Stainless Insights in China from November 11th to November 15th.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,100 | -17 | -0.84% |

| Foshan | 2,145 | -17 | -0.82% | ||

| Hongwang | Wuxi | 1,995 | -24 | -1.25% | |

| Foshan | 2,010 | -26 | -1.38% | ||

| 304/NO.1 | ESS | Wuxi | 1,925 | -28 | -1.52% |

| Foshan | 1,935 | -35 | -1.88% | ||

| 316L/2B | TISCO | Wuxi | 3,625 | -14 | -0.40% |

| Foshan | 3,710 | -17 | -0.47% | ||

| 316L/NO.1 | ESS | Wuxi | 3,465 | -24 | -0.71% |

| Foshan | 3,480 | -22 | -0.66% | ||

| 201J1/2B | Hongwang | Wuxi | 1,265 | -4 | -0.36% |

| Foshan | 1,245 | -20 | -1.70% | ||

| J5/2B | Hongwang | Wuxi | 1,135 | -11 | -1.08% |

| Foshan | 1,145 | -20 | -1.85% | ||

| 430/2B | TISCO | Wuxi | 1,145 | 0 | 0.00% |

| Foshan | 1,160 | 0 | 0.00% |

TREND|| Spot prices decline weakly, and market sentiment is cautious near the end of the year.

Last week, the stainless steel spot market in Wuxi fluctuated downward, and industry speculation was weak. During the week, steel mills urged agents to pick up goods, and market arrivals increased slightly. Agents lowered quotations to ship goods, and low-priced resources were gradually consumed; spot and futures prices declined in tandem, the price advantage of point-price resources expanded, and inventory continued to decline for three consecutive weeks. In November, steel mills increased production, and with the arrival of the off-season, the supply-demand situation was weak, and prices fluctuated. As of last Friday, the main contract price of stainless steel had decreased by US$56 to US$1970/MT compared to the previous week.

300 Series: Positive news fell short of expectations, and terminal demand performance was weak.

Last week, the spot market price of stainless steel 304 fluctuated downward. As of Friday, the mainstream base price of cold-rolled four-foot 304 in the Wuxi area was US$1940/MT, down US$42 from the previous Friday, and the price of private hot-rolled was US$1905/MT, down US$56/MT from the previous Friday. Last week, the futures market declined weakly, and at the beginning of the week, the futures market fell first and then rose, and market quotations stopped falling and stabilized. Market sentiment was cautious, and transactions were light. During the week, macroeconomic positive news was released but fell short of expectations, futures prices rose slightly and then fell back, downstream purchasing intentions were insufficient during the off-season, coupled with the decline in raw material quotations, and stainless steel costs moved downward. On Thursday, Tsingshan agents lowered their prices by US$56 to take delivery, and market agents followed suit by lowering prices to ship goods and seize the market. Low-priced resources had eye-catching transactions on the same day. The impact of the previous steel mill production cuts on market arrivals was less than consumption, and inventory was slightly reduced.

200 Series: Production and inventory continue to tug-of-war, and 201 sentiment is mixed.

The mainstream base price of cold-rolled 201J1 in the Wuxi market reached US$1235/MT, the mainstream base price of cold-rolled J2/J5 reached US$1095/MT, and the five-foot hot-rolled 201J1 reached US$1200/MT. During the week, the spot price of 201 continued to decline following the futures market, and market sentiment turned pessimistic, with the overall transaction atmosphere being light.

400 Series: Supply pressure remains, prices remain stable and wait for a rise.

In the Wuxi spot market, the quoted price of state-owned cold-rolled 430 was US$1150/MT, a decrease of US$3/MT from the previous week's quoted price; the quoted price of hot-rolled 430 was around US$1105/MT, a small decrease from the quoted price on Thursday last week.

