Stainless Insights in China from September 16th to September 20th

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,175 | -2 | -0.12% |

| Foshan | 2,220 | -2 | -0.11% | ||

| Hongwang | Wuxi | 2,075 | -5 | -0.25% | |

| Foshan | 2,070 | -1 | -0.06% | ||

| 304/NO.1 | ESS | Wuxi | 1,995 | -5 | -0.26% |

| Foshan | 1,995 | -5 | -0.26% | ||

| 316L/2B | TISCO | Wuxi | 3,750 | -24 | -0.66% |

| Foshan | 3,835 | -10 | -0.26% | ||

| 316L/NO.1 | ESS | Wuxi | 3,585 | -23 | -0.66% |

| Foshan | 3,610 | -10 | -0.28% | ||

| 201J1/2B | Hongwang | Wuxi | 1,295 | -24 | -2.00% |

| Foshan | 1,290 | -18 | -1.51% | ||

| J5/2B | Hongwang | Wuxi | 1,180 | -18 | -1.66% |

| Foshan | 1,185 | -18 | -1.65% | ||

| 430/2B | TISCO | Wuxi | 1,185 | -4 | -0.34% |

| Foshan | 1,200 | -5 | -0.44% |

TREND || Trading Stagnant During Holidays, Typhoon Delays Production and Shipment.

Last week, the spot and futures prices of stainless steel in the Wuxi market fluctuated. Industry speculation was relatively strong. The arrival of steel mill goods decreased, and some goods were piled up on the road due to adverse weather conditions. However, overall market demand was weak, mainly driven by rigid demand, and inventory increased slightly. Currently, prices have fallen to a low valuation level, coupled with the Fed's interest rate cut stimulating investment sentiment, helping prices rebound. As of last Friday, the main contract price of stainless steel increased by US$2/MT to US$2050/MT compared with last Friday, an increase of 0.11%.

300 Series: Post-holiday benefits were released, and transactions improved slightly.

Last week, the 304 market price weakened slightly. As of Friday, the main base price of cold-rolled four-foot 304 private in Wuxi was US$2025/MT, down US$7 from last Friday; the price of hot-rolled stainless steel remained at US$1995/MT. After the holiday, the futures market fluctuated, and steel mills and agents had a strong willingness to maintain prices, and spot prices remained stable. Affected by the adverse weather of the typhoon, it was difficult for market merchants to deliver goods, and inventory increased slightly, affecting downstream purchasing sentiment. On Thursday, the Federal Reserve announced its first interest rate cut, and the magnitude of the rate cut exceeded market expectations, which boosted investment sentiment and pushed up futures prices. Terminal transactions improved slightly, but due to inventory pressure and weak demand, most transactions were still dominated by low-priced resources.

200 Series: Macroeconomic benefits boosted market sentiment.

The main base price of cold-rolled 201J1 in the Wuxi market rose to US$1270/MT, the main base price of cold-rolled J2/J5 rose to US$1155/MT, and the main base price of five-foot hot-rolled 201J1 rose to US$1255/MT. Last week, the futures market showed a strengthening trend, and the overall transaction volume of 201 remained at a low level. Raw material prices continued to rise with the macro level, providing relatively strong support for the cost of 201, and downstream customers' purchases were mainly based on rigid demand.

400 Series: Positive news boosted sentiment, and prices may rebound.

In the Wuxi spot market, the quotation for state-owned cold-rolled 430 was US$1195/MT, and the quotation for state-owned hot-rolled 430 was around US$1140/MT. The guiding price for TISCO cold-rolled 430 was US$1500/MT, and the guiding price for JISCO cold-rolled 430 was US$1660/MT, both unchanged from last week.

