Stainless Insights in China from December 30th to January 3rd.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,015 | 1 | 0.05% |

| Foshan | 2,055 | 1 | 0.05% | ||

| Hongwang | Wuxi | 1,900 | -7 | -0.40% | |

| Foshan | 1,930 | -2 | -0.10% | ||

| 304/NO.1 | ESS | Wuxi | 1,830 | -7 | -0.42% |

| Foshan | 1,855 | -2 | -0.10% | ||

| 316L/2B | TISCO | Wuxi | 3,400 | 0 | 0.00% |

| Foshan | 3,465 | 0 | 0.00% | ||

| 316L/NO.1 | ESS | Wuxi | 3,230 | 0 | 0.00% |

| Foshan | 3,250 | 7 | 0.22% | ||

| 201J1/2B | Hongwang | Wuxi | 1,210 | -8 | -0.75% |

| Foshan | 1,190 | 6 | 0.52% | ||

| J5/2B | Hongwang | Wuxi | 1,085 | -1 | -0.14% |

| Foshan | 1,090 | 6 | 0.57% | ||

| 430/2B | TISCO | Wuxi | 1,125 | 0 | 0.00% |

| Foshan | 1,125 | 0 | 0.00% |

TREND || Futures Weakness Leads to Increased Market Pessimism.

Last week, stainless steel spot prices in the Wuxi market fluctuated and fell, and industry speculation weakened. After the holiday, stainless steel futures prices continued to decline, hitting new lows for the year. Large steel mills lowered their opening quotations, and market agents followed suit, reducing profits and shipping goods. Downstream merchants held orders and waited, with insufficient willingness to purchase, and most transactions were based on low-priced resources, resulting in a slight reduction in inventory. The main Stainless steel contract broke through the previous low point of US$1885/MT, with the lowest point falling to US$1865/MT, and finally closed at US$1870/MT, a drop of 1.70%. The weakness of futures prices led to increased market pessimism, and the center of gravity of spot prices further shifted downward. The price of cold-rolled 304 fell to US$1840/MT, and the price of 304 hot-rolled fell to US$1820/MT, a decrease of US$7 to US$28/MT compared with last week's price. The 316L variety maintained stable operation, and the market improved somewhat. The 201 and 430 varieties ran weakly and stably, with prices down US$7.

300 Series: Inventory Changes from Increase to Decrease, Futures and Spot Prices Fall to New Lows.

Last week, 304 spot market prices continued to decline. As of Friday, the mainstream base price of cold-rolled four-foot 304 in the Wuxi area was reported at US$1855/MT, and the hot-rolled price was reported at US$1825/MT, both down US$14/MT from last Friday. At the beginning of the week, prices were low, coupled with the release of positive market sentiment, and speculative restocking demand was released, resulting in a slight reduction in inventory. After the New Year's Day holiday, both the stock market and the futures market fell, and investment sentiment once cooled down. There were rumors that regulatory authorities required the short-term release of negative sentiment, the commodity market was under pressure, and stainless steel futures and spot prices continued to fall to new lows. Downstream merchants mostly held orders and waited, and transactions decreased significantly in the second half of the week.

200 Series: Prices Run Weakly, Inventory Slightly Reduced.

Last week, 201 prices mainly ran weakly, with cold-rolled 201J2 reported at US$1055/MT; cold-rolled 201J1 reported at US$1180/MT, and hot-rolled 201J1 quoted at US$1160/MT. During the week, 201 cold-rolled prices were flat, and 201 hot-rolled prices were down US$7/MT. The market continued to weaken, and the consumption side held pessimistic sentiment about the future market, with limited acceptance of high-priced resources, and cold-rolled inventory slightly accumulated. After the hot-rolled price was lowered, traders offered discounts for shipments, market inquiries were active, the transaction atmosphere improved, and hot-rolled inventory was reduced.

400 Series: Cost Support Shifts Downward, 430 Prices Operate Under Pressure.

Last week, 430 prices ran weakly. As of Friday, the Wuxi market cold-rolled 430 was quoted at US$1130/MT, flat compared with last Friday's quotation; the state-owned hot-rolled 430 was quoted at around US$1055/MT, down US$7/MT from last Friday's quotation. During the week, more JISCO’s cold-rolled resources arrived, and the market's available resources increased; the downward trend of the futures market affected market trading confidence, downstream purchasing sentiment cooled down, the consumption side purchased cautiously, and the spot market inventory digestion was relatively slow.

