This week of Stainless Insights in China, we saw a rebound in price in most of the grades. Jakarta said there will be a Metal Exchange in Indonesia in 2025, which pushed the LME nickel to rise. The peak season is to come in September and October in the manufacturing industry, and as an upper end in the supply chain, the prelude of the peak is now at the corner. The declining inventory last week gave some confidence to the market sellers. For more about the market dynamics, please keep reading.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,190 | 8 | 0.41% |

| Foshan | 2,230 | 8 | 0.40% | ||

| Hongwang | Wuxi | 2,080 | 0 | 0.00% | |

| Foshan | 2,095 | 10 | 0.50% | ||

| 304/NO.1 | ESS | Wuxi | 2,020 | 7 | 0.37% |

| Foshan | 2,020 | 7 | 0.37% | ||

| 316L/2B | TISCO | Wuxi | 3,765 | 3 | 0.08% |

| Foshan | 3,810 | 6 | 0.15% | ||

| 316L/NO.1 | ESS | Wuxi | 3,620 | -1 | -0.04% |

| Foshan | 3,595 | 3 | 0.08% | ||

| 201J1/2B | Hongwang | Wuxi | 1,360 | 3 | 0.23% |

| Foshan | 1,360 | -3 | -0.23% | ||

| J5/2B | Hongwang | Wuxi | 1,250 | 1 | -0.12% |

| Foshan | 1,260 | -3 | -0.25% | ||

| 430/2B | TISCO | Wuxi | 1,225 | -3 | -0.25% |

| Foshan | 1,235 | -4 | -0.38% |

TREND || End of Off-Season, Stainless Steel Futures and Spot Prices Rise Together.

Last week, Wuxi's stainless steel spot prices saw a steady increase, with a slight rise in the 300 series and stable prices for the 200 and 400 series. Industry speculation was relatively strong. The futures market fluctuated upwards last week. Rising raw material prices boosted stainless steel cost support, and coupled with the release of positive macroeconomic news, strong expectations drove a month-on-month increase in stainless steel prices. Transactions improved, demand gradually shifted towards the peak season, inventory was reduced, and the supply-demand pattern recovered. As of Friday, the main stainless steel contract price increased by US$36/MT to US$2115/MT compared to the previous week.

300 series: both futures and spot prices rise, with inventory reduction.

Last week, the prices of 304 market quotations fluctuated upwards. As of Friday, the mainstream base price of cold-rolled four-foot stainless steel 304 in the Wuxi region was US$2040/MT, an increase of US$7/MT compared to the previous Friday; the price of hot-rolled stainless steel was US$2025/MT, an increase of US$14/MT compared to the previous Friday. At the beginning of the week, raw material prices rose slightly, supporting the cost of stainless steel. Downstream demand purchases mainly followed the market, with average transactions in the first half of the week. With the release of positive macroeconomic news and the increase in TISCO's opening price, the futures market rebounded in the second half of the week, and spot quotations followed suit. The supply side contracted, coupled with the expectation of the peak season, market bullish sentiment warmed up, stimulating end-user purchasing enthusiasm, and transactions improved, reducing inventory.

200 series: inventory reduction and production suspension boosting the firm pricing psychology.

The mainstream base price of cold-rolled 201J1 in the Wuxi market reached US$1315/MT, the mainstream base price of cold-rolled stainless steel J2/J5 reached US$1215/MT, and the five-foot hot-rolled 201J1 reached US$1285/MT. Last week, prices showed a trend of falling first and then rising, with the raw material market strengthening cost support for 201. At the beginning of the week, the spot market continued the pessimistic sentiment of the previous week, with more low-priced resources. In the second half of the week, with the rise in the futures market, traders' firm pricing psychology strengthened, and market sentiment improved, leading to a better overall transaction atmosphere.

400 series: raw materials weaken, and prices fluctuate.

