From August 12th to 16th, Stainless Insights in China of last week, stainless steel prices plunged, when will the peak season come as promised?

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,180 | -14 | -0.68% |

| Foshan | 2,225 | -14 | -0.67% | ||

| Hongwang | Wuxi | 2,065 | -16 | -0.79% | |

| Foshan | 2,080 | -17 | -0.86% | ||

| 304/NO.1 | ESS | Wuxi | 2,005 | -16 | -0.82% |

| Foshan | 2,010 | -18 | -0.96% | ||

| 316L/2B | TISCO | Wuxi | 3,750 | -25 | -0.70% |

| Foshan | 3,825 | -6 | -0.15% | ||

| 316L/NO.1 | ESS | Wuxi | 3,575 | -40 | -1.14% |

| Foshan | 3,590 | -20 | -0.57% | ||

| 201J1/2B | Hongwang | Wuxi | 1,340 | -18 | -1.48% |

| Foshan | 1,340 | -20 | -1.59% | ||

| J5/2B | Hongwang | Wuxi | 1,230 | -17 | -1.50% |

| Foshan | 1,240 | -20 | -1.73% | ||

| 430/2B | TISCO | Wuxi | 1,220 | -4 | -0.38% |

| Foshan | 1,225 | -3 | -0.25% |

TREND || Stainless Steel Prices Drop for 9 Consecutive Days, Falling Below US$2035.

Last week, the spot price of stainless steel in the Wuxi market declined weakly, and industry speculation was weak. Last week, the commodity market accelerated its decline and bottomed out, with stainless steel falling below US$2035/MT. Steel mill production was reduced, market arrivals decreased, supply pressure decreased, and inventory was slightly reduced. As prices fell, terminal demand was pressured, and price increases were hindered. As of Friday, last week, the main stainless steel futures contract price decreased by US$27/MT to US$2055/MT compared to the previous week.

300 Series: Futures and spot prices fell, and inventory decreased slightly.

Last week, the market price of 304 fluctuated downward. As of Friday, the mainstream base price of cold-rolled four-foot 304 in the Wuxi area was US$2020/MT, a decrease of US$14/MT from the previous Friday; the price of private hot-rolled stainless steel was US$2005, a decrease of US$7 compared to the previous Friday. Last week, the commodity market fell across the board, and the main stainless steel futures contract price followed suit. Currently, it is close to the annual low. Market arrivals decreased, and as prices fell, demand for low-priced purchases increased, and inventories decreased slightly during the week. Raw material prices remained relatively firm, and cost support limited the downward space for stainless steel. With the price drop of Tsingshan on Wednesday, market pessimism spread, and traders' quotations fell across the board, further dampening the market trading atmosphere, and transactions were relatively general during the week.

200 Series: Lack of support, weak supply and demand, 201 prices hover at a low level.

The mainstream base price of cold-rolled stainless steel 201J1 in the Wuxi market fell to US$1290/MT, the mainstream base price of cold-rolled stainless steel J2/J5 fell to US$1190, and the five-foot hot-rolled 201J1 fell to US$1275/MT. Last week, the price of 201 continued to decline following the futures market. Recently, the mild performance of US inflation data and the much lower-than-expected number of initial jobless claims have boosted expectations of interest rate cuts. The price of raw material copper fluctuated with the non-ferrous metals sector during the week, providing limited cost support for 201. Both traders and downstream customers were cautious in their purchases, and the overall transaction atmosphere was relatively light.

400 Series: Continued inventory accumulation, downward shift in support, 430 prices under pressure.

In the Wuxi spot market, the quotation of state-owned cold-rolled stainless steel 430 was US$1210-US$1220/MT, a decrease of US$7 compared to the previous week; the quotation of hot-rolled stainless steel 430 was around US$1135/MT, which was flat compared to the previous week's quotation. Last week, the futures market continued to decline, and prices had fallen to a relatively low level for the year, and market pessimism was relatively strong. On the raw material side, high-carbon ferrochromium weakened with the decline in the price of coking coal, reducing the cost support for 430, and prices fell slightly.

