Stainless Insights in China from August 26 to August 30

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,190 | 0 | 0.00% |

| Foshan | 2,230 | 0 | 0.00% | ||

| Hongwang | Wuxi | 2,075 | -3 | -0.15% | |

| Foshan | 2,095 | 4 | 0.22% | ||

| 304/NO.1 | ESS | Wuxi | 2,020 | 0 | 0.00% |

| Foshan | 2,020 | 1 | 0.08% | ||

| 316L/2B | TISCO | Wuxi | 3,755 | 0 | 0.00% |

| Foshan | 3,840 | 0 | 0.00% | ||

| 316L/NO.1 | ESS | Wuxi | 3,580 | 0 | 0.00% |

| Foshan | 3,595 | 0 | 0.00% | ||

| 201J1/2B | Hongwang | Wuxi | 1,340 | 0 | 0.00% |

| Foshan | 1,335 | -1 | -0.12% | ||

| J5/2B | Hongwang | Wuxi | 1,245 | -3 | -0.25% |

| Foshan | 1,235 | -1 | -0.13% | ||

| 430/2B | TISCO | Wuxi | 1,200 | -14 | -1.30% |

| Foshan | 1,215 | -11 | -1.03% |

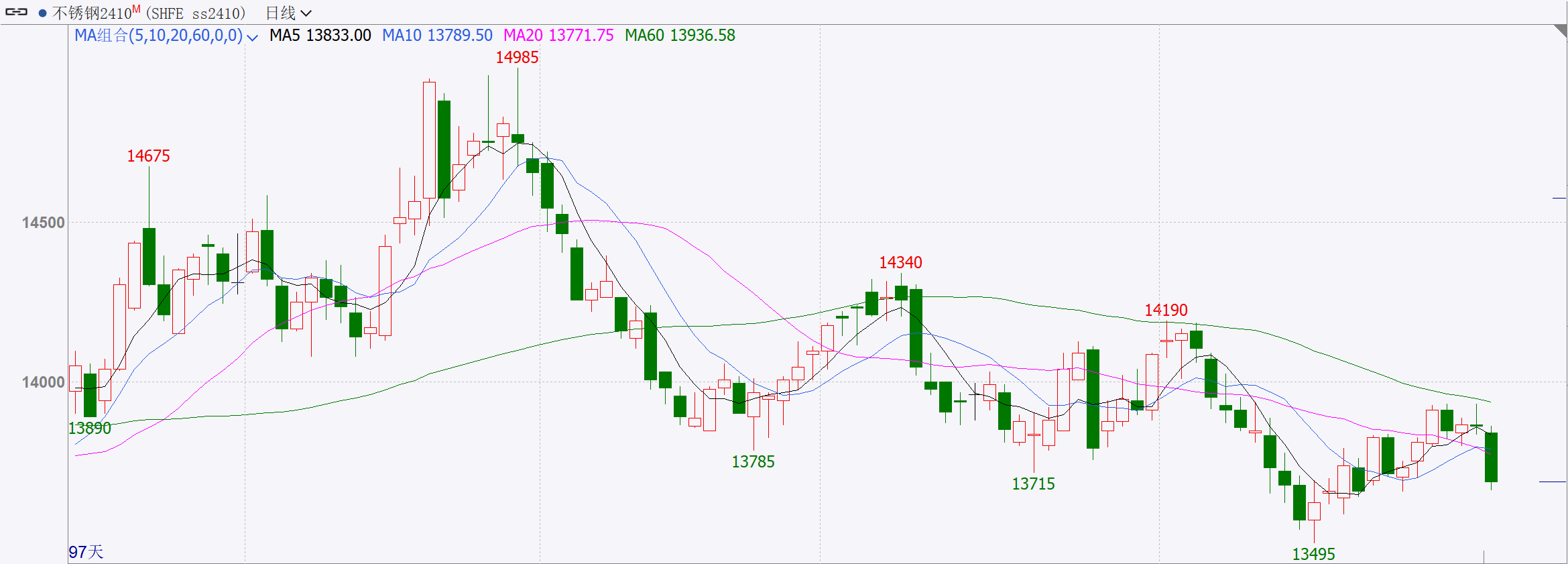

TREND|| Stainless Steel Prices Struggle to Stabilize.