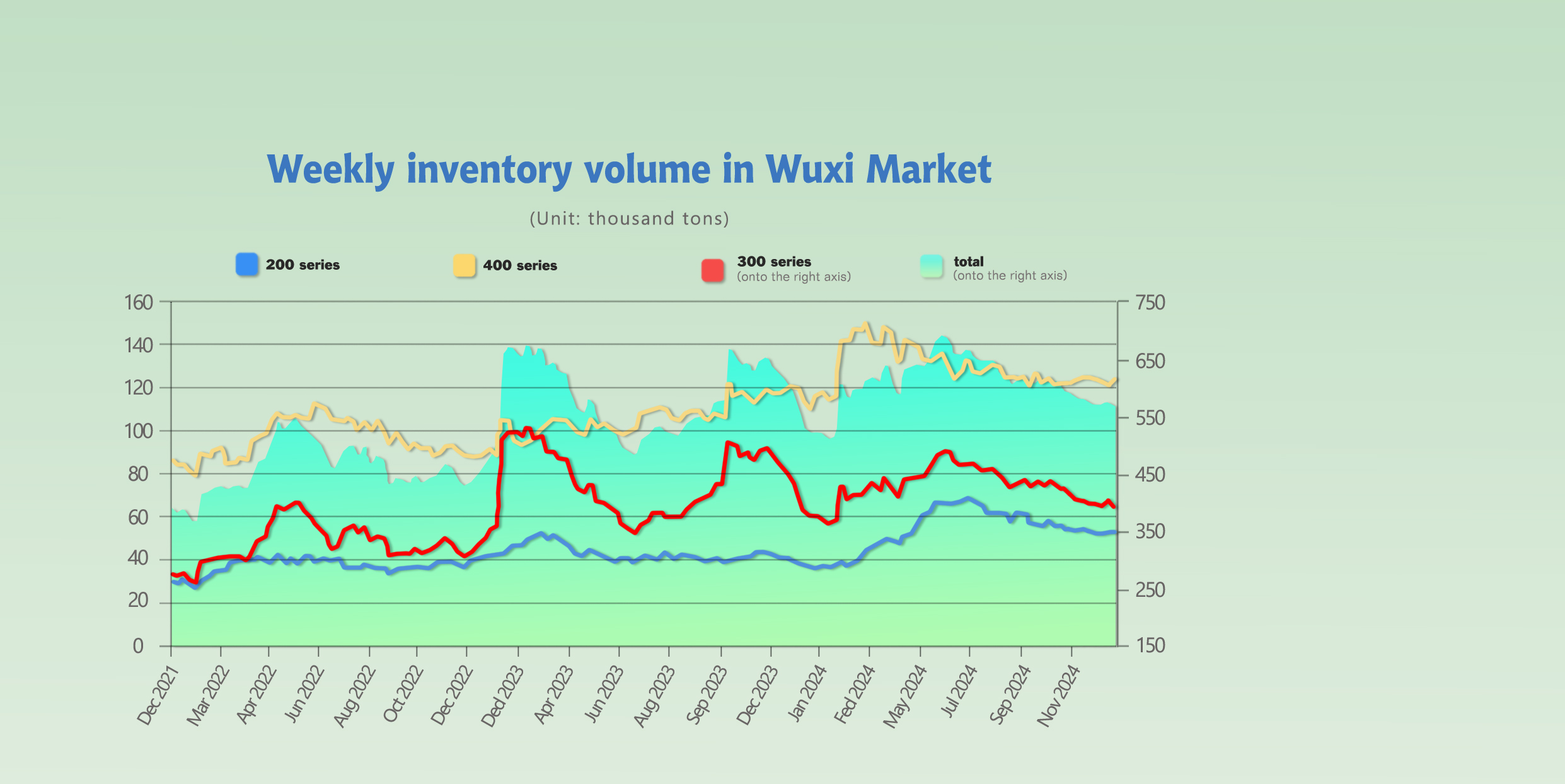

INVENTORY || First Inventory Decline in 2025.

The total inventory at the Wuxi sample warehouse downed by 7,431 tons to 564,629 tons (as of 3rd January).

The breakdown is as followed:

200 series: 161 tons down to 52,339 tons,

300 Series: 10,292 tons down to 388,655 tons,

400 series: 3,022 tons up to 123,635 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Dec 26th | 52,500 | 398,947 | 120,613 | 572,060 |

| Jan 3rd | 52,339 | 388,655 | 123,635 | 564,629 |

| Difference | -161 | -10,292 | 3,022 | -7,431 |

300 Series: Price War Continues, Inventory Changes from Increase to Decrease.

Approaching the Spring Festival, steel mills have successively reduced production and carried out maintenance, coupled with a decrease in imported resources, market arrivals have declined, and supply pressure has eased; demand-side off-season weakness, downstream merchants mostly hold orders and wait, and transactions are mostly based on rigid demand, and the weak supply and demand pattern has not improved. With Trump taking office soon, subsequent policies lack predictability, market trading sentiment is weak, and the commodity market is under pressure. The overall macro and fundamentals are weak, and subsequent inventory may increase slightly.

