Stainless Insights in China from September 9th to 13th.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,155 | -27 | -1.31% |

| Foshan | 2,200 | -27 | -1.29% | ||

| Hongwang | Wuxi | 2,055 | -19 | -0.95% | |

| Foshan | 2,045 | -36 | -1.82% | ||

| 304/NO.1 | ESS | Wuxi | 1,980 | -28 | -1.51% |

| Foshan | 1,980 | -34 | -1.81% | ||

| 316L/2B | TISCO | Wuxi | 3,735 | -19 | -0.51% |

| Foshan | 3,800 | -37 | -1.00% | ||

| 316L/NO.1 | ESS | Wuxi | 3,570 | -13 | -0.37% |

| Foshan | 3,580 | -14 | -0.41% | ||

| 201J1/2B | Hongwang | Wuxi | 1,305 | -20 | -1.65% |

| Foshan | 1,295 | -28 | -2.36% | ||

| J5/2B | Hongwang | Wuxi | 1,185 | -36 | -3.21% |

| Foshan | 1,195 | -28 | -2.57% | ||

| 430/2B | TISCO | Wuxi | 1,175 | -11 | -1.06% |

| Foshan | 1,195 | -11 | -1.05% |

TREND || Stainless Steel Prices Weakened Before Mid-Autumn Festival.

Stainless steel futures prices fluctuated weakly last week. On Monday, futures prices fell sharply again, but subsequently rebounded. Throughout the week, major commodities showed signs of rebound, and stainless steel also rebounded from its low point on Wednesday. Trading volume decreased during the week, and the holding volume also decreased significantly in the last three trading days of the week. The main contract of the stainless steel market closed at US$2025/MT last week, with a weekly decline of 0.85%, and the lowest price of the week was US$1980/MT.

300 Series: Spot-Futures Basis Inverted.

Last week, the 304 market price weakened slightly. As of Friday, the main base price of cold-rolled four-foot 304 in Wuxi was US$2010/MT, down US$21/MT from the previous Friday; the price of private hot-rolled stainless steel was US$1975/MT, down US$28/MT from the previous Friday. Last week, the futures market first fell and then rose. At the beginning of the week, the futures market fell sharply to a new low, coupled with TSINGSHAN's opening price decline, market confidence was insufficient, and the end-users maintained low inventory operations, and the willingness to purchase weakened. Spot agents and traders lowered prices to promote sales, but the actual effect was not good, and the inventory increased week-on-week, inhibiting price increases. Due to increased losses, some steel mills have issued production reduction plans, and supply pressure has eased somewhat, but with the callback of nickel iron and ferrochrome quotations, cost support has shifted downward, and actual market transactions remain cautious.

200 Series: Inventory and Raw Materials Intertwined, Consumption Waits for Price Trends.

The main base price of cold-rolled 201J1 in the Wuxi market rose to US$1270/MT, the main base price of cold-rolled J2/J5 rose to US$, and the main base price of five-foot hot-rolled 201J1 rose to US$1240/MT. Last week, the futures market showed a trend of weakening first and then strengthening, and the overall transaction atmosphere of 201 was weak. Raw material prices continued to strengthen with the macro level, and traders and downstream customers were cautious in purchasing, and there was no significant improvement in demand.

400 Series: Supply-Side Contraction Expected.

In the Wuxi spot market, the quotation for state-owned 430 cold-rolled was US$1185/MT, down US$7 from the previous Friday; the quotation for state-owned hot-rolled 430 was around US$1125/MT, unchanged from the previous Friday's quotation. The guiding price for TISCO cold-rolled 430 was US$1485/MT, and the guiding price for JISCO cold-rolled 430 was US$1640/MT, both unchanged from last week. Ningbo Baoxin's ex-factory price notice for September 2024 (including tax): 304 cold-rolled is negotiated on a case-by-case basis; cold-rolled 430 is US$1555/MT, a decrease of US$4/MT compared to August 2024.

