Stainless Insights in China from December 9th to December 13th.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,025 | -8 | -0.43% |

| Foshan | 2,070 | -8 | -0.43% | ||

| Hongwang | Wuxi | 1,940 | -6 | -0.30% | |

| Foshan | 1,955 | 0 | 0.00% | ||

| 304/NO.1 | ESS | Wuxi | 1,855 | -7 | -0.40% |

| Foshan | 1,875 | -4 | -0.24% | ||

| 316L/2B | TISCO | Wuxi | 3,450 | -31 | -0.91% |

| Foshan | 3,550 | -11 | -0.32% | ||

| 316L/NO.1 | ESS | Wuxi | 3,280 | -29 | -0.92% |

| Foshan | 3,325 | -24 | -0.73% | ||

| 201J1/2B | Hongwang | Wuxi | 1,240 | 0 | 0.00% |

| Foshan | 1,205 | -4 | -0.38% | ||

| J5/2B | Hongwang | Wuxi | 1,105 | 3 | 0.28% |

| Foshan | 1,105 | -4 | -0.42% | ||

| 430/2B | TISCO | Wuxi | 1,135 | -6 | -0.54% |

| Foshan | 1,140 | 0 | 0.00% |

TREND || Loose Monetary Policy Boosts Market Sentiment.

300 Series: Macroeconomic Benefits Help, Inventory Continues to Decline.

Last week, Wuxi market stainless steel spot prices stopped falling and stabilized, and industry speculation was average. Stainless steel futures prices rebounded after hitting bottom, with the highest rebound exceeding US$1950/MT. The release of macroeconomic benefits boosted market sentiment, and agents' willingness to support prices increased, with spot prices running steadily. The current valuation is low, and the futures price rebound drove increased procurement by downstream merchants, with low-priced resources gradually digested, and inventory declining for the seventh consecutive week. As of last Friday, the stainless steel 2502 contract price increased by US$17.3/MT from last week to US$1935/MT.

200 Series: Expectations and Market Forces Intertwined, Mainstream Prices Remain Stable.

Last week, 201 prices were mainly flat, with cold-rolled 201J2 reported at US$1075/MT base price; cold-rolled 201J1 reported at US$1210/MT base price, and hot-rolled 201J1 quoted at US$1180/MT.

400 Series: Positive News Boosts Market Sentiment, Prices Run Smoothly.

Last week, 430 prices ran weakly and stably. As of Friday, the Wuxi market cold-rolled 430 was quoted at US$1135/MT-US$1140/MT, and the hot-rolled 430 was quoted at around US$1085/MT. Currently, 430 prices are at a low point for the year, and the shortage of some cold-rolled products has not been alleviated. In addition, the better-than-expected macroeconomic benefits last week boosted market sentiment, downstream procurement sentiment warmed up, and inventory has been reduced to some extent.

