Stainless Insights in China from September 2nd to September 6th.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,180 | -6 | -0.28% |

| Foshan | 2,225 | -6 | -0.27% | ||

| Hongwang | Wuxi | 2,075 | -3 | -0.15% | |

| Foshan | 2,080 | -16 | -0.79% | ||

| 304/NO.1 | ESS | Wuxi | 2,005 | -13 | -0.68% |

| Foshan | 2,015 | -7 | -0.38% | ||

| 316L/2B | TISCO | Wuxi | 3,755 | 0 | 0.00% |

| Foshan | 3,840 | 0 | 0.00% | ||

| 316L/NO.1 | ESS | Wuxi | 3,580 | 0 | 0.00% |

| Foshan | 3,595 | 0 | 0.00% | ||

| 201J1/2B | Hongwang | Wuxi | 1,325 | -14 | -1.16% |

| Foshan | 1,320 | -14 | -1.17% | ||

| J5/2B | Hongwang | Wuxi | 1,225 | -21 | -1.89% |

| Foshan | 1,220 | -14 | -1.27% | ||

| 430/2B | TISCO | Wuxi | 1,190 | -10 | -0.92% |

| Foshan | 1,205 | -10 | -0.91% |

TREND || Can Peak Season Demand Be Realized?

Last week, steel mill arrivals decreased, imports continued to decline, and market arrivals of resources remained low, easing supply pressure. Demand is slowly recovering, and current prices have fallen to low valuations. With the basis repaired and some end-users increasing their speculative purchasing intentions, the supply-demand situation has improved, and inventories have continued to decline, helping to push prices up. As of Friday, the main stainless steel futures contract price decreased by US$57/MT compared to the previous week, reaching US$2040/MT.

300 Series: Inventory Declines for Four Consecutive Weeks.

Last week, 304 market prices weakened slightly. As of Friday, the main base price of 304 private cold-rolled four-foot material in the Wuxi area was US$2030/MT, down US$7/MT from the previous Friday; the private hot-rolled price was US$2000/MT, down US$21/MT from the previous Friday. At the beginning of the week, the futures market opened sharply lower and then fluctuated weakly around US$2000/MT, damaging market confidence. The previous stocking demand has gradually affected, and downstream purchasing intentions have weakened. Agents have offered discounts to sell, but the effect has been unsatisfactory. With the decline in spot prices, the market's acceptance of low-priced resources has increased, coupled with the fact that some steel mills have actively reduced inventories through maintenance, market arrivals of resources have decreased last week, and inventories have declined for four consecutive weeks, helping the futures market to stop falling and rebound, and market confidence has somewhat recovered. Transactions are mainly dominated by low-priced resources.

200 Series: 201 Remained Stable.

The main base price of 201J1 cold-rolled material in the Wuxi market reached US$1290/MT, the main base price of cold-rolled J2/J5 reached US$1190/MT, and the five-foot hot-rolled 201J1 reached US$1255/MT. Last week, the futures market showed a continuous weakening trend, and the overall transaction atmosphere of 201 was generally average. Raw material prices fluctuated with the macro level, and investor sentiment was relatively cautious. Both traders and downstream customers' purchases were mainly based on rigid demand.

400 Series: Cost Support Still Exists, 430 Prices Under Pressure.

In the Wuxi spot market, the cold-rolled 430 price was quoted at US$1190/MT, down US$14/MT from the previous Friday; the hot-rolled stainless steel 430 price was around US$1140/MT, flat compared to the previous week's quotation. The guiding price of TISCO cold-rolled stainless steel 430 was US$1485/MT, and the guiding price of JISCO cold-rolled 430 was US$1640/MT, both unchanged from last Thursday.