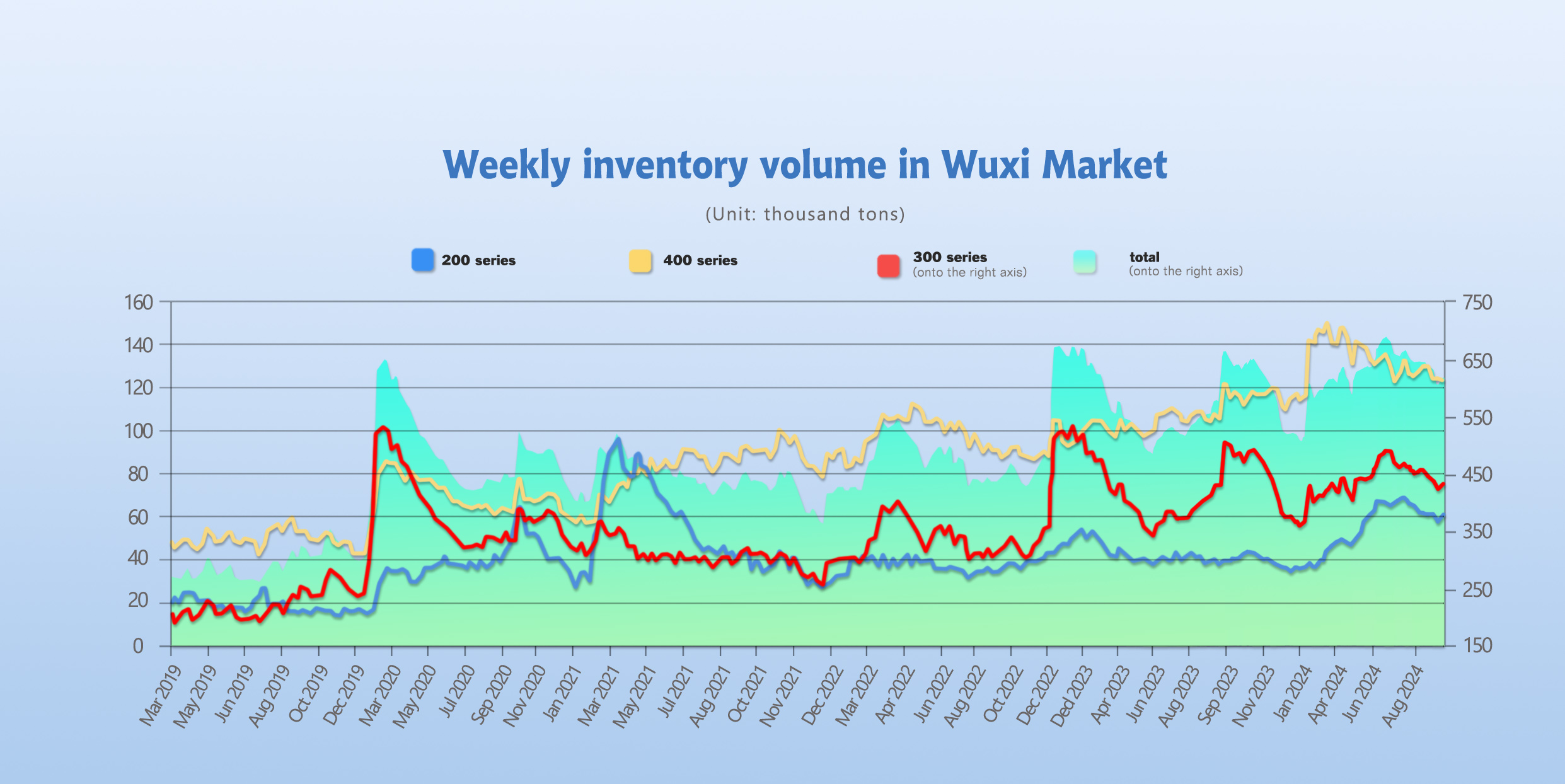

INVENTORY|| Weak demand before the holiday, inventory stacked.

In August, the crude steel output of large-scale stainless steel production enterprises in China was 3.4638 million tons, a decrease of 0.73 million tons month-on-month, a decrease of 0.21%; compared with the same period last year, it increased by 5.47 million tons, an increase of 1.6%. In September, the planned output of steel mills decreased slightly compared with August but remained at a high level.

