WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,185 | 0 | 0.00% |

| Foshan | 2,225 | 0 | 0.00% | ||

| Hongwang | Wuxi | 2,070 | -3 | -0.14% | |

| Foshan | 2,085 | -3 | -0.14% | ||

| 304/NO.1 | ESS | Wuxi | 2,010 | -1 | -0.07% |

| Foshan | 2,020 | 6 | 0.30% | ||

| 316L/2B | TISCO | Wuxi | 3,755 | 0 | 0.00% |

| Foshan | 3,810 | 8 | 0.23% | ||

| 316L/NO.1 | ESS | Wuxi | 3,595 | -13 | -0.36% |

| Foshan | 3,590 | 4 | 0.12% | ||

| 201J1/2B | Hongwang | Wuxi | 1,350 | -4 | -0.34% |

| Foshan | 1,350 | -3 | -0.23% | ||

| J5/2B | Hongwang | Wuxi | 1,240 | -8 | -0.75% |

| Foshan | 1,250 | -3 | -0.25% | ||

| 430/2B | TISCO | Wuxi | 1,215 | -4 | -0.38% |

| Foshan | 1,220 | -10 | -0.88% |

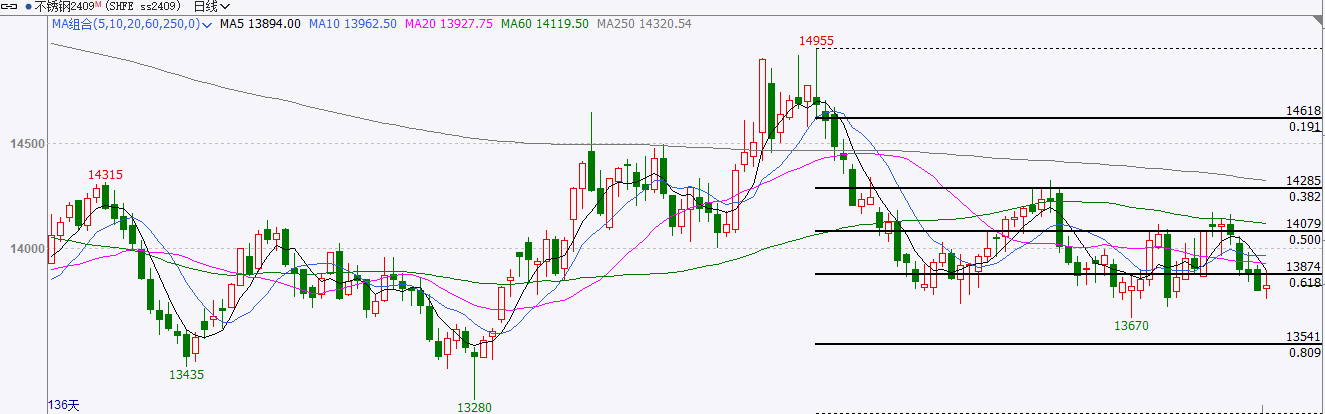

TREND || Instead of the Expected Peak, There's an Accelerated Decline.

About the Stainless Insights in China, last week, the spot price of stainless steel in the Wuxi market declined weakly, and industry speculation was weak. With the decline of domestic and foreign assets last week, investment sentiment was weak, and the stainless steel futures price fluctuated downward. Raw material prices rose, pushing up stainless steel costs, and steel mills' losses deepened. Demand-side has not yet shown significant improvement, and terminal rigid demand purchases, coupled with a slight increase in inventory, have suppressed price increases. As of Friday, the main stainless steel futures contract price decreased by US$42/MT to US$2065/MT compared to last week.

300 Series: Futures and Spot Prices Decline, Inventory Increases Slightly.

Last week, the quoted price of the 304 market fluctuated downward. As of Friday, the mainstream base price of cold-rolled four-foot stainless steel 304 in the Wuxi region was US$2020/MT, a decrease of US$14/MT compared to the previous Friday; the price of hot-rolled stainless steel was US$2000/MT, a decrease of US$21/MT compared to the previous Friday. The futures market performed poorly last week. In the first half of the week, the futures market was affected by the panic-selling of overseas assets, and the domestic commodity market fell across the board, with the main stainless steel contract falling below the US$2095/MT mark, and market purchasing sentiment cooled down.