200 Series: Increased Arrivals, Weak Pattern Remains Unchanged.

Arrivals of Hongwang cold-rolled resources have increased. The consumption side's acceptance of high-priced resources is not high, and overall purchases are still mainly based on rigid demand, and inventory has slightly accumulated. After the 201 hot-rolled price was lowered, discounted resources appeared in the market, the transaction atmosphere improved somewhat, and hot-rolled inventory decreased. In the short term, the 201J2 price may maintain weak and stable operation, and it is expected that inventory may continue to accumulate next week.

400 Series: Downstream Demand is Weak, Inventory Continues to Accumulate.

Downstream demand in the off-season is weak, and supply and demand fundamentals pressure continues to exist. It is expected that inventory may continue to accumulate next week.

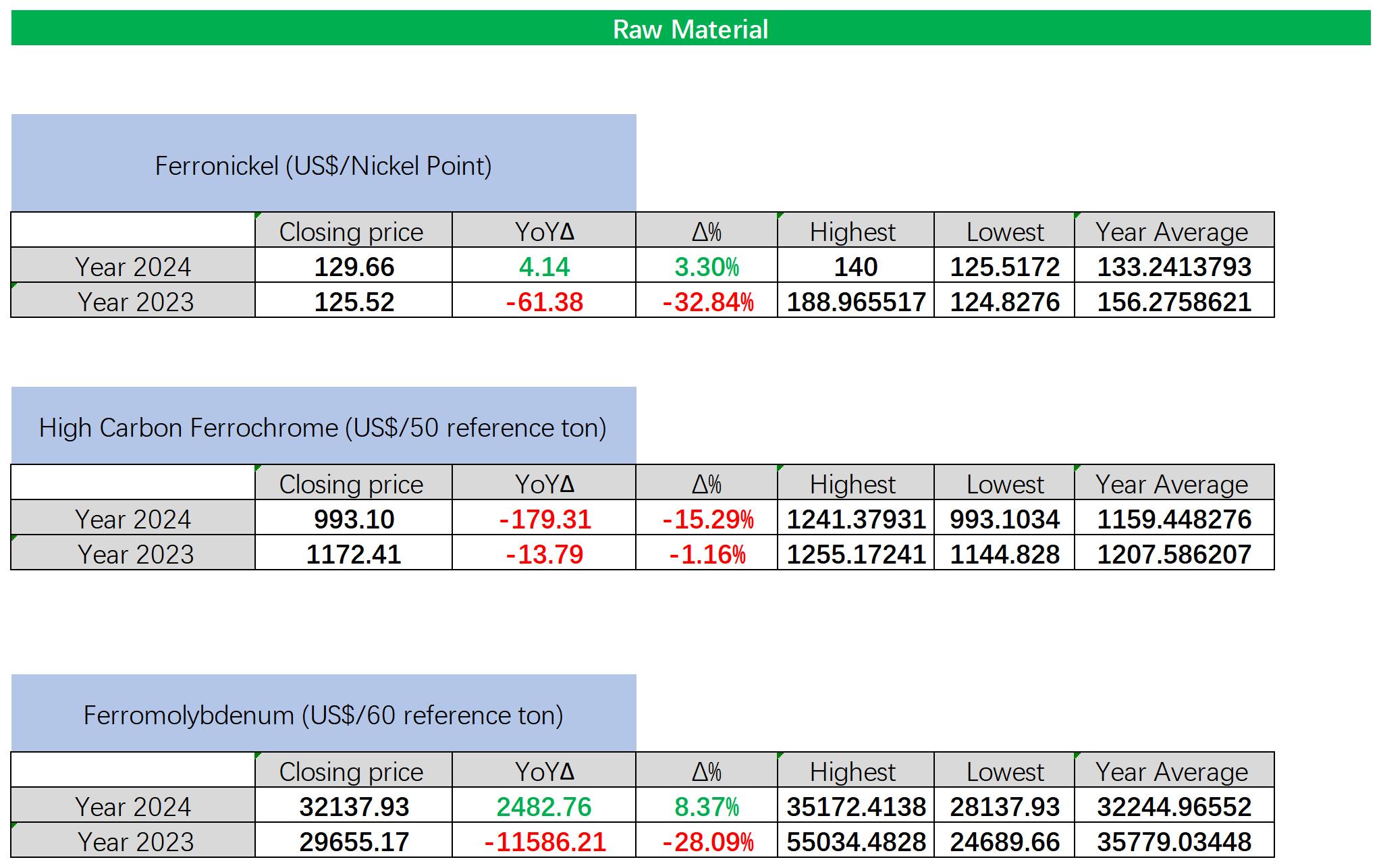

RAW MATERIAL || Philippines Plans to Amend Mining Law to Control Nickel Market.