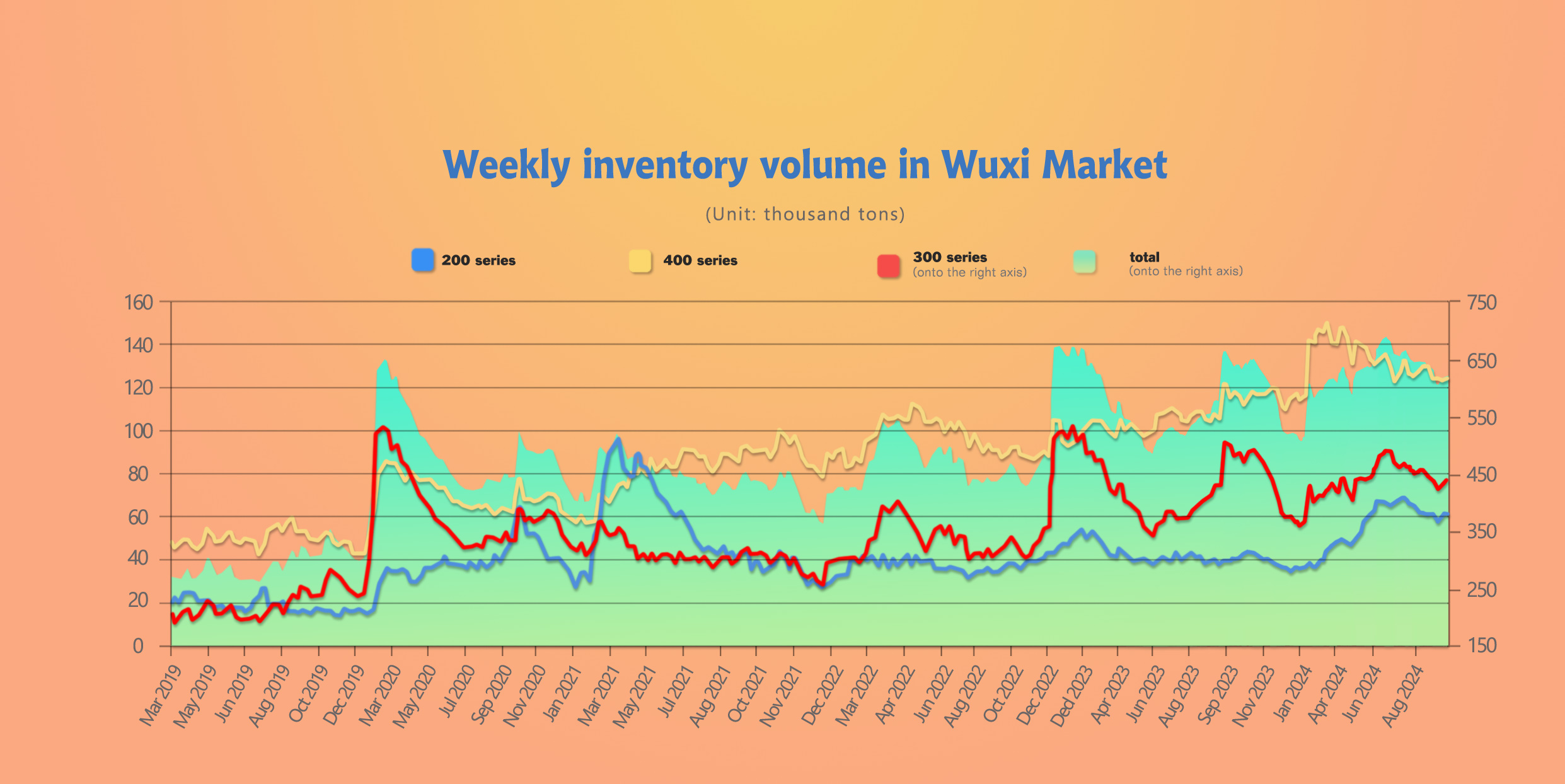

INVENTORY || Slight Increase in Spot Inventory.

The total inventory at the Wuxi sample warehouse up by 8,444 tons to 619,179 tons (as of 19th September).

the breakdown is as followed:

200 series: 121 tons up to 60,575 tons,

300 Series: 7,484 tons up to 434,655 tons,

400 series: 839 tons up to 123,949 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Sep 12th | 60,454 | 427,171 | 123,110 | 610,735 |

| Sep 19th | 60,575 | 434,655 | 123,949 | 619,179 |

| Difference | 121 | 7,484 | 839 | 8,444 |

200 Series: Steel Mill Production Cuts Ease Supply, Inventory Remains Stable.

During the last inventory cycle, the spot price of 201 operated weakly. With the price adjustments of J1 and J2 cold-rolled, market sentiment was mainly pessimistic. Downstream customers were cautious in purchasing, and pre-Mid-Autumn Festival stocking demand was less than expected. The overall transaction volume remained at a low level, and the 200 series inventory has achieved two consecutive increases. On the macro level, affected by key data such as the US unemployment rate, CPI, and PPI, the non-ferrous metals sector fluctuated, and copper prices fluctuated accordingly, weakening the cost support for 201. In terms of steel mills, Beigang New Materials' steelmaking reduction led to insufficient raw material supply, and the Haian plant was shut down for two weeks. Under the tug-of-war between supply and demand, the upside and downside space of 201 prices will be limited in the short term. It is expected that the 200 series inventory will remain stable next week. The focus will be on steel mill pricing and market transaction conditions.

300 Series: Warehouse Receipt Resources Consumed, Weak Supply and Demand for 300 Series.

The last inventory cycle coincided with the Mid-Autumn Festival holiday, futures prices stagnated, and spot prices lacked guidance and operated steadily. The Mid-Autumn Festival holiday, coupled with the invasion of Typhoon Bebinca, brought the market to a near standstill, and the trading atmosphere was poor. TISCO's pre-storage warehouses accumulated significantly, and both cold-rolled and hot-rolled inventories increased slightly. On the supply side, steel mill production was reduced, and the resources from Hongwang have not yet flowed into China. However, as prices weakened, warehouse receipts gradually declined, and the market's available circulating resources have not yet seen a substantial improvement. On the demand side, the "golden September and silver October" did not appear, and current transactions were still dominated by rigid demand and low-priced resources. Speculative replenishment expectations were weak, the supply and demand pattern was weak, and inventory turned from decline to increase, inhibiting the height of price rebound. The current price is at a historically low valuation. As macroeconomic benefits are released and end-user confidence improves, supply and demand will improve. It is expected that inventory will decline slightly next week. Continue to pay attention to subsequent steel mill production and market transaction conditions.

400 Series: Weak Supply and Demand, Slight Increase in Inventory.

Last week, the futures market showed a trend of fluctuating and strengthening, coupled with the release of downstream terminal replenishment demand before the holiday, market sentiment rebounded somewhat. However, due to the impact of extreme weather caused by typhoons, spot transactions were limited, trading volume was low, and inventory increased slightly. The output of 400 series crude steel in August fell from a high level, and the planned production of steel mills in September was further reduced, reducing the amount of goods arriving in the market later, and easing supply-side pressure. The price of high-chromium raw materials remained stable, and cost support still existed, limiting the downward space for prices. With the start of the Federal Reserve's interest rate cut cycle boosting market confidence and the gradual release of domestic and foreign macroeconomic benefits, warming downstream sentiment may drive demand to improve. It is expected that inventory will decline slightly next week. In the future, we will continue to pay attention to inventory changes and market transaction conditions.

RAW MATERIAL || Global Risks for Nickel Intensify.

According to Ferrous Metals Recycling's report on September 9, 2024, challenging factors include oversupply of primary nickel, a slump in China's real estate market, sluggish manufacturing output, and ongoing conflicts in Ukraine and the Middle East. Price volatility is another complicating factor. Like other commodities, nickel prices on the London Metal Exchange have been under pressure and have been declining in recent months. LME nickel futures fell from over $21,000 per ton in May 2024 to $15,600 per ton in late July, reaching their lowest level in three years.

1.Demand Uncertainty

Meanwhile, nickel stocks in LME warehouses have surged from 37,000 tons a year ago to over 120,000 tons in early September. Part of the increase in LME nickel inventories is due to the increased amount of metal from China entering warehouses. However, the increased volatility in nickel prices reflects a shift in the investment landscape, which disrupted equity and commodity markets in early Q3. With unstable manufacturing output, nickel production exceeding demand, and uncertainty surrounding global demand growth and the future course of monetary policy in major economies, investors' risk appetite continues to be affected.