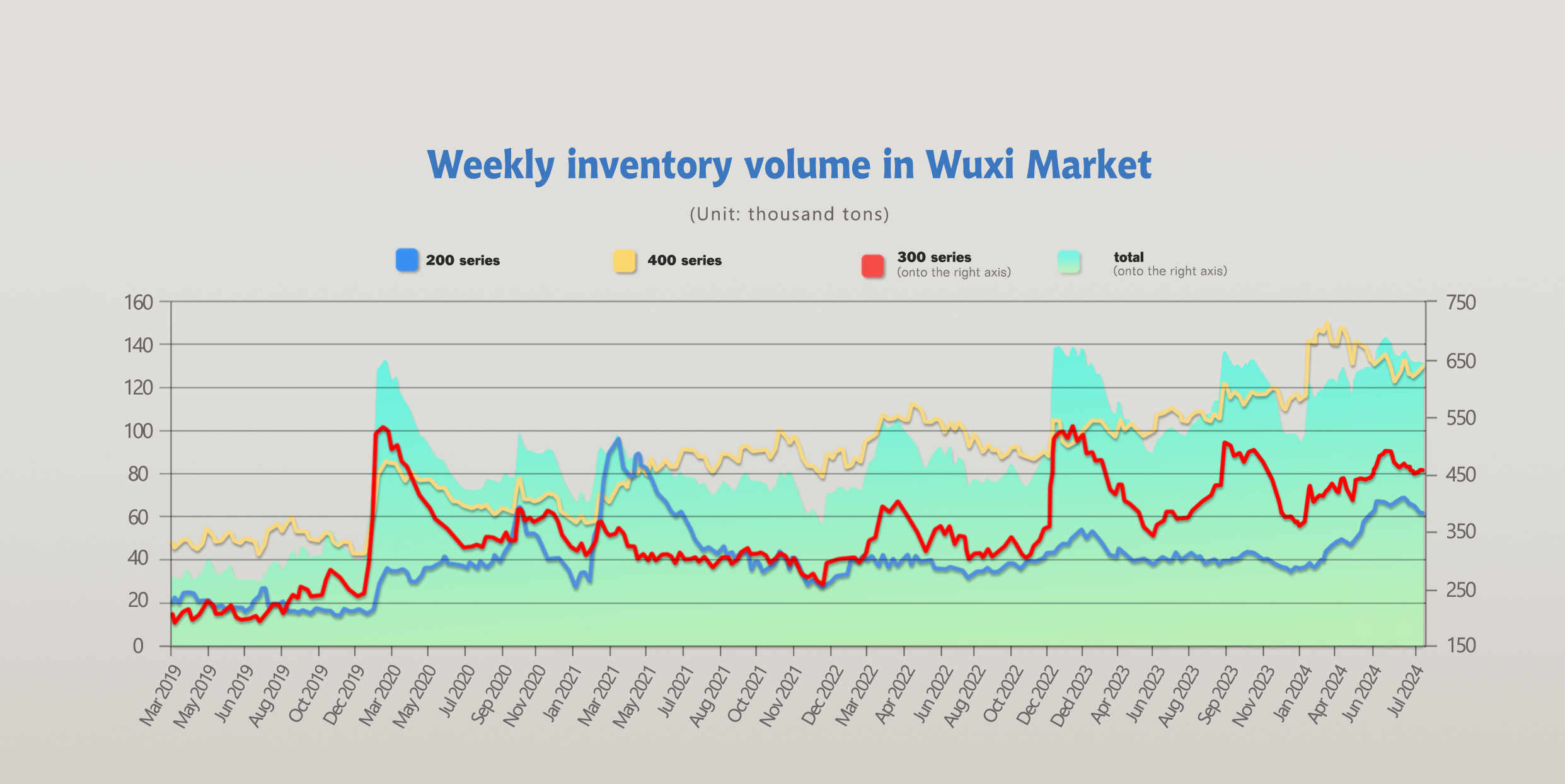

INVENTORY || Inventory Decline Fails to Halt Price Drop.

