Stainless Insights in China from October 28th to November 1st.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,180 | -16 | -0.76% |

| Foshan | 2,220 | -16 | -0.74% | ||

| Hongwang | Wuxi | 2,065 | -9 | -0.44% | |

| Foshan | 2,085 | -1 | -0.07% | ||

| 304/NO.1 | ESS | Wuxi | 2,000 | -1 | -0.08% |

| Foshan | 2,015 | -3 | -0.15% | ||

| 316L/2B | TISCO | Wuxi | 3,740 | -17 | -0.47% |

| Foshan | 3,825 | -6 | -0.15% | ||

| 316L/NO.1 | ESS | Wuxi | 3,580 | -11 | -0.33% |

| Foshan | 3,595 | -14 | -0.41% | ||

| 201J1/2B | Hongwang | Wuxi | 1,310 | -20 | -1.64% |

| Foshan | 1,300 | -3 | -0.24% | ||

| J5/2B | Hongwang | Wuxi | 1,190 | -16 | -1.44% |

| Foshan | 1,200 | -3 | -0.26% | ||

| 430/2B | TISCO | Wuxi | 1,170 | -7 | -0.67% |

| Foshan | 1,185 | -4 | -0.40% |

TREND || Fluctuating Prices and Lowered Transactions.

Last week, both spot and futures prices of stainless steel in the Wuxi market saw a slight decline, with weak industry speculation. Spot market transactions were poor, and downstream businesses adopted a cautious wait-and-see attitude, lacking confidence in the future market. Transactions were mainly driven by rigid demand and low-priced resources; agents offered discounts to sell, and inventory was slightly reduced. On November 1st, futures prices fell to a low of US$2025/MT, rebounding nearly US$28/MT intraday to US$2050/MT, starting the fourth quarter on a positive note. The main contract price of stainless steel had copied and pasted the price level as the futures, decreased by US$19/MT to US$2050/MT compared to the previous week, a decrease of 0.95%.

300 Series: Weakly Fluctuating Spot and Futures Prices.

Last week, the spot price of 304 fluctuated downward. As of last Friday, the main base price of cold-rolled four-foot 304 in the Wuxi region was US$2010/MT, down US$14/MT from the previous Friday; the price of private hot-rolled was US$1985/MT, down US$7/MT from the previous Friday. The futures market maintained a downward trend last week. At the beginning of the week, Tsingshan increased its opening price by US$14/MT, and spot traders followed suit, but downstream end-users maintained a wait-and-see attitude, and overall purchasing intentions were insufficient, with actual transactions mainly focused on low-priced resources. In the second half of the week, spot and futures prices declined synchronously, and market sentiment deteriorated. Intraday inquiries were insufficient, and agents offered promotional discounts, but the actual effect was poor. The market arrivals of resources decreased last week, the basis narrowed, leading to an increase in warehouse receipt resources, and the overall circulating resources in the market decreased, resulting in a month-on-month reduction in inventory.

200 Series: Cooling Macroeconomic Sentiment, Increased Production and Decreased Inventory Intertwined.

The main base price of cold-rolled 201J1 in the Wuxi market fell to US$1270/MT, cold-rolled J2/J5 fell to US$1140/MT, and five-foot hot-rolled 201J1 fell to US$1235/MT. The spot price fluctuated downward during the week, with low-priced resources emerging in the market, and traders reduced prices to sell, but downstream end-users mainly adopted a wait-and-see attitude, and overall transactions were limited.

400 Series: Quotations Decreased by US14/MT.

In the Wuxi spot market, the price of state-owned cold-rolled stainless steel 430 was US$1175/MT, down US$7 from the previous week's quotation; the price of state-owned hot-rolled stainless steel 430 was around US$1110/MT, down US$14/MT from the previous week's quotation.