However, nickel iron quotations continued to rise, and with strong cost support, traders maintained a firm pricing mentality, and spot prices fell steadily with a limited overall decline. As the futures market fell and bottomed out, coupled with the price reduction of steel mills at the opening, merchants adjusted their quotations downwards. In the future, transactions were more cautious, and end-users were cautious in purchasing, resulting in slow market sales and a slight accumulation of inventory.

200 Series: Positive News and Price Reductions Run in Parallel.

The mainstream base price of cold-rolled stainless steel 201J1 in the Wuxi market reached US$1305/MT, the mainstream base price of cold-rolled stainless steel J2/J5 reached US$1200/MT, and the five-foot hot-rolled stainless steel 201J1 reached US$1275/MT. Prices continued to decline last week. Affected by macroeconomic policies, the decline in raw material copper prices weakened the support for 201. Traders offered discounts to sell more goods during the week, and low-priced resources emerged in the market. Downstream customers were cautious, and the overall transaction atmosphere was relatively light.

400 Series: Supply Pressure Increases, Inventory Accumulates Again.

In the Wuxi spot market, the quoted price for state-owned cold-rolled stainless steel 430 was US$1215-US$1220/MT, and the quoted price for state-owned hot-rolled stainless steel 430 was around US$1125/MT, both of which decreased by US$7/MT compared to the previous week's quotation. Last week, the guiding price for TISCO cold-rolled stainless steel 430 was US$1470/MT, and the guiding price for JISCO 430 cold-rolled steel was US$1625/MT, both of which were flat compared to the previous week's quotation. The futures market fluctuated downward last week, and spot market prices followed suit with a slight decline. After the price decline, transactions did not improve significantly, market confidence was frustrated, downstream purchasing enthusiasm was not high, and market sales were mainly based on low-priced rigid demand.