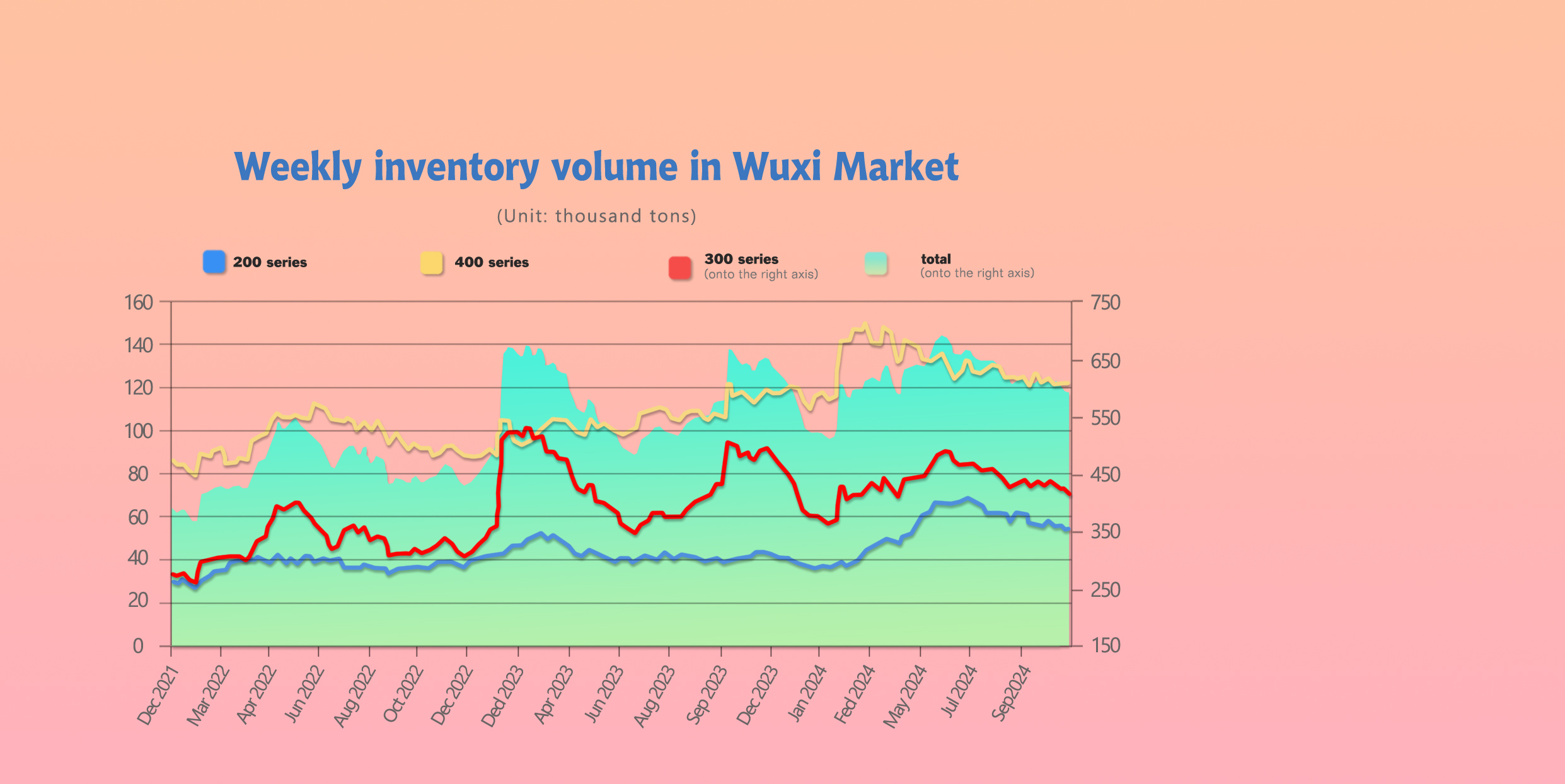

INVENTORY || Inventory declines for three consecutive periods! Warehouse resources are digested.

The total inventory at the Wuxi sample warehouse down by 10,896 tons to 585,866 tons (as of 14th November).

The breakdown is as followed:

200 series: 1,494 tons down to 53,067 tons,

300 Series: 9,018 tons down to 411,925 tons,

400 series: 384 tons up to 120,874 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Nov 7th | 54,561 | 420,943 | 121,258 | 596,762 |

| Nov 14th | 53,067 | 411,925 | 120,874 | 585,866 |

| Difference | -1,494 | -9,018 | -384 | -10,896 |

200 series: Agents reduce prices to ship goods, 201 continues to destocking.