2.Increased Production

According to estimates from Macquarie Insights, global primary nickel production increased by 5.8% year-on-year to 1.76 million tons in the first half of 2024. As in the past, growth was driven by Indonesia and China, where combined primary nickel production increased by 10.8% year-on-year to 1.3 million tons, accounting for nearly 75% of global supply. According to Macquarie's estimates, Indonesia's exports of nickel-containing products (including nickel pig iron (NPI) and nickel in stainless steel) increased by 22% year-on-year to 998,000 tons from January to June 2024. Indonesia's nickel exports alone accounted for 57% of global nickel production in the first half of this year, leading to a supply imbalance and putting pressure on producers in other parts of the world.

SUMMARY || China's September Peak Expectations Likely to Be Disappointed.

Last week, the Federal Reserve announced a 50 basis point reduction in the target range for the federal funds rate, which was a positive for the metals market, and nickel and stainless steel futures rebounded slightly. Last week, the Wuxi area was continuously affected by typhoons, delaying processing and delivery progress. Coupled with the general trading atmosphere after the holiday resumption of work, the "golden September" expectation is likely to be disappointed near the end of the month. Social inventories in the Wuxi area increased last week, and supply pressure increased. The overall feedback from the spot market was generally weak. On the raw material side, the price of high-nickel iron weakened slightly, and high-carbon ferrochrome operated steadily, and the cost support for stainless steel remained, and the inverted cost of steel mills failed to reverse. It is expected that stainless steel will mainly consolidate in the short term.

300 Series: The Federal Reserve's interest rate cut after the holiday boosted market sentiment slightly, and transactions improved slightly. With the release of news about steel mill maintenance and production cuts, supply-side pressure may ease, helping to reduce inventory. It is expected that the spot price of 304 will fluctuate with the futures market in the short term, and attention should be paid to the digestion of inventory.

200 Series: With the boost of macroeconomic interest rate cut policies, the futures market strengthened, driving the improvement of the 201 market sentiment. Coupled with the news of steel mill shutdowns and maintenance, some merchants are optimistic about the future market. However, downstream customers are mainly cautious and choose to purchase at low prices. The short-term downward space of prices is limited.

400 Series: Steel mills currently maintain reduced production, and the planned production in September has been reduced, easing supply pressure. With the approaching National Day holiday, seasonal demand for terminal stocking is strengthening, and the supply-demand contradiction may ease. It is expected that the 430 price will continue to maintain a weak and stable operation in the short term.