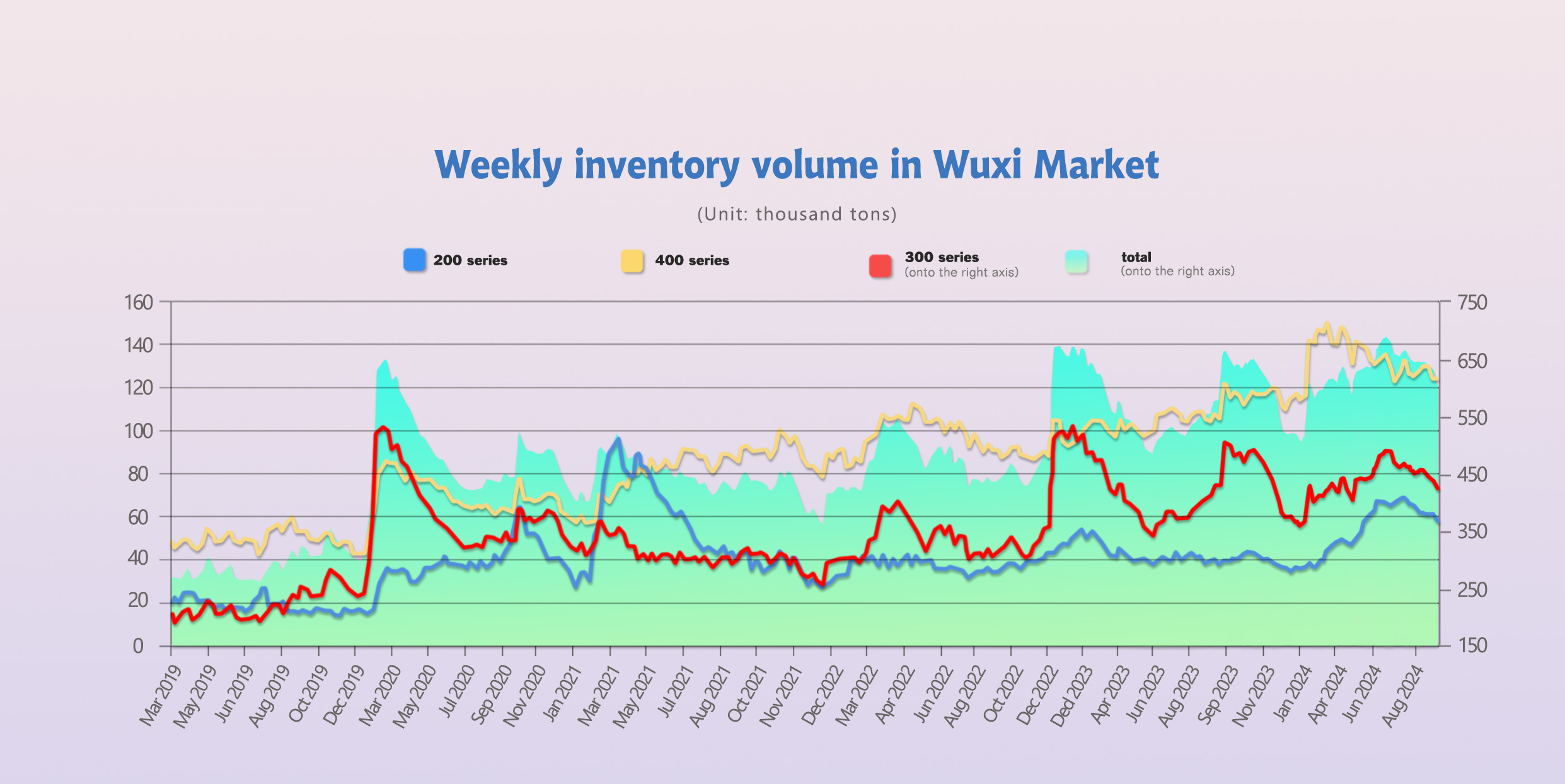

INVENTORY || Four Consecutive Weeks of Inventory Decline, Supply-Demand Improves.