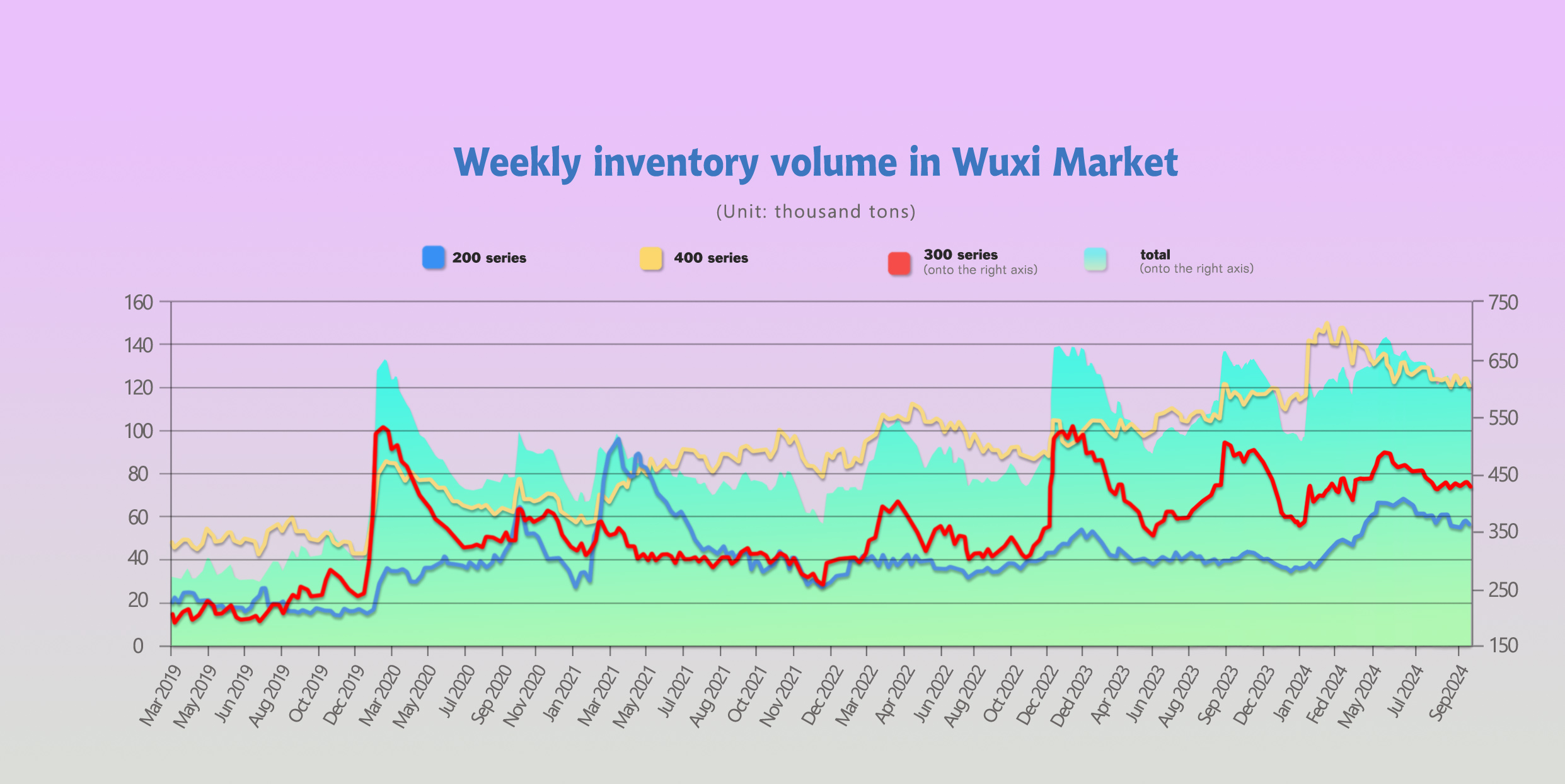

INVENTORY || Inventory Decreased by 14,000 Tons.