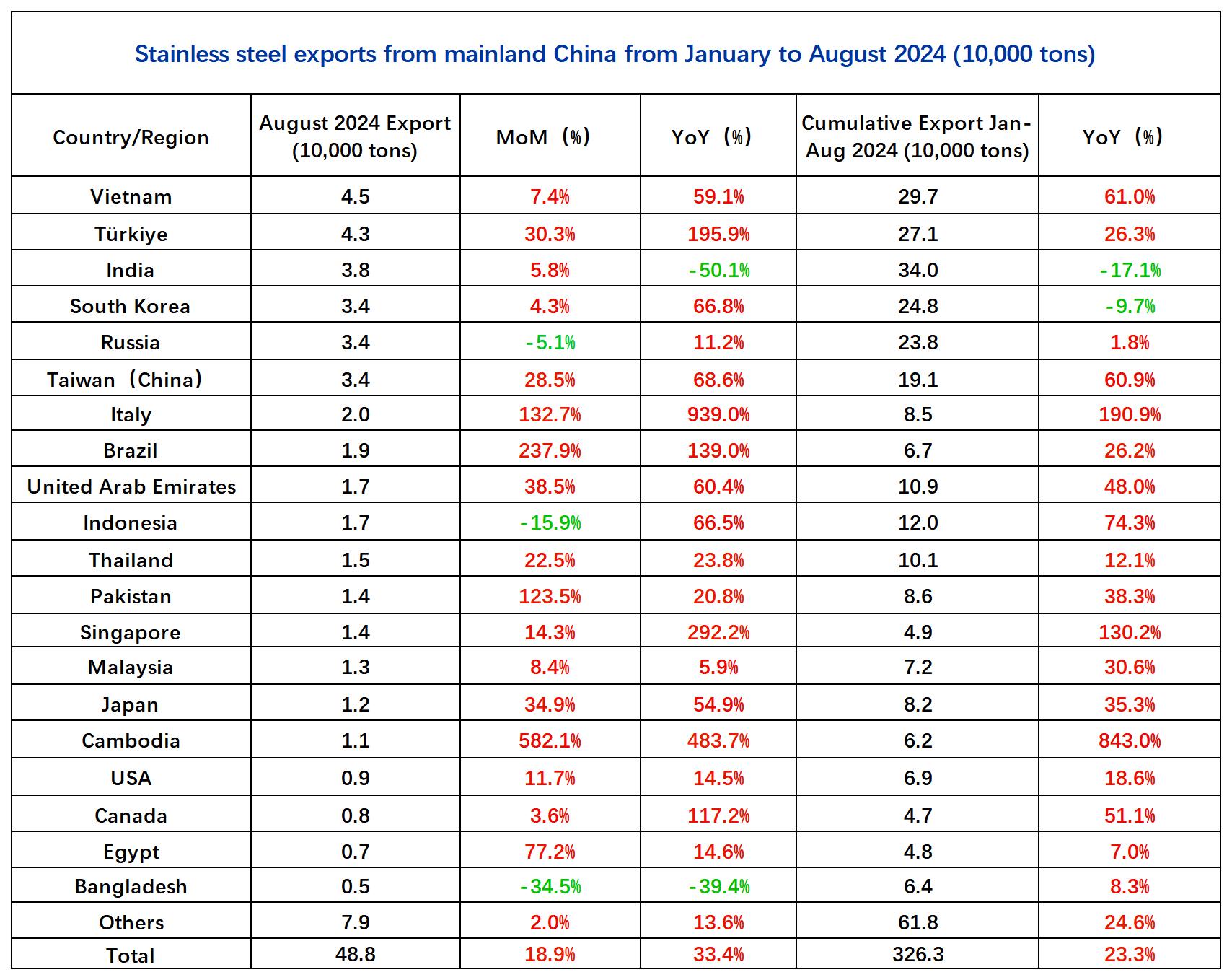

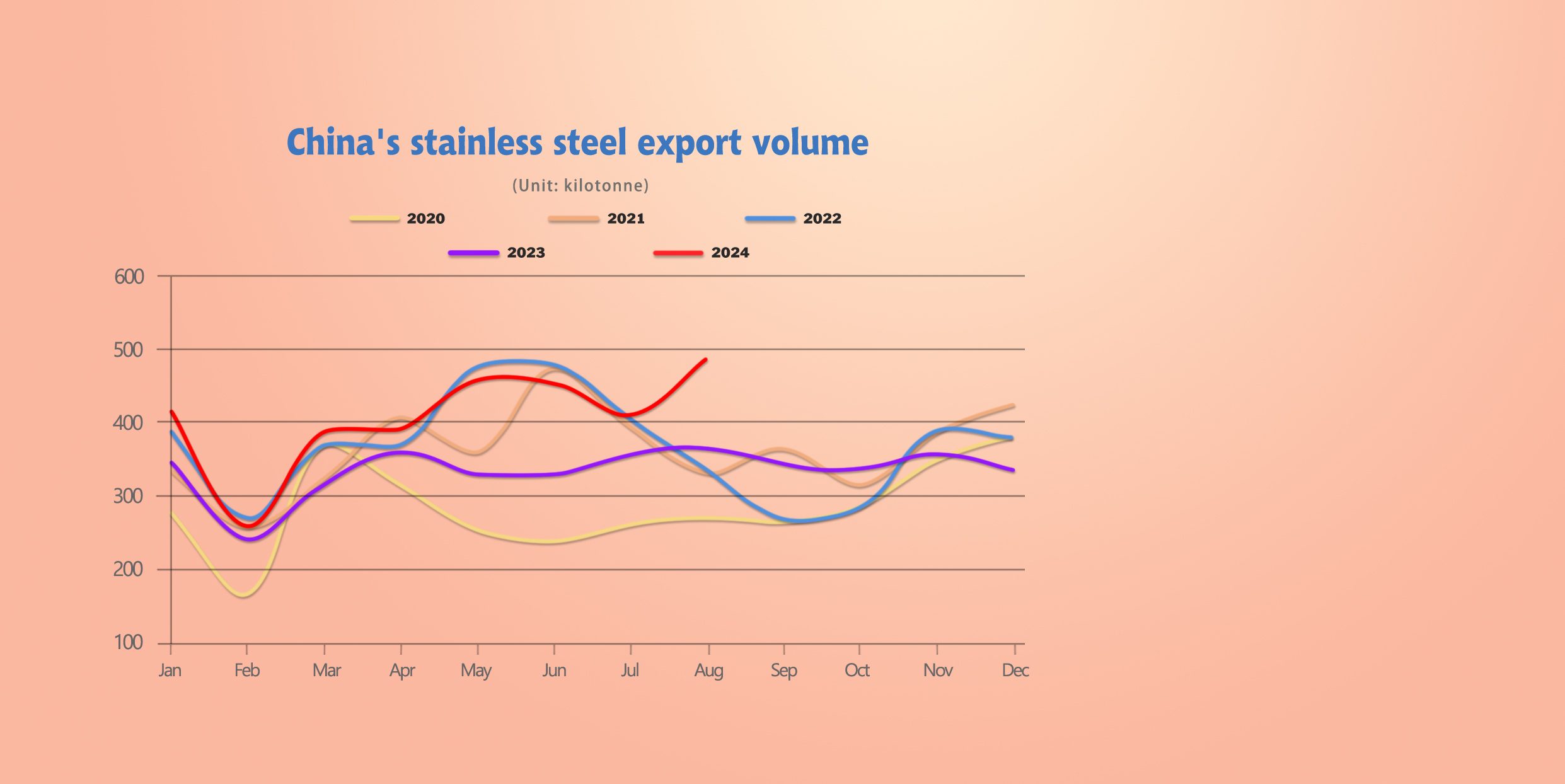

EXPORT || China's August Exports Hit a New High.

According to China Customs data, in August 2024, China's stainless steel exports amounted to approximately 488,000 tons (a new historical high, and previous export data have been updated and revised simultaneously with customs), a month-on-month increase of 77,400 tons, or 18.9%, and a year-on-year increase of 122,200 tons, or 33.4%.

From January to August 2024, China's cumulative stainless steel exports amounted to approximately 3.2633 million tons, a year-on-year increase of 617,700 tons, or 23.3%.

The significant increase in China's stainless steel exports in August was mainly reflected in the increase in coils with a width greater than or equal to 600mm, of which hot-rolled coils increased by 21,000 tons month-on-month, an increase of 22%, and cold-rolled coils increased by 37,000 tons month-on-month, an increase of 19.6%. The main destinations for China's stainless steel exports are India, Vietnam, Turkey, and other regions. In August 2024, the top ten regions in mainland China exported approximately 300,000 tons, accounting for about 61.55%. From January to August 2024, their cumulative exports amounted to approximately 1.965 million tons, accounting for about 60.23%.

Since the beginning of this year, the profit margin of China's stainless steel industry chain has shrunk, and domestic demand has performed poorly. Increasing exports has become a major way for enterprises to get out of difficulties. At the same time, Yongwang in Indonesia has suspended production, and some regions have shifted their procurement demand to China.

In August, the export volume of most regions in China increased. From the regions with a larger month-on-month increase, Brazil increased by 13,000 tons, Italy increased by 1.16 million tons, Turkey increased by 10,000 tons, Cambodia increased by 0.96 million tons, and Pakistan increased by 0.8 million tons.