During this inventory period, the price of 201 fluctuated downward. The destocking of cold-rolled products was mainly due to Hongwang resources, while the destocking of hot-rolled products was mainly due to Beigang resources. With the strengthening of the futures market on Friday last week, market sentiment was boosted, and the price of 201J2 cold-rolled increased by US$7/MT. Downstream customers actively purchased, the transaction atmosphere was active, and inventory was destocked. After the futures market fluctuated downward last week, traders were pessimistic about the future and took the initiative to cut prices to ship goods. Downstream customers were mainly cautious and replenished their stocks mainly with low-priced resources, and overall transactions were generally average. In November, the crude steel output of the 200 series in steel mills increased slightly month-on-month, and market supply remained at a high level. In the short term, the price of 201J2 may maintain a weak and stable operation. It is expected that the inventory of the 200 series may accumulate slightly next week, and the focus will be on market transactions and steel mill dynamics.

300 Series: Agents compete to seize the market, and low-priced warehouse resources are digested.

During this inventory period, spot and futures prices declined in tandem, the price advantage of point-price resources expanded, and the digestion of traditional resources was slow. From the inventory structure, Jiangyin hot-rolled resources increased significantly, and the inventory of 300 series hot-rolled increased month-on-month. Warehouse receipts decreased month-on-month, and cold-rolled resources flowed into the market, but due to the continuous decline in prices recently, the digestion of traders' previous base point pricing orders increased, and cold-rolled products were significantly destocked. During the week, Tsingshan agents and Delong agents lowered prices to reduce inventory, and downstream terminal merchants increased their speculative replenishment demand, and some warehouses saw a significant destocking of cold-rolled resources. Raw material prices decreased month-on-month compared with the previous week, and costs continued to decline, and steel mills' profits have recovered but are still in a loss-making state. Subsequent production may continue to increase, and supply pressure has not improved significantly. Peak season demand is not obvious, and the off-season is gradually coming, coupled with low price valuations, market confidence in the future is insufficient, and the supply and demand pattern remains weak. At present, the fundamentals are weak. Trump's coming to power has cooled expectations for future interest rate cuts, and domestic macroeconomic policies have been fluctuating, with overall macroeconomic sentiment being neutral. It is expected that subsequent inventory may turn from decreasing to increasing.

400 Series: Cost support collapses, cautious purchasing leads to a slight decrease in inventory.

During this inventory period, the price of 430 in the Wuxi market remained stable. During the week, traders took the initiative to reduce inventory, and downstream actual transactions had a large margin of price reduction. Coupled with the downward fluctuation of the futures market in the previous period, low-priced resources emerged in the market, and downstream buyers increased their willingness to purchase at low prices, and the inventory of the spot market decreased slightly. The continuous decline in the price of high-chromium raw materials has weakened the cost support for 400 series stainless steel. According to the current raw material prices, steel mills are still in a loss-making state, and the cost inversion continues, and steel mills still have a firm pricing mentality. In November, the output of steel mills increased significantly, and the supply of stainless steel continued to maintain a high level, while terminal demand was weak, and the pressure on the supply and demand fundamentals continued to exist. It is expected that inventory may increase slightly next week, and the focus will be on subsequent steel mill production and market transaction conditions.

RAW MATERIAL|| Low stainless steel price compresses the ore cost.

On Friday, November 15, 2024, LME nickel closed down 260 to $15,475/ton, and LME nickel inventories decreased to 154,434 tons. On Friday, the Liyang Zhonglianjin stainless steel 304 index closed at US$1910/M. Overnight, the main Shanghai nickel contract closed down US$72 to US$17143/MT; the main Shanghai stainless steel contract closed down US$13 to US$1840/MT.