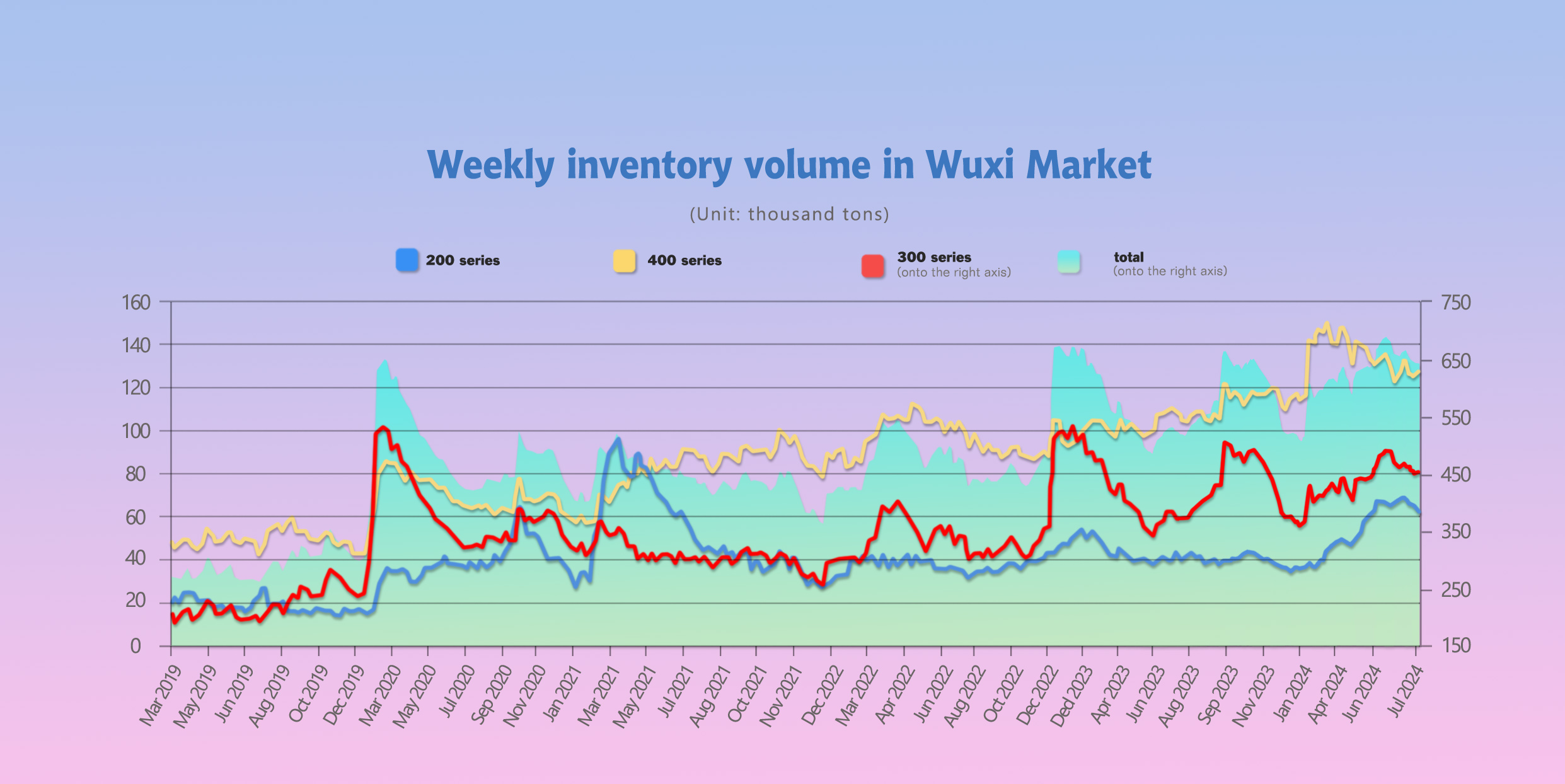

INVENTORY|| Inventory increased by 700 tons.

The total inventory at the Wuxi sample warehouse up by 682 tons to 642,721 tons (as of 8th August).

the breakdown is as followed:

200 series: 3,405 tons down to 61,267 tons,

300 Series: 2,358 tons up to 454,307 tons,

400 series: 1,729 tons up to 127,147 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Aug 1st | 64,672 | 451,949 | 125,418 | 642,039 |

| Aug 8th | 61,267 | 454,307 | 127,147 | 642,721 |

| Difference | -3,405 | 2,358 | 1,729 | 682 |

200 Series: Production limited, inventory decreased.

During the last inventory cycle, affected by the shutdown of Foshan Chengde, the arrival of 200 series resources decreased compared to the previous week, coupled with the continuous reduction of inventory for three consecutive weeks, the overall supply pressure eased. After the release of US economic and employment data last week, the non-ferrous metals sector maintained a downward trend, and copper prices followed suit, weakening the cost support for 201. In the short term, the spot price fluctuated frequently, and traders were cautious about taking goods and downstream purchases, and the market sentiment was mainly wait-and-see. In August, the production of the 200 series decreased, coupled with the boost of expectations for the peak season in September, most merchants maintained an optimistic attitude towards the future. It is expected that the inventory will continue to decrease next week.

300 Series: Commodity market fell across the board, stainless steel weakened and inventory accumulated.

Last week, the main futures price rose sharply and then fell back, and the spot price followed with a slight correction. On the macro side, Japan's interest rate hike caused a panic-selling of global assets, and expectations of a US interest rate hike heated up.