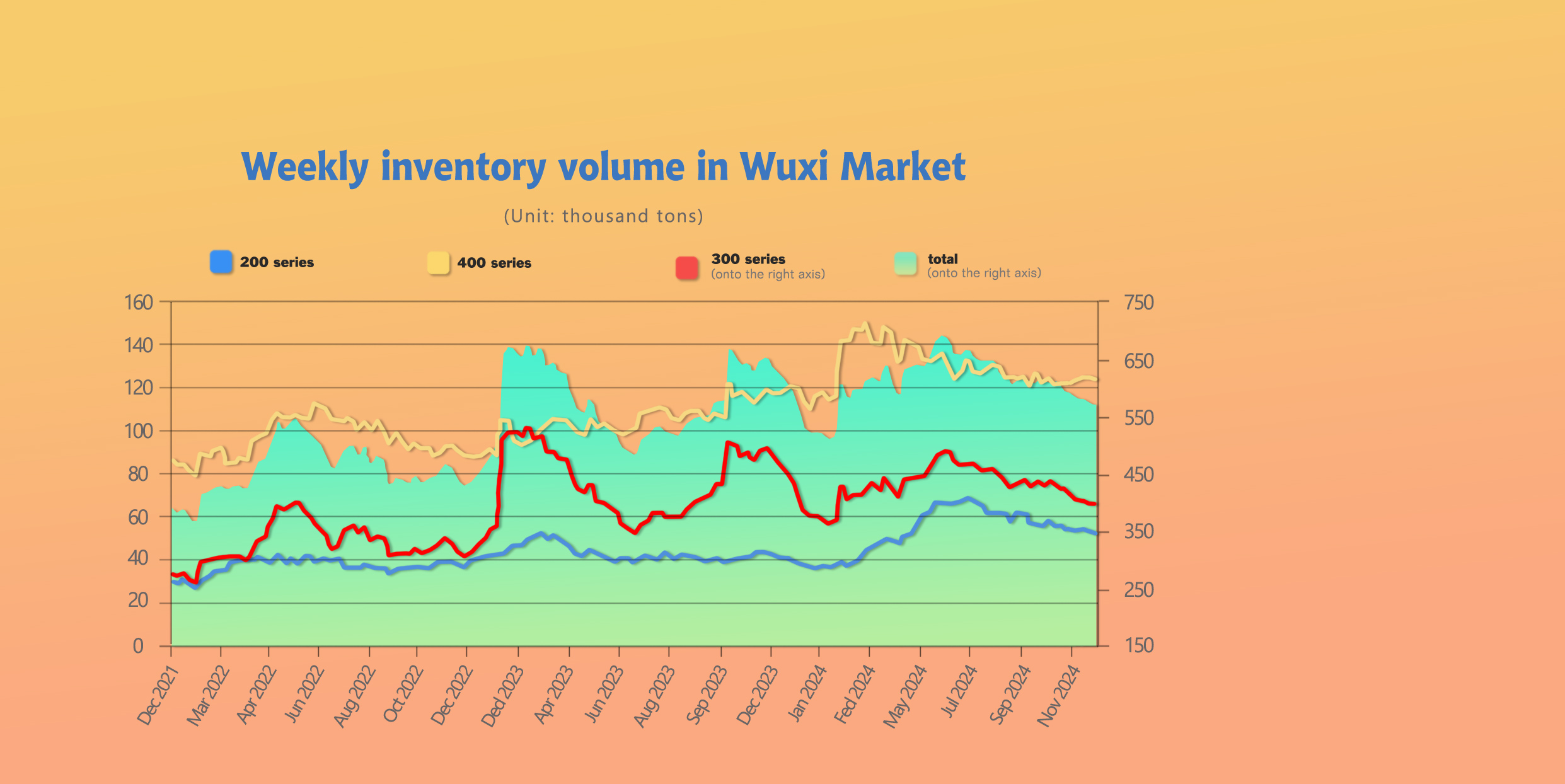

INVENTORY || Inventory Declines for Seven Consecutive Weeks.

The total inventory at the Wuxi sample warehouse down by 4,970 tons to 568,561 tons (as of 12th December).

The breakdown is as followed:

200 series: 1,168 tons up to 51,986 tons,

300 Series: 2,964 tons down to 392,859 tons,

400 series: 838 tons up to 123,716 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Dec 5th | 53,154 | 395,823 | 124,554 | 573,531 |

| Dec 12th | 51,986 | 392,859 | 123,716 | 568,561 |

| Difference | -1,168 | -2,964 | -838 | -4,970 |

300 Series: Positive Macro Sentiment, Inventory Reduction.

Last week, 300 series prices maintained weak fluctuations. The current valuation is low, and coupled with the lack of some hot-rolled product specifications, downstream merchants' willingness to purchase has increased, and hot-rolled inventory has significantly decreased. During the week, prices fluctuated weakly, agents' actual transaction concessions expanded, low-priced resources were gradually digested, and inventory maintained a decreasing trend.

200 Series: Arrivals are Promptly Digested, Cold and Hot Rolling Slightly Decreased.

During last week, some 201 cold-rolled traders made concessions for shipments according to market conditions, and downstream customers selectively replenished their inventories at lower prices, resulting in a reduction in cold-rolled inventory. 201 hot-rolled resources had fewer transactions, and inventory slightly accumulated. In the short term, the 201J2 price is likely to remain stable. It is expected that inventory may continue to decrease next week. Key attention should be paid to steel mill trends and market transaction conditions.

400 Series: Market Shortages, Positive Factors Help Reduce Inventory.

From the perspective of the current inventory structure, fewer JISCO’s cold-rolled resources have arrived, and the market's available resources have decreased. Currently, 430 prices are at a low point for the year, and the shortage of some cold-rolled products has not been alleviated. Coupled with the better-than-expected macroeconomic benefits last week that boosted market sentiment, downstream purchase sentiment has warmed up, and inventory has shifted from increasing to decreasing.

RAW MATERIAL || Indonesia Plans to Further Restrict Nickel Product Production.

According to a report from the Jakarta Post on the 11th December, the Indonesian Ministry of Energy and Mineral Resources plans to further restrict nickel product production to boost prices and protect domestic industries. Tri Winarno, Director of Coal and Mineral Mining at the Indonesian Ministry of Energy and Mineral Resources emphasized that, under the current geopolitical tensions and global conflicts, restricting production is crucial for the resilience of the national economy and resources.