The total inventory at the Wuxi sample warehouse up by 7,994 tons to 610,735 tons (as of 12th September).

the breakdown is as followed:

200 series: 2,982 tons up to 60,454 tons,

300 Series: 5,917 tons up to 427,171 tons,

400 series: 905 tons down to 123,110 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Sep 5th | 57,472 | 421,254 | 124,015 | 602,741 |

| Sep 12th | 60,454 | 427,171 | 123,110 | 610,735 |

| Difference | 2,982 | 5,917 | -905 | 7,994 |

300 Series: Spot-Futures Basis Inverted, Inventory Turns from Decline to Increase.

During last week, the main futures price bottomed out and rebounded, the spot-futures basis was inverted, market purchasing sentiment weakened, and inventory continued to accumulate. Overseas restarted production resources have not yet returned. Currently, the futures price has fallen to a low level, further squeezing steel mills' profits. Some steel mills in South China have suspended production for maintenance until the end of September, coupled with a month-on-month decrease in production for major mainstream steel mills in September, short-term market arrivals have decreased, and cold-rolled inventory has continued to decline. On the raw material side, nickel iron prices have fluctuated at a high level, and ferrochrome production has decreased slightly, providing strong price support, and stainless steel cost support is evident, with limited downward space. On the macro side, the expectation of a Federal Reserve rate cut is about to be realized, and the global investment environment has improved; domestic monetary policy is loose, and market liquidity is running relatively strong, and the economy is gradually recovering. The current price is at a historical low, and the warming of investment sentiment has driven prices to rebound; with the release of favorable macro policies, coupled with improved supply and demand, it is expected that inventory will continue to decline next week, helping to push prices up. Continue to pay attention to the subsequent production of steel mills and market transaction conditions.

200 Series: Transaction Volume Decreased, Inventory Accumulated.

During last week, the spot price of 201 fell again. The consumption end was mainly wait-and-see, the overall transaction volume was small, and the inventory accumulated slightly. The planned crude steel output of the 200 series in September decreased month-on-month, and the market supply pressure eased somewhat. In the short term, 201 may run steadily. It is expected that the inventory of 201 cold-rolled will decline next week, and the focus will be on raw material fluctuations and transaction conditions.

400 Series: Steel Mills Reduce Production, Finished Product Inventory Declines.

Last week, the decline in the spot price of 430 in the Wuxi market slowed significantly, market sentiment rebounded, traders made concessions to promote sales, and low-price transactions improved week-on-week, and inventory decreased slightly. Currently, steel mills maintain reduced production, the output of 400 series crude steel in August fell from a high level, and the arrival of resources from steel mills was less, and the amount of resources available in the market was significantly reduced; in September, steel mills' production plans were further reduced, and market supply pressure continued to decline. It is expected that inventory will continue to decline slightly next week, and the focus will continue to be on inventory changes and market transaction conditions.

SUMMARY || Weak Demand During Traditional Peak Season.

Stainless steel prices fluctuated last week. Raw material prices softened, and steel mills' production profits remained inverted. Overall market transaction atmosphere was generally weak. Downstream consumer demand during the peak season was unsatisfactory. Traders maintained relatively low inventories, and social inventories decreased, while warehouse receipts continued to be withdrawn. The market will focus on the speed of social inventory depletion, as well as the subsequent production plans of steel mills and the peak season performance of the demand side. It is expected that stainless steel prices will fluctuate in the future.

300 Series: It is expected that the short-term spot price of cold-rolled 304 will fluctuate with the futures market, and attention should be paid to the follow-up of market transactions and inventory digestion.

200 Series: Supported by the expectation of interest rate cuts, copper prices and manganese prices continued to rise, strengthening the cost support for 201. The downward space for short-term prices is limited. It is expected that the 201J2 price range will fluctuate around US$1210/MT.

400 Series: With the imminent Federal Reserve rate cut and the rebound of futures prices, market confidence has been boosted. The Mid-Autumn Festival and National Day holidays are approaching, and pre-holiday stocking demand still exists. Downstream demand is expected to be gradually released, and the supply-demand contradiction will be alleviated. It is expected that the 430 price will continue to maintain a weak and stable operation in the short term. In the future, we will continue to pay attention to the production plans of steel mills and market transaction conditions.

