Stainless Insights in China from October 7th to October 11th

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,215 | 57 | 2.80% |

| Foshan | 2,225 | 57 | 2.74% | ||

| Hongwang | Wuxi | 2,110 | 39 | 2.01% | |

| Foshan | 2,110 | 18 | 0.90% | ||

| 304/NO.1 | ESS | Wuxi | 2,035 | 48 | 2.58% |

| Foshan | 2,045 | 32 | 1.69% | ||

| 316L/2B | TISCO | Wuxi | 3,735 | 43 | 1.20% |

| Foshan | 3,810 | 32 | 0.88% | ||

| 316L/NO.1 | ESS | Wuxi | 3,575 | 62 | 1.84% |

| Foshan | 3,605 | 28 | 0.83% | ||

| 201J1/2B | Hongwang | Wuxi | 1,335 | 46 | 3.94% |

| Foshan | 1,330 | 27 | 2.25% | ||

| J5/2B | Hongwang | Wuxi | 1,235 | 48 | 4.47% |

| Foshan | 1,230 | 27 | 2.45% | ||

| 430/2B | TISCO | Wuxi | 1,210 | 43 | 4.05% |

| Foshan | 1,190 | 25 | 2.36% |

TREND || Macro positives drive price increases, prices weaken in the latter half of the week.

Stainless steel futures prices peaked and then fell this week. After the National Day holiday, the capital market surged, and the bulk commodity market was extremely active. However, on the first trading day after the holiday, prices retreated, cooling overall market enthusiasm. Throughout the week, several policy meetings provided guidance, offering some support to macro sentiment. Trading in stainless steel futures was active, but open interest significantly decreased, indicating a wait-and-see approach due to policy sensitivity. The main contract for stainless steel futures closed at US$2,100, up 0.43% for the week, with a weekly high of US$2,160. In the spot market, stainless steel prices rose along with the overall market sentiment, reaching a peak of US$2,165/MT, but as post-holiday sentiment cooled, prices adjusted with fluctuations.

300 Series: Positive news released, futures and spot prices rebound.

This week, prices in the 304 spot market weakened slightly. As of Friday, the mainstream base price for 304 private sector cold-rolled sheets in Wuxi reported at US$2,055/MT, up US$28/MT from before the holiday; private hot-rolled prices reported at US$2,020/MT, up US$36/MT. The futures market opened high and fluctuated downwards; on the first trading day after the holiday, futures prices peaked above US$2,155/MT. With an optimistic outlook from end-users, traders mostly raised their quotes, and downstream speculative buying showed strong willingness, leading to active transactions in the market. On Tuesday, Tsingshan opened with a significant surge, but the market cooled after the initial high, with previous uptrends completing their orders. Acceptance of high-priced resources was hindered, and agents offered discounts for sales, resulting in decent trading performance throughout the week. Although there was a slight inventory accumulation due to the bustling market before and after the long holiday, the overall increase was not substantial, boosting consumer confidence in the market.

200 Series: Policies drive emotional reversal, prices of 201 rise.

In the Wuxi market, the mainstream base price for cold-rolled stainless steel 201J1 reached US$1,310/MT, while the base prices for J2/J5 cold-rolled sheets were at US$1205/MT, and the five-foot hot-rolled 201J1 at US$1265/MT. At the beginning of the week, 201 spot prices surged, and the trading atmosphere was active. After the National Day holiday, downstream customer demand became more pronounced. With the futures market strengthening and steel mills adjusting their prices upward, market sentiment improved, leading to an overall increase in transaction volume.

400 Series: Positive factors ignite market expectations for peak season post-holiday.

In the Wuxi spot market, state-owned cold-rolled stainless steel 430 was quoted at US$1,210~1215/MT, up US$43/MT from before the holiday; state-owned hot-rolled stainless steel 430 remained stable at around US$1,125/MT. The guiding price for Taiyuan Iron and Steel's 430/2B was set at US$1,505/MT, an increase of US$43/MT from before the holiday. Jiu Steel's 430 price was US$1,160/MT, up US$21/MT from the previous price.