The total inventory at the Wuxi sample warehouse down by 15,589 tons to 602,741 tons (as of 5th September).

the breakdown is as followed:

200 series: 2,597 tons down to 57,472 tons,

300 Series: 13,442 tons down to 421,254 tons,

400 series: 450 tons up to 124,015 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Aug 29th | 60,069 | 434,696 | 123,565 | 618,330 |

| Sep 5th | 57,472 | 421,254 | 124,015 | 602,741 |

| Difference | -2,597 | -13,442 | 450 | -15,589 |

300 Series: Supply Pressure Eases, Inventory Continues to Decline.

Last week, market arrivals of hot-rolled products increased, with a noticeable increase in 300 series hot-rolled resources from steel mills such as Beigang. Currently, with the decline in hot-rolled prices, market purchasing intentions are insufficient, leading to a significant accumulation of inventory. Arrivals of cold-rolled products have decreased compared to hot-rolled products, and Hongwang's restarted production resources will not enter the domestic market until the end of September, temporarily alleviating the domestic supply pressure of cold-rolled products. The spot-futures basis has narrowed, and spot-priced resources have improved in terms of transactions, and warehouse receipts have been gradually digested. At the beginning of the month, Tai Steel agent pickups increased, and pre-positioned inventory decreased, coupled with the current price falling to a low valuation, speculative purchasing demand has rebounded.

200 Series: Steel Mill Production Cuts Boost Sentiment, 201 Inventory Continues to Decline.

During last week, 201 spot prices were under pressure and declined, and the transaction atmosphere was weak. The futures market maintained a weak trend, and prices of both cold-rolled and hot-rolled products declined at the beginning of the week, and market sentiment was pessimistic. On the raw material side, affected by the macro level, frequent fluctuations in US stocks and US bonds made investors cautious. Commodity prices fluctuated, and copper prices followed the fluctuations of the futures market and fell back, weakening the cost support for 201. In terms of steel mills, a large-scale steel mill in South China will overhaul some production lines in September, which is expected to affect the crude steel output of the 200 series by 30,000-40,000 tons. The continuous decline in inventory coupled with steel mill production cuts has reduced market supply pressure. In the short term, the downside of 201 is limited, and it is expected that 201 cold-rolled will continue to decline next week. The focus should be on the rise and fall of raw materials and the dynamics of steel mills.

400 Series: Downstream Just-in-Time Purchases, Inventory Accumulates Slightly.

At the beginning of last week, merchants lowered prices to promote transactions, but affected by the continued decline in the futures market, market sentiment was relatively cautious, and the spot market trading atmosphere was relatively cold, with overall transaction volume relatively low, and inventory turned from decline to increase. Current inventories are still at high levels for the same period, and the pressure on the supply-demand fundamentals continues to exist, but the price of high-chromium raw materials remains stable, and cost support still exists, limiting the downside space of 430. The market has positive expectations for the traditional peak season demand, and the supply-demand contradiction may ease. It is expected that inventories will decline slightly next week, and we will continue to pay attention to changes in inventories and market transactions.