The total inventory at the Wuxi sample warehouse down by 14,013 tons to 600,349 tons (as of 31st October).

the breakdown is as followed:

200 series: 2,259 tons down to 55,004 tons,

300 Series: 8,400 tons down to 425,089 tons,

400 series: 3,354 tons down to 120,256 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Oct 24th | 57,263 | 433,489 | 123,610 | 614,362 |

| Oct 31st | 55,004 | 425,089 | 120,256 | 600,349 |

| Difference | -2,259 | -8,400 | -3,354 | -14,013 |

300 Series: Reduced Circulating Resources, Inventory Turned from Increase to Decrease.

During last inventory period, futures prices declined weakly, and spot prices followed suit with slight decreases. The basis narrowed, and the advantage of spot pricing resources expanded. By the end of the month, steel mills required agents to pick up goods, leading to a significant reduction in steel mill front-end inventory. Last week, market arrivals decreased, while warehouse receipts increased month-on-month, and market-available goods were in short supply. Jiangyin arrivals of hot-rolled resources decreased significantly. At the beginning of the week, Tsingshan increased its opening price, boosting market consumption sentiment, coupled with the fact that current prices are at a low valuation, purchases improved, and inventory decreased slightly. Currently, steel mills continue to suffer production losses, and in November, steel mills may maintain a state of reduced production. Demand will remain weak and stable, and traders will reduce prices to clear inventory. It is expected that inventory will maintain a slight decrease in the short term.

200 Series: Market Confidence Eroded, Agents Offer Discounts to Reduce Inventory.

Last week, the spot price of 201 fluctuated. At the beginning of the week, the futures market rebounded, coupled with the fact that steel mills opened with price increases, boosting market sentiment, and traders followed suit by increasing prices by US$7/MT. The downstream end-market was optimistic about the future price trend and actively purchased, leading to a slight reduction in inventory. In the second half of the week, mainstream quotations followed the downward trend of the futures market, and traders offered preferential shipments, causing downstream customers to become more cautious. Steel mills arrived as usual during the week, and the market paid close attention to steel mill prices. In the short term, the price of 201J2 will remain stable, and it is expected that the inventory of the 200 series will continue to decrease next week.

400 Series: Cost Collapse, Reduced Production Leads to Inventory Reduction.

During last week, the fluctuation of the futures market repeatedly affected market trading confidence. During the week, traders took the initiative to reduce inventory and increased their willingness to offer promotional discounts, leading to an influx of low-priced resources in the market. Downstream buyers were more willing to purchase at low prices, and low-price transactions were acceptable during the week. At the end of the month, steel mills urged settlement and delivery, and agents such as JISCO increased their deliveries, significantly reducing steel mill front-end inventory. On the raw material side, high-chromium prices continued to decline following the steel procurement price, and the cost support for the 400 series declined. In October, steel production continued to contract, and market supply pressure eased, but overall downstream demand remained weak, and the inventory digestion speed was slow. It is expected that inventory may decrease slightly next week. The focus will be on subsequent steel mill production and market transaction conditions.

RAW MATERIAL || Weak Consumption, Decreasing Stainless Steel Costs.