The total inventory at the Wuxi sample warehouse down by 602 tons to 642,119 tons (as of 16th August).

the breakdown is as followed:

200 series: 771 tons down to 60,496 tons,

300 Series: 1,821tons down to 452,486 tons,

400 series: 1,990 tons up to 129,137 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Aug 8th | 61,267 | 454,307 | 127,147 | 642,721 |

| Aug 15th | 60,496 | 452,486 | 129,137 | 642,119 |

| Difference | -771 | -1,821 | 1,990 | -602 |

300 Series: Futures and spot prices fell, and inventory decreased.

Last week, the main futures price continued to decline, and spot prices fell slightly. Market arrivals decreased last week, futures prices continued to decline, and steel mills actively reduced production to reduce inventory, leading to a slight decrease in 300 series inventory.

200 Series: Inventory reduction vs. price reduction, weak supply and demand for 201.

During last week, the spot price of 201 continued to decline, traders were cautious about purchasing goods, and the amount of circulating resources in the market decreased, and the inventory of 200 series had declined for two consecutive periods. Although there were positive signals such as the recovery of the US job market, the price of raw material copper was still constrained by high warehouse receipts and no improvement in downstream demand, and the overall rebound was limited, providing insufficient cost support for 201. During the week, low-priced resources of 201 emerged in the market, and traders offered significant price concessions. Downstream consumers held a pessimistic attitude towards the future market, and the trading atmosphere was light. In August, steel mill production decreased, but in the current depressed commodity market, it had a limited boost to the market. In the short term, the spot price of 201 may continue to operate weakly, and it is expected to continue to decrease next week. The focus will be on the rise and fall of raw materials and the dynamics of steel mills.

400 Series: Continued inventory accumulation, 430 prices hover at a low level.

In July, the crude steel production of the 400 series increased significantly, and the arrival of resources from steel mills was relatively large, with sufficient market supply. The futures market continued to decline, and the market had insufficient confidence in the future, and the spot market transactions were relatively cold. Terminal purchases were cautious, and transactions were mainly based on rigid demand and low-priced resources. The digestion of spot market inventory was slow, and the inventory accumulation pattern continued.