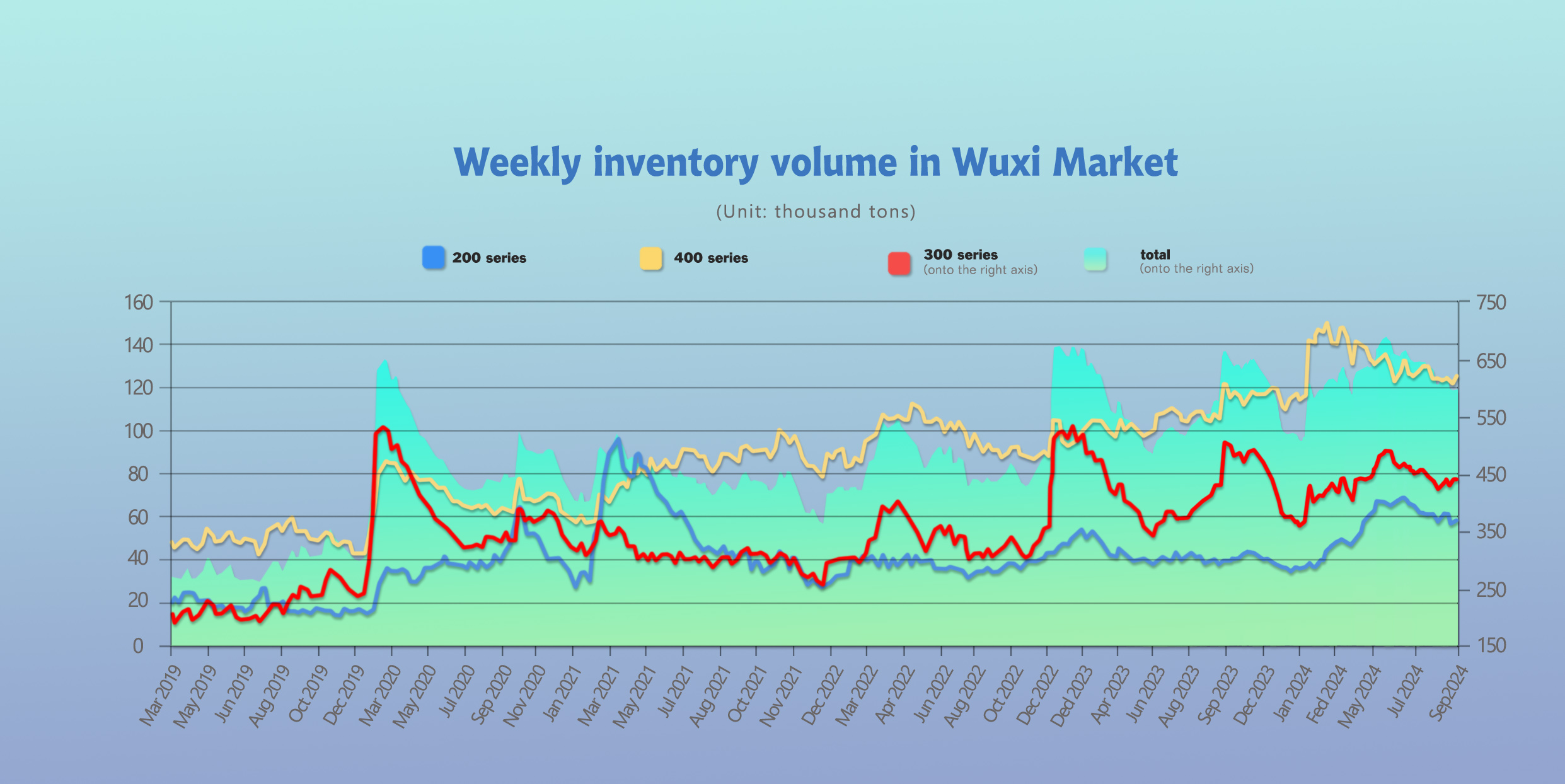

INVENTORY || Shipments halted during the holiday, inventory slightly increased.