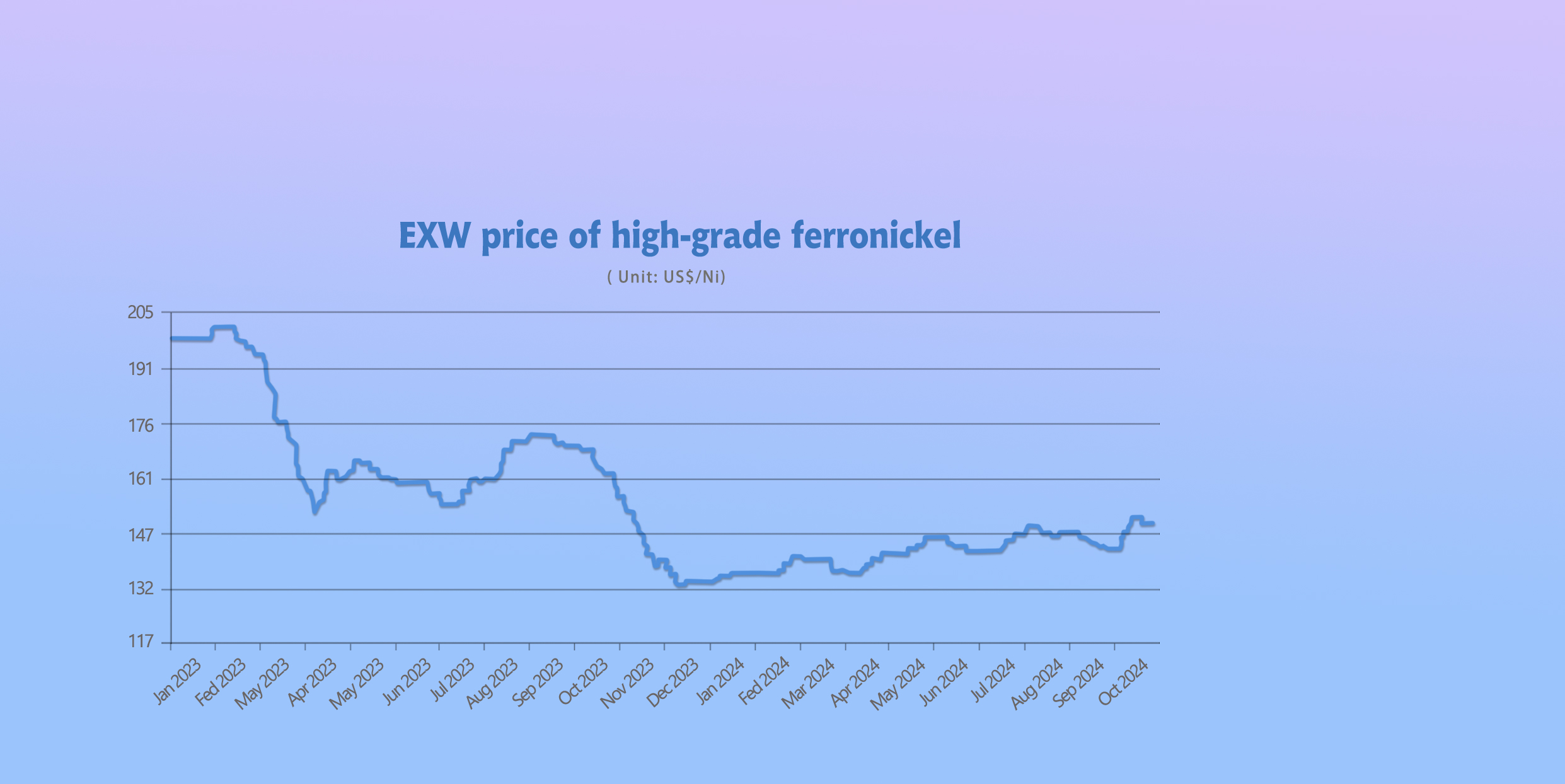

On Friday, November 1, 2024, the London Nickel price closed 385 points higher at US$16,120 per ton, and LME nickel inventories remained flat at 146,820 tons. Last week, the mainstream ex-factory price of high-nickel pig iron remained flat at US$145/nickel point, and the price of ferrochrome decreased slightly to US$1127/50 reference ton.

NICKEL: Price of High-Nickel Pig Iron Increased in October, Expected to Stabilize in the Future.

In October, the domestic price of high-nickel pig iron first rose and then fell, and the current mainstream ex-factory price is US$145-US$146/nickel point, an increase of US$6/nickel point compared with the end of last month, an increase of 4.6%. In September, the total output of high-nickel pig iron produced by major domestic nickel iron producers and steel mills was approximately 215,000 tons, a decrease of 0.22 million tons compared with 21.72 million tons in August. With the significant increase in nickel iron prices in October, the profits of domestic nickel iron plants have recovered, and production motivation has increased. It is expected that nickel iron production will maintain an increase in November.