Domestic macroeconomic positives supported, and the sentiment of domestic and foreign capital markets was weak in the short term, and the weakness of the commodity market made stainless steel rise weakly. With the decline in prices, the current valuation is at a low level, raw material prices have risen, stainless steel costs have increased, steel mills' losses have deepened, and August production has been reduced to support prices, coupled with the impact of Delong's bankruptcy and reorganization on subsequent production, the overall supply pressure has eased somewhat. On the demand side, as prices continue to decline and then weaken, the expectations of the peak season and the weak reality are in a game, and end-users are strongly cautious, rigid demand is cautious in purchasing, and speculative demand is poor, and the supply and demand pattern has not yet improved substantially. It is expected that inventory will increase slightly next week. (Note: Considering the warehouse receipt resources, the social inventory and warehouse receipt inventory of 300 series cold-rolled steel in the Wuxi region last week was 37.01 million tons, an increase of 0.01 million tons compared to the previous week, an increase of 0.03%; compared with the same period last year, it increased by 14.19 million tons, an increase of 62.16%)

400 Series: Capacity increased, inventory accumulated.

During last week, the arrival of steel mill resources increased, and the amount of resources available in the market increased; with the previous decline in the price of 430, after a short period of concentrated replenishment by downstream, transactions became weak again, and the inventory digestion pace slowed down, and market transactions were mainly low-priced resources, and spot inventory turned from decreasing to increasing. The continuous decline of high chromium on the raw material side weakened the cost support for 430, and the prices of both cold-rolled 430 and hot-rolled stainless steel declined last week. Based on the current raw material prices, steel mills are still in a loss-making state. In August, steel mill production remained at a high level, coupled with the fact that some of Tsingshan's 300 series were converted to 400 series, and production capacity increased significantly. In the future, the market supply pressure will not decrease; while the demand side continues to be weak, and downstream purchases are cautious, the supply and demand contradiction has not been alleviated in the short term. It is expected that inventory will continue to accumulate next week.

RAW MATERIAL || Nickel Iron Market Supply is Tight, Prices Rise Steadily.

Last week, the ex-factory price of high-grade ferro-nickel continued to trend stronger, reaching US$144/nickel point as of Thursday, up US$2.1/MT unit from the previous Thursday.

Last week, SHFE nickel fell weakly. As of Thursday's close, the main SHFE nickel contract closed at US$17,912/MT, down US$714 or 3.83% from the previous Thursday.

The supply of Indonesian ferro-nickel remains tight. Although quotas were approved in June, nickel ore still maintains a high premium. Some factories have purchased a large amount of Philippine nickel ore to maintain production, and ferro-nickel has strong cost support. As the stainless steel industry is about to enter the traditional peak season of September and October, steel mills have increased production in August, leading to increased demand for raw materials. It is expected that ferro-nickel prices will remain stable and strong in the short term.

Another major raw material, high-carbon ferrochromium, has a mainstream ex-factory quotation of US$1211-US$1225/50 reference ton, with some regions decreasing by US$7 compared to the previous week's quotation. With the decline in coke prices last week, the comprehensive production cost of high-carbon ferrochromium has decreased, but the loss situation of high-carbon ferrochromium production enterprises has not been significantly alleviated.

From the supply side, the market supply pressure remains relatively large in August. According to statistics, in July, the total domestic output of high-carbon ferrochromium was about 803,600 tons, a month-on-month decrease of about 20,500 tons, a decrease of 2.49%. Although there has been a decrease, it is still at a high level of over 800,000 tons. Recently, the mainstream quotation of high-carbon ferrochromium has continued to decline, and factory losses have intensified, forcing the price of chromium ore to decline slightly, and costs have eased slightly, increasing the wait-and-see attitude in the high-carbon ferrochromium market, but the pace of production decline has slowed down.

Although the price of high-carbon ferrochromium remains weak and stable at present, due to the fact that the market supply exceeds demand has not changed significantly, the price support in August remains weak.

SUMMARY || Stainless steel social inventories have resumed accumulation, and steel mills' losses have deepened.

Last week, stainless steel prices trended weakly, raw material prices remained high overall, steel mills' production profits were further inverted, the overall market transaction atmosphere weakened, downstream consumer demand was unsatisfactory, traders offered discounts and promotions, social inventories accumulated again, and the momentum of warehouse receipt reduction weakened. The future will focus on the speed of social inventory reduction and the subsequent production and arrival rhythm of steel mills. It is expected that stainless steel prices will fluctuate in the future.