In the Wuxi spot market, the quotation for cold-rolled 430 was US$1225-US$1230/MT, and the quotation for hot-rolled 430 was around US$1140/MT, both of which were flat compared to the previous week's quotation. Last week, the guiding price for TISCO cold-rolled 430 was US$1470/MT, and the guiding price for JISCO cold-rolled 430 was US$1630/MT, both of which were flat compared to the previous week's quotation. With the decline in market prices last week, the market's willingness to purchase at low prices increased, transactions improved compared to the previous period, and inventory continued to be reduced.

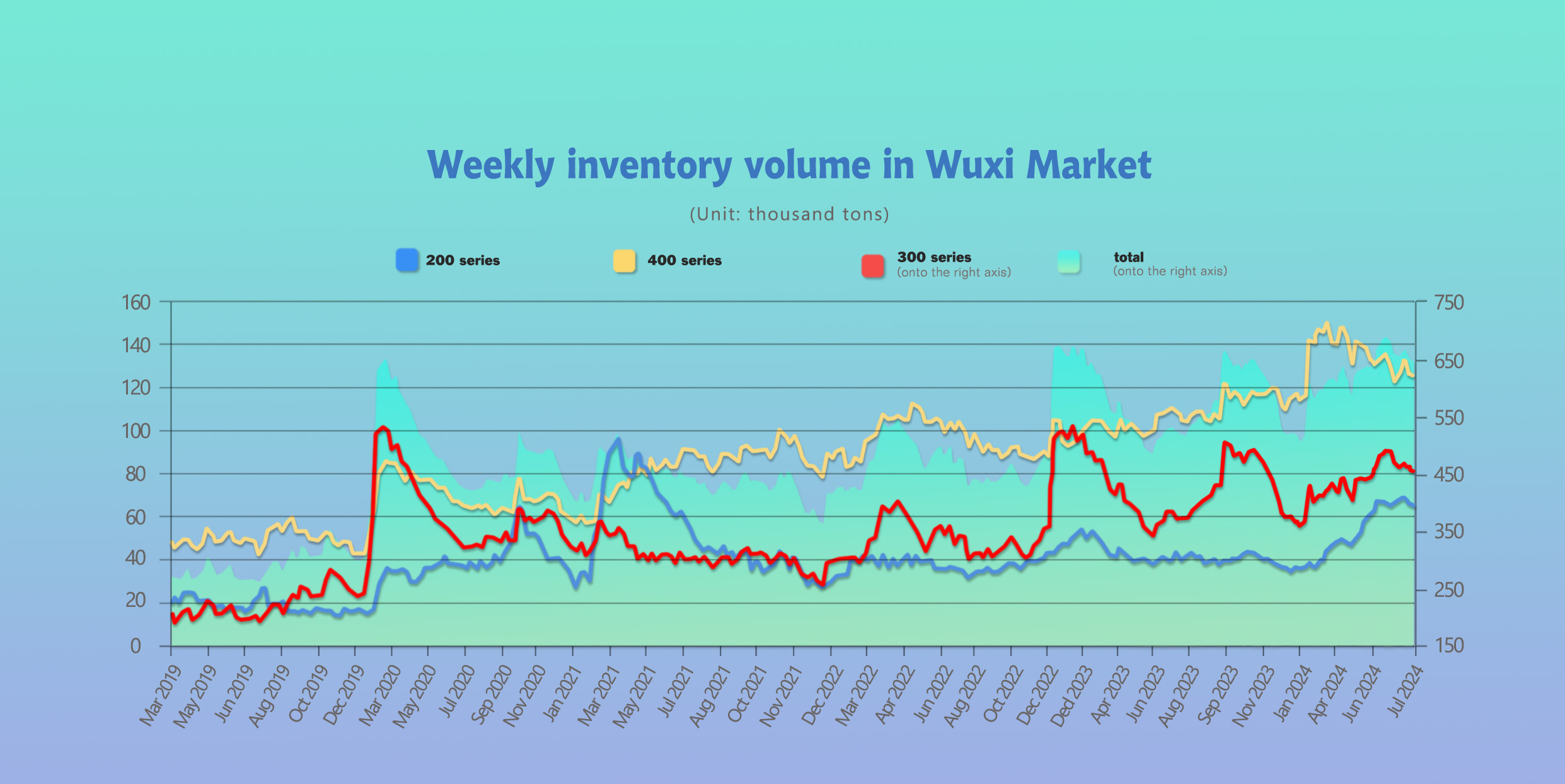

INVENTORY || Preludes to Peak Season Arrival, Inventory Reduction.