The S&P Global recently discusses the potential for significant growth in the Philippine nickel mining industry, driven by proposed legislative changes. The Philippines is already a major player in the global nickel market, currently holding the position of the world's second-largest nickel producer. However, the country aims to further expand its production capacity, capitalizing on the increasing global demand for nickel, particularly driven by the electric vehicle (EV) battery sector.

A key factor driving this potential expansion is the push for a new mining law championed by the Philippine President. This proposed legislation aims to streamline the permitting process for mining operations, which has historically been a significant hurdle for companies seeking to invest in the Philippine mining sector. The current permitting process is often lengthy and complex, deterring potential investors and hindering the growth of the industry.

"the president himself mentioned to me that he is fully aware of mining's importance to our country's socio-economic growth and of the issues that hinder the industry from attaining its full potential." said Michael Toledo, the top figure of the Chamber of Mines of the Philippines.

"And we are happy to note that our government officials are busy working on our recommendations, and look forward to their realization in the near future," Toledo pointed out by email.

The new law seeks to address these issues by simplifying regulations and creating a more favorable investment climate.

Philippines mining industry eyeing growth

| Reserves and Resources | Global Market Share | |

| Nickel | 7.7% | 32 million tons |

| Cobalt | 3.1% | 1 million tons |

| Gold | 1.8% | 131.2 million tons |

| Copper | 1.5% | 46.6 million tons |

| Bauxite | 0.9% | 361.1 million tons |

Source: S&P Global Market Intelligence

The anticipated benefits of this new law are multifaceted. Firstly, it is expected to attract greater foreign investment into the Philippine mining sector. By reducing bureaucratic red tape and providing greater regulatory certainty, the Philippines aims to become a more attractive destination for mining companies looking to expand their operations. This influx of investment could lead to the development of new nickel mines and the expansion of existing ones, significantly boosting the country's nickel output.

Secondly, the law is expected to boost the overall contribution of the mining sector to the Philippine economy. Increased nickel production and exports would generate substantial revenue for the government, contribute to job creation in mining communities, and stimulate related industries. This economic boost is particularly important for the Philippines as it seeks to recover from the economic impacts of the global pandemic.

The S&P Global also highlights the optimism surrounding the passage of this new law. Both the Philippine government and the Chamber of Mines of the Philippines express confidence that the legislation will be approved. This optimism reflects a broader consensus on the need to modernize the country's mining sector and unlock its full potential. The passage of this law would signal a significant shift in the Philippine mining landscape, paving the way for substantial growth in the nickel industry and solidifying the country's position as a key player in the global nickel market, especially as the demand for battery metals continues to rise.

SUMMARY || Futures Continue to Explore New Lows, Price Stability Broken.

Stainless steel futures falling below previous lows and continuing to explore lower points has caused market panic, and stainless steel spot prices have further shifted downward. Due to the shorter sales cycle in January and February, some downstream users have a certain demand for purchasing and stocking goods. Both steel mills and traders have the idea of competing for orders, which has led to further declines in transaction prices. However, considering cost factors, the bidding and procurement of raw materials by steel mills at the beginning of the month will likely be affected to a certain extent, but the impact is expected to be limited. Therefore, the limited downward range of costs forms a certain support for spot prices. It is expected that the decline in spot prices will be relatively limited.

300 Series: Current futures and spot prices are falling, the price difference continues to narrow, and investment sentiment is weak. Domestic imported resources have declined. Approaching the holidays, most steel mills have started maintenance plans, and supply-side pressure has eased. Demand in the off-season maintains rigid demand purchases. It is expected that the short-term 304 cold-rolled spot price will fluctuate.

200 Series: The futures market drives the 201 price downward, and market transactions have a profit margin of about US$7/MT. The production reduction and maintenance of steel mills in January and February will affect nearly 460,000 tons of 200 series crude steel output, and supply pressure has been alleviated. However, the consumption side is still mainly based on rigid demand purchases. Under the pull of supply and demand, the short-term 201J2 price may maintain stable operation.

400 Series: Last week, the price of high-chromium at the raw material end continued to decline following the steel bidding price, and the cost support of the 400 series was weakened again; coupled with weak downstream demand in the off-season, the supply and demand fundamentals pressure continued to exist. In January, steel mills successively started maintenance and production reduction plans, and the later market supply pressure may be alleviated to a certain extent. Under the game of supply and demand, it is expected that the short-term 430 price will operate weakly and stably.