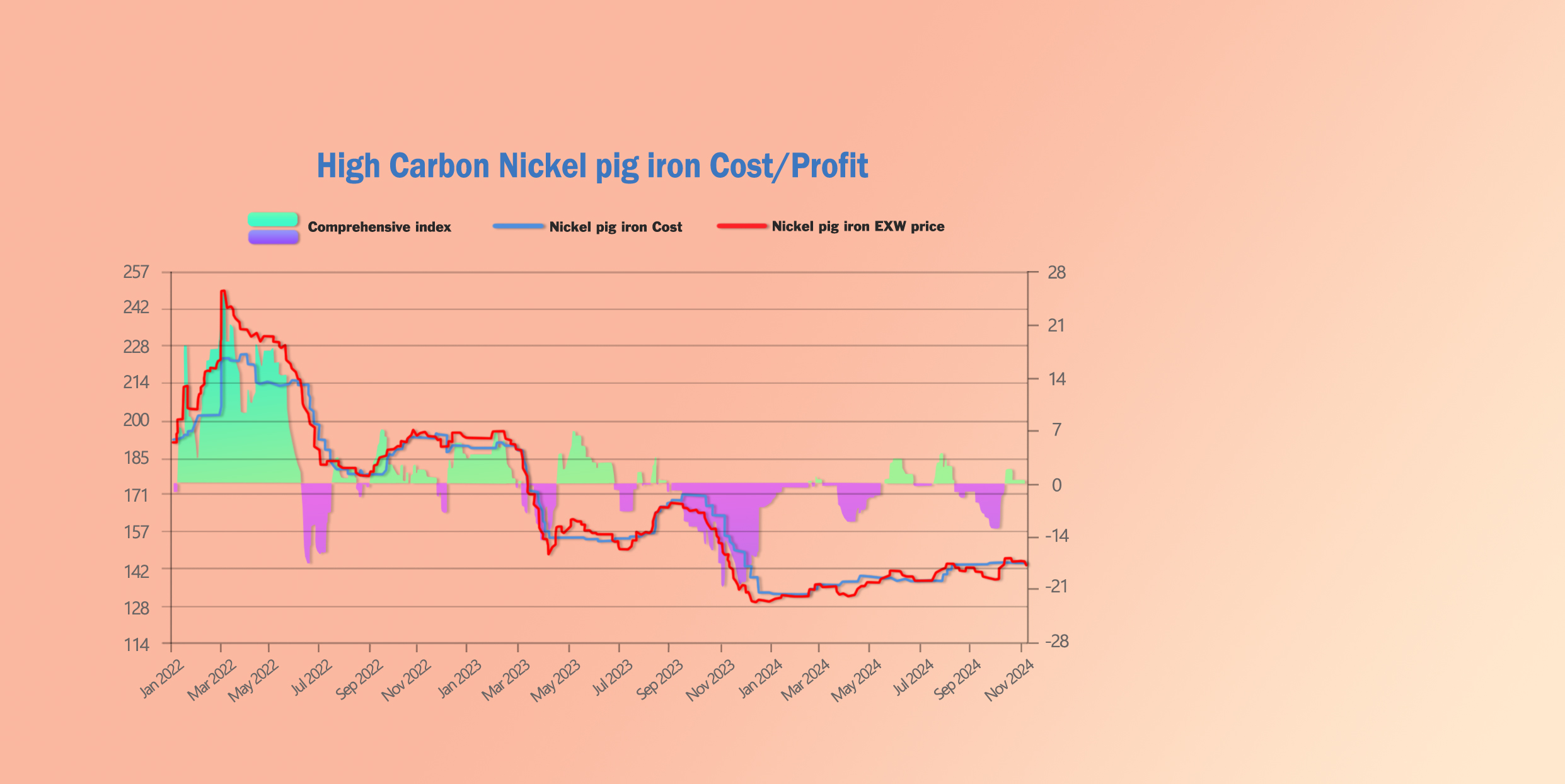

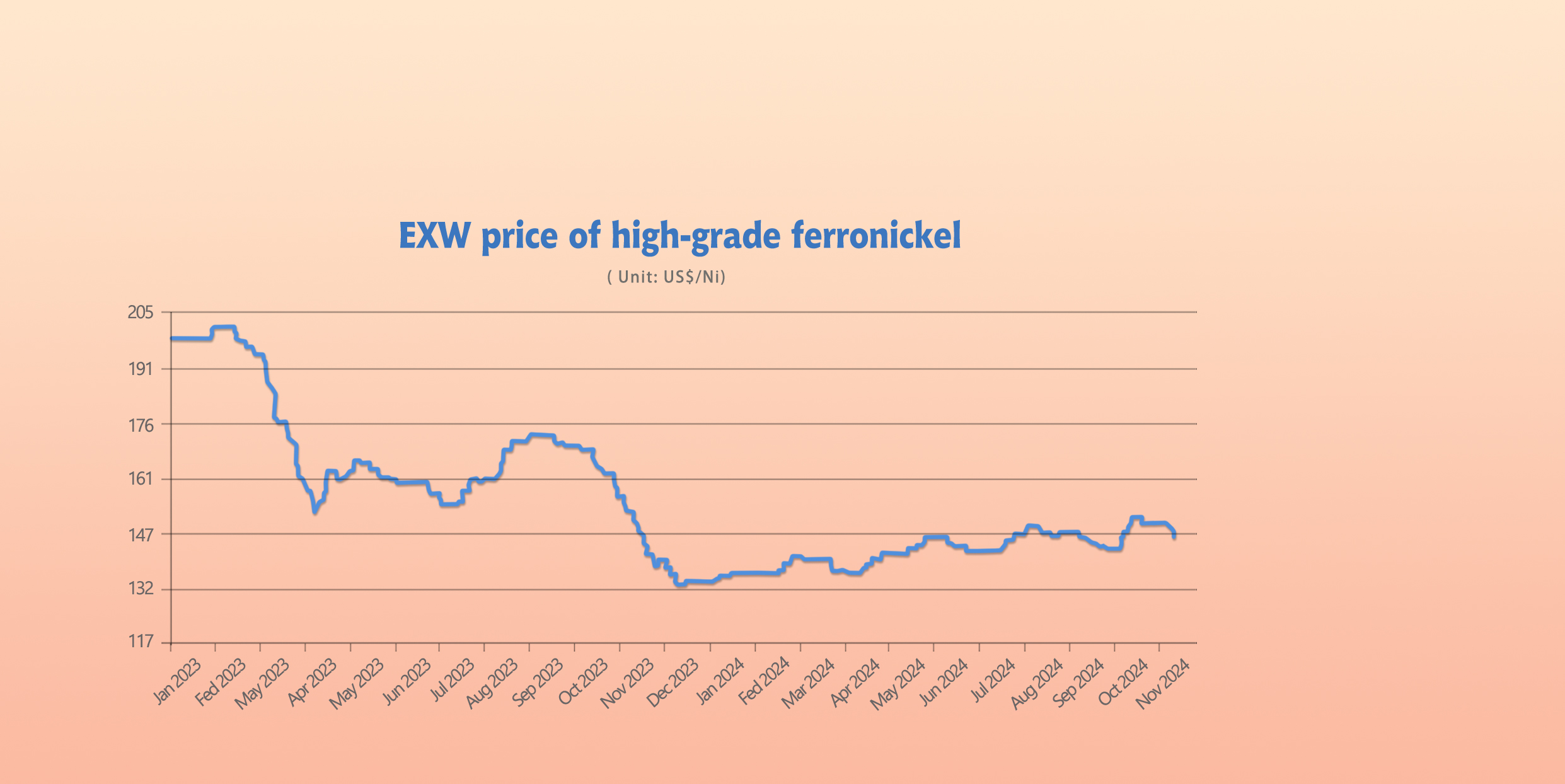

NICKEL

Last week, high-nickel pig iron was under pressure and fell, with the mainstream quotation falling to US$140/nickel point (EXW included). At the beginning of the week, some steel mills purchased high-nickel pig iron at US$142/nickel point (EXW included). Still, during the week, stainless steel prices fell sharply, putting pressure on the raw material end, and steel mills lowered their inquiry prices under cost pressure. On Wednesday last week, Tsingshan Group announced the second round of bidding for high-nickel pig iron in November at US$139/nickel point(EXW included), with a transaction volume of tens of thousands of tons, a decrease of US$1 from the previous round, and the nickel iron market was further pressured. The factory quotation was around US$142/nickel point, and there was still a gap between the intended prices of both supply and demand, and the market supply and demand game continued. On the nickel ore side, at the beginning of the week, the quotation of nickel ore strengthened, and due to the increase in import costs caused by the appreciation of the US dollar, the mainstream transaction price of Philippine to Chinese nickel ore (1.3% grade) increased to 39-41 US dollars/wet ton, and the domestic Indonesian nickel ore with 1.6% grade maintained HPM+17 to +18 during the week. Currently, the production cost of high-nickel pig iron is around US$148/50 reference ton, and the cost support is relatively strong. It is expected that high-nickel pig iron will be under pressure in the short term.

