Last week, as China cut the interest rate, stock prices increased temporarily. Lower interest rates did boost the stock prices and stainless steel prices, but the market couldn't help to draw back due to the sluggish demand. Roll up and keep reading Stainless Insights in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,150 | 0 | 0.00% |

| Foshan | 2,190 | 0 | 0.00% | ||

| Hongwang | Wuxi | 2,050 | -6 | -0.29% | |

| Foshan | 2,055 | 6 | 0.29% | ||

| 304/NO.1 | ESS | Wuxi | 1,980 | 4 | 0.22% |

| Foshan | 1,980 | 4 | 0.22% | ||

| 316L/2B | TISCO | Wuxi | 3,705 | 14 | 0.39% |

| Foshan | 3,750 | 8 | 0.23% | ||

| 316L/NO.1 | ESS | Wuxi | 3,565 | -3 | -0.08% |

| Foshan | 3,540 | -3 | -0.08% | ||

| 201J1/2B | Hongwang | Wuxi | 1,335 | -17 | -1.35% |

| Foshan | 1,340 | -8 | -0.68% | ||

| J5/2B | Hongwang | Wuxi | 1,230 | -17 | -1.47% |

| Foshan | 1,245 | -8 | -0.73% | ||

| 430/2B | TISCO | Wuxi | 1,205 | -6 | -0.51% |

| Foshan | 1,220 | -4 | -0.38% |

TREND|| Prices Yo-Yo Under a Weak Supply and Demand Scenario.

Wuxi's stainless steel spot prices fluctuated last week. The 300 series saw a slight increase, while the 200 and 400 series prices declined slightly. Speculation in the industry remained low. The futures market experienced a rise followed by a fall last week. At the beginning of the week, steel mills raised their opening prices, coupled with the support of anti-dumping policies, leading to a synchronous rise in both futures and spot prices. In the second half of the week, as the positive impact of macroeconomic factors gradually faded, pricing power gradually returned to fundamental trading, and prices fell back under the weak supply and demand situation. As of Friday, the main stainless steel contract price increased by US$6.25 to US$2045/MT compared to the previous week, representing a weekly increase of 0.33%. The lowest price for the week was US$2025/MT.

300 Series: Strong Cost Support.

Last week, the prices of 304 market quotations fluctuated.As of Friday, the mainstream base price of 304 private cold-rolled four-foot in the Wuxi region was US$2005/MT, an increase of US$7/MT compared to the previous week; the price of private hot-rolled steel was US$1980/MT, an increase of US$14/MT compared to the previous Friday. At the beginning of the week, the central bank's announcement of a reduction in the LPR boosted market sentiment, and coupled with Tsingshan's announcement of a price increase and the impact of short covering, the futures market rose significantly, reaching a high of around US$2080/MT and then consolidating. Traders' confidence in the future market rebounded, and spot quotations mostly followed suit. However, after the price increase, the downstream market had a low acceptance of high-priced resources, and transactions were weak, mainly driven by rigid demand. On Thursday, the futures market turned sharply downward, and nickel and stainless steel fell in tandem, causing traders to become cautious again, and speculative sentiment was low.

200 Series: Prices Difficult to Boost.

The mainstream base price of cold-rolled stainless steel 201J1 in the Wuxi market reached US$1305/MT, the mainstream base price of cold-rolled steel J2/J5 reached US$1200/MT, and the five-foot hot-rolled stainless steel 201J1 reached US$1275/MT. In the first half of the week, the strengthening of the futures market drove the 201 market; on the other hand, the continuous decline in raw material copper prices weakened the cost support for 201. Under the multiple effects, the 201 price showed a trend of rising first and then falling. The downstream market has adopted a cautious wait-and-see attitude, and market transactions have returned to a low level.

400 Series: Buyers Maintain a Wait-and-See Attitude.

In the Wuxi spot market, the quotation for state-owned cold-rolled steel 430 was US$1205/MT to US$1210/MT, and the quotation for state-owned hot-rolled steel 430 was around US$1120/MT, both of which decreased by US$7/MT compared to the previous week. The guiding price for TISCO cold-rolled steel 430 was US$1450/MT last week, and the guiding price for JISCO’s cold-rolled steel 430 was US$1605/MT, both of which remained flat compared to the previous week. Last week, the futures market fluctuated, and the spot market sentiment was weak. Downstream demand was cautious, and market shipments were mainly driven by low-priced rigid demand.