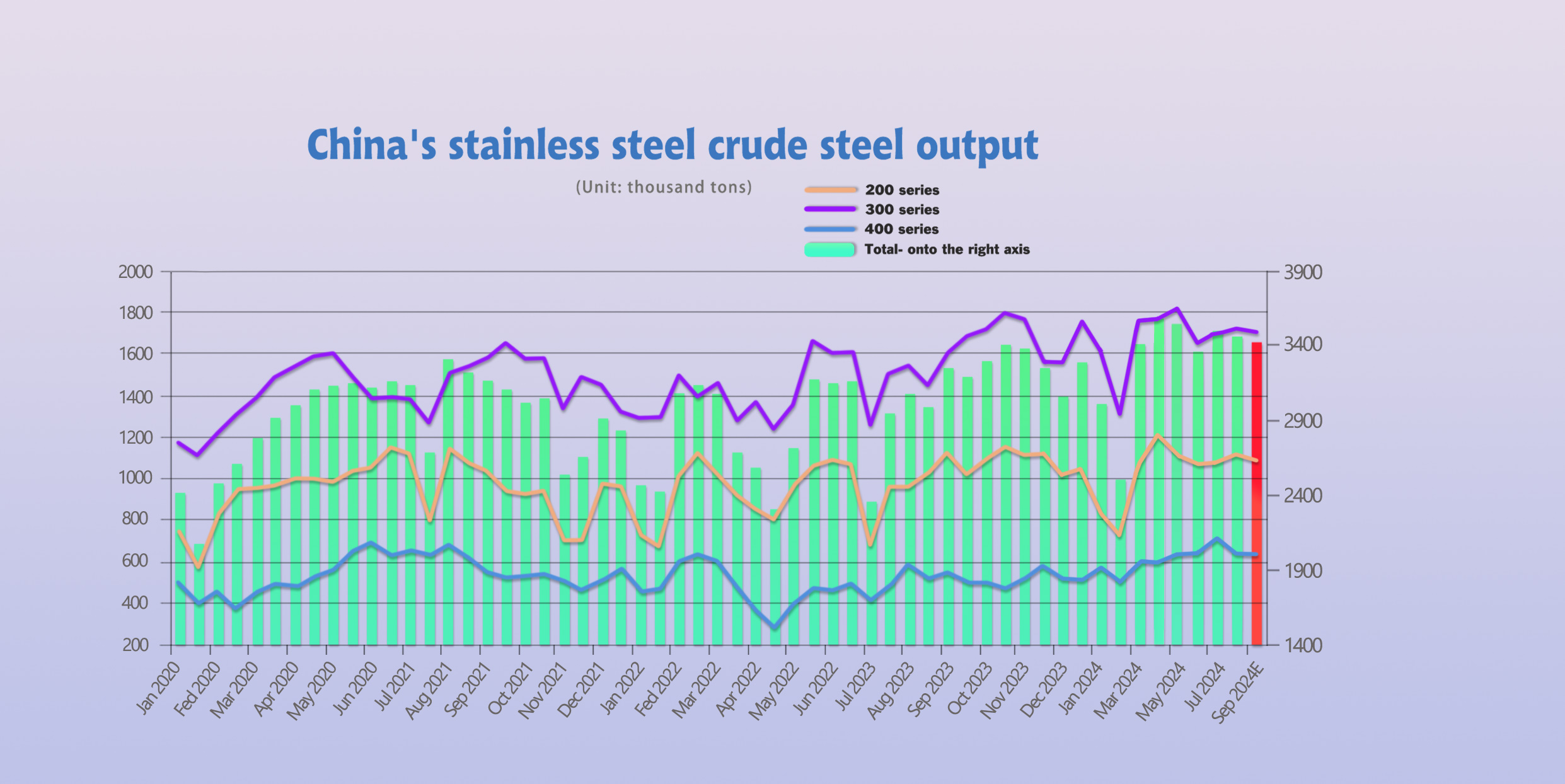

Production|| Slight Decrease in Steel Mill Production in September.

Market inventory continued to decline in the first week of September, boosting consumer confidence. Currently, with prices falling to low valuations, speculative purchasing sentiment has warmed up, and spot transactions have improved. As positive US economic data, such as non-farm payrolls, have been released, expectations of a Federal Reserve rate cut within the month and an increasing rate cut magnitude have gradually expanded. Domestic policies have been gradually released, and the commodity market has rebounded, driving up demand for stainless steel. Currently, raw material prices are fluctuating at high levels, pushing up the production costs of stainless steel, and squeezing steel mills' profits, reducing their production willingness. In September, steel mill production is expected to decrease slightly compared to August, but it still remains at a high level. According to our survey and statistics, the estimated 200 series production in September is 1.0871 million tons, 300 series production is 1.7004 million tons, and 400 series production is 63.14 million tons, with a total production of around 3.4189 million tons, a month-on-month decrease of 1.30% compared to August, and a year-on-year decrease of 1.06% compared to last year.

RAW MATERIAL || Ore Prices Stable, Supporting Stainless Steel Prices.

Last week, Shanghai Nickel fluctuated weakly. As of the close of trading on Thursday, the main Shanghai Nickel contract closed at US$17,585/MT, down US$1183/MT or 6.31% from the previous Thursday. Last week, the EXW price of high-nickel pig iron remained stable, at US$143/nickel point as of Thursday, unchanged from the previous Thursday.