Last week, the stainless steel futures and spot prices in the Wuxi market fluctuated upwards, with strong speculation in the industry. Due to a decrease in steel mill arrivals and continued decline in imports, market arrivals remained low, easing supply pressure. On the demand side, a slow recovery and prices falling to low valuations boosted the willingness of some end-users to speculate and purchase, improving the supply-demand situation and continuing to reduce inventories. As of Friday night, the main stainless steel futures contract price decreased by US$25 compared to the previous week, reaching US$2070/MT.

300 Series: Futures Prices Rebound Continuously.

Last week, the 304 market prices increased slightly. As of Friday, the main base price of cold-rolled four-foot stainless steel 304 in the Wuxi area reached US$2035/MT, and the private hot-rolled price reached US$2025/MT, both increasing by US$7 compared to the previous Friday. At the beginning of the week, boosted by the positive macroeconomic atmosphere, the futures market rebounded for two consecutive days, improving market sentiment.

Subsequently, the bullish sentiment was strong, end-users increased their purchases, and futures order placement was hot, leading to improved spot transactions. As the futures market weakened slightly in the second half of the week, high-priced resources in the market were difficult to sell, and downstream purchases slowed down. Transactions of low-priced resources were still acceptable. During the week, market arrivals decreased, imports continued to weaken, and supply pressure eased. With the improvement in demand driven by seasonal expectations, the supply-demand situation improved, and inventories continued to decline.

200 Series: Fed Rate Cut Helps Boost Non-ferrous Metals Market.

The main base price of cold-rolled stainless steel 201J1 in the Wuxi market reached US$1310/MT, the main base price of cold-rolled stainless steel J2/J5 reached US$1210/MT, and the five-foot hot-rolled 201J1 reached US$1270/MT. The futures market showed a trend of rising first and then falling last week, and the overall transaction atmosphere of 201 was generally average. After the Fed confirmed a rate cut in September, investors favored commodities, and the non-ferrous metals sector strengthened, with copper prices rising during the week, boosting market sentiment for 201. Some 201 traders were optimistic about the future, but downstream customer purchases remained cautious.

400 Series: Prices Remain Stable.

In the Wuxi spot market, the cold-rolled stainless steel 430 price was quoted at US$1195-US$1205/MT, down US$7 from the previous Friday; the state-owned hot-rolled 430 price was around US$1140/MT, flat compared to the previous week's quotation. The guiding price of TISCO cold-rolled stainless steel 430 was US$1485/MT, and the guiding price of JISCO cold-rolled stainless steel 430 cold-rolled was US$1640/MT, both flat compared to the previous week's quotation.

