next week, but attention remains on mill output and transaction performance in the market.

300 Series: Slight Inventory Decline

Prices remained range-bound at low levels, and Tsingshan lifted price caps, bringing more low-priced resources into circulation. With bearish macro sentiment gradually easing, the supply-demand balance regained influence in pricing decisions. Downstream buyers became more active at low price points, contributing to the slight de-stocking.

However, escalating China-U.S. trade tensions may slow exports. Domestically, frequent policy changes continue, and the market awaits further easing measures such as reserve requirement and interest rate cuts. While fundamentals are playing a larger role in pricing, the overcapacity situation shows no clear improvement. Inventory levels may see a minor rebound going forward, with focus remaining on mill output and how quickly the market can absorb supply.

400 Series: Lower Cost Support, Cautious Downstream Buying

Inventory from TISCO increased for both cold- and hot-rolled products, while JISCO’s cold-rolled inventory saw a slight drop. Overall, spot inventory rose.

Despite weak prices, downstream buyers remained cautious. Inventory is expected to continue a slow drawdown next week, with minor fluctuations in 400 series spot levels.

RAW MATERIAL || Indonesia’s New Nickel Export Tariff to Raise Production Costs

Nickel: New Indonesian Tariff Policy Takes Effect

Last week, high-nickel pig iron (NPI) ex-works prices were weak, settling at US$137.2/nickle point by previous Friday, down US$2 from previous week.

On April 11, the President of Indonesia officially signed a new tariff policy on nickel products, effective April 26. Under the new system, tariffs will be dynamically adjusted based on changes in the HMA price (HMA is the spot settlement price published by the exchange, taking the average value from the 5th to the 25th of the month prior to the HPM cycle.). The updated ranges are:

1.Nickel Ore: From a fixed 10% to a range of 14%–19%; for ore with grade ≤1.5%, the rate is 2%

2.Nickel Pig Iron (NPI): From a fixed 5% to 5%–7%

3.Nickel Matte: From a fixed 2% to 3.5%–5.5%, with the removal of the 1% windfall tax

4.Ferronickel: From a fixed 2% to 4%–6%

Currently, the HMA price is set at $18,000/ton. The nickel ore tariff is now at 14%, up 4% from before. NPI production costs are expected to increase by around US$2.75/nickel point. The ferronickel tariff stands at 5%, unchanged from previous levels.

The new tariff system adopts a tiered structure tied to HMA price movements. Over the past two years, HMA prices have mostly hovered below $20,000/ton, so tariffs will likely fluctuate between the first and second tiers in the short term. This policy will directly impact both production costs and trade prices for nickel products.

With stronger cost support under the new policy, downside potential for NPI prices appears limited. Some mills have already resumed raw material procurement, and NPI prices are expected to remain stable in the near term.

Chrome: Price Gains Stalled

High-carbon ferrochrome retail prices have softened recently, with fewer high-price offers. Mainstream ex-works prices currently hover around US$1144.8-US41172/MT. Despite high input costs, chrome prices are struggling to rise. This is due in part to recent tariff-related declines in stainless steel prices, which have suppressed raw material prices. In addition, following the stainless price drop, buyers in the raw material market have become more cautious, slowing transactions and weakening price support.

Another factor is the partial restart of certain submerged arc furnaces, which has increased high-chrome supply and contributed to the resistance in price increases.

SUMMARY || Pessimistic Outlook for Stainless Steel Market; Supply-Demand Imbalance Remains Unresolved

Due to the ongoing trade war, market sentiment around demand continues to deteriorate, leading to increasingly cautious procurement behavior. Buyers are mainly replenishing only as needed, making it difficult to effectively draw down social inventories, which remain at high levels.

On the raw material side, there has been some easing, lowering production costs for steel mills—but most still operate at a loss. Against a backdrop of unfavorable macroeconomic conditions, the fundamental imbalance in the stainless steel market is unlikely to improve in the short term. The market may continue to experience a prolonged period of adjustment, with prices expected to fluctuate widely in the near future.

300 Series: Mixed Macro Sentiment, Low-End Transactions Improve

Macro factors present a mixed picture, resulting in continued volatility in stainless futures. However, improved transaction activity at lower price levels has helped ease inventory pressure somewhat.

On the demand side, export growth is limited due to tariff-related restrictions, while domestic demand awaits a boost from favorable government policy measures. In the short term, stainless steel prices are expected to consolidate at the bottom.

200 Series: Mill Price Guidance Boosts Confidence, Prices Hold Firm

Steel mills' pricing strategies have helped stabilize market confidence, with traders maintaining firm quotes.

On the cost side, copper prices have rebounded while manganese prices dipped slightly over the week. Ferrochrome remains in a high price range, offering stronger cost support.