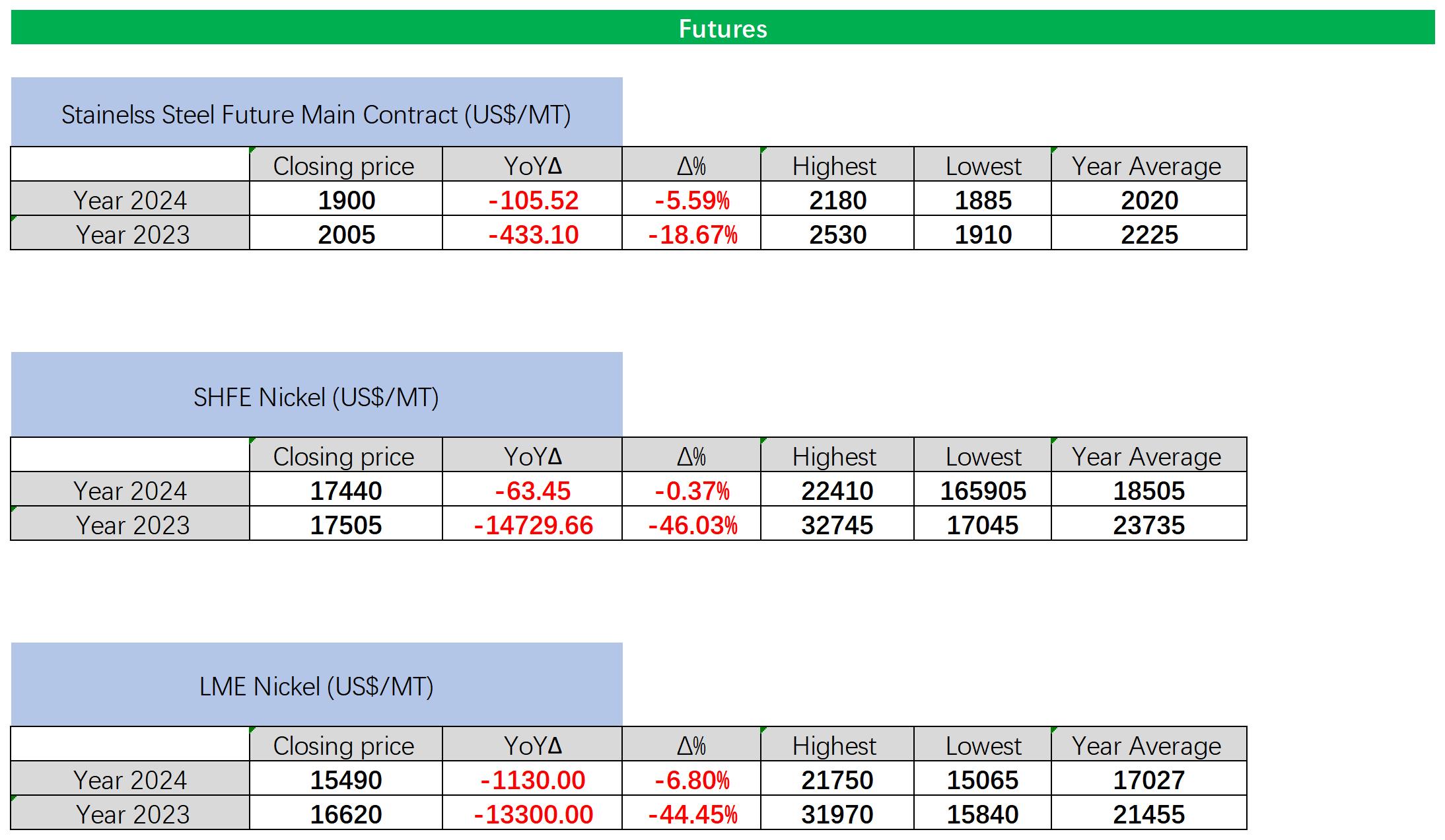

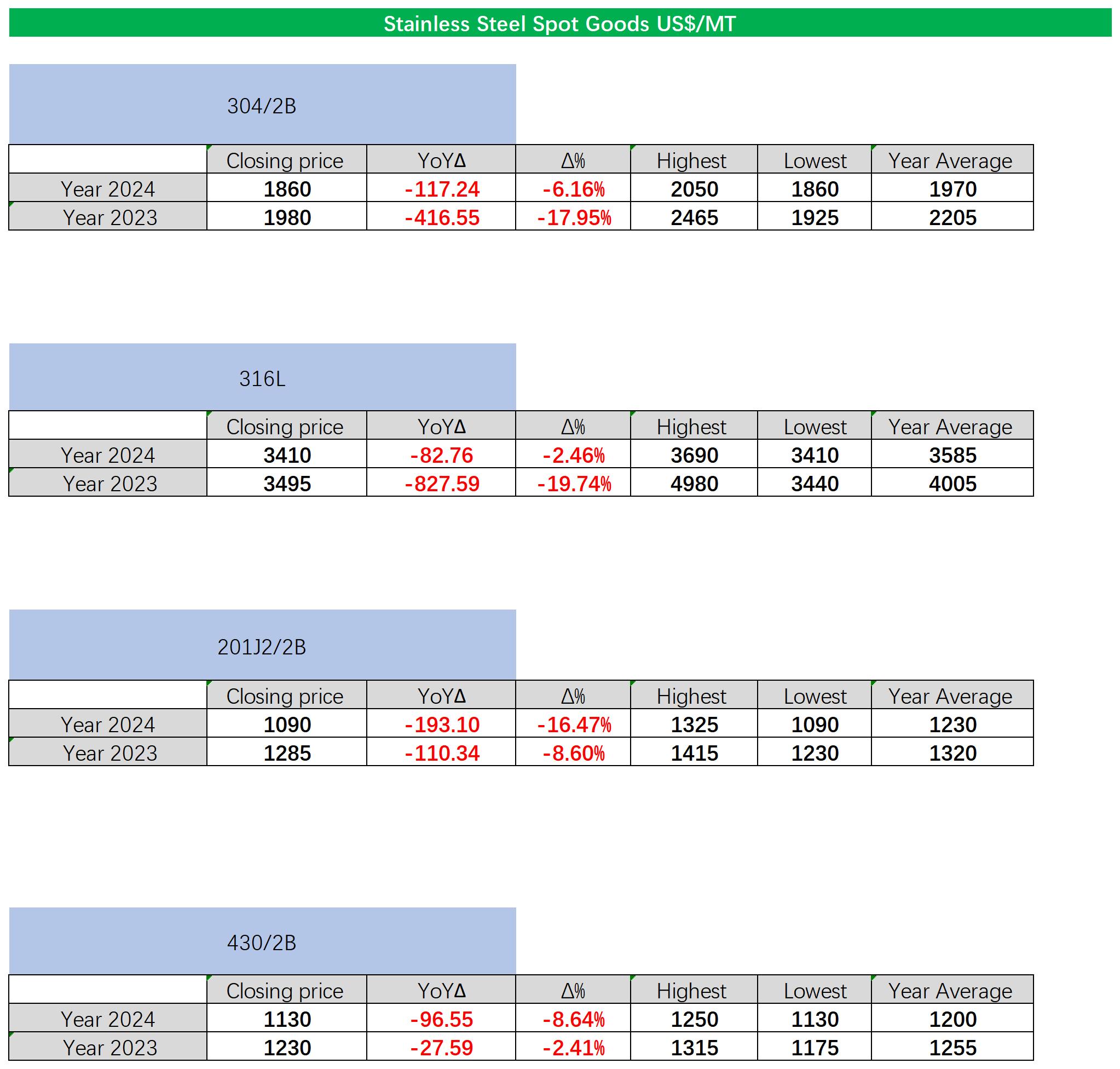

KEY CLOSING PRICES BETWEEN 2023 and 2024

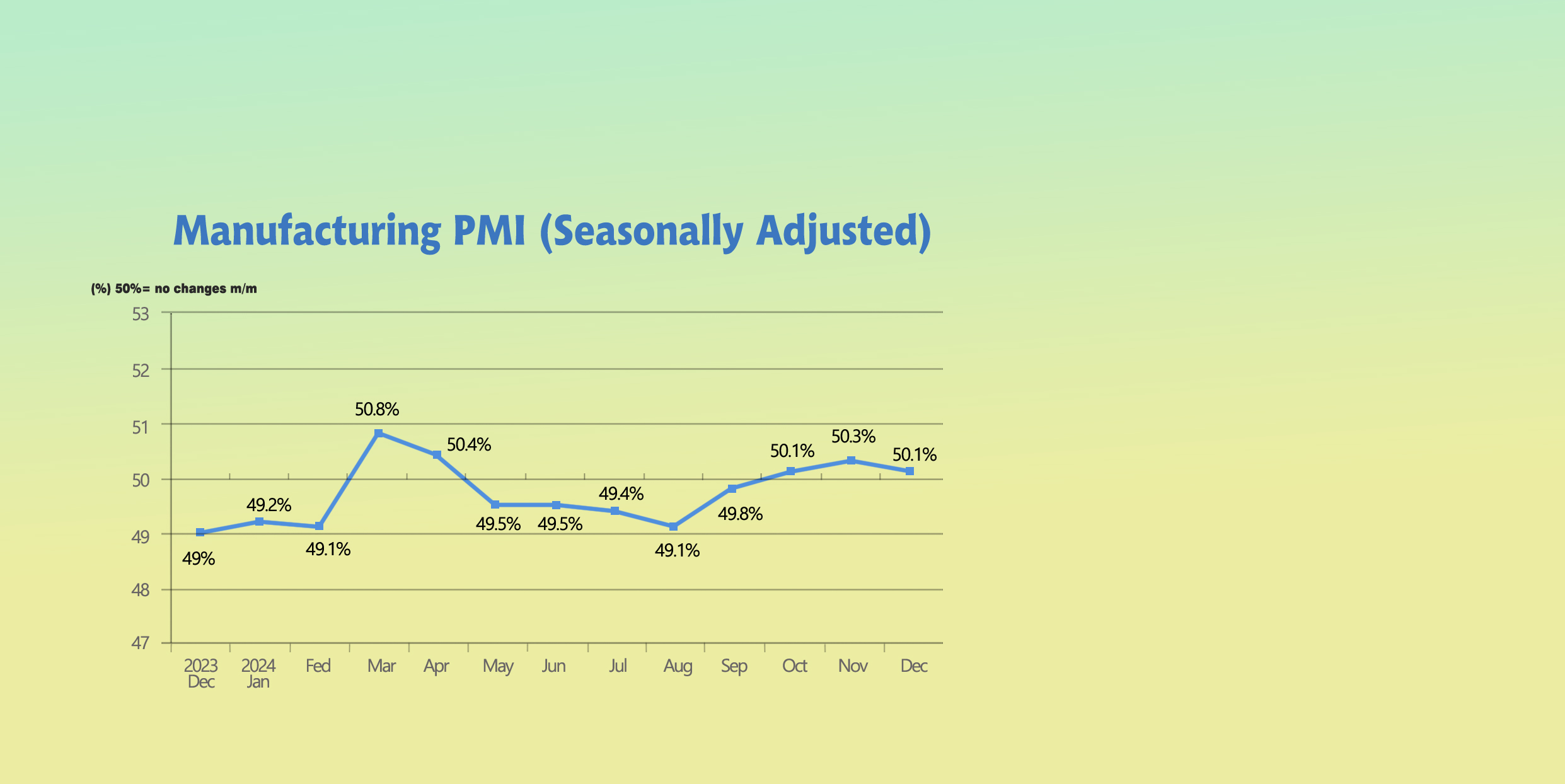

MACRO || China's Manufacturing PMI in December 2024 at 50.1%.

In December 2024, China's Manufacturing Purchasing Managers' Index (PMI) stood at 50.1%, a slight decrease of 0.2 percentage points compared to the previous month. However, it remained in the expansion zone for the third consecutive month, indicating that the economic conditions continue to improve.The following is a detailed analysis:

Overall Situation

Although the PMI for the manufacturing sector decreased slightly in December, it remained in the expansion zone, indicating that the manufacturing industry is still expanding, though at a slower pace. The Production Index was 52.1%, down by 0.3 percentage points from last month. The New Orders Index stood at 51.0%, an increase of 0.2 percentage points compared to the previous month. Both indices remained above the critical threshold, reflecting continued expansion in manufacturing output and market demand.