At the 2025 Indonesian Economic Outlook held in Kuningan, South Jakarta on Tuesday, Tri Winarno announced that they will regulate nickel products on the market to prevent oversupply and achieve optimal production levels. He mentioned that they will restrict surplus nickel products to promote price increases, but did not disclose specific restrictions and timing.

Affected by this news, Shanghai Nickel rose all the way after opening in the morning of the 12th, with an increase of more than 3%. The night trading on the 12th opened higher, with the highest rise to US$18052/MT. As of the close on Friday afternoon, the main Shanghai Nickel contract closed at US$17930/MT, up US$386/MT from last Friday, an increase of 2.2%.

SUMMARY || Market Sensitivity to Policies Has Declined.

Stainless steel futures prices fluctuated strongly last week. The policies proposed at the Politburo meeting after the market closed on Monday boosted market confidence, but the market failed to maintain its strength, reflecting the market's continuous interpretation and game-playing of policies. The most important thing is still to see the implementation of policies. The market's sensitivity to continuous policy signals has declined. Stainless steel is currently in the off-season. Last week's stainless steel futures trend also broke the downward trend of the past month or so. Market transactions improved last week, with downstream mainly purchasing on demand. Social inventories maintained a decreasing trend, and warehouse receipts continued to accumulate. Raw material prices remained stable. It is expected that the stainless-steel market will fluctuate in the future.

300 Series: The release of national favorable policies improved market sentiment, and low market prices boosted terminal purchase demand, helping to reduce inventory. Steel mill output continues to increase, and supply-side pressure still exists. Under the game between long and short positions, it is expected that the short-term 304 cold-rolled spot price will fluctuate.

200 Series: The consumer side is cautiously purchasing, and the market is more concerned about subsequent steel mill maintenance and production shutdown plans. It is expected that the output of 200 series crude steel from steel mills will decrease in December, and supply pressure will be alleviated. In the short term, the cold-rolled 201J2 price is likely to continue to run smoothly.

400 Series: Steel mill output in November fell from a high level, coupled with a slight reduction in market inventory last week, market supply pressure has been eased, and short-term supply and demand contradictions have slightly eased. As domestic macroeconomic policies gradually increase and are implemented, it is expected that the 430 price will run weakly and stably in the short term.