Shipments of 201-grade stainless from Hongwang (Zhoushan) have continued to arrive, increasing available supply. However, with end users still largely in a wait-and-see mode, both cold-rolled and hot-rolled inventories have seen a slight buildup.

Under the ongoing supply-demand standoff, prices for 201 are expected to remain stable in the short term.

400 Series: Weakening Cost Support, Sluggish Downstream Demand

Retail prices for high-carbon ferrochrome shifted from strength to weakness last week, with some high offers pulling back.

This led to weaker cost support for 400-series stainless steel. At the same time, downstream demand dipped slightly due to reduced stainless steel production in April.

Prices for 430-grade stainless slipped slightly and have now stabilized at weak levels.

Given that production costs remain elevated, 430 prices are expected to remain weak and steady in the short term.

MACRO || China’s Q1 Steel Exports Reach 27.43 Million Tons, Up 6.3% YoY

According to China’s General Administration of Customs (April 14), the country exported 10.456 million tons of steel in March 2025.

Total steel exports for Q1 reached 27.429 million tons, a 6.3% year-over-year increase.

Steel imports in March totaled 501,000 tons, bringing the Q1 total to 1.55 million tons, down 11.3% year-over-year.

In March 2025, China imported 128,900 tons of stainless steel, down 23,800 tons from last year—a 15.58% decline.

Stainless steel exports, meanwhile, totaled 470,600 tons, up 84,300 tons, or 21.81% year-over-year.

China's Stainless Imports from Indonesia Drop Sharply

According to customs data, China imported 100,700 tons of stainless steel from Indonesia in March, down 22,200 tons, or 18.06% year-over-year.

For the first quarter, total imports from Indonesia were 375,700 tons, down 158,300 tons, or 29.64% compared to the same period last year.

Indonesia Dominates Taiwan's 300 Series Imports

Taiwan Customs data shows that in March, total imports of 300-series stainless steel reached 74,193 tons.

Of that, 55,467 tons came from Indonesia (mainly Tsingshan Group), accounting for 74.76%, firmly securing the top spot.

Hot-rolled black coils: Indonesia supplied 47,429 tons, making up 80.35% of the total 59,028 tons in this category.

Hot-rolled white coils: Indonesia exported 8,038 tons, accounting for 67.79% of the 11,857 tons total.

In comparison, mainland China ranked second, supplying 15,222 tons, or 20.52%, which is roughly a quarter of Indonesia’s volume—highlighting a significant gap between the two.