300 Series: Currently, the cost of stainless steel is relatively firm, and steel mills' production is still maintained at a high level. The supply pressure in the future still exists, and inventory may increase. On the macro side, due to the significant appreciation of the RMB, the demand side may be affected this month, and the supply-demand contradiction is difficult to alleviate. It is expected that the spot price of 304 cold-rolled steel will fluctuate in the short term.

200 Series: Driven by the expectations of "Golden September, Silver October" and the reduction of supply pressure, some traders remain optimistic about the future market, and spot prices are relatively firm. However, the continuous decline in the futures market and the weak support from the raw material end have made consumers cautious about 201, and their acceptance of high-priced resources is not high. Under the tug-of-war between supply and demand, the trading atmosphere is poor. It is expected that the price of 201 will remain stable to weak in the short term.

400 Series: In August, steel mills' production was maintained at a high level, coupled with the fact that some of Qingdao's 300 series production capacity shifted to 400 series, and production capacity increased significantly. The market supply pressure will not decrease in the future. The demand side continues to be weak, and downstream purchases are cautious. The supply and demand contradiction has not been alleviated in the short term, but after mid-August, the market will gradually enter the peak demand season, and the steady growth policy is expected to be further intensified, and downstream demand is expected to be released. It is expected that the price of 430 will continue to maintain a weak and stable operation in the short term.