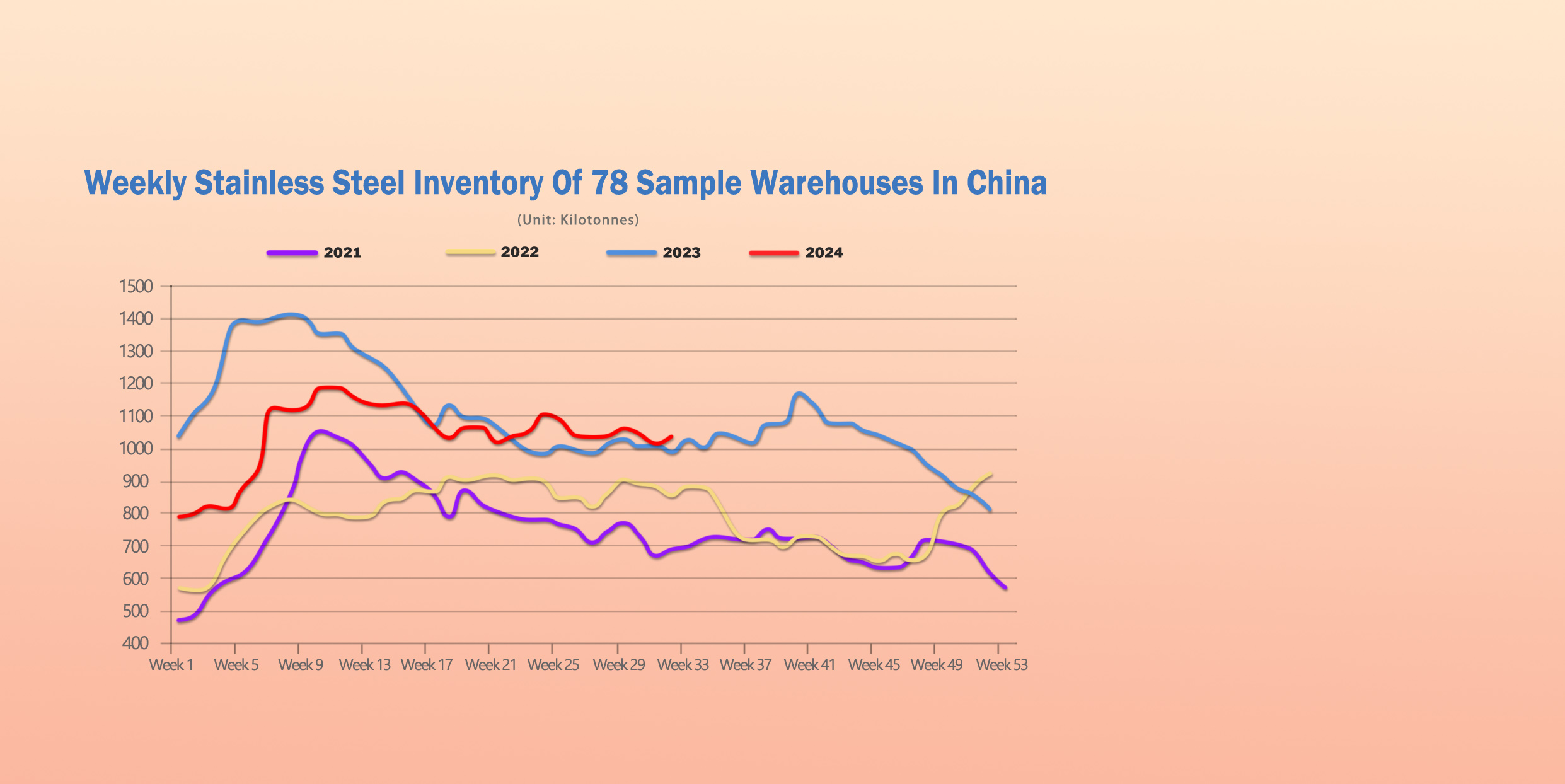

Stainless steel inventory digestion rate is slow.

As of August 8, the total inventory in 89 sample warehouses across China increased by 2.3% week-on-week to 1.09 million tons, with all series showing varying degrees of increase, of which 300 series inventory increased by nearly 14,000 tons. This is mainly due to the high inventory in some steel mills, the continuous increase in market arrivals, and the general performance of transactions, resulting in a significant increase in inventory.

Overall, this year's social inventory has shown a long inventory accumulation cycle and a slow destocking speed. The total inventory has fluctuated slightly, and the current inventory is slightly higher than the same period last year.

RAW MATERIAL || Cost Decline, Steel Mills Still in Severe Losses.

Raw material prices mainly operated weakly last week. Nickel pig iron prices weakened due to the drag of stainless steel prices, but the supply of Indonesian nickel ore remained tight, with a large amount of Philippine ore being purchased externally. It is expected that nickel pig iron prices will operate weakly in the short term but the downside space is limited. Downstream demand for stainless steel is weak, spot prices have been falling continuously, and steel mills' production costs have been severely inverted. Although stainless steel costs have fallen slightly, steel mills are currently in a state of severe losses.