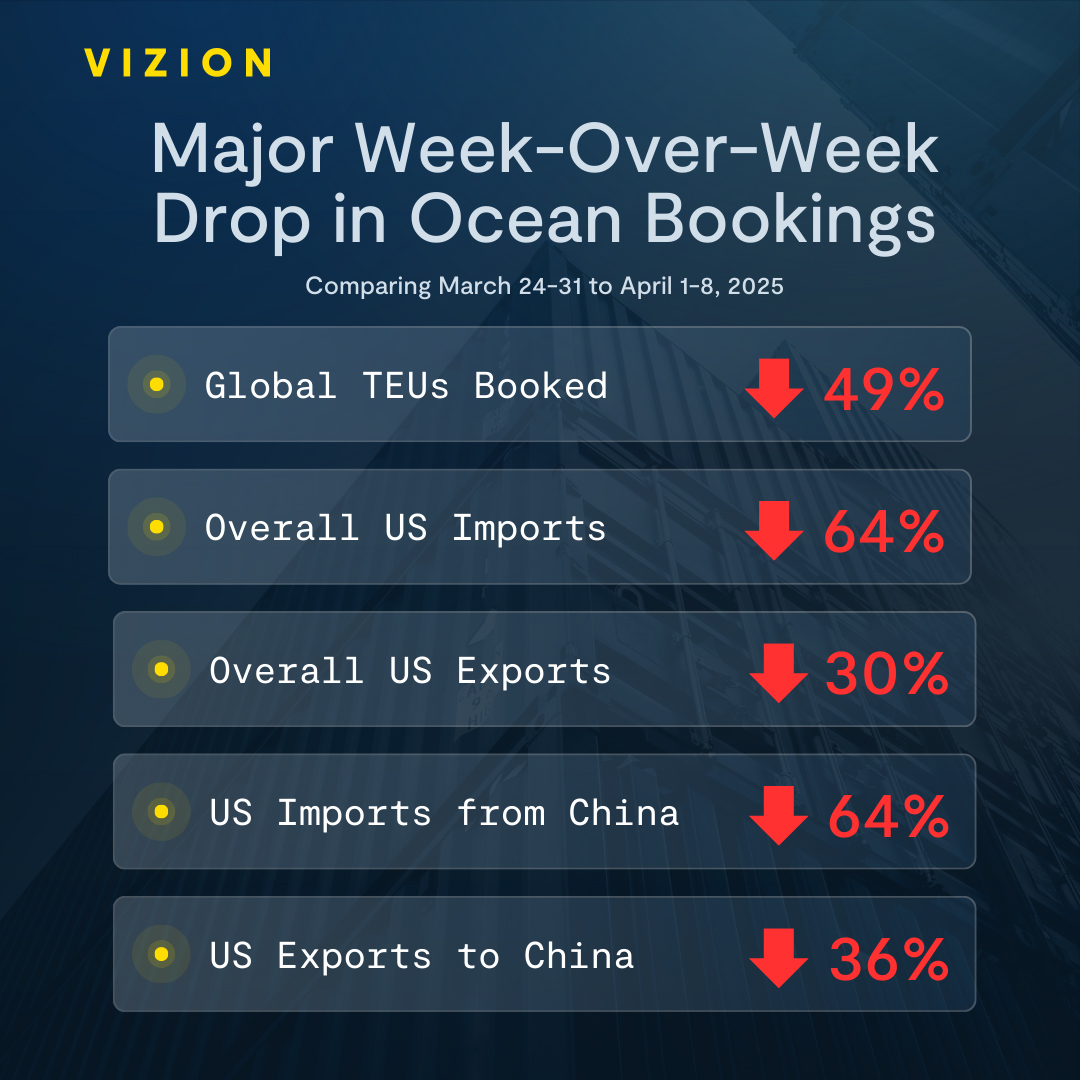

SEA FREIGHT || Global Bookings Plunge 49%, U.S. Imports from China Down 64%

On April 17 (local time), the Office of the United States Trade Representative announced a proposal to impose additional fees on Chinese vessels docking at U.S. ports.

Ocean Freight Market Hit Hard by Tariff Uncertainty

The global shipping industry, which facilitates over 90% of world trade, is facing significant disruptions as the U.S. ramps up its trade war efforts. From April 1 to 8, global container booking volumes dropped sharply by 49%, with U.S. container imports from China plunging 64%, according to industry data.

The trade war's impact has been particularly pronounced on the trans-Pacific route. Data from Vizion, a container freight analytics firm, shows that compared to the week of March 24–31, bookings between April 1–8 fell by 49% globally.

U.S. overall imports: down 64%

U.S. imports from China: down 64%

U.S. exports to China: down 36%

Vizion attributes the sudden decline to a widespread “booking freeze” among U.S. importers, which coincided with Trump’s announcement of steep new tariffs. As U.S. buyers hold off on new imports, Chinese exporters have also paused shipments.

Freight forwarders operating on Asia–North America routes have confirmed that exports to the U.S. are largely on hold.

A freight forwarding company in Shanghai, which specializes in traditional sea freight and full-container Amazon FBA shipments to the U.S., told China Shipping Weekly that bookings for April 5–11 fell by around 70%.

Meanwhile, a NVOCC (non-vessel operating common carrier) based in Qingdao reported a 30%–40% drop in bookings on the same route during that period, citing tariffs as the main reason shippers are halting deliveries.

The story is the same in South China. A freight company in Guangzhou focused on trans-Pacific routes noted that the combination of the tariff war and carriers canceling sailings has severely affected their booking volumes.

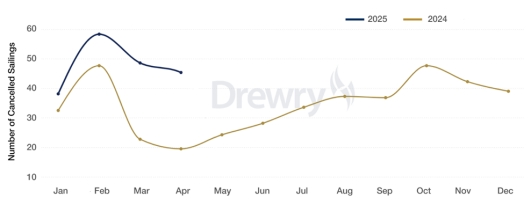

Booking Slump Directly Impacts Capacity Demand and Freight Rates

According to Drewry, global east–west trade lanes experienced 198 canceled sailings between March and April—a 46.47% year-on-year increase. From April 15 to May 18, about 44 eastbound trans-Pacific sailings are expected to be cut.

Drewry cites two major reasons for the spike in blank sailings:

1.Uncertainty surrounding U.S. tariff policy

2.A drop in cargo volume expectations

Cancelled Sailings Push Freight Rates Slightly Higher

Interestingly, reduced capacity has started to nudge rates upward.

According to Drewry’s World Container Index, during the week of April 4–10:

The Shanghai–New York base port rate rose 2% from the previous week, to $3,976/FEU

The Shanghai–Los Angeles rate rose 3%, to $2,815/FEU

Drewry predicts that rates may continue to climb in the coming weeks as blank sailings increase and the tariff environment remains volatile.