The total inventory at the Wuxi sample warehouse down by 8,534 tons to 642,039 tons (as of 1st August).

the breakdown is as followed:

200 series: 1,307 tons down to 64,672 tons,

300 series: 6,161 tons down to 451,949 tons,

400 series: 1,066 tons down to 125,418 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Jul 25th | 65,979 | 458,110 | 126,484 | 650,573 |

| Aug 1st | 64,672 | 451,949 | 125,418 | 642,039 |

| Difference | -1,307 | -6,161 | -1,066 | -8,534 |

200 Series: Fundamental Improvement, Rising Costs Accelerate Inventory Consumption.

At the beginning of last week, traders offered a discount of US$7/MT, resulting in an influx of low-priced resources in the market, and downstream customers were mainly on a wait-and-see attitude. With the rebound of the futures market, downstream confidence in the future market strengthened, and the overall transaction atmosphere improved. Affected by high on-site inventory, Foshan Chengde underwent a half-month shutdown last week, mainly affecting the production of cold-rolled stainless steel 201. In terms of raw materials, the copper price followed the upward adjustment of the non-ferrous metals market on Wednesday, providing strong cost support for 201. Multiple positive factors such as inventory reduction and production cuts, coupled with expectations of a traditional peak season, boosted market sentiment. In the short term, the price of 201 may have room for upward movement.

300 Series: Warehouse Receipt Reduction, Supply-Demand Recovery Helps Prices Rise.

During last week, the main futures price rebounded slightly, and spot prices remained stable. On the supply side, imports decreased, and steel mill production remained stable. Coupled with the increased delivery by agents at the end of the month, the amount of resources available in the market decreased; on the demand side, as the price rose during the transition to the peak season, speculative demand increased, the supply-demand pattern improved, and inventory continued to be reduced. Affected by a major event at a steel mill in East China, steel mill production in August may decrease slightly, warehouse receipt resources will flow out, and market bullish sentiment will heat up. Raw material prices are relatively strong, and nickel iron prices have risen with the market, supporting costs upward. Based on current raw material prices, steel mill profits have recovered. On the macro level, positive domestic and overseas factors have stimulated market sentiment, and strong expectations have driven real improvement. It is expected that inventory will continue to be reduced next week, and we will continue to pay attention to subsequent steel mill production and market transactions.

400 Series: Cost Support Shifts Downward, Prices Run Weakly.

Last week, in order to alleviate the pressure on funds, merchants reduced prices to promote transactions, and downstream demand increased with the purchase of low prices. The transaction situation was acceptable during the week; in addition, at the end of the month, steel mills urged settlement and delivery, and agents delivered more goods, and the reduction in inventory was mainly reflected in the pre-positioned inventory of steel mills. In August, the bidding price of high-chromium steel from major steel mills decreased month-on-month, and cost support shifted further downward. Based on current raw material prices, the steel mill's loss situation has not been alleviated. Under the weakness of both raw materials and demand, there is insufficient upward momentum for prices. It is expected that the price of 430 will fluctuate in the short term, and we will continue to pay attention to inventory changes and market transactions.