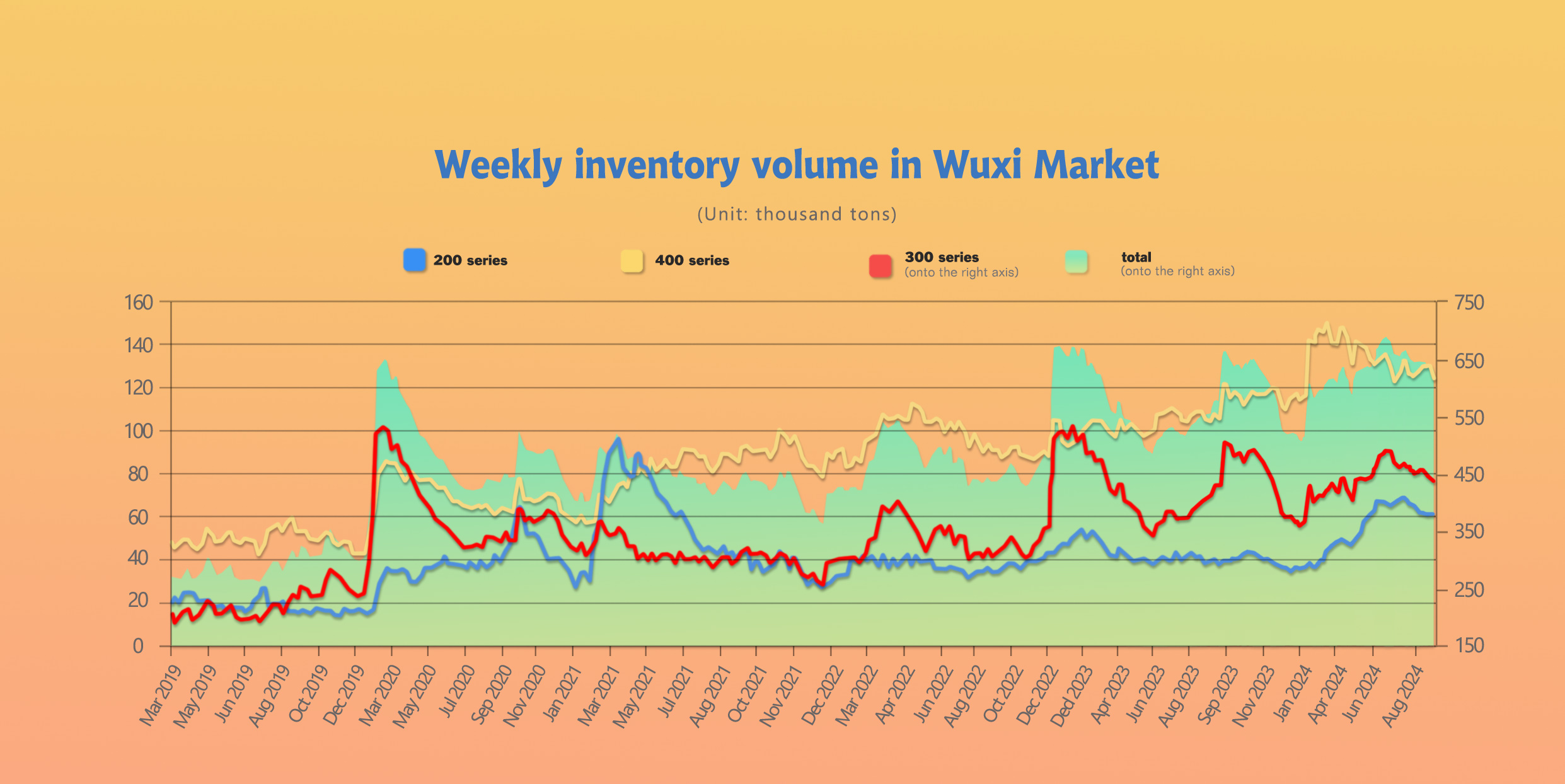

INVENTORY|| Inventory Decline Slowly.

The total inventory at the Wuxi sample warehouse down by 13,614 tons to 618,330 tons (as of 29th August).

the breakdown is as followed:

200 series: 165 tons down to 60,069 tons,

300 Series: 8,011 tons down to 434,696 tons,

400 series: 5,438 tons down to 123,565 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Aug 22nd | 60,234 | 442,707 | 129,003 | 631,944 |