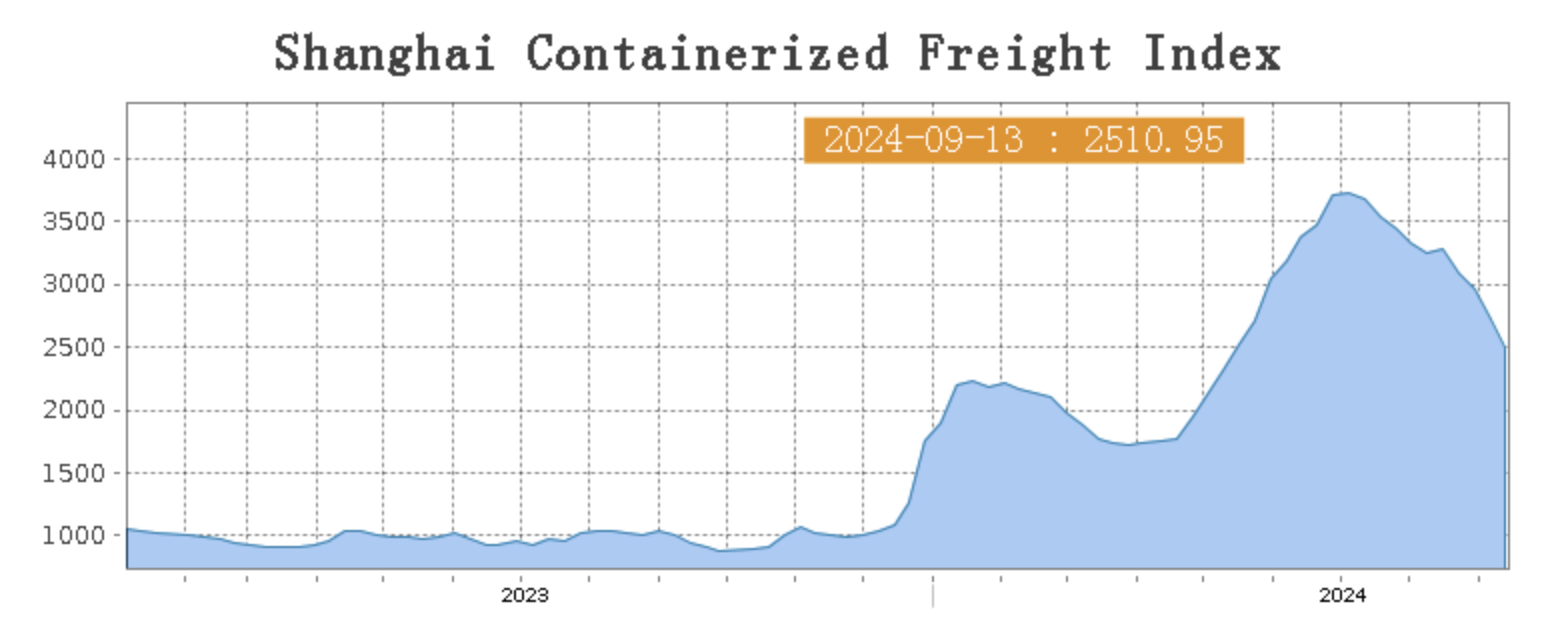

SEA FREIGHT|| Freight Rates Decline on multiple Routes.

Last week, the cargo volume of China's export container shipping market declined overall, and freight rates on major ocean routes fell again, with the composite index declining.

On 13th September, the Shanghai Containerized Freight Index dropped by 7.9% to 2510.95.

Europe/ Mediterranean:

Sentix's September Eurozone Investor Confidence Index came in at -15.4, below expectations and the previous reading, indicating a pessimistic outlook for the European economy. Currently, shipping capacity is at a high level, and the traditional peak season for shipping routes shows signs of ending early. Last week, with a decline in market cargo volume, most carriers have launched price reduction strategies to attract cargo, intensifying market competition.

On 13th September, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2841/TEU, which dropped by 17.9%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3365/TEU, which decreased by 12%.

North America:

Due to market expectations of a US port strike, some shippers have chosen to ship their goods early to avoid the impact. Last week, overall market demand was stable, with a slight decline in cargo volume, and spot market booking prices fell, with a more significant decline on the US East Coast route.

On 13th September, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$5494/FEU and US$6838/FEU, both reporting an 2.0% and 9% decline accordingly.

The Persian Gulf and the Red Sea:

On 13th September, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 16.2% from last week's posted US$1264/TEU.

Australia/ New Zealand:

On 13th September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$2267/TEU, without any changes from the previous week.

South America:

On 13th September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$7301/TEU, an 3% drop from the previous week.