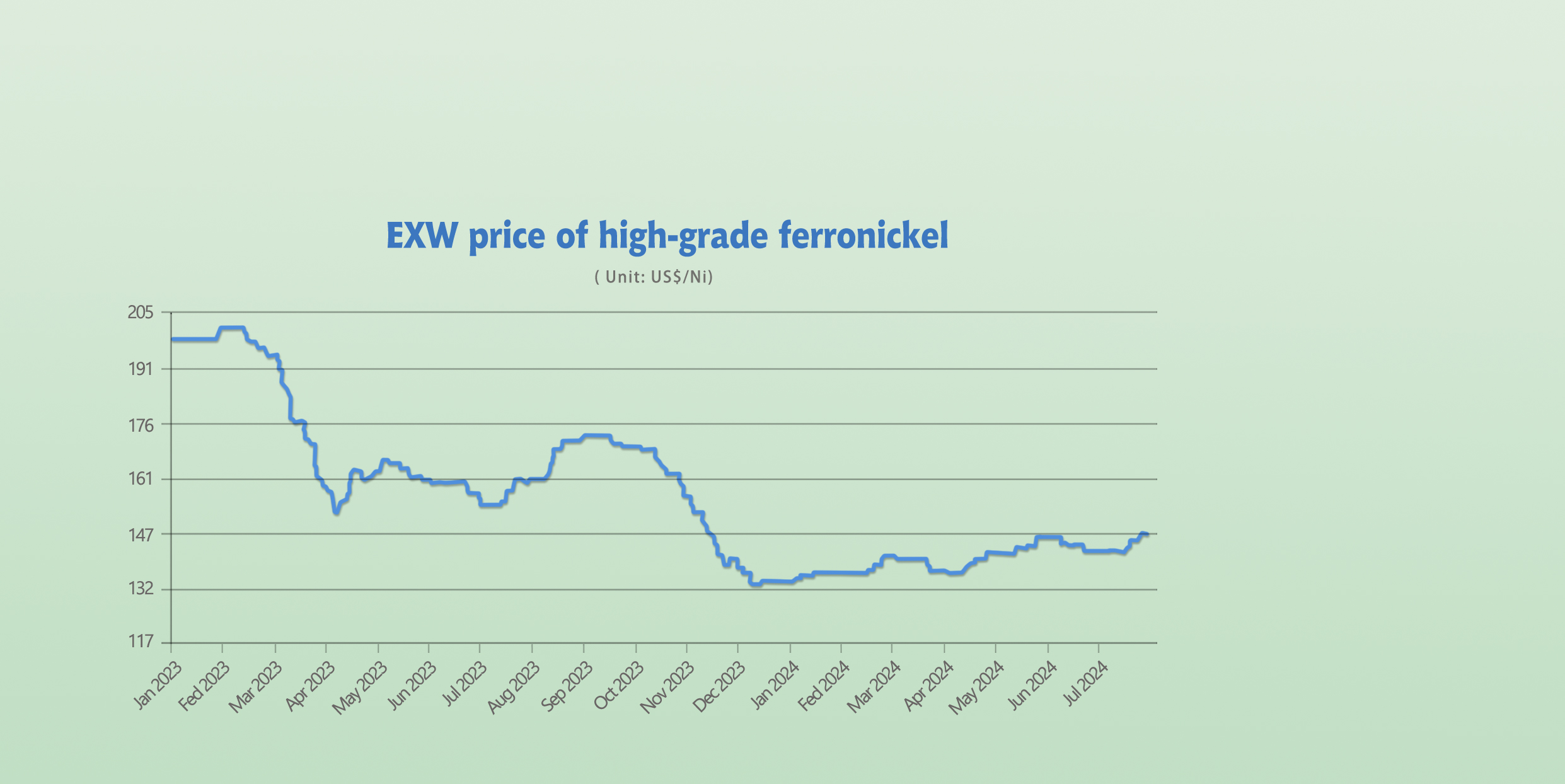

Raw Material|| Nickel Prices Rebound, Ferro-Nickel Rises Steadily.

Nickel: APNI Announces Indonesia Metal Exchange for 2025, Nickel Prices Rise.

According to Gerber news on July 31, 2024, the Indonesian Nickel Mining Association (APNI) announced yesterday the launch of the Indonesia Metal Exchange (IME). Following APNI's announcement, nickel prices surged by over 5.5%. Expectations of a decline in Asian stainless steel prices have not materialized.

APNI Announces Indonesia Metal Exchange for 2025 The Indonesian Nickel Mining Association (APNI) announced yesterday that it plans to introduce the Indonesian Metal Exchange (IME) starting in 2025. In view of this, APNI aims to decouple Indonesia from the foreign commodity exchanges that currently determine benchmark prices. Indonesia has the largest known nickel reserves and is the world's most important nickel exporter.