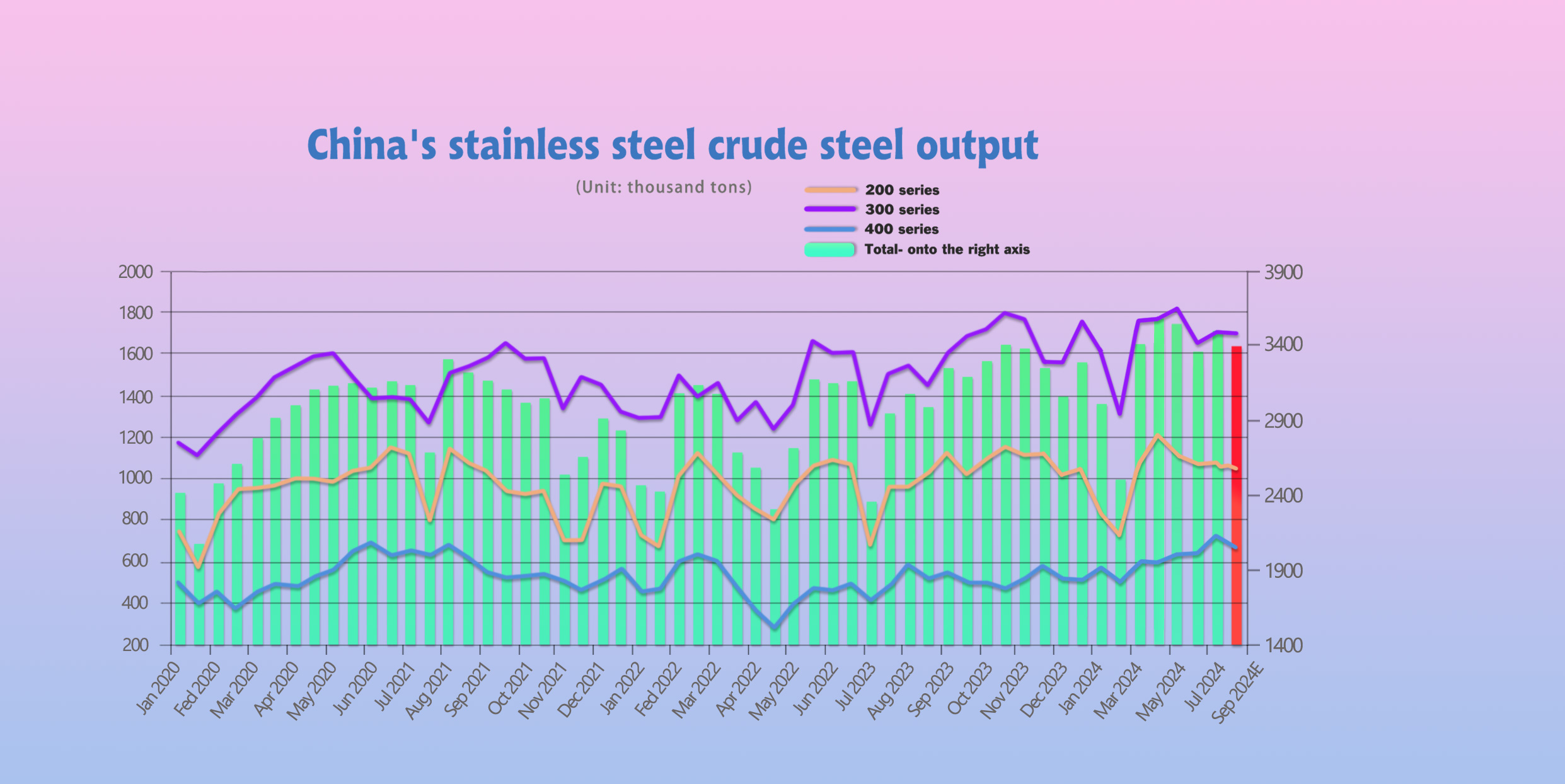

PRODUCTION || Stainless Steel Crude Steel Output Expected to Decrease 5.85% Month-on-Month.

In July 2024, the crude steel output of large-scale stainless steel enterprises in China was 3.4611 million tons, a month-on-month increase of 107,800 tons, or 3.22%, and a year-on-year increase of 173,500 tons, or 5.28%. The output of various series in July varied.

The specific output details for each series are as follows:

200 Series production was 1.0588 million tons, a month-on-month decrease of 7,600 tons, or 0.71%, and a year-on-year decrease of 26,500 tons, or 2.44%.

300 Series production was 1.6903 million tons, a month-on-month increase of 43,400 tons, or 2.64%, and a year-on-year decrease of 21,000 tons, or 1.23%.

400 Series production was 712,100 tons, a month-on-month increase of 72,000 tons, or 11.25%, and a year-on-year increase of 221,000 tons, or 45%.

According to statistics, the global economy is slowing down, and the sentiment in the commodity market is depressed. Stainless steel prices have fluctuated downward along with the broader market. As global assets have experienced panic-selling, the cautious sentiment of end-users has increased, and their willingness to purchase has decreased. Steel mills' long-term order intake has been insufficient. The price of nickel iron has continued to strengthen, production costs have shifted upward, and steel mills' profits have contracted again. Currently, at the low valuation of spot prices, steel mills have taken the initiative to reduce production to support prices, coupled with Delong's application for bankruptcy reorganization, which has affected future production. In August, steel mills' production is expected to decline slightly compared to July. According to statistics, the estimated production of the 200 series in August is 1.0413 million tons, the 300 series is 1.6917 million tons, and the 400 series is 665,500 tons, with a total production of around 3.3985 million tons, a month-on-month decrease of 5.85% compared to July and a year-on-year decrease of 4.30% compared to last year.