Although stainless steel and nickel prices have fallen recently, nickel pig iron prices have remained relatively firm. From the supply side, the cost inversion problem of domestic nickel pig iron plants has eased, and factories have sufficient production motivation, with production maintaining a slight increase. Although Indonesia has added new production lines, due to the impact of nickel ore quota approval issues, nickel ore supply is tight, premiums remain high, and production increases are limited, which also supports nickel pig iron prices on the cost side. However, the decline in stainless steel prices has transmitted to the raw material end, and steel mills have been more cautious in purchasing. It is expected that nickel pig iron prices will be under pressure in the short term.

High-chromium prices have been mainly weak and stable, with the mainstream ex-factory quotation at US$1210-US$1239/50 reference ton, unchanged from the previous week's quotation. At present, high-chromium production still maintains a high level, and coupled with the expected increase in domestic imports of ferrochrome, the market's oversupply situation continues. However, considering the increased demand for raw materials during the peak season for stainless steel, it is expected that high-chromium prices will mainly fluctuate steadily in the short term.

SUMMARY || Stainless Steel Social Inventories Have Decrease.

Stainless steel prices fluctuated last week, with futures prices falling sharply during the week, dragging down spot prices. Traders maintained relatively low inventories, and social inventories decreased, while warehouse receipts continued to be withdrawn. In the future, the main focus will be on steel mill production plans and the peak season performance of the demand side, as well as the stimulus intensity of domestic macroeconomic policies. It is expected that stainless steel prices will fluctuate in the future.

300 Series: With the decline in market arrivals and improved transactions, stainless steel inventories have continued to decline. Currently, raw material prices remain firm, and there is support for stainless steel prices. Currently, downstream customers have low inventory levels. With the expected release of favorable macroeconomic policies and the upcoming Mid-Autumn Festival holiday, there may be a small release of terminal demand. It is expected that the short-term spot price of 304 cold-rolled will fluctuate with the futures market.

200 Series: The expectation of a peak season in September continues to boost market sentiment, and some merchants' quotations are relatively firm. The market is paying close attention to the futures price and steel mill dynamics. It is expected that the upside and downside of 201 will be limited in the short term, and the price of 201J2 will fluctuate around US$1185/MT-US$1255/MT.

400 Series: In August, steel mill production declined, and steel mills maintained reduced production. Inventories declined slightly but at a slower pace. Currently, inventories are still at high levels for the same period, continuing to suppress the upward space of prices. However, cost support from the raw material end still exists, and coupled with the expected gradual release of traditional peak season demand, it is expected that the downside space of 430 prices will be limited in the short term, and it may stop falling and stabilize.

MACRO || China Accelerates Bond Issuance, Supporting Social Financing and Infrastructure.

On the macro front, US short-term interest rates indicate a much higher probability of a 50BP rate cut in September than a 25BP cut, improving investment sentiment; Since August, China's government bond issuance has accelerated significantly, with a total issuance of US$398 billion for the entire month and net issuance reaching US$256 billion, an increase of approximately US$94 billion year-on-year, which has effectively boosted the growth rate of social financing. In terms of credit, high-frequency data shows that there are no signs of stabilization in the real estate cycle, and the PMI shows a weakening of manufacturing activities, indicating that the endogenous financing demand of the private sector may still be sluggish. Overall, it is expected that new loans in August will be around US$142 billion, and new social financing will be around US$398 billion, with the growth rate of social financing likely to increase to 8.5% and the growth rate of M2 may decline to 6.0%. Domestic macro policies continue to exert force, monetary policy remains loose, and the economy is gradually recovering and improving. Currently, prices are at a low valuation stage. With the release of favorable macro policies and the improvement of supply and demand during the peak season, it is expected that inventories will continue to decline next week, helping to push prices up. Continue to pay attention to the subsequent production of steel mills and market transaction conditions.

