Canada will impose 25% tariffs on most stainless steel products, starting on October 15th. China is making an effort to control steel output. Keep reading Stainless Insights in China last week.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,175 | -6 | -0.28% |

| Foshan | 2,220 | -6 | -0.27% | ||

| Hongwang | Wuxi | 2,065 | 0 | 0.00% | |

| Foshan | 2,080 | 0 | 0.00% | ||

| 304/NO.1 | ESS | Wuxi | 2,010 | 1 | 0.08% |

| Foshan | 2,005 | -4 | -0.22% | ||

| 316L/2B | TISCO | Wuxi | 3,730 | -17 | -0.47% |

| Foshan | 3,815 | -8 | -0.23% | ||

| 316L/NO.1 | ESS | Wuxi | 3,560 | -17 | -0.49% |

| Foshan | 3,575 | -16 | -0.45% | ||

| 201J1/2B | Hongwang | Wuxi | 1,335 | -6 | -0.46% |

| Foshan | 1,330 | -8 | -0.69% | ||

| J5/2B | Hongwang | Wuxi | 1,240 | 11 | 1.02% |

| Foshan | 1,230 | -8 | -0.76% | ||

| 430/2B | TISCO | Wuxi | 1,205 | -11 | -1.03% |

| Foshan | 1,220 | -7 | -0.64% |

TREND || Stainless Steel Warehouse Inventories Decline, Steel Mills' Losses Ease Slightly.

Last week, the macro atmosphere improved. The latest minutes from the Federal Reserve meeting indicated that interest rates will be cut for the first time in September, and further cuts may occur later in the year, which is positive for the commodity market. As of Friday, the main stainless steel contract increased by US$11/MT to US$2065/MT for the week, representing a cumulative increase of 0.55%. The main SHFE nickel contract increased by US$396 to US$18765/MT for the week, representing a cumulative increase of 2.19%. Last week, steel mill production decreased, imports continued to decline, and market arrivals decreased, reducing supply pressure; demand recovered slowly, prices fell to low valuations, and some end-users had a stronger willingness to speculate and purchase, improving the supply and demand situation, and inventory decreased slightly.

Steel mill production in August decreased month-on-month, coupled with the continued weakness in import data, easing domestic supply pressure. On Demand Side, Recovery was slow, stainless steel maintained a low level of fluctuation, and downstream markets were mostly cautious and operated cautiously, but peak season expectations still existed, and the supply and demand situation was expected to improve, and inventory was destocked.

300 Series: Futures and Spot Prices Fluctuate, Supply and Demand Recovery Accelerates Inventory Reduction.

Last week, the market price of 304 remained stable. As of Friday, the mainstream base price of cold-rolled four-foot stainless steel 304 in the Wuxi area was US$2020/MT, and the price of private hot-rolled steel was US$2005/MT, both unchanged from the previous Friday. The market fluctuated and explored upward last week. The price maintained a range of US$2035-US$2090/MT last week. The rebound in the commodity market drove the price of stainless steel to rebound from its low point, but the overall fundamentals remained weak, suppressing the upside space. In the second half of the week, as speculative sentiment declined, the price of stainless steel fell sharply on Thursday, and both spot and futures prices fell again. This month, stainless steel imports have declined, coupled with the reduction in steel mill production in August, and market arrivals have decreased; on the demand side, with the decline in prices and the continued existence of peak season expectations, the willingness of end-users to speculate and replenish inventories has increased, and transactions have improved, and inventories have decreased slightly.

200 Series: Continuous destocking, driven by macro factors, the 201 market may usher in a turnaround.

The mainstream base price of 201J1 cold-rolled stainless steel in the Wuxi market reached US$1290/MT, the mainstream base price of cold-rolled stainless steel J2/J5 reached US$1205/MT, and the five-foot hot-rolled stainless steel 201J1 reached US$1270/MT. The price of 201 did not fluctuate last week, and the market showed a trend of rising first and then falling. There was a slight increase in inquiries and transactions for the 201 market. US employment data showed that the current employment situation is weaker than expected, and low bond yields have indirectly confirmed this. This phenomenon has increased the probability of the Fed cutting interest rates in September, and investors favor commodities such as copper. However, both 201 traders and downstream customers were cautious in their purchases, and the overall transaction atmosphere was generally weak.