CHROME

High-carbon ferrochrome operated weakly and steadily last week, with the mainstream price falling by US$7 to US$1102/50 reference ton. On the raw material side, last week, the long-term contract price of South African 40-42% chromite concentrate remained at 270 US dollars/ton, the appreciation of the US dollar increased import costs, and the port price of South African 40-42% chromite remained at US$8/dry metric ton, and the quotation was firm. Currently, the production cost of high-carbon ferrochrome has decreased to around US$1146/50 reference ton, and the factory is still inverted, and the cost support of ferrochrome still exists. Last week, there were no favorable factors driving the ferrochrome market. On the demand side, stainless steel fluctuated at a low level, steel mills had sufficient inventories, and steel mills continued to put pressure on prices. Baosteel Desheng's purchasing price for high-carbon ferrochrome in November was US$1136/50 reference ton(cash; EXW included), a decrease of US$21/50 reference tons month-on-month. The transaction volume in the spot market was also weak, and holders offered concessions to ship goods due to financial pressure, but the concession space was limited due to cost constraints. Currently, the fundamentals of the ferrochrome market have changed little, and market confidence in the future is insufficient. If the stainless steel market remains weak, there is still a risk of a decline in ferrochrome prices. It is expected that the quotation of high-carbon ferrochrome will operate weakly and steadily.