| Aug 29th | 60,069 | 434,696 | 123,565 | 618,330 |

| Difference | -165 | -8,011 | -5,438 | -13,614 |

300 Series: Inventory Decline Boosts Price Increase.

Last week, the main futures price fluctuated upwards, while spot prices remained stable. Near the end of the month, TISCO agent pickups increased, and pre-positioned inventory decreased slightly. Futures prices rebounded following the upward trend of the futures market, spot transactions were poor, and prices were weak, with the spot-futures basis widening, and spot-priced resources having a significant advantage. Warehouse receipts were gradually digested, and although they still increased year-on-year, the overall growth rate gradually narrowed. As time shifted to the peak season, end-user confidence has been somewhat restored, and long-term orders have increased, gradually releasing demand and increasing speculative restocking intentions. Currently, inventories are still at high levels, and steel mills' production increases are less than in previous years, coupled with the continued decline in imports, domestic circulating resources have decreased, supply pressure has eased, the supply-demand situation has improved, and continuous inventory decline has helped prices rebound. Raw material prices have been stable, most of the nickel ore was traded in a serious premiums, and ferrochrome production has declined, and cost support has limited the downside of stainless steel. On the macro side, Powell made a dovish rate cut statement, and the first rate cut may come in September, improving the investment environment. Domestic macro policies continue to exert force, monetary policy is loose, and there has been continuous positive news about real estate, and related industries have gradually recovered and rebounded. Currently, prices are at an undervalued stage. With the release of favorable macroeconomic policies and the improvement of fundamentals, it is expected that inventories will continue to decline slightly next week. We will continue to pay attention to the subsequent production of steel mills and market transactions.

200 Series: August Monthly Decline in Inventory, High Inventory Still Suppresses Prices.

Restricted by high inventories, the main quotation for hot-rolled products decreased by US$7/MT on Monday, and the transaction atmosphere was generally average. After the Fed released a signal of a rate cut, the market reacted quickly, strengthening investors' confidence in commodities. Raw materials such as copper followed the rise of the non-ferrous metals sector, providing strong support for the cost of 201. With the warming up of the futures market at the beginning of the week and the approaching of the "golden September" peak season, traders were optimistic about the future. However, the consumption end was dominated by a wait-and-see mood, and the acceptance of high-priced resources was low. End-users made just-in-time purchases, and inventories remained stable, highlighting the supply-demand contradiction. In the short term, 201 prices may stabilize. It is expected that the 201 cold-rolled resources will continue to decline next week, and the focus will be on the dynamics of steel mills and transaction conditions.

400 Series: Continuous Inventory Decline.

Last week, the 430 market price mainly operated weakly and steadily. During the week, merchants lowered the price of cold-rolled products to promote transactions, and low-priced resources frequently appeared in the market.

Downstream buyers increased their purchases of low-priced products, and transactions during the week were acceptable. In addition, with steel mills urging settlement and delivery at the end of the month, TISCO agent pickups increased, and the reduction in inventory was mainly reflected in the steel mills' pre-positioned inventory. Currently, steel mills have reduced production, and market supply pressure has eased. Coupled with the traditional peak season boosting market sentiment, downstream demand has gradually been released, and the supply-demand situation is expected to gradually improve. It is expected that inventories will continue to decline slightly next week, and we will continue to pay attention to changes in inventory and market transactions.

RAW MATERIAL|| Steel Mills Maintain High Production, Increasing Raw Material Demand.

SHFE Nickel fluctuated strongly last week. As of Thursday's close, the main Shanghai nickel contract closed at US$18,769/MT, up US$435.9 or 2.38% from previous Thursday. Last week, the ex-factory price of high-nickel pig iron increased slightly, reaching. One of the TSINGSHAN mill in South China purchased tens of thousands of tons of high-nickel pig iron at US$143/nickel point as of last Thursday. Recently, stainless steel and nickel prices have stopped falling and rebounded, coupled with the arrival of the traditional peak season for stainless steel in September and October, steel mills have maintained high production levels, and raw material demand has increased. The supply of Indonesian nickel ore remains tight, and ore price premiums remain high, providing strong support for nickel pig iron costs. It is expected that nickel pig iron prices will remain stable and trend upward in the short term.

SUMMARY|| Market Trades on Rate Cut Expectations, Fundamentals Limit Stainless Steel Rebound.

Last week, stainless steel prices fluctuated. Raw material prices eased slightly but remained high overall, and the inverted production profit margins of steel mills have somewhat eased. The overall market transaction atmosphere was generally average, downstream consumer demand was unsatisfactory, and traders frequently offered discounts to promote sales. Social inventories declined slightly, and warehouse receipts were withdrawn at a faster pace. In the future, attention should be paid to the speed of social inventory depletion and the subsequent production and arrival schedules of steel mills. It is expected that stainless steel prices will fluctuate in the future.