Asian Nickel Prices Jump Over 5.5% The US market nickel prices on the SHFE and the London Metal Exchange have already reacted to this news today, rising sharply. On the SHFE, the most actively traded contract (ni2408) rose by more than 5.6%. On the LME, nickel prices rose by more than 2.4% shortly after trading began. High-grade ferro-nickel ex-factory prices have been trending stronger last week, reaching US$141/nickel point as of Thursday, up US$1.4 from the previous Thursday. The supply of Indonesian ferro-nickel remains tight, but nickel ore still maintains a high premium, mainly due to the scarcity of Indonesian ore, as the authorities have lagged far behind schedule in issuing mining licenses. The recent expansion of the SIMBARA online tracking and reporting system, which includes nickel ore, may also further curb illegal mining in Indonesia and put additional pressure on supply. Some factories have purchased Philippine nickel ore to maintain production, and costs have supported the rise in ferro-nickel prices.

Last week, Shanghai nickel rebounded from its decline. As of Thursday's close, the main SHFE nickel contract closed at US$18930/MT, up US$1205/MT or 6.21% from the previous Thursday.

The stainless steel industry is about to enter the traditional peak season of September and October, and steel mills will increase production, leading to increased demand for raw materials. It is expected that ferro-nickel prices will remain stable and strong in the short term.

Chromium: In August, the procurement price of high-carbon ferrochromium in major domestic stainless steel mills decreased by US$14/50 reference ton month-on-month, and the retail price of high-chromium in the spot market also decreased by US$14/50 reference ton. With the decline in prices, losses of production enterprises in the main producing areas have increased, and the production enthusiasm of factories has decreased. In the future, the phenomenon of factory reduction or shutdown may increase. However, given that the supply exceeds demand in the short-term high-chromium market has not changed significantly, it is expected that the high-chromium price will continue to run relatively weakly.

SUMMARY|| Macroeconomic factors drive, peak season is coming.

Stainless steel prices were relatively strong last week, with raw material prices remaining high overall. Steel mill production profits remained negative, the overall market transaction atmosphere improved slightly, downstream consumption demand remained sluggish, and traders offered discounts and promotions. Social warehouses and warehouse receipts continued to decline. The future will focus on the speed of social inventory reduction and the subsequent production and arrival rhythm of steel mills. It is expected that stainless steel will fluctuate in the future.

300 Series: Macroeconomic positives and supply reduction boosted stainless steel market sentiment, with inventory being reduced for two consecutive weeks. Raw material quotations remain firm, supporting the upward trend of stainless steel costs. The expectation of "Golden September, Silver October" still exists, and demand may gradually recover. It is expected that stainless steel prices will remain volatile and strong in the short term.

200 Series: On the one hand, rising futures prices boosted market sentiment; on the other hand, macroeconomic policies such as the increased expectation of a rate cut in September continued to drive up raw material copper prices. Under the combined effects, traders are optimistic about the future trend. Inventory has achieved two consecutive declines, and the supply pressure has been relieved. It is expected that the price of 201 will remain stable and strong in the short term.

400 Series: Raw material high chromium prices were weak, with mainstream steel mills' high chromium bidding prices in August down month-on-month, further reducing the cost support for the 400 series. The market supply pressure has eased somewhat, coupled with the support of expectations for the traditional peak season of "Golden September, Silver October", the supply and demand pattern has improved, and it is expected that the price of 430 will fluctuate in the short term.