MACRO|| China suddenly cancels export tax rebates for aluminum products, and domestic and foreign prices diverge.

On November 15, 2024, China's Ministry of Finance and other departments announced adjustments to the export tax rebate policy for aluminum products, canceling export tax rebates for aluminum products, copper products, and chemically modified oils, fats, and other products of animal, vegetable, or microbial origin; and reducing the export tax rebate rate for some finished oil products, photovoltaic products, batteries, and some non-metallic mineral products from 13% to 9%, effective from December 1, 2024. The market reacted quickly, especially with aluminum prices showing a clear "strong outside, weak inside" trend. In terms of aluminum prices, domestic and foreign prices have diverged, with LME Aluminum's main contract accelerating upward and at one point rising nearly 7.8%, while the main contract of SHFE Aluminum opened lower overnight, falling by more than 2%.

According to data from authoritative institutions, the total export volume of these 24 related aluminum products from January to September 2024 was approximately 4.62 million tons, accounting for 99% of China's total aluminum product exports. It is understood that in 2023, China's aluminum product exports were 5.287 million tons, accounting for 8.4% of its 2023 production; China's copper product exports in 2023 were 670,000 tons, accounting for 3% of its 2023 production. In the short term, the cancellation of export tax rebates for aluminum products may, to a certain extent, increase the export costs of aluminum product export enterprises, suppress the export enthusiasm of Chinese aluminum processing enterprises, and increase domestic supply, thus putting downward pressure on domestic aluminum prices; a decrease in China's aluminum product exports coupled with limited overseas aluminum supply increases may push up overseas aluminum prices. Referring to June 19, 2007, when China's Ministry of Finance issued an announcement to adjust the export tax rebate policy for 2831 products, including non-alloyed aluminum rods and other simple non-ferrous metal processed products, the price of aluminum (A00) fell from US$2845/ton on June 21, 2007 to US$2762/ton on July 20, 2007, a decrease of 3%; the LME 3-month aluminum price rose from US$2,719/ton on June 21, 2007 to US$2,847 /ton on July 20, 2007, an increase of 5%.

Currently, the profits of China's non-ferrous metals industry are mainly concentrated in the upstream mining end, and the competition in the midstream and downstream smelting and processing links is fierce. In the short term, although the cancellation of export tax rebates will put some pressure on the domestic downstream profile market, in the long run, it will help to force enterprises to make efforts in technological innovation and other fields, and focus on high-value-added products.