300 Series: The stainless steel futures market has risen for consecutive days due to expectations of a peak season, coupled with the continuous decline in inventories, reducing market spot resources and boosting market sentiment. End-user purchases have increased. Currently, the macroeconomic sentiment is improving, and fundamentals are gradually recovering. It is expected that the short-term spot price of 304 cold-rolled will fluctuate with the futures market.

200 Series: Last week, the 201 hot-rolled product decreased by US$7 at the beginning of the week due to high inventory levels. However, from the perspective of the total inventory of the 200 series, it has declined for a consecutive month in August, coupled with a slight decline in steel mill production, easing supply pressure. However, since the steel mill limited prices in the middle of the month, the consumption end has been mostly cautious. It is expected that the upside and downside of 201 will be limited in the short term, and the price of 201J2 will fluctuate around US$1210-US$1255/MT.

400 Series: In August, steel mill production declined, and steel mills maintained reduced production; coupled with the continuous decline in inventories in the 400 series spot market for two consecutive weeks, market supply pressure has eased. The price of high-chromium raw materials remained stable, and the cost support for 430 was still present. Given the high production costs of steel mills, it is expected that the price of 430 will continue to fluctuate weakly in the short term. We will continue to pay attention to the production plans of steel mills and market transactions in the future.

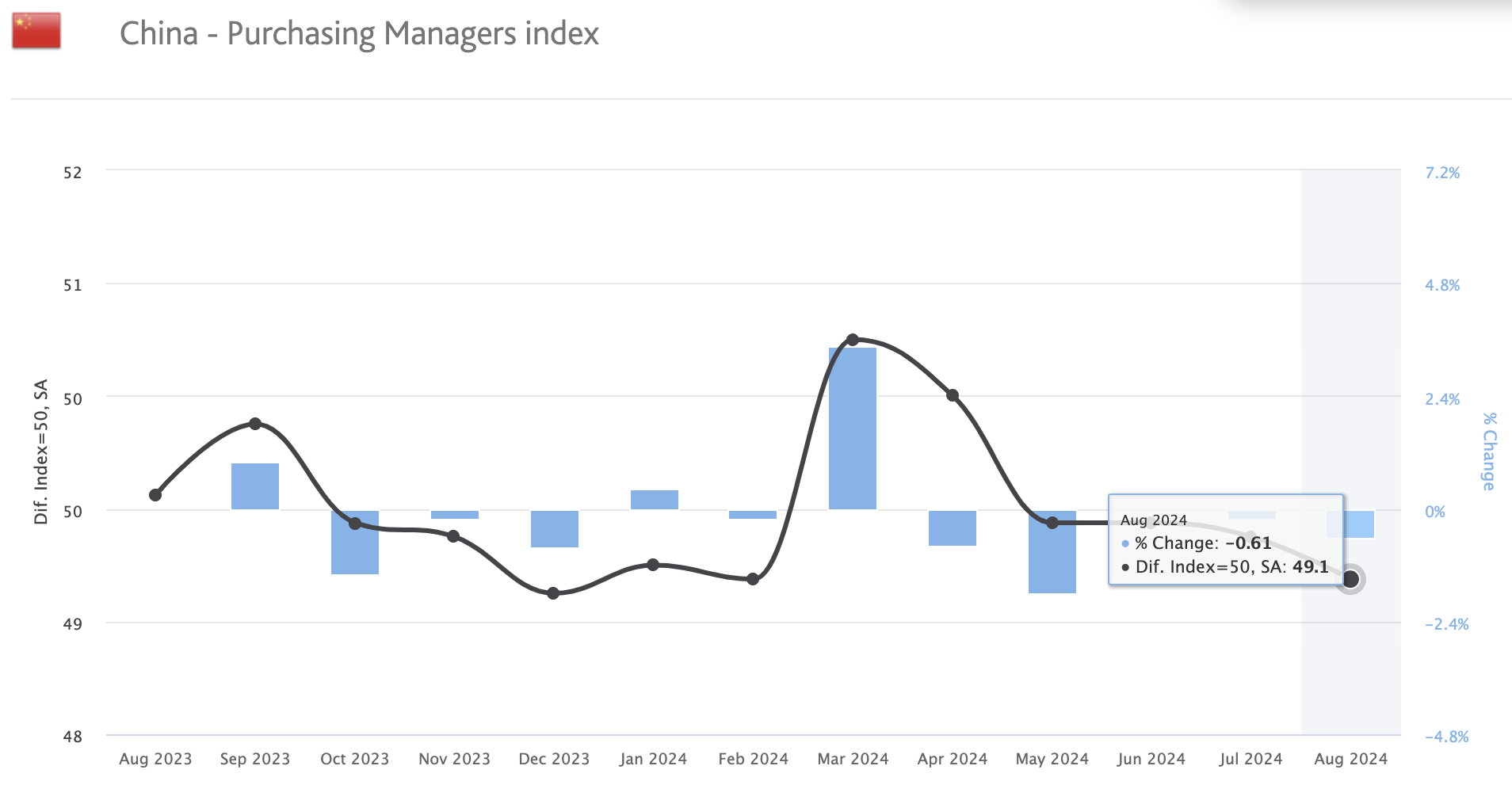

MACRO|| Insufficient Demand, China's August PMI Continues to Weaken.

The Caixin China General Manufacturing Purchasing Managers' Index (PMI) fell by 0.3 percentage points month-on-month to 49.1 in August, lower than market expectations (with a Bloomberg consensus forecast of 49.5%). Weak demand remains the primary reason for the contraction in production, especially in the construction sector.