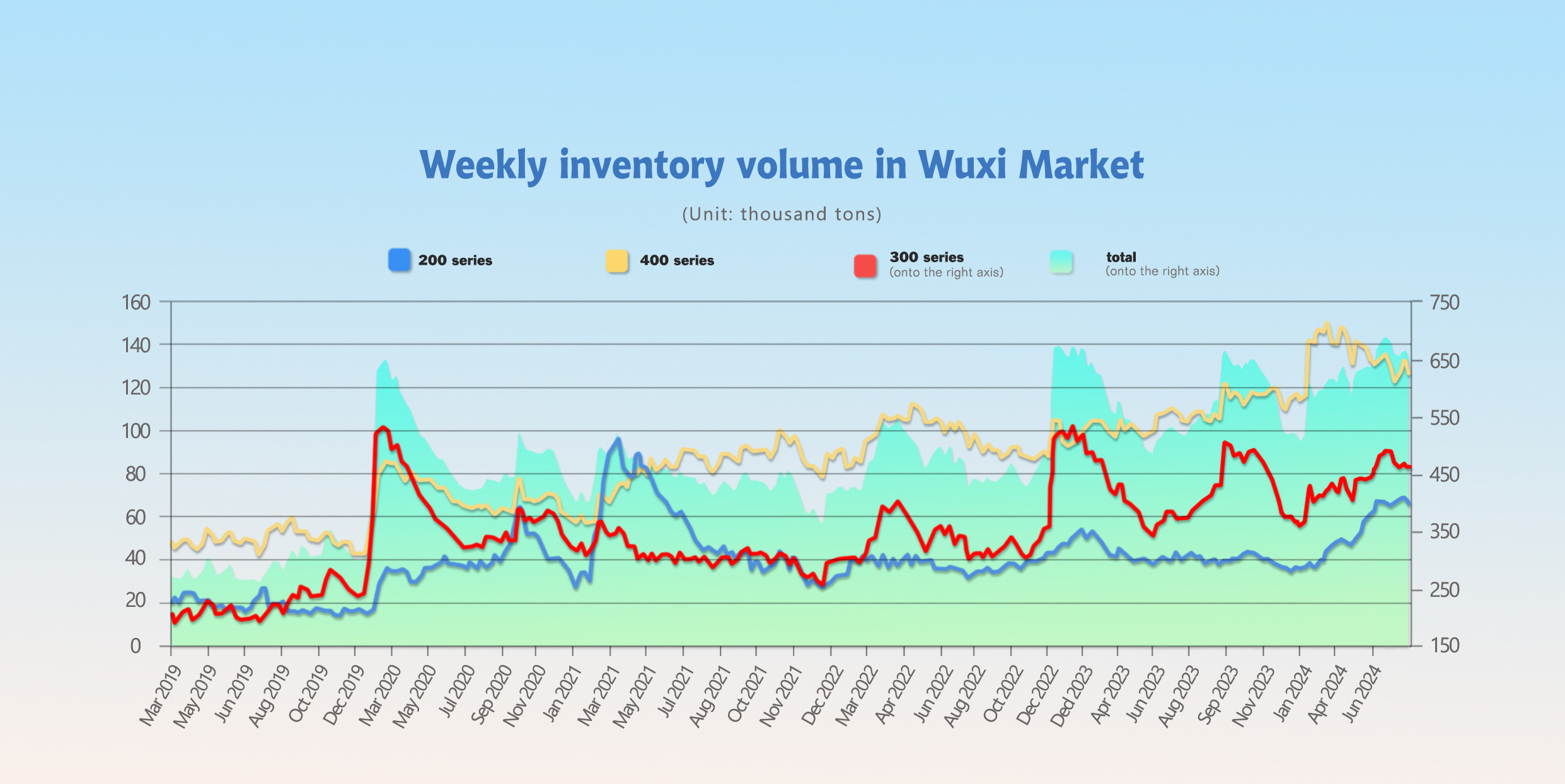

INVENTORY|| Wuxi sees a weekly decline of 11,600 tons.

The total inventory at the Wuxi sample warehouse down by 11,631 tons to 662,204 tons (as of 25th July).

the breakdown is as followed:

200 series: 1,791 tons down to 65,979 tons,

300 series: 4,659 tons down to 458,110 tons,

400 series: 5,181 tons down to 126,484 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Jul 18th | 67,770 | 462,769 | 131,665 | 662,204 |

| Jul 25th | 65,979 | 458,110 | 126,484 | 650,573 |

| Difference | -1,791 | -4,659 | -5,181 | -11,631 |

300 Series: Inventory reduction last week.

During last week, the main futures contract rebounded and rose, while spot prices fluctuated and remained stable. Hence, mainstream steel mills' warehouse receipts flowed out, and the market's cold-rolled arrivals increased significantly. Downstream enterprises' wait-and-see sentiment increased, and demand for cold-rolled products was weak, leading to a significant increase in inventory. Hot-rolled products had insufficient supply, and downstream demand improved, leading to a continuous reduction in inventory.