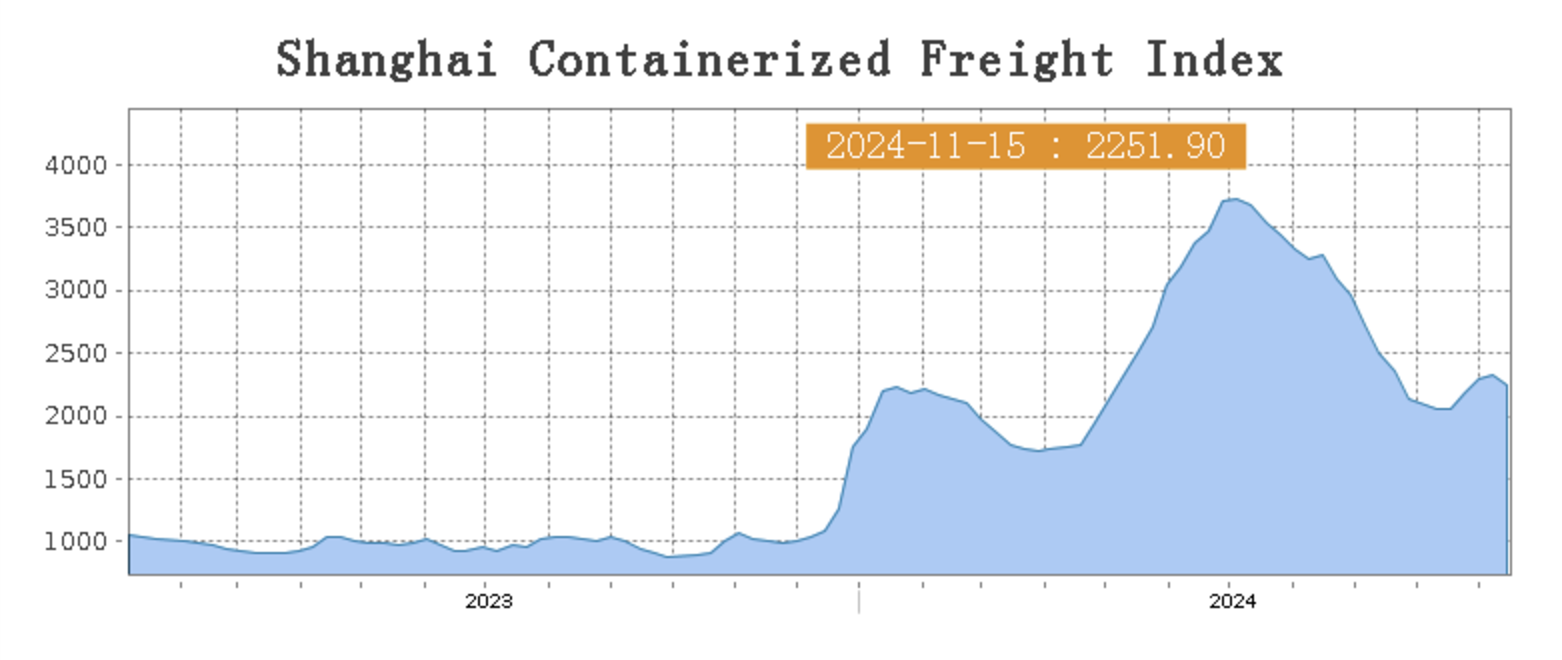

SEA FREIGHT || Transportation Market Adjusts, Freight Rates Decline on Most Routes.

Last week, the Chinese export container transportation market experienced an adjustment, with transportation demand lacking further growth momentum, leading to a decline in freight rates on most routes and a decrease in the comprehensive index. On 15th November, the Shanghai Containerized Freight Index fell by 3.4% to 2251.90.

Europe/ Mediterranean:

According to data released by the German Institute for Economic Research, the ZEW Economic Sentiment Index for the eurozone stood at 12.5 in November, below the previous value and market expectations, indicating a renewed weakening of the European economy and challenging the prospects for future recovery. Last week, transportation demand was generally stable, and spot market booking prices declined slightly after consecutive increases.

On 15th November, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2512/TEU, which dropped by 1.1%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3080/TEU, which increased by 0.8%.

North America:

Data released by the US Bureau of Labor Statistics showed that the US CPI increased by 2.6% year-on-year in October, hitting a three-month high. The rebound in inflation data may affect the Federal Reserve's future pace of interest rate cuts and weigh on the economy. In addition, the policy changes of the incoming US administration may create significant uncertainty for the future global economic outlook. Last week, transportation demand growth slowed down, and the supply and demand fundamentals lacked sufficient support, leading to adjustments in market freight rates.

On 15th November, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$4181/FEU and US$5062/FEU, both reporting an 11.6% and 4.1% fall accordingly.

The Persian Gulf and the Red Sea:

On the Persian Gulf route, the ongoing local tensions continued to support the transportation market, and spot market booking prices continued to rise.

On 15th November, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf slid by 4% from last week's posted US$1421/TEU.

Australia/ New Zealand:

On 15th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$2159/TEU, a 1.4.% lift from the previous week.

South America:

On the evening of November 14 (local time), Chinese President Xi Jinping and Peruvian President Dina Boluarte jointly attended the inauguration ceremony of Chancay Port via video link at the Presidential Palace in Lima. Chancay Port, located 80 kilometers north of Peru's capital, Lima, is a key project under the China-Peru collaboration within the Belt and Road Initiative. Once operational, the port will reduce the one-way sea freight time between China and Peru to 23 days, cutting logistics costs by over 20% and creating more than 8,000 direct jobs in Peru annually.

On 15th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$5515/TEU, an 7.0% increase from the previous week.