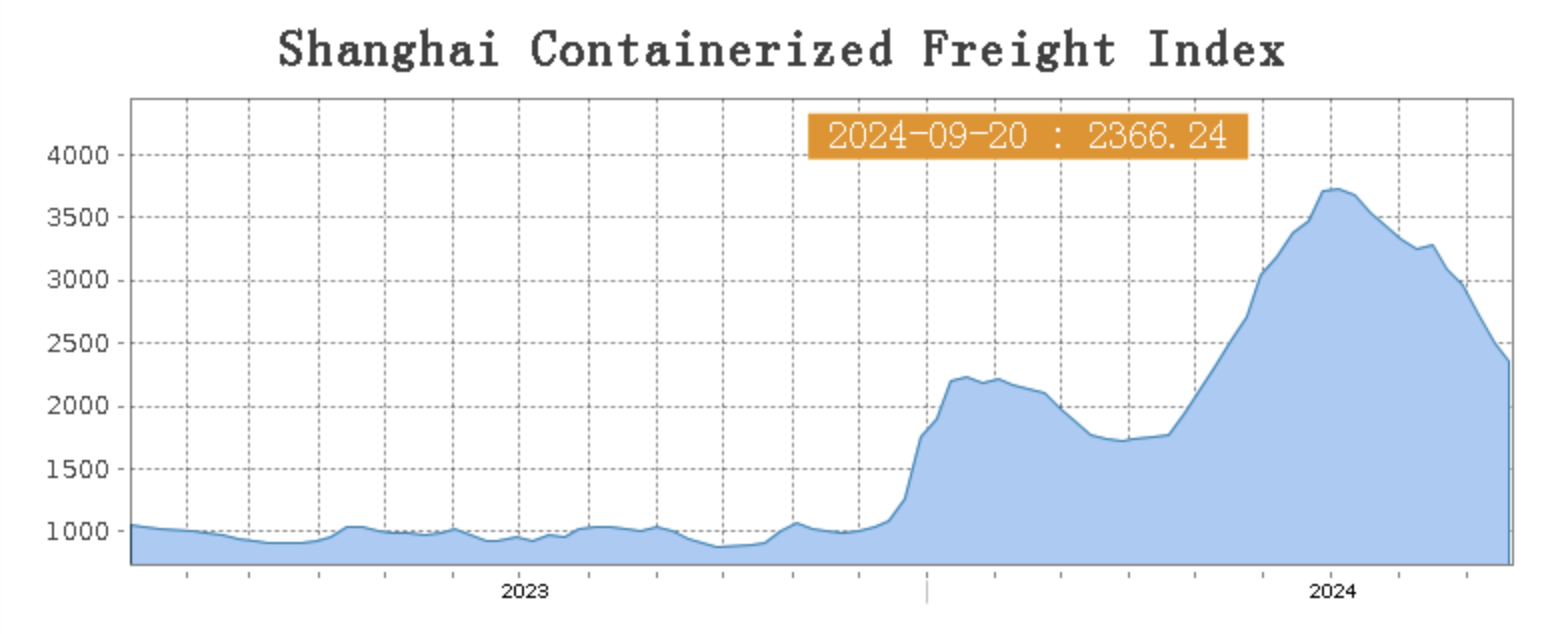

SEA FREIGHT || The transportation market performs weakly, and market freight rates continue to decline.

Last week, China's export container transportation market performed relatively weakly after the short holiday, and ocean freight rates continued to decline, dragging down the composite index. On 20th September, the Shanghai Containerized Freight Index dropped by 5.8% to 2366.24.

Europe/ Mediterranean:

According to data released by the German Institute for Economic Research, the ZEW economic sentiment index for the eurozone fell to 9.3 in September, lower than the previous value and market expectations, reaching a new low since October 2023, indicating that the European economic recovery has shown signs of slowing down. After the EU decided to impose anti-subsidy duties on electric vehicles exported from China, there is a lack of further growth momentum in transportation demand. Last week, the transportation market weakened further, and spot market booking prices continued to adjust. On 20th September, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2592/TEU, which dropped by 8.8%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$2955/TEU, which decreased by 12.2%.

North America:

Due to market expectations of a US port strike, some shippers have chosen to ship their goods early to avoid the impact. Last week, overall market demand was stable, with a slight decline in cargo volume, and spot market booking prices fell, with a more significant decline on the US East Coast route.

On 20th September, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$5341/FEU and US$6486/FEU, both reporting an 2.8% and 5.1% decline accordingly.

The Persian Gulf and the Red Sea:

On 20th September, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 9.3% from last week's posted US$1147/TEU.

Australia/ New Zealand:

On 20th September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$2193/TEU, a 4.3% decrease from the previous week.

South America:

On 20th September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$6990/TEU, an 4.3% drop from the previous week.