However, certain industries performed poorly: indices for sectors such as ferrous metal smelting and rolling processing, as well as metal products, were both below the critical point, indicating relatively insufficient supply and demand. The PMI for high-energy-consuming industries was 48.8%, a decrease of 0.4 percentage points from the previous month, suggesting a slight decline in economic conditions for these industries.

Price Situation

The indices for purchasing prices of major raw materials and factory gate prices were 48.2% and 46.7%, respectively, down by 1.6 and 1 percentage points compared to the previous month. This indicates a general decline in manufacturing market prices. The accelerated drop in the prices of basic raw materials is the main reason behind the overall decline in manufacturing prices. While this alleviates cost pressures for businesses, it also reflects that the economic recovery is still under pressure.

Procurement and Supply Situation

To meet production needs, businesses increased their purchasing efforts. The Purchasing Volume Index was 51.5%, up by 0.5 percentage points from the previous month, marking two consecutive months of expansion. The Supplier Delivery Time Index was 50.9%, an increase of 0.7 percentage points compared to last month, suggesting that the delivery time of raw material suppliers in the manufacturing sector continues to shorten. However, this also reflects a relatively low volume of orders and weak demand, as indicated by the short delivery periods.

Export Orders Index Changes

In December 2024, China's manufacturing New Export Orders Index was 48.3%, an increase of 0.2 percentage points from the previous month. This marks two consecutive months of growth, but the index has remained in the contraction zone for the past eight months. This suggests that while the export situation has improved to some extent, it still faces certain pressures overall.

Relationship Between Export and Market Demand

The New Orders Index stood at 51.0%, rising by 0.2 percentage points from the previous month and marking a four-month streak of improvement. This indicates that both domestic and external demand have improved. The recovery in export demand, along with the restoration of domestic demand, has contributed to a stable and accelerated recovery of overall market demand, providing some support for the development of the manufacturing sector. However, the recovery of external demand is relatively weak.