As of October 10, statistics show that the total inventory in Wuxi sample warehouses increased by 12,400 tons to 612,700 tons compared to the previous period. Among them, the inventory of the 200 series decreased by 500 tons to 55,400 tons; the inventory of the 300 series increased by 7,700 tons to 432,100 tons; and the inventory of the 400 series rose by 5,100 tons to 125,200 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Sep 26th | 55,859 | 424,416 | 120,081 | 600,356 |

| Oct 10th | 55,373 | 432,145 | 125,201 | 612,719 |

| Difference | -486 | 7,729 | 5,120 | 12,363 |

300 Series: Inventory growth significantly decreases year-on-year, market confidence strengthens.

This week, Wuxi's stainless steel 300 series inventory increased by 7,700 tons (with cold-rolled inventory up by 1,100 tons and hot-rolled inventory up by 6,600 tons) to 432,100 tons. Last week, both stainless steel futures and spot prices saw a notable rise, boosting market sentiment and increasing purchasing willingness. During the National Day holiday, transactions were stagnant, leading to a normal influx of inventory, but due to active buying by end-users before the holiday, the year-on-year increase in inventory post-holiday significantly decreased. Warehouse receipts continued to decrease, enhancing confidence among consumers and traders regarding future market trends. Currently, steel mills are reducing production, and resource inflows from overseas restarts are not easing supply pressure significantly. Demand is showing some improvement with rising prices, and speculative demand is increasing. Raw material prices remain high, pushing up cost support, limiting the downward potential for stainless steel prices. Overall fundamentals are improving, coupled with ongoing macro positives and expectations for peak season. A slight inventory reduction is anticipated next week, with continued attention on future steel mill production and market transaction conditions.

200 Series: Price increase of US$50/ton, inventory reduction.

In the Wuxi market, the inventory of stainless steel 200 series decreased by 500 tons to 55,400 tons, with both cold-rolled and hot-rolled inventories declining. During this inventory cycle, the spot price of 201 surged by US$50/ton. Ahead of the holiday, steel mills announced production cuts and maintenance plans, reducing market arrivals and easing supply pressure. After the holiday, Tsingshan’s 201 cold-rolled and hot-rolled prices both rose by US$57/ton, boosting market sentiment. Traders are optimistic about future trends, actively purchasing downstream, resulting in a lively trading atmosphere and slight inventory reduction. With positive signals like interest rate cuts and reserve requirement ratio reductions released, raw material prices are stabilizing at high levels, providing strong support for 201 costs. In the short term, 201 prices are likely to remain strong, and it’s expected that 200 series inventory will continue to decrease next week, with a focus on steel mill movements and market transaction conditions.

400 Series: Inventory increase of 5,100 tons.

This week, the inventory of stainless steel 400 series in the Wuxi market increased by 5,100 tons to 125,200 tons, with cold-rolled inventory up by 5,400 tons and hot-rolled inventory down by 300 tons. This inventory cycle coincided with the National Day holiday, leading to normal arrivals from steel mills and an increase in market circulation resources. Coupled with a stagnation in transactions during this period, the 400 series experienced an inventory buildup. After the holiday, guiding prices from TISCO and JISCO both rose, reflecting strong intentions from steel mills to increase prices.

RAW MATERIAL || Overall increase in raw material prices.

In terms of costs, this week the mainstream factory price of high-nickel pig iron rose by US$4 to US$142/nickel. This week, Shanghai nickel opened high but closed lower; as of Thursday's close, the main contract for Shanghai nickel settled at US$19,075/ton, down US$81/ton or 0.43% from before the holiday. On Thursday, at the London Metal Exchange (LME), nickel opened at $17,405, hitting a low of $17,305 and a high of $17,530 during the day.