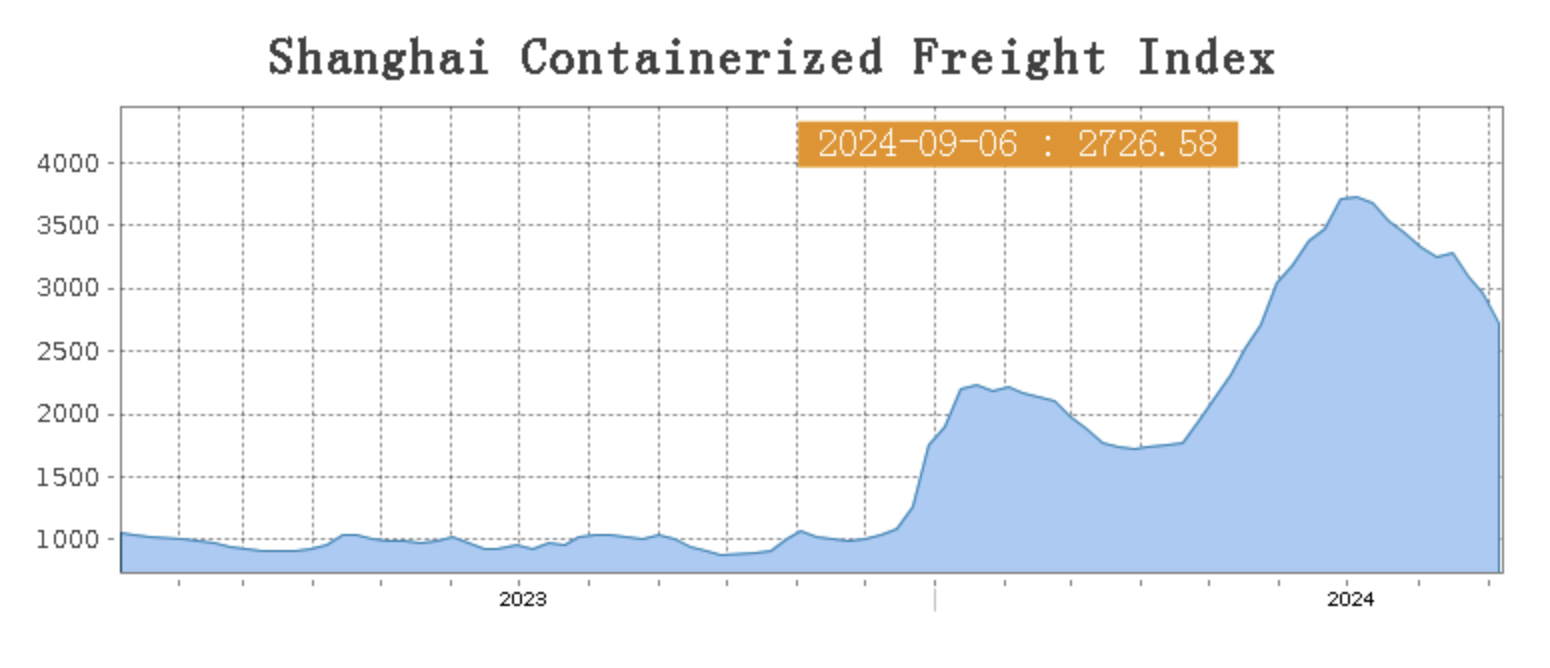

SEA FREIGHT|| Freight Rates Decline on multiple Routes.

Last week, the demand for container shipping from China remained relatively stable, and freight rates on different routes diverged due to differences in their fundamental factors, leading to a continued decline in the composite index.

On 6th September, the Shanghai Containerized Freight Index dropped by 8% to 2726.58.

Europe/ Mediterranean:

Last week, there was a lack of momentum for further growth in transportation demand. With an imbalanced supply-demand situation, market freight rates continued to decline.

On 6th September, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$3459/TEU, which dropped by 10.8%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3823/TEU, which decreased by 6.4%.

North America:

Last week, there were signs of a slowdown in transportation demand growth. The supply-demand fundamentals lacked further support, and spot market booking prices showed a downward trend.

On 6th September, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$5605/FEU and US$7511/FEU, both reporting an 8.7% and 11% decline accordingly.

The Persian Gulf and the Red Sea:

On 6th September, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 14.1% from last week's posted US$1509/TEU.

Australia/ New Zealand:

On 6th September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$2268/TEU, a 1.5% lift from the previous week.

South America:

On 6th September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$7523/TEU, an 2.3% drop from the previous week.