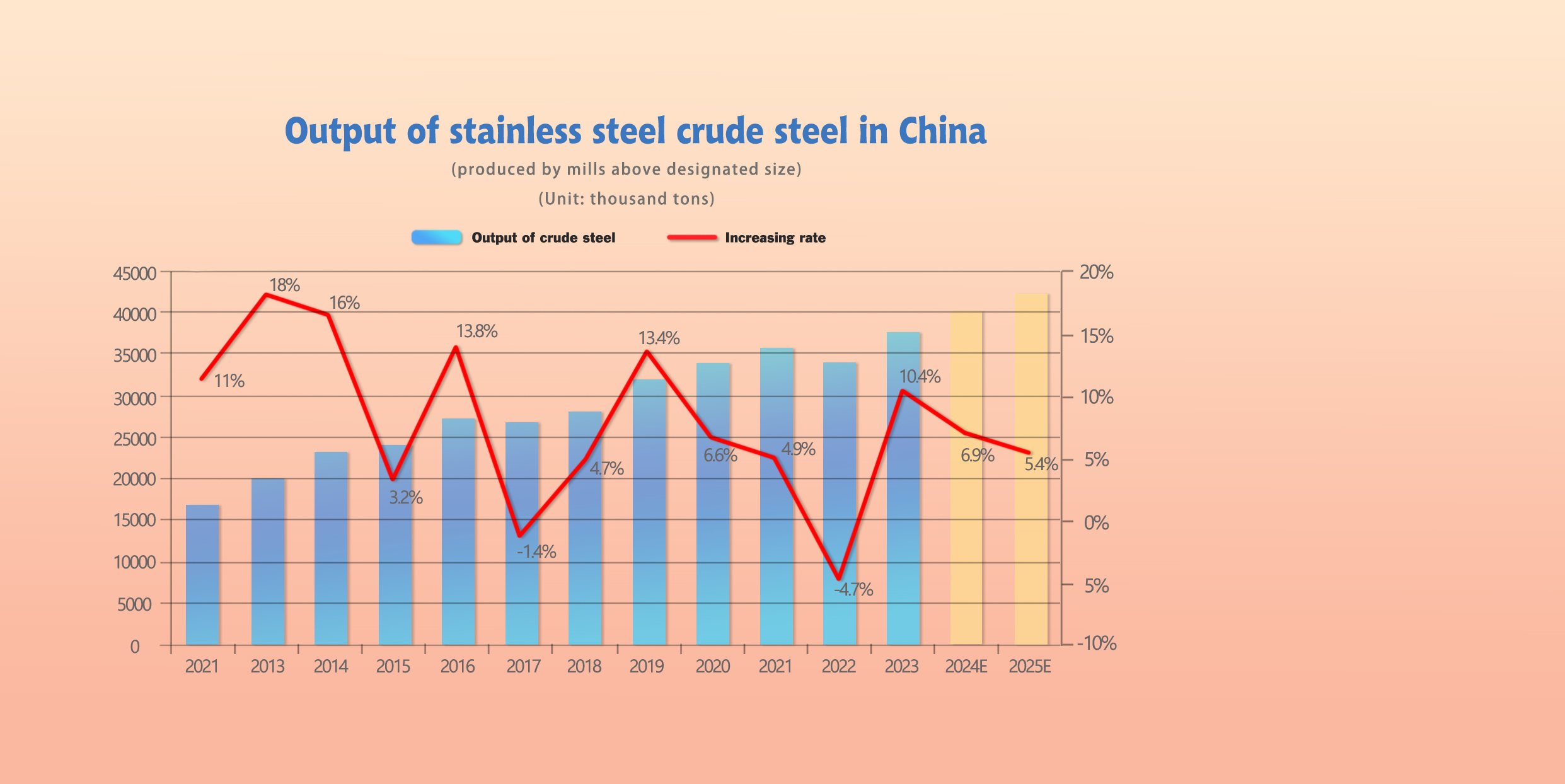

MACRO || 2024 Stainless Steel Crude Steel Output May Exceed 40 Million Tons.

According to statistics, the crude steel output of domestic stainless steel production enterprises above designated size in 2024 was 40.08 million tons, an increase of 2.59 million tons year-on-year, with a growth rate of 6.9% (Note: The output data for December is calculated based on steel mill production schedules, the same below).

Calculated by series:

200 series output was 12.76 million tons, an increase of 490,000 tons year-on-year, with a growth rate of 4%;

300 series output was 20.13 million tons, an increase of 1 million tons year-on-year, with a growth rate of 5.2%;

400 series output was 7.19 million tons, an increase of 1.1 million tons year-on-year, with a growth rate of 18.1%.

Calculated by End-product:

Wide-width plate and coil crude steel output was 29.16 million tons, an increase of 1.51 million tons year-on-year, with a growth rate of 5.5%;

Narrow strip crude steel output was 5.6 million tons, a decrease of 130,000 tons year-on-year, with a decrease rate of 2.3%;

Stainless steel long product crude steel output was 5.31 million tons, an increase of 1.22 million tons year-on-year, with a growth rate of 29.7%.

As of December 2024, the newly added stainless steel crude steel capacity within the year was 4.29 million tons, reaching 57.79 million tons. It is estimated that the stainless steel capacity utilization rate in 2024 was only 69.35%, a decrease of 0.7 percentage points compared to 2023.

Looking ahead to 2025, considering that new capacity will continue to be released next year, it is expected that the full-year crude steel output in 2025 will increase by 2.16 million tons to 42.24 million tons, with a growth rate of 5.4%, of which the 200 series output will be 13.2 million tons, an increase of 3.5% year-on-year, the 300 series output will be 21.24 million tons, an increase of 5.5% year-on-year, and the 400 series output will be 7.8 million tons, an increase of 8.5% year-on-year. Domestic stainless steel consumption is expected to grow steadily in 2025, with an estimated year-on-year increase of 6.36% to 39.28 million tons.