Chromium iron prices dropped by US$14 to US$1,280/50 basis tons.

In October, the mainstream procurement price for high-chromium steel from steel mills decreased by US$57/50 basis tons compared to the previous month, with high-chromium prices following suit, down by US$14/50 basis tons to currently report at US$1,280~1,310 /50 basis tons. During the week, coke prices increased, raising production costs for high-chromium enterprises, exacerbating factory losses, and reducing production enthusiasm. Some high-chromium companies have begun maintenance, which may alleviate supply pressure and support a price rebound.

SUMMARY || Macro financial policies stimulate the market, post-holiday return to rationality.

Last week, stainless steel prices initially rose but then weakened. On the first trading day after the holiday, futures prices were actively traded, showing an intraday adjustment trend. Spot prices followed the futures, improving market transaction sentiment.

Downstream inquiries increased, though purchases remained cautious, leading to a rebuild in social inventories and a slight increase in warehouse receipts. Future attention will focus on steel mill production schedules and demand performance during peak seasons, as well as the strength of domestic macroeconomic policy stimuli, with expectations for stainless steel prices to fluctuate.

300 Series: Currently, nickel pig iron prices are rising, pushing up cost support, which limits the downward potential for stainless steel prices. Macro-wise, the likelihood of further interest rate cuts by the Federal Reserve has increased, and there are still expectations for favorable domestic policies. In the short term, prices for 304 cold-rolled spot goods are expected to fluctuate in line with the futures market.

200 Series: Production cuts by steel mills, favorable macro policies, and stocking demands during the National Day holiday have collectively contributed to inventory reduction in the 201 market, with spot prices continuing to rise. Prices saw a slight correction in the latter half of the week, with traders offering discounts of US$7/ton for sales. However, traders remain optimistic about future trends, with some agents maintaining firm quotes. In the short term, 201 prices are expected to operate steadily with a slight upward bias.

400 Series: Steel mills are maintaining reduced production levels, easing short-term supply pressure in the market. Post-holiday, there remains some replenishment demand from end-users, resulting in a slow reduction in 400 series spot inventory, which may alleviate supply-demand conflicts. After significant price increases for 430, low-priced resources have noticeably decreased, but downstream acceptance of high-priced resources remains limited, leading to a generally cautious market attitude. In the short term, 430 cold-rolled prices are expected to remain weakly stable.

SEA FREIGHT || Post-holiday market recovery is slow, most routes see price declines.

Last week, China's export container transportation market performed relatively weakly after the short holiday, and ocean freight rates continued to decline, dragging down the composite index. On 20th September, the Shanghai Containerized Freight Index dropped by 3.4% to 2062.57.

Europe/ Mediterranean:

According to data released by the European Statistical Office, the Eurozone Economic Sentiment Indicator dropped to 96.2 in September, below market expectations. Recently, the transportation market on the Asia-Europe routes has continued to weaken, with spot market booking prices continuing to decline this week. On October 11th, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2040/TEU, which dropped by 9.3%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$2369/TEU, which decreased by 6.8%.

North America:

At the beginning of October, there was a brief strike by dock workers on the U.S. East Coast. However, the strike has since been resolved and has not significantly impacted the North American shipping market. Last week, transportation demand has recovered slowly after the long holiday, leading to an unfavorable supply-demand balance and a continued decline in market freight rates.

On October 11th, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$4730/FEU and US$5554/FEU, both reporting a 2.5% and 1.3% decline accordingly.

The Persian Gulf and the Red Sea:

On October 11th, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 2.5% from last week's posted US$986/TEU.

Australia/ New Zealand:

On October 11th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1966/TEU, a 2.1% decrease from the previous week.

South America:

On 20th September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$6341/TEU, a 1.5% drop from the previous week.