Since August, the price of coke has fallen by US$21/MT cumulatively, which has not provided sufficient driving force for the cost of ferrochrome. The price of ferrochrome in some major producing areas has been reduced by another US$7/MT. The mainstream ex-factory price of high-carbon ferrochrome is US$1218-US$12312/50 reference ton, and some regions have decreased by US$14/50 reference ton compared to the previous week. With the fourth round of price reduction of coke last week, the production cost of high-carbon ferrochrome has shifted downward slightly, but the loss situation of high-carbon ferrochrome producers has not been significantly alleviated. After August, the South African winter is coming to an end, and there is an expectation of an increase in domestic chrome ore imports, which will continue to put pressure on supply. However, as the cost support of high-carbon ferrochrome gradually weakens, it is expected that high-carbon ferrochrome will mainly operate stably and weakly in the short term.

Molybdenum ferroalloy is constrained by the high price of molybdenum concentrate, and the inverted profit situation of smelters has not improved. Moreover, the domestic supply and demand continue to tug-of-war, and the price of molybdenum is mainly flat.

SUMMARY || Stainless Steel Transactions Sluggish, Steel Mills' Losses Deepen.

On the macro front, the CPI annual rate exceeded 3% in July, expectations for a Fed rate cut have heated up, and domestic macro policies have continued to exert force, with monetary policy being loose. Short-term domestic and foreign capital markets have seen increased tug-of-war. Futures and spot prices have fallen to their lowest levels this year, and currently, they are at a low valuation, causing market panic. End-users are making purchases based on rigid demand and maintaining low inventory operations.

Raw material prices have been stable, with a severe premium on nickel ore and a decline in ferrochrome production. Cost support has limited the downside space for stainless steel. Production in August has decreased, and imports have continued to decline, and overall supply pressure has eased. It is expected that inventory will decline slightly next week. The market will continue to pay attention to the subsequent production of steel mills and market transaction conditions. Stainless steel will fluctuate with commodity sentiment, and it is expected that the spot price of cold-rolled stainless steel 304 will fluctuate in the short term.

300 Series: Although the supply side has contracted in August, it is still at a high level. The end-user's maintenance of low inventory production, coupled with the weakening of peak season expectations, has suppressed the upward trend of stainless steel, and steel mills' losses have deepened. Currently, the cost support for stainless steel is still relatively strong, and there is some support for the bottom of spot prices, but demand has not yet improved. It is expected that the price of 304 will fluctuate in the short term.

200 Series: In August, steel mill production decreased, and weak supply and weak demand have formed in the 201 market. Under the influence of this pattern, the price of 201 has been under downward pressure, and the gross base price of cold-rolled J2 has been reported by some traders at around US$1185/MT, and the market sentiment is mainly pessimistic. Although there have been frequent positive news of destocking and production cuts, and the traditional peak season of "Golden September, Silver October" is approaching, the market remains cautious. It is expected that the price of 201 will be mainly weak and stable in the short term.

400 Series: In August, steel mill production has declined somewhat, but the contraction in supply is limited, and the problem of supply and demand imbalance is difficult to alleviate in the short term, and the market supply pressure is relatively large. On the other hand, the demand side continues to be weak, and coupled with high inventory levels, it has put pressure on prices. The price of 430 may continue to be under downward pressure. With the approach of the traditional peak demand season of "Golden September, Silver October", market sentiment may be boosted, and downstream demand may rebound. It is expected that the price of 430 will continue to maintain a weak and stable operation in the short term.