400 Series: Cost support continued to shift downward.

In the Wuxi spot market, the quotation of state-owned cold-rolled stainless steel 430 was US$1210/MT, a decrease of US$7/MT compared to the previous Friday, and the quotation of state-owned hot-rolled stainless steel 430 was around US$1135/MT. Last week, the guiding price of TISCO cold-rolled stainless steel 430 was US$1475/MT, an increase of US$7/MT compared to last week; the guiding price of JISCO cold-rolled stainless steel 430 was US$1635/MT, which was the same as the previous week's quotation.

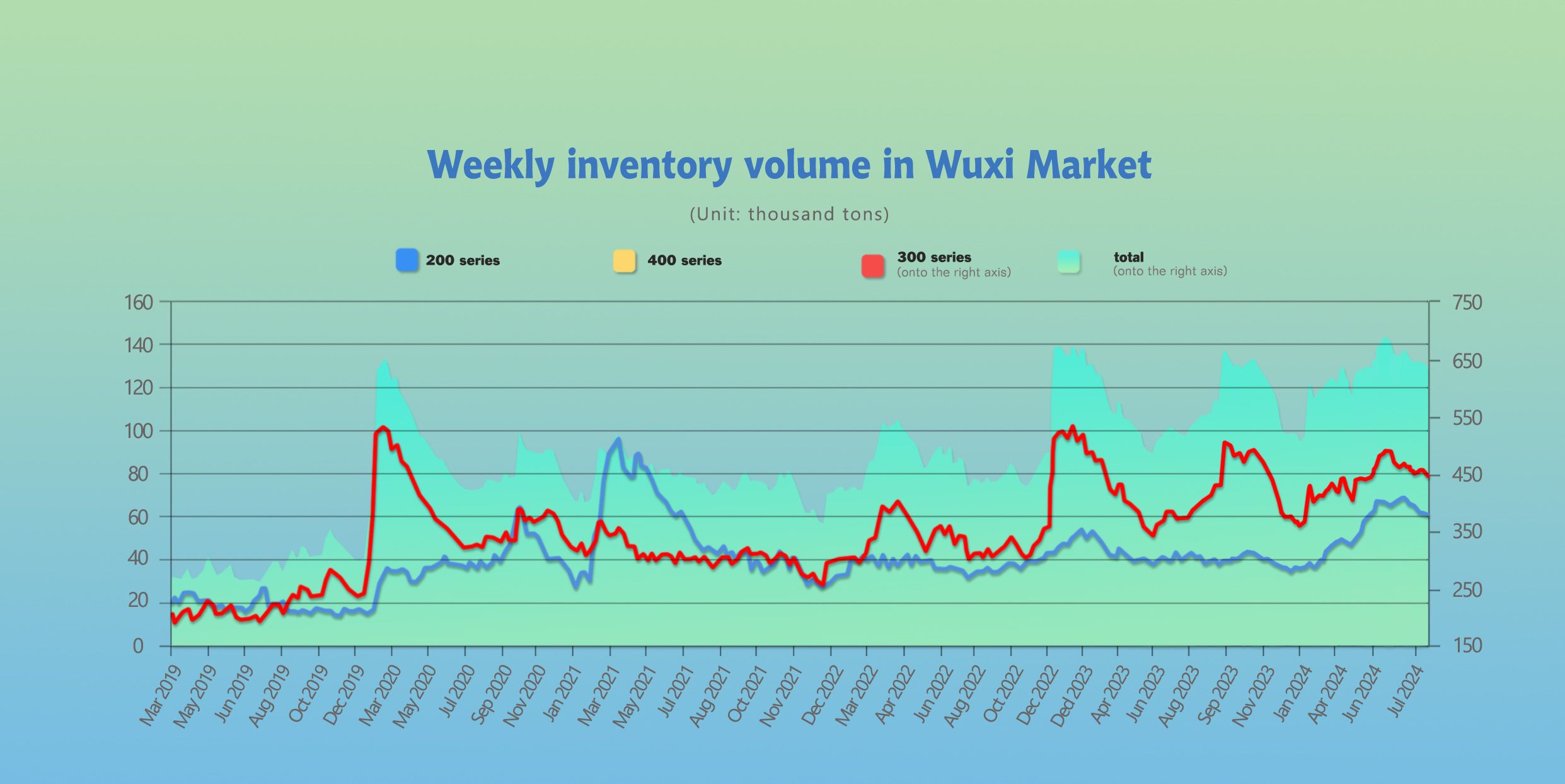

INVENTORY || Inventory Digested Slowly, Decreased by 10,000 Tons Last.