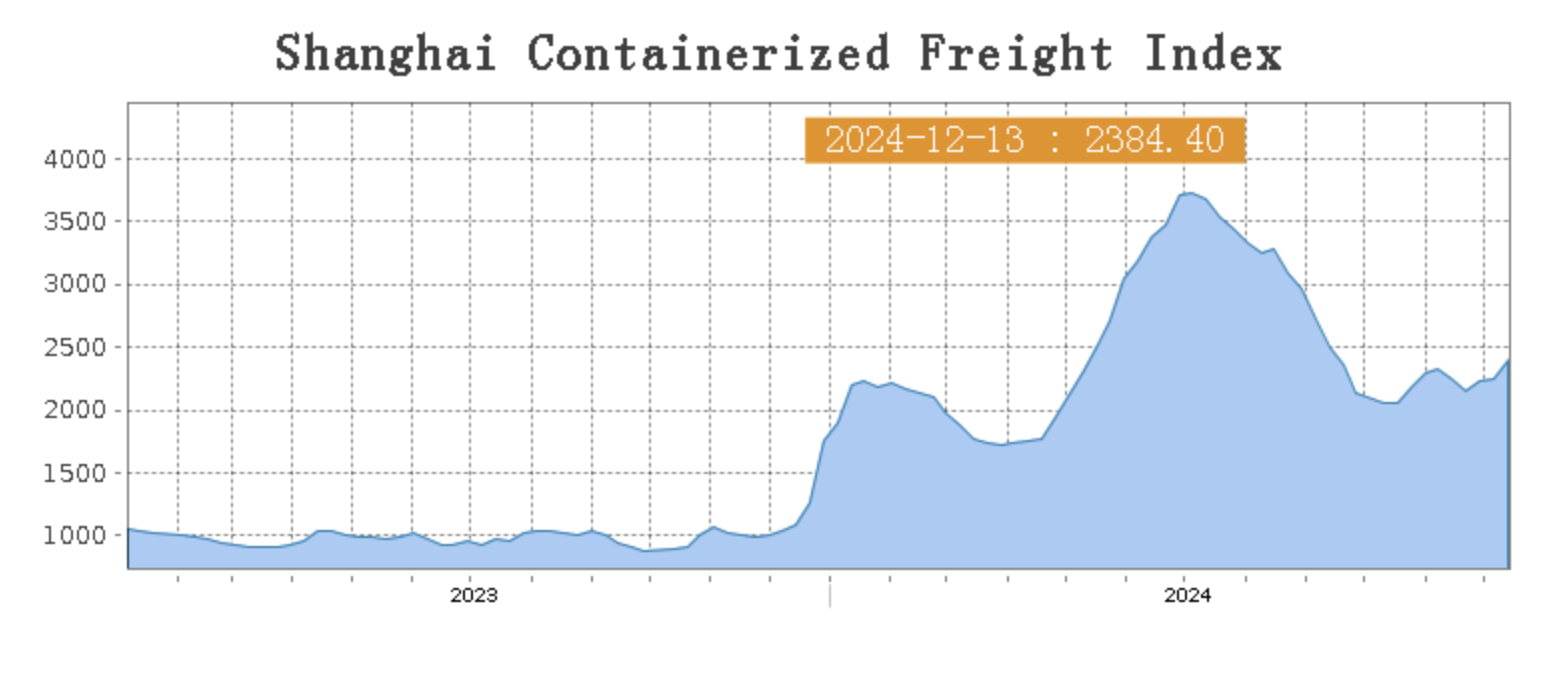

SEA FREIGHT || Divergent Trends in the Shipping Market, Freight Rates Fluctuate.

Last week, China's export container transport market was generally stable, with different routes showing differentiated trends due to their respective supply and demand fundamentals. The composite index rose.

On 13th December, the Shanghai Shipping Exchange released the Shanghai Containerized Freight Index (SCFI) at 2384.4 points, up 5.7% from the previous week.

Europe/ Mediterranean:

Last week, transport demand growth was weak, and supply and demand fundamentals lacked further support. Spot market booking prices slightly declined.

On 13th December, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2963TEU, which slid by 2.2%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3746/TEU, which droped by 0.4%.

North America:

The potential strike at US East Coast and Gulf Coast ports in January next year, coupled with President-elect Trump's plan to raise tariffs, is expected to drive volume growth at US container ports, continuing into early 2025. Last week, transport demand was generally stable, and the supply and demand relationship was basically balanced. Against the backdrop of continuous decline in market freight rates in the fourth quarter, major shipping companies carried out technical rate increases for booking fares to push up freight rates. Last week, spot market booking prices rose sharply. However, the market reflects that the relationship between transport capacity supply and demand has not changed, and substantial support for the sharp rise in freight rates is difficult to sustain.

On 13th December, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$4023/FEU and US$5494/FEU, both reporting a 21.6% and 11.6% rose accordingly.

The Persian Gulf and the Red Sea:

On the Persian Gulf route, the ongoing local tensions continued to support the transportation market, and spot market booking prices continued to rise.

On 13th December, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf went up by 2.2% from last week's posted US$1507/TEU.

Australia/ New Zealand:

On 13th December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1922/TEU, a 8.6% fall from the previous week.

South America:

On 13th December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$5608/TEU, an 1.8% decrease from the previous week.