Unlike the overall decline in new orders in August, new export orders increased by 0.2 percentage points month-on-month to 48.7%, indicating that the divergence between domestic and foreign demand continues and has marginally widened. Although overseas data has weakened recently, we expect exports to remain resilient in the second half of the year under the baseline assumption of a "soft landing" of the US economy. In terms of industries, new export orders for industries such as pharmaceutical manufacturing (+14.8 percentage points), electrical machinery and equipment manufacturing (+10.0 percentage points), metal products manufacturing (+8.9 percentage points), and automobile manufacturing (+7.6 percentage points) have shown significant improvement month-on-month.

From the perspective of major industries, the PMI of high-tech manufacturing and equipment manufacturing increased by 2.3 and 1.7 percentage points month-on-month to 51.7 and 51.2 respectively, returning to the expansionary zone; the PMI of the consumer goods industry was 50.0, located at the critical point; while the PMI of high energy-consuming industries declined by 2.2 percentage points month-on-month to 46.4. In terms of sub-sectors, the PMI of non-metallic mineral product manufacturing (-3.7 percentage points), chemical raw material and chemical product manufacturing (-3.3 percentage points), and ferrous metal smelting and rolling processing (-2.1 percentage points) ranked among the top in terms of month-on-month decline. We believe that this industrial differentiation mainly reflects differences in demand structure. The weakness of raw material manufacturing is mainly affected by the negative impact of the real estate sector, while high-tech manufacturing and equipment manufacturing are mainly supported by exports and manufacturing investment, and their performance is relatively better. Consumer demand is located between real estate and exports, and its performance is in the middle.