The total inventory at the Wuxi sample warehouse down by 10,175 tons to 631,944 tons (as of 22nd August).

the breakdown is as followed:

200 series: 262 tons down to 60,234 tons,

300 Series: 9,779tons down to 442,707 tons,

400 series: 134 tons down to 129,003 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Aug 15th | 60,496 | 452,486 | 129,137 | 642,119 |

| Aug 22nd | 60,234 | 442,707 | 129,003 | 631,944 |

| Difference | -262 | -9,779 | -134 | -10,175 |

300 Series: Strong Continued Imports.

During last week, the main futures price rebounded from the bottom, and spot prices remained stable. On the macro front, the latest minutes from the Federal Reserve meeting indicated that interest rates will be cut for the first time in September, and further cuts may occur later in the year, boosting sentiment in the commodity market and increasing investment intentions. Domestic macro policies continue to exert force, monetary policy is loose, and positive news about real estate continues to emerge, leading to a gradual recovery and rebound in related industries. Steel mill production in August decreased month-on-month, coupled with the continued weakness in import data, reducing market arrivals and easing domestic supply pressure. Demand recovered slowly. As time goes by, the transition from the off-season to the peak season has led to increased expectations for replenishing inventories, coupled with the current low valuation of prices, and the willingness to purchase has improved, improving the supply and demand situation and leading to destocking. Raw material prices have remained stable, with a severe premium on nickel ore and a decline in ferrochrome production.

Cost support has limited the downside space for stainless steel. Currently, prices are operating weakly, and low-priced resources are flowing out. With the release of favorable macro policies and the improvement of fundamentals, it is expected that inventory will continue to decrease slightly next week. The market will continue to pay attention to the subsequent production of steel mills and market transaction conditions.

200 Series: Spot Prices Stabilize, Inventory Decreases Slightly.

Last Friday, the three major steel mills jointly raised prices, and the downward trend eased last week, and market sentiment improved. The revised US employment data boosted investor sentiment, and expectations for a Fed rate cut in September have heated up, but the high inventory of raw material copper and the imbalance between supply and demand have not been significantly improved, and copper prices have declined slightly during the week, weakening the cost support for 201. With the rebound of spot prices, the inquiry volume and transaction volume of the 201 spot market increased, and inventory has decreased for three consecutive months in August. In the short term, the price of 201 may still remain stable. It is expected that there will be continued destocking next week.

400 Series: Tsingshan Shifts Production to 400 Series, Increasing Supply Pressure.

Last week, the price of the 430 market continued to decline. Traders actively destocked during the week, and there was a large margin of concession in actual transactions. Downstream buyers increased their willingness to purchase at low prices, and the situation of low-price transactions improved; however, Tsingshan shifted production to the 400 series, leading to an increase in the production of the 400 series and an increase in market arrivals, increasing supply pressure.

On the raw material side, Tsingshan's bidding price for high-carbon ferrochrome in September decreased by US$28/50 reference month-on-month, and the cost support for 430 gradually shifted downward. Currently, the spot inventory of the 400 series is still at a high level, and effective destocking is difficult to achieve in the short term, and the pressure of supply and demand fundamentals continues to exist, suppressing the upward space of prices. In August, steel mill production declined somewhat, and supply-side pressure eased. Coupled with the approaching of the traditional peak season of "Golden September, Silver October", market sentiment has warmed up, and downstream demand is expected to be gradually released. It is expected that inventory will continue to decrease slightly next week.

Raw Material || Tight Supply of Indonesian Nickel Ore Pushes Up Philippine Nickel Prices.

Last week, the ex-factory price of high-nickel pig iron has slightly lay down, closing at US$142/Nickle as of last Thursday, down US$1.41 from last Thursday.

Last week, SHFE nickel fluctuated, closing at US$18229/MT as of Thursday, down US$106/MT or 0.58% from last Thursday.

This time, the steel mills' purchasing price has been slightly adjusted downward. Recently, stainless steel prices have been operating weakly, and steel mills have suffered severe production losses, which has put pressure on the raw material end, causing nickel pig iron prices to drop. However, the supply of nickel ore in Indonesia is tight, and a large amount of Philippine ore is being purchased externally for production, providing strong support for the cost end. It is expected that nickel pig iron prices will stabilize around US$141/MT in the short term.