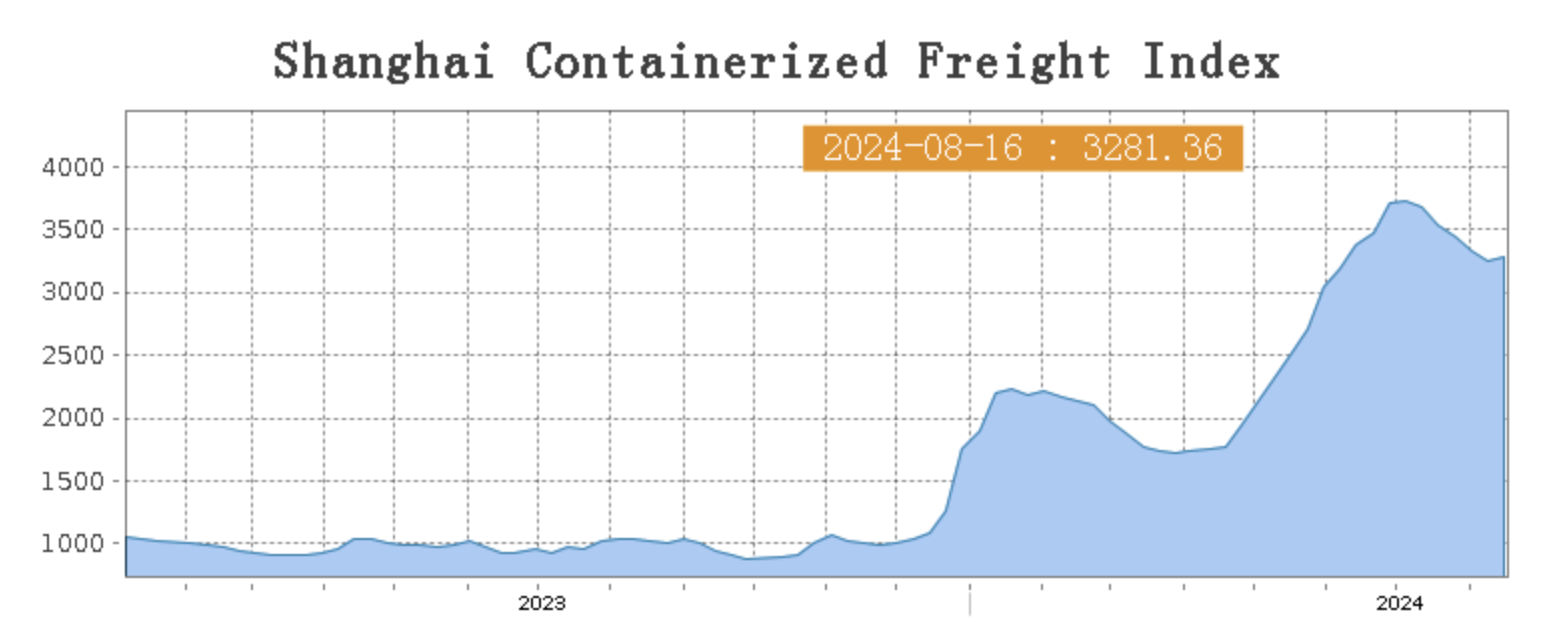

SEA FREIGHT || Freight Rates Fluctuate on Various Routes.

Last week, the Chinese export container shipping market remained generally stable, with freight rates on major ocean routes fluctuating. The composite index experienced slight fluctuations. On 16th August, the Shanghai Containerized Freight Index lifted by 0.8% to 3281.36.

Europe/ Mediterranean:

Some shipping companies slightly lowered their prices to attract cargo, while others maintained their freight rates.

On 16th August, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$4610/TEU, which dropped by 3.7%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$4645/TEU, which decreased by 1.9%.

North America:

Last week, the cabin utilization rate of various voyages remained at over 95%, with some voyages fully loaded. Some shipping companies implemented their previously announced mid-month price increase plans, and the spot booking prices on various routes generally increased.

On 16th August, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$6581/FEU and US$9297/FEU, both are reporting an 8.5% and 2.4% growth accordingly.

The Persian Gulf and the Red Sea:

On 16th August, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 3.1% from last week's posted US$2139/TEU.

Australia/ New Zealand:

On 16th August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1911/TEU, a 7.6% lift from the previous week.

South America:

On 16th August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$7730/TEU, an 3.2% drop from the previous week.