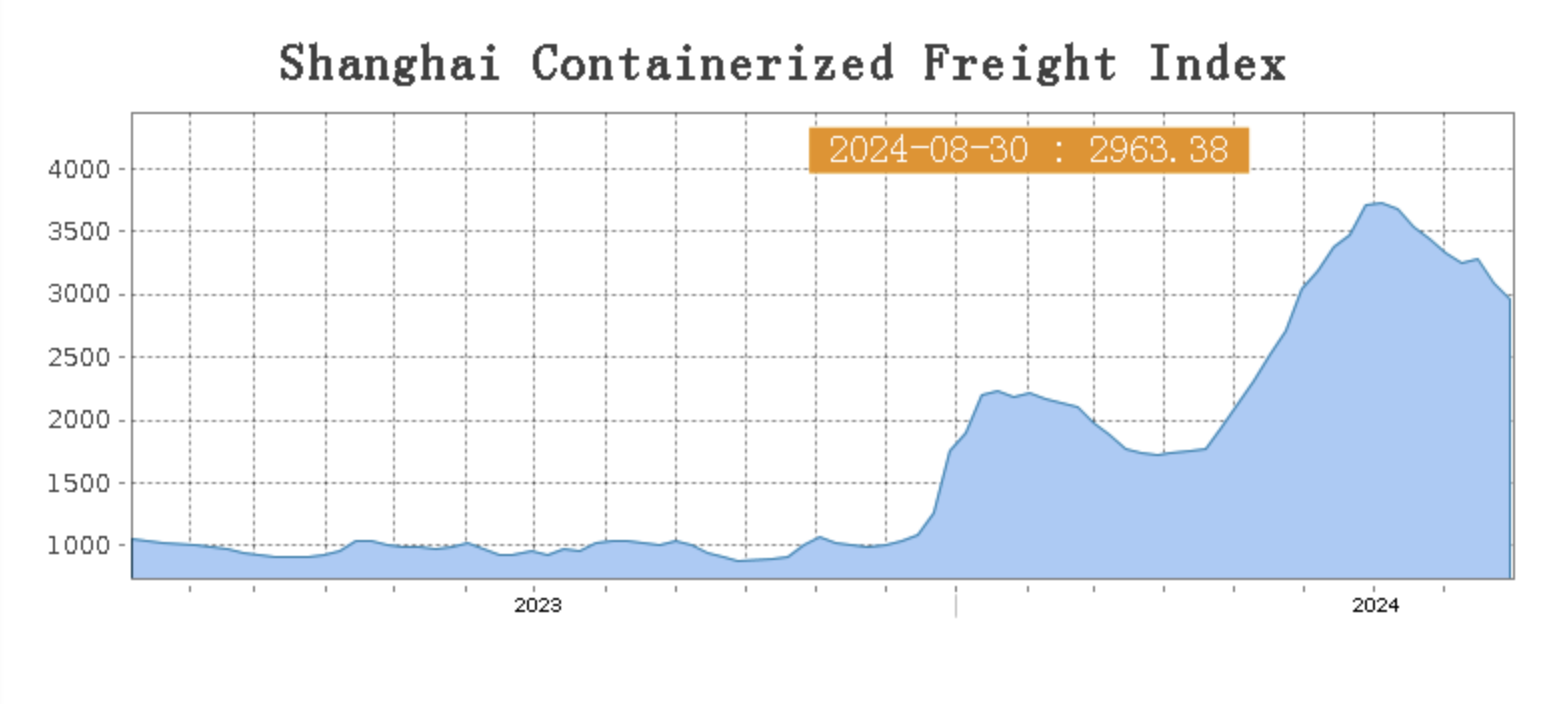

SEA FREIGHT|| Freight Rates Decline on Some Routes.

Last week, the demand for container shipping from China remained relatively stable, and freight rates on different routes diverged due to differences in their fundamental factors, leading to a continued decline in the composite index.

On 30th August, the Shanghai Containerized Freight Index dropped by 4.3% to 3097.63.

Europe/ Mediterranean:

The EU's final decision to impose anti-subsidy duties on electric vehicles exported from China will have a significant impact on future Sino-European trade and the Asia-Europe shipping market. Recently, there have been signs of weakening transportation demand, and market freight rates have continued to adjust.

On 30th August, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$3876/TEU, which dropped by 11.9%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$4083/TEU, which decreased by 9.7%.

North America:

Last week, transportation demand was weak, and the supply and demand fundamentals lacked support. The market failed to sustain last week's price increase trend, and freight rates declined.

On 30th August, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$6140/FEU and US$8439/FEU, both reporting an 3.1% growth and 1.3% decline accordingly.

The Persian Gulf and the Red Sea:

On 30th August, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 10% from last week's posted US$1756/TEU.

Australia/ New Zealand:

On 30th August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$2235/TEU, a 7.9% lift from the previous week.

South America:

On 30th August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$7698/TEU, an 1.8% increase from the previous week.