In July, steel mill production increased slightly, and warehouse receipts remained high, with no significant relief in supply pressure. Demand remained weak, and under the general decline of the commodity market, downstream purchases were mainly driven by rigid demand, and speculative demand was insufficient. Raw material prices were weak, and cost support continued to decline. Based on current raw material prices, steel mills were still in a loss-making state. Under the dual weakness of supply and demand, it is expected that inventory will increase slightly next week. We will continue to pay attention to subsequent steel mill production and market transactions.

200 Series: First inventory reduction since July.

In the first half of last week, the stainless steel futures market rallied, and the price of 201 increased by about US$14/MT, with a slight increase in transaction volume. In the second half of the week, prices followed the industry market's callback, and downstream sentiment returned to wait-and-see. Raw material prices remained weak, and under the influence of macroeconomic policies, the non-ferrous metals sector was under pressure and declined. The supply and demand situation in the copper market remained weak, and prices continued to fall, weakening the cost support for 201. In the short term, the spot price of 201 will be mainly stable and weak. In the future, we will focus on steel mill pricing and market transactions.

400 Series: Inventory reduction last week.

During last inventory period, as the end of the month approached, steel mills delivered previous orders, and agent deliveries increased; the price of 430 continued to decline, and the market had more low-priced resources. Downstream demand for low-priced purchases was still acceptable, and the transaction situation improved compared to the previous period, with a slight reduction in inventory. The slight decline in the price of high-chromium raw materials weakened the support for 430. Based on current raw material prices, steel mills were still in a loss-making state, with severe cost inversions. In July, steel mill production remained at a high level, and the supply pressure in the later market will not decrease. It is expected that inventory may increase slightly next week. We will continue to pay attention to inventory changes and market transactions.

RAW MATERIAL|| Ore Prices Remain Stable.

Last week, the ex-factory price of high-nickel iron increased significantly, reaching US$138/nickel point by last Thursday, up US$2.7 from the previous Thursday.

SHFE nickel fell sharply, hitting a new low in nearly 5 months. As of Thursday's close, the main contract of Shanghai nickel closed at US$17318/MT, down US$865/MT from the previous Thursday, a decrease of 4.76%.

In July, the shortage of Indonesian nickel ore continued to exist, and the premium remained high. Local factories imported a large amount of Philippine ore to maintain production. Coupled with the decline in nickel iron profit margins, factories switched to producing more profitable ferronickel, leading to a reduction in nickel iron reflux. In the mid-upper ten days of July, nickel iron prices remained stable. In the mid-lower ten days of July, steel mills collectively entered the market to purchase raw materials, and the purchase price of nickel iron increased significantly, approaching the US$140 mark. Currently, the supply of domestic nickel iron is in a tight balance, but the sharp decline in nickel prices has limited the upside of nickel iron prices. It is expected that nickel iron prices will remain stable in the short term.

In August, the purchasing prices of mainstream high-chromium steel were successively announced. The purchasing price of TISCO was determined to be US$1209/50 reference ton, and the purchasing price of Tsingshan was determined to be US$123/50 reference ton, both of which decreased by US$14 month-on-month. The mainstream ex-factory quotation high-carbon ferrochrome remained stable last week, maintaining around US$1210/MT to US$1238/MT, unchanged from the previous weekend. The spot price of the main variety of 40-42% South African powder ore decreased to US$8.6/MT, and the mainstream quotation of Turkish 40-42% lump ore remained at around US$10.4/MT. The price of coke remained stable last week, and the comprehensive production cost of high-carbon ferrochrome decreased slightly.

With the announcement of the steel purchasing prices, it is expected that the market price of high-chromium will be affected by this and continue to weaken in the later period, which may force the price of chrome ore to fall back. However, the price of lump ore is significantly firm, the profit margin of high-chromium factories is limited, and the market supply exceeds demand without significant improvement. The support for high-chromium prices is expected to weaken, and the mainstream price will remain stable and weak in the short term.

SUMMARY|| Stainless Steel Prices Oscillate at Low Levels, Warehouse Receipts Significantly Reduced.