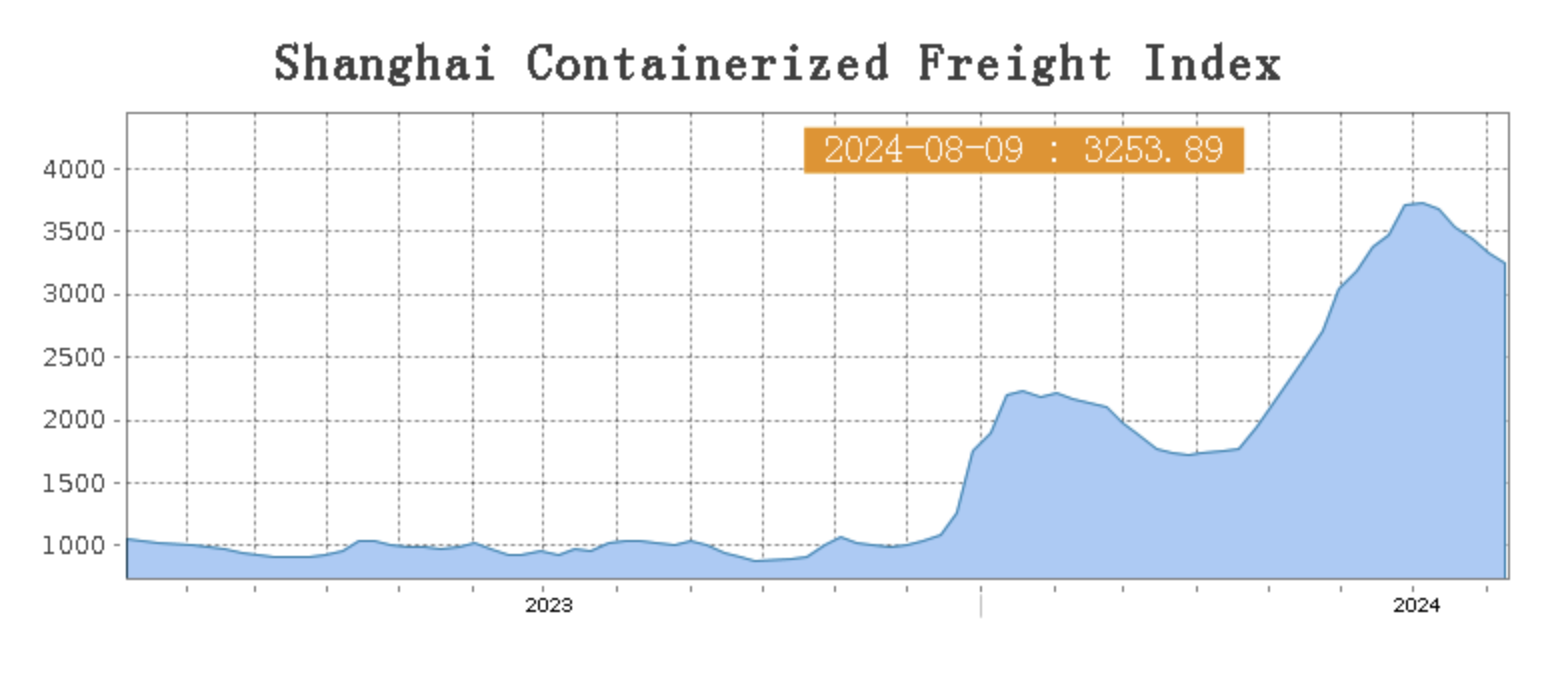

SEA FREIGHT || Freight rates Continue to decline.

Last week, the Chinese export container shipping market continued its adjustment trend. The momentum for further growth in transportation demand was lacking, and freight rates on most routes declined, leading to a decrease in the composite index.

According to the latest data released by the General Administration of Customs, China's exports in US dollar terms grew by 7% year-on-year in July, and China's total import and export volume for the first seven months reached a new historical high for the same period. On 9th August, the Shanghai Containerized Freight Index dropped by 2.4% to 3253.89.

Europe/ Mediterranean:

Currently, the transportation market faces numerous risk factors, including a tense geopolitical situation and Sino-European trade relations. The Asia-Europe route will continue to face significant uncertainty in the near future. Last week, transportation demand growth was weak, and market freight rates continued to decline.

On 9th August, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$4786/TEU, which dropped by 2.5%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$4733/TEU, which decreased by 5.3%.

North America:

The US unemployment rate rose to 4.3% in July, the highest level since October 2021, sparking concerns about a future US economic recession. Last week, transportation demand continued to slow down, and the supply-demand fundamentals lacked support, causing the market freight rates to continue to adjust.

On 9th August, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$6068/FEU and US$9083/FEU, both are reporting 2.8% slide accordingly.

The Persian Gulf and the Red Sea:

On 9th August, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 0.4% from last week's posted US$2208/TEU.

Australia/ New Zealand:

On 9th August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1776/TEU, a 12.3% lift from the previous week.

South America:

On 9th August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$7987/TEU, an 1.5% increase from the previous week.