Outlook for November

After the National Day holiday in October, many steel mills entered the market to purchase nickel iron, and the price of nickel iron rose rapidly, breaking through a new high for the year. However, the price of stainless steel was relatively weak, and steel mills suffered losses, making them cautious about purchasing high-priced raw materials. After the surge, the price of nickel iron fell slightly. Indonesia has new nickel ore quotas, reducing the supply pressure on the mine end, coupled with the commissioning of new production capacity, and production capacity continues to climb. There is an expectation of increased nickel iron supply. It is expected that the price of nickel iron will remain stable in the short term.

CHROME: Prices Hit Bottom, Production Contracts.

In October, the retail price of domestic high-carbon ferrochrome continued to decline, with a cumulative decline of US$50/50 reference ton, and the current mainstream ex-factory price is around US$1132-US$1161/50 reference ton. With the decline in the price of high-chromium, the production situation of high-chromium plants in the main production areas of the south and north has changed significantly. The southern main production area has seen a decrease in production, while the northern main production area has been undergoing rotational overhauls, with intermittent operation. According to industry feedback, at the end of October, two 33,000 KVA blast furnaces at a high-chromium production enterprise in Inner Mongolia started overhauls, shutting down one 33,000 KVA blast furnace and one 48,000 KVA blast furnace. The overhaul is expected to end in mid-November, lasting about 20 days, affecting the reduction of high-chromium production by more than 8,000 tons at this plant. A 16,500 KVA blast furnace at a high-chromium production enterprise in Guangxi also started overhaul today; a high-chromium production enterprise in Sichuan also stated that its high-chromium production in October had been reduced by half, and with the arrival of the dry season in November, production may continue to decline under high cost pressure. On November 1st, two 33,000 KVA blast furnaces that had previously suspended production due to overhauls at a high-chromium plant in Inner Mongolia have resumed production, and two 30,000 KVA blast furnaces at another production enterprise that had previously undergone overhauls will also resume production last weekend. This involves a total of about 20,000 tons of high-chromium production. Overall, the domestic production of high-chromium has fluctuated frequently recently, with a significant decrease, and the situation of oversupply in the market has been effectively improved. It is expected that with the end of the rainy season in the south, the production of high-chromium may continue to shift from south to north, but the overall production will contract, and the weak decline in the price of high-chromium will slow down.

SUMMARY || Future Direction Still Needs to Focus on Last Week's Macroeconomic Events.

Last week, both the futures and spot prices of stainless steel fluctuated. The traditional peak season of "golden September and silver October" is coming to an end. The effects of the previous round of financial policies have not yet been transmitted to the downstream, and after the digestion of macroeconomic benefits, stainless steel has returned to a weak fundamental operation. In November, the total steel mill production recovered to 3.27 million tons, a month-on-month increase of about 110,000 tons, with the increase in production mainly concentrated in the 300 series. The short-term supply-demand imbalance is difficult to change. On the raw materials side, some steel mills and factories still had a firm pricing sentiment for high-nickel pig iron during the week, the decline in high-carbon ferrochrome was difficult to change, and scrap steel weakened slightly, causing a slight decrease in the cost of stainless steel compared with the previous week. However, due to insufficient market confidence and downward market conditions during the week, steel mills' losses have increased. It is expected that stainless steel will continue to fluctuate in a low range in the short term. Continue to pay attention to macroeconomic policies, raw material prices, and steel mill production.

300 Series: With the decline in the prices of nickel iron and ferrochrome, the cost end of stainless steel has shifted downward, and steel mill profits have recovered somewhat. In October, steel mill production rebounded slightly, and imported resources flowed into the market, putting pressure on supply. On the macro side, as the US economy remains resilient, the probability of a Federal Reserve rate cut has decreased; domestically, macroeconomics may cut interest rates and reserve requirements again this year, and we are waiting for a clear direction. It is expected that the spot price of 304 cold-rolled will fluctuate with the futures market in the short term.