Last week, stainless steel prices fluctuated. Raw material prices generally remained high, and steel mills maintained a loss-making production profit. Steel mills are expected to reduce production in July. The overall market transaction atmosphere was cold, and downstream consumer demand remained weak. Traders' promotional efforts to reduce prices were ineffective, and social inventories decreased slightly. The market is paying attention to the speed of social inventory reduction and the subsequent production and arrival schedules of steel mills. It is expected that stainless steel prices will fluctuate in the future.

Last week, the registered warehouse receipts of stainless steel on the Shanghai Futures Exchange decreased by 40,615 tons to 146,979 tons compared to the previous week. Warehouse receipts were significantly reduced last week, and the reduction rate accelerated. The market is paying attention to the maintenance of the reduction rate in the future. Warehouse receipt resources have put great pressure on market inventory, and the market's digestion capacity still needs to be maintained to maintain the reduction rate.

300 Series: Currently, raw material prices are running relatively strong, cost support is strong, and steel mills have a firm pricing mentality, limiting the downside of stainless steel. In July, it is expected that production supply will remain high, and demand orders will remain weak. The pattern of weak supply and demand has not improved, and spot prices are under pressure to rise. It is expected that the spot price of 304 cold-rolled steel will fluctuate in the short term.

200 Series: In August, some steel mills also reported maintenance news, which alleviated supply pressure, and inventory turned from increasing to decreasing. Market confidence has been restored. It is expected that the price of 201 will fluctuate around US$1200/MT to US$1270/MT in the short term.

400 Series: The purchasing price of high-chromium steel in August decreased month-on-month, which further weakened the cost support for stainless steel 430, and the downside space of 430 prices expanded. The current price is already at the annual low. However, given the high production cost of steel mills, the firm pricing mentality still exists, and the price decline space is limited. It is expected that the price of cold-rolled 430 will mainly run weakly in the short term.

MACRO|| China's Apparent Stainless Steel Demand is Expected to Reach 2.88 Million Tons in August.

In June 2024, China's stainless steel imports were 131,300 tons, a month-on-month decrease of 24.72% and a year-on-year increase of 11.16%. From January to June, the cumulative imports were 1.1077 million tons, an increase of 31.43% compared to the same period last year. In June, China's stainless steel exports were 452,800 tons, a month-on-month decrease of 1.06% and a year-on-year increase of 31.89%. From January to June, the cumulative exports were 2.3644 million tons, an increase of 15.96% compared to the same period last year.

In June, overseas non-ferrous metals continued to decline and hit a bottom, and Shanghai nickel prices followed suit. Stainless steel prices fell first and then rose during the month, and prices were more resilient compared to raw materials. In June, downstream demand in the traditional off-season was weak. As prices rebounded after a surge, the wait-and-see sentiment of end-users warmed up, and purchases were mainly driven by rigid demand, while replenishment and speculative demand were weak. On the supply side, production declined significantly, but the decline in prices caused warehouse receipts to flow into the market, and market arrivals did not shrink significantly, and supply and demand remained weak. Indonesia's Weda Bay reduced production, and imports decreased month-on-month; export data hit a new high, and net exports continued to strengthen. Domestic demand recovery was below expectations, and apparent consumption in June declined slightly month-on-month. According to calculations, apparent demand in June was 2.78 million tons, a month-on-month decrease of 207,000 tons and a year-on-year increase of 61,500 tons, an increase of 2%.

In July, the main futures contract rebounded and fell back to a low of US$2020/MT. In the second half of the month, driven by interest rate cuts and anti-dumping policies, prices rose sharply and exceeded US$2065/MT. Coupled with the increase in opening prices by steel mills, spot prices rose, and market sentiment warmed up, and speculative purchasing intentions strengthened. On the supply side, steel mill production recovered slightly, but the overall magnitude was not large, overseas imports decreased, and overall domestic supply pressure remained stable; on the demand side, expectations of a "golden September and silver October" still existed, and high demand from shipbuilding and home appliances drove an improvement in stainless steel demand in August. Import and export data remained strong, and apparent stainless steel consumption maintained an upward trend. It is estimated that stainless steel consumption in July will increase by 30,000 tons month-on-month to 2.81 million tons, an increase of 10,000 tons compared to June, an increase of 0.37%; it is estimated that apparent stainless steel demand in August will be 2.88 million tons, an increase of 85,000 tons compared to July, an increase of 3.04%.