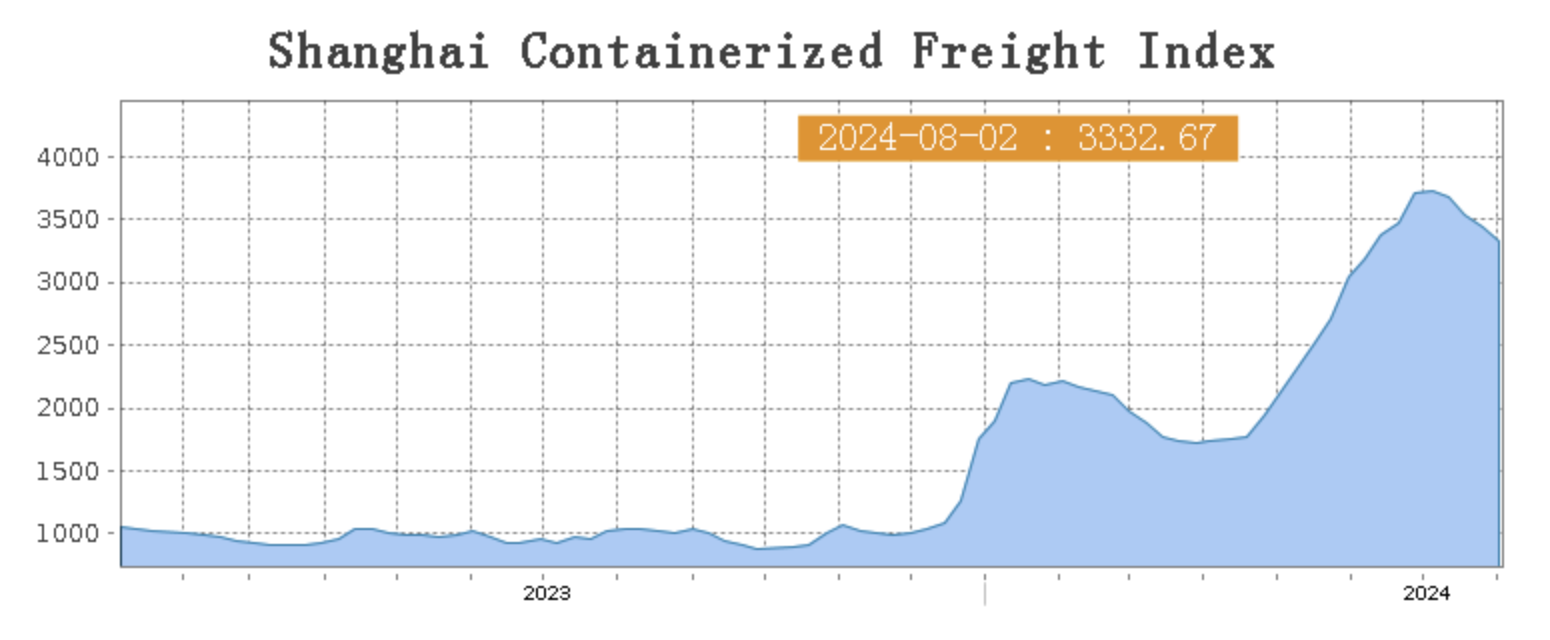

SEA FREIGHT || Growth in Transport Demand Slows, Most Routes Continue to Adjust.

Last week, the overall market of China's export container shipping remained stable. Due to differences in supply and demand fundamentals among various ocean routes, the trends diverged, and the comprehensive index declined slightly. On 2nd August, the Shanghai Containerized Freight Index dropped by 3.3% to 3332.67.

Europe/ Mediterranean:

Recent tensions in the Middle East have escalated, and the Asia-Europe route will continue to face numerous risk events. Last week, transportation demand remained relatively stable, and spot market booking prices declined slightly.

On 2nd August, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$4907/TEU, which dropped by 1.7%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$4997/TEU, which decreased by 5.2%.

North America:

As inflation continues to exceed the 2% target, the Federal Reserve maintained interest rates unchanged last week. Last week, there was a lack of further momentum in transportation demand, the supply and demand fundamentals weakened, and market freight rates continued to adjust.

On 2nd August, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$6245/FEU and US$99346/FEU, reporting a 6.3% and 2.2% slide accordingly.

The Persian Gulf and the Red Sea:

On 2nd August, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 0.1% from last week's posted US$2217/TEU.

Australia/ New Zealand:

On 2nd August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1581/TEU, a 6.7% lift from the previous week.

South America:

On 2nd August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$7867/TEU, an 0.9% decrease from the previous week.