200 Series: The price of the 200 series is consolidating in a low range, and agents are offering discounts to sell at the end of the month. Compared with the same period last year, inventories are still at a high level. Coupled with the impact of macroeconomic sentiment on the decline in raw material prices, the cost support for 201 has weakened. Downstream consumers have a strong wait-and-see attitude and mainly purchase on demand. It is expected that the price of 201 will fluctuate weakly, and the rough base price of cold-rolled 201J2/J5 will range between US$1105-US$1150/MT.

400 Series: Given the high production costs of steel mills, the steel mills' firm pricing attitude has supported the spot market price, and the upside and downside of 430 in the short term are limited. With the gradual implementation of domestic macroeconomic policies, the market still has expectations for macroeconomic policies. Under the game of supply and demand, it is expected that the price of 430 will run weakly and steadily in the short term.

MACRO || Europe: Stainless Steel Profits Continue to Decline.

The European Steel Association, Eurofer, revealed on October 29, 2024, that it has downgraded its outlook for the fourth time this year due to weak demand and a sluggish economy. Eurofer has lowered its forecast for EU steel demand growth in 2024 from 4.2% to 3.8%. "Even with a projected mild recovery in 2025, consumption is likely to remain well below pre-pandemic levels," Eurofer said. It added that in the second quarter, the EU's steel imports fell by 1.5%, but its overall share climbed to a record high of 28%.

INDIA: Restrictions on imports of low-cost steel and stainless steel from China will harm India's MSMEs.

As the Indian government considers imposing additional duties to curb the influx of cheap steel and stainless steel imports, which are impacting domestic producers, EEPC India states that restricting imports of steel from China will severely impact the engineering products sector, especially small and medium-sized enterprises that rely on competitively priced steel to sustain operations. EEPC India, an organization advocating for engineering product exporters, opposes restrictions on imports of steel from cost-effective markets. Some small companies are producing steel-based infrastructure products. Stakeholders say that since MSMEs contribute about 30% to India's GDP, any measure that affects these small businesses will harm economic growth. It is worth noting that the growth in steel imports has occurred against a backdrop of a supply-demand gap in the domestic market. Although India's crude steel production grew by 4.44% and finished steel production by 5.30% in the first five months of the 2024-2025 fiscal year, steel consumption exceeded production, growing by 13.78%. EEPC emphasizes that any protectionist measures could lead to higher steel prices, reducing the competitiveness of MSMEs and jeopardizing their ability to maintain cost-effective operations.

On the other hand, large companies like India's JSL have urged the government to balance its import policy to ensure a level playing field. In the 2024 fiscal year, India became a net importer of steel for the first time since the 2017 fiscal year, with an overall trade deficit of 1.1 million tons.