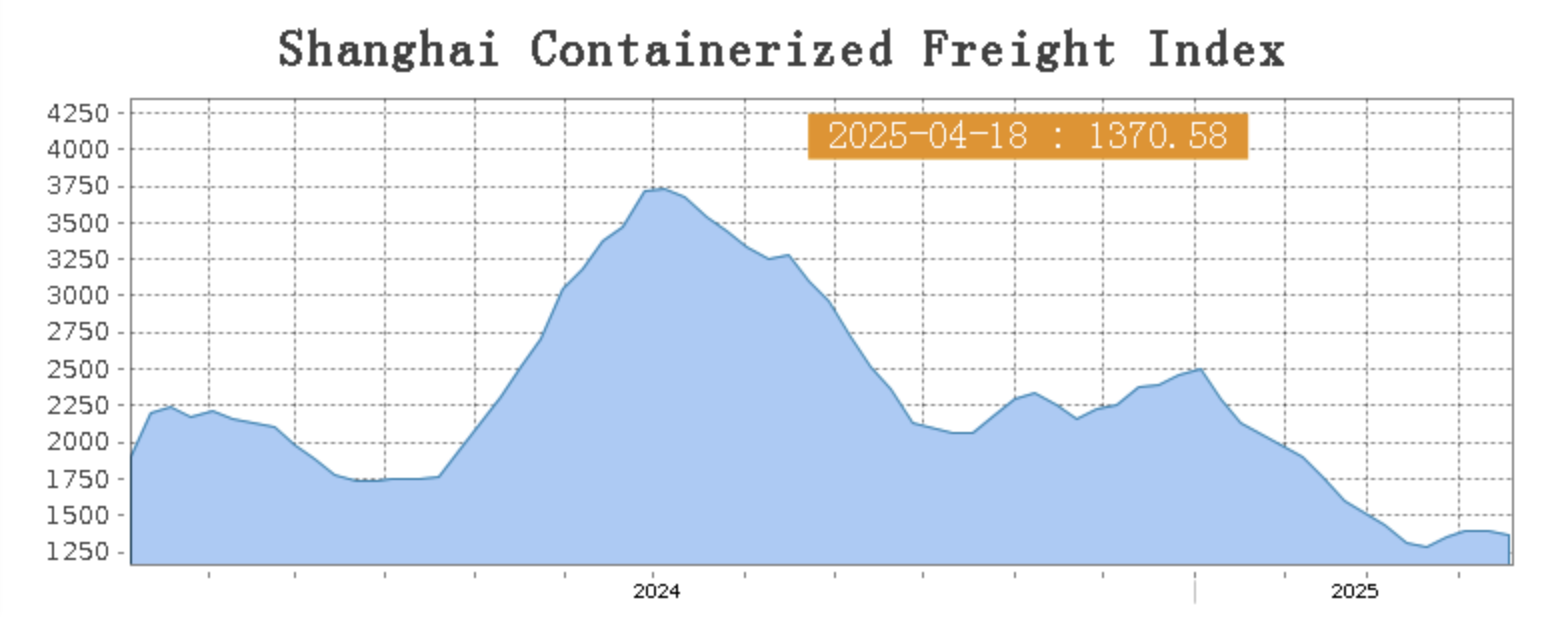

Freight Market Stabilizes, Rates mixed on Most Routes

China’s export container shipping market remained generally stable last week, with the composite index edging slightly. On April 18th, the Shanghai Containerized Freight Index (SCFI) fell 1.7% to 1370.58 points.

Europe/ Mediterranean:

As the impact of trade conflicts deepens, the future prospects of the European economy are facing a test. Last week, the transportation market continued to maintain overall stability. The transportation demand was relatively stable, and the market freight rates declined slightly.

On April 18th, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1316/TEU, which decreased by 2.9%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$2161/TEU, which grew by 0.8%

North America:

According to the latest report of the World Trade Organization (WTO), the WTO has adjusted its forecast for the global merchandise trade volume this year from an initial expected growth of 2.7% at the beginning of the year to a decline of 0.2%, a downward adjustment of nearly three percentage points in total. Last week, the cargo volume in the transportation market of the China-US route showed a downward trend, and the market began to regulate the overall scale of capacity deployment. The freight rates of the routes to the western United States declined slightly.

On April 18th, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$2103/FEU and US$3251/FEU, reporting 4.5% drop and 0.8% lift accordingly.

The Persian Gulf and the Red Sea:

On April 18th, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped 3.3% to US$1266/TEU.

Australia&New Zealand:

On April 18th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand rose 0.1% to US$891/TEU.

South America:

On April 18th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports rose 0.4% to US$1573/TEU.