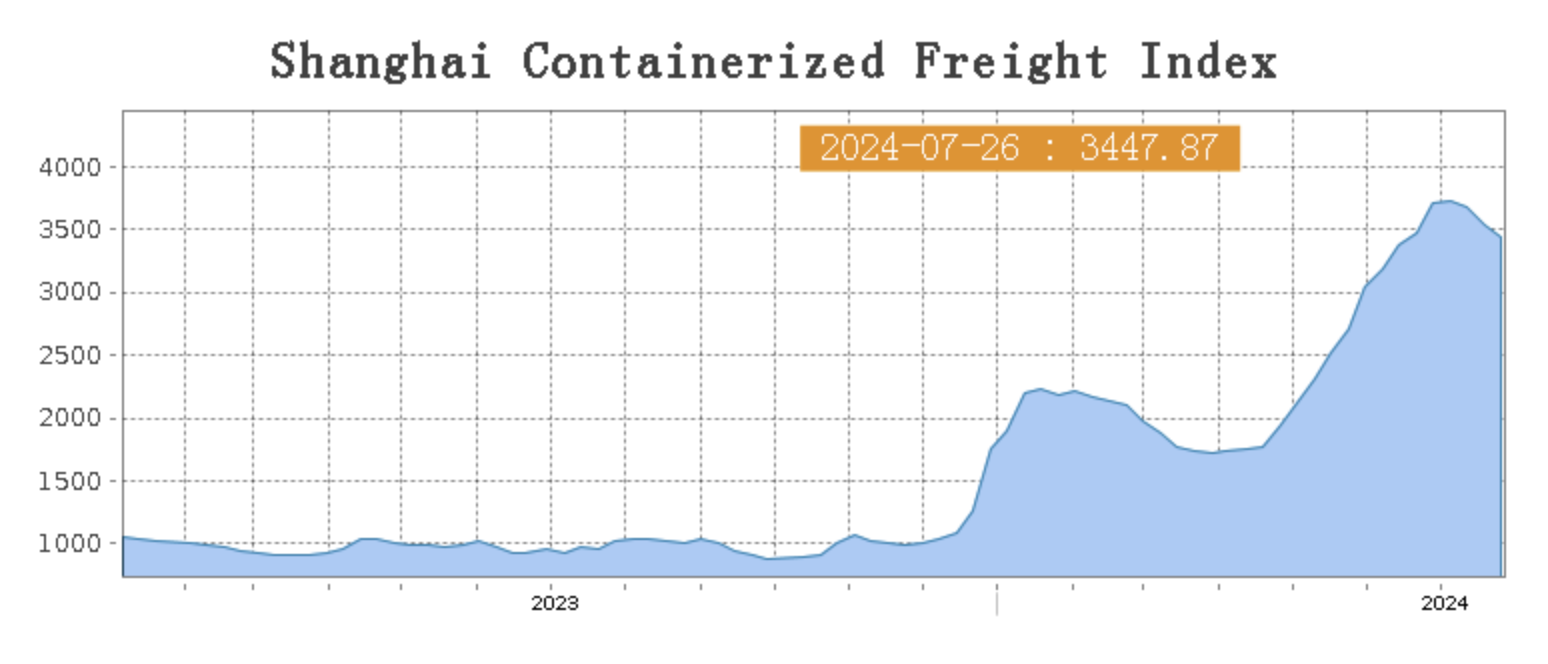

Sea Freight|| Shipping Market was overall stabilized.

Last week, the overall market of China's export container shipping remained stable. Due to differences in supply and demand fundamentals among various ocean routes, the trends diverged, and the comprehensive index declined slightly. On 26th July, the Shanghai Containerized Freight Index dropped by 2.7% to 3447.87.

Europe/ Mediterranean:

According to data released by S&P Global, the preliminary composite PMI of the euro-zone in July was 50.1, lower than the previous value and market expectations, and the preliminary PMI of both manufacturing and services declined month-on-month. In the future, China-Europe trade will still face the test of policy uncertainty, and its impact on the export container shipping market needs further attention. Last week, overall transportation demand remained stable, and spot market booking prices remained stable.

On 26th July, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$5000/TEU, which dropped by 1%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$5270/TEU, which decreased by 1.7%.

North America:

According to data released by S&P Global, the US Markit Manufacturing PMI in July fell sharply to 49.5, hitting a new low in seven months. Although the services PMI remained stable, the manufacturing and services PMI continued to diverge. Last week, transportation demand growth was weak, and the supply and demand fundamentals lacked further support, and market freight rates continued to decline.

On 26th July, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$6663/FEU and US$9557/FEU, reporting a 6.5% and 2.0% slide accordingly.

The Persian Gulf and the Red Sea:

On 26th July, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 1.2% from last week's posted US$2219/TEU.

Australia/ New Zealand:

On 26th July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1482/TEU, a 7.0% lift from the previous week.

South America:

On 26th July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$7939/TEU, an 3.3% decrease from the previous week.