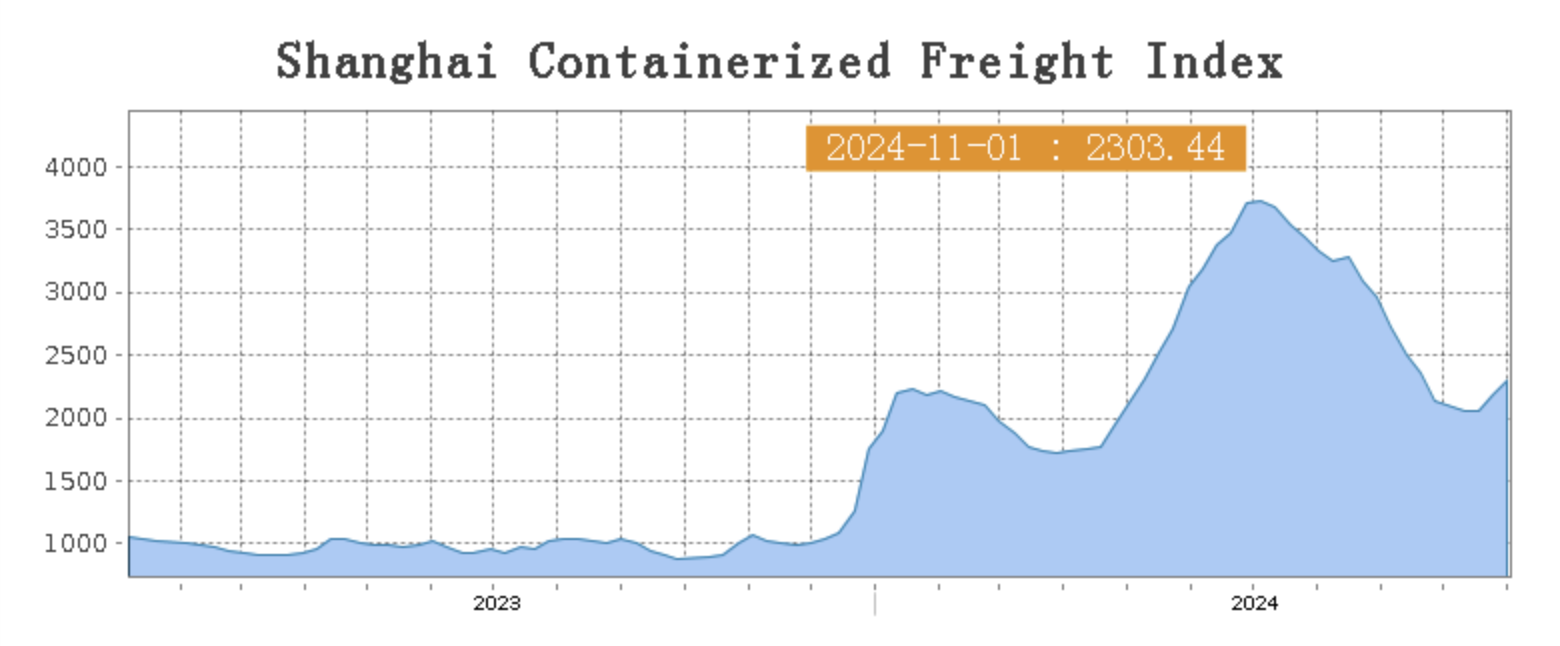

SEA FREIGHT || Transport Market Remains Stable and Improves, Market Freight Rates Continue to Rise.

Last week, the Chinese export container transportation market continued to maintain a stable and improving trend, with ocean freight rates continuing to rise, driving the comprehensive index upward. On 1st November, the Shanghai Containerized Freight Index lifted by 5.4% to 2303.44.

Europe/ Mediterranean:

According to data released by Eurostat, the eurozone's GDP grew by 0.4% quarter-on-quarter in the third quarter, with Germany growing slightly by 0.2% and the French economy continuing to accelerate compared to the second quarter, which was better than market expectations. Last week, the transportation market performed well, with transportation demand remaining at a high level, and shipping companies continued to push up spot market freight rates.

On 1st November, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2442/TEU, which grew by 9.7%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$2907/TEU, which increased by 13.8%.

North America:

Last week, overall transportation demand was stable, the supply-demand relationship was good, and market freight rates increased slightly.

On 1st November, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$4826/FEU and US$5258/FEU, both reporting an 0.9% and 3.1% growth accordingly.

The Persian Gulf and the Red Sea:

On the Persian Gulf route, the ongoing local tensions continued to support the transportation market, and spot market booking prices continued to rise.

On 1st November, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf bounced by 5.6% from last week's posted US$1507/TEU.

Australia/ New Zealand:

On 1st November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$2145/TEU, a 4.2% lift from the previous week.

South America:

On 1st November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$6359/TEU, an 1.2% increase from the previous week.