Export Industry Performance

The New Export Orders Index rose by more than 2 percentage points to 50%. This improvement is likely due to factors such as the year-end consumption peak and the rush for exports, which have jointly helped restore the supply and demand for consumer goods.

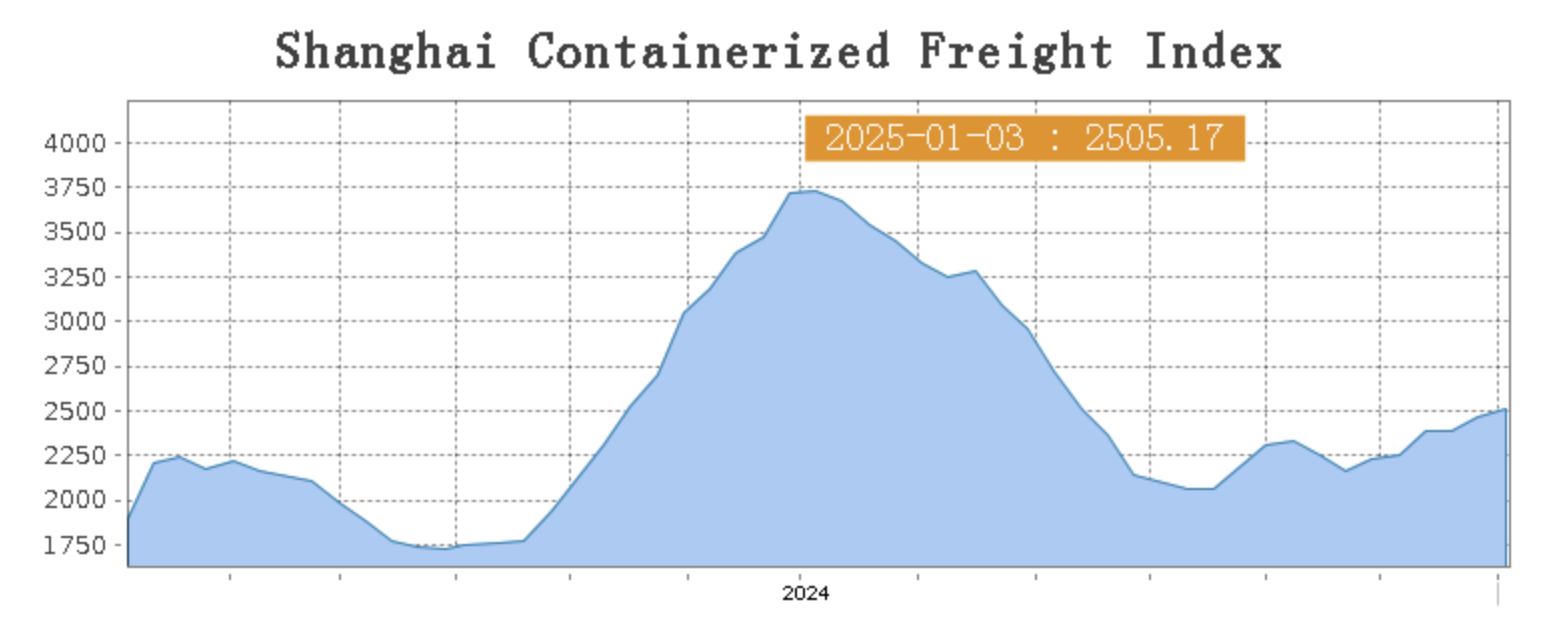

Sea Freight || Freight rate increased before CNY holiday.

Last week, the market situation of China's export container shipping remained stable, with differentiated trends appearing in different routes, and market freight rates fluctuating, with the composite index rising slightly.

Last week, transportation demand growth was weak, the supply and demand balance was not ideal, and market freight rates fell slightly. China’s Containerized Freight market continued to be interrupted by the regional fluctuation. On 3rd January, the Shanghai Containerized Freight Index rose by 1.8% to 2505.17.

Europe/ Mediterranean:

On 3rd January, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2851/TEU, which fell by 3.7%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3747/TEU, which dropped by 0.9%.

North America:

On 3rd January, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$4997/FEU and US$6418/FEU, reporting a 9.1% and 5.7% spike accordingly.

The Persian Gulf and the Red Sea:

On 3rd January, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 1.9% from last week's posted US$1472/TEU.

Australia/ New Zealand:

On 3rd January, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$2147/TEU, a 1.8% jump from the previous week.

South America:

On 3rd January, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$5344/TEU, an 2.3% slide from the previous week.