The premium for nickel ore is severe, and there has been no significant progress in the approval of RKAB nickel ore in Indonesia, and the tight supply situation of local nickel ore continues. The premium for Indonesian nickel ore continues to rise: due to the tight supply of domestic nickel ore in Indonesia, a large amount of Philippine nickel ore is being purchased. In July 2024, China's nickel ore imports were 3.4851 million tons, a month-on-month decrease of 27.2% and a year-on-year decrease of 30.6%. Among them, 3.2734 million tons of nickel ore were imported from the Philippines, a month-on-month decrease of 25.56% and a year-on-year decrease of 26.2%.

As the rainy season in the Surigao region of the Philippines is approaching, the FOB price of medium-grade nickel ore in the Philippines has increased, pushing up the CIF price in China: the mainstream transaction price of medium-grade nickel ore in the Philippines has risen to 41-42 CIF US dollars/wet ton. The cost support for nickel pig iron is strong, and the current production cost of high-nickel pig iron in China is around US$154/nickel point, with high factory costs and active price support. The supply and demand sides of the high-nickel pig iron market are becoming increasingly differentiated, and it is expected that nickel pig iron prices will fluctuate around the cost level in the short term.

SUMMARY || Steel Mills' Losses Have Eased Slightly.

Social inventories have been destocked last week. Steel mills' August production has decreased compared to the previous month, and imports have also contracted, reducing the supply-side pressure in the market, and the overall supply-demand contradiction has eased somewhat. Raw material prices have weakened slightly under negative feedback last week, but they still remain at high levels, and the degree of inverted profits for steel mills has eased. Currently, spot resources are relatively abundant, while traders still maintain low inventories and have a weak desire to replenish stocks, and the driving force for destocking is insufficient. In summary, raw material prices have remained high overall, and steel mills are still operating at a loss. The current market fundamentals are still in a state of oversupply. In the future, we need to closely monitor the production plans of steel mills on the supply side, the arrival rhythm of the market, and the destocking speed of social inventories.

300 Series: Currently, stainless steel continues to be in a loss-making state, forcing raw material prices to fall back, and stainless steel costs have eased. Under the weak market sentiment about the "Golden September" peak season, steel mills' production in August may be significantly reduced. It is expected that the spot price of 304 cold-rolled steel will fluctuate with the futures market in the short term. Attention should be paid to market transaction follow-up and changes in steel mill production.

200 Series: With the reduction in steel mill production in August and the continuous destocking of the market, the supply pressure of 201 has eased. However, the current inventory level is still at a historical high, and downstream demand has not improved significantly, and a situation of weak supply and weak demand has formed. Under the stalemate between the two sides, the price of 201 has not fluctuated. It is expected that the upside and downside space of 201 will be limited in the short term, and the price of 201J2 will fluctuate around US$1175/MT-US$1250/MT.

400 Series: Although steel mill production has declined in August, the overall production level remains high, supply and demand remain loose, and coupled with high inventory levels suppressing price increases, the price of 430 is under pressure. Given that cost support from the raw material end still exists, it is expected that the price of 430 will continue to maintain a weak and stable operation in the short term. The market will continue to pay attention to steel mill production and market transaction conditions.

Macro || China Government Intervenes to Control Excess Steel Capacity.

On August 23, China's Ministry of Industry and Information Technology issued a notice suspending the steel capacity replacement work, requiring all regions to suspend the publication and announcement of new steel capacity replacement plans from August 23, 2024. This move aims to further deepen the supply-side structural reform of the steel industry and improve the steel industry's capacity replacement policy.

This is the second time that the steel capacity replacement policy has been suspended. In January 2020, the National Development and Reform Commission and the Ministry of Industry and Information Technology jointly issued a document requiring all regions to suspend the publication and announcement of new steel capacity replacement plans, and no new steel projects should be filed, while simultaneously revising the steel capacity replacement measures.

The steel industry's capacity replacement policy was first proposed in 2013, stating that "the steel industry is strictly prohibited from constructing new production capacity projects, and project construction must formulate a capacity replacement plan and implement equivalent or reduced capacity replacement." Since then, it has been continuously modified to control output.

Xu Xiangchun, Director of Shanghai Steel Union Information, said that the initial intention of the steel industry's capacity replacement policy was to limit and reduce capacity. However, in the actual implementation process, enterprises and local governments have adopted various methods to expand capacity in disguise, leading to continuous expansion of steel capacity. Under the current situation of declining demand, excess steel capacity has become more serious. Therefore, suspending capacity replacement is to "slam on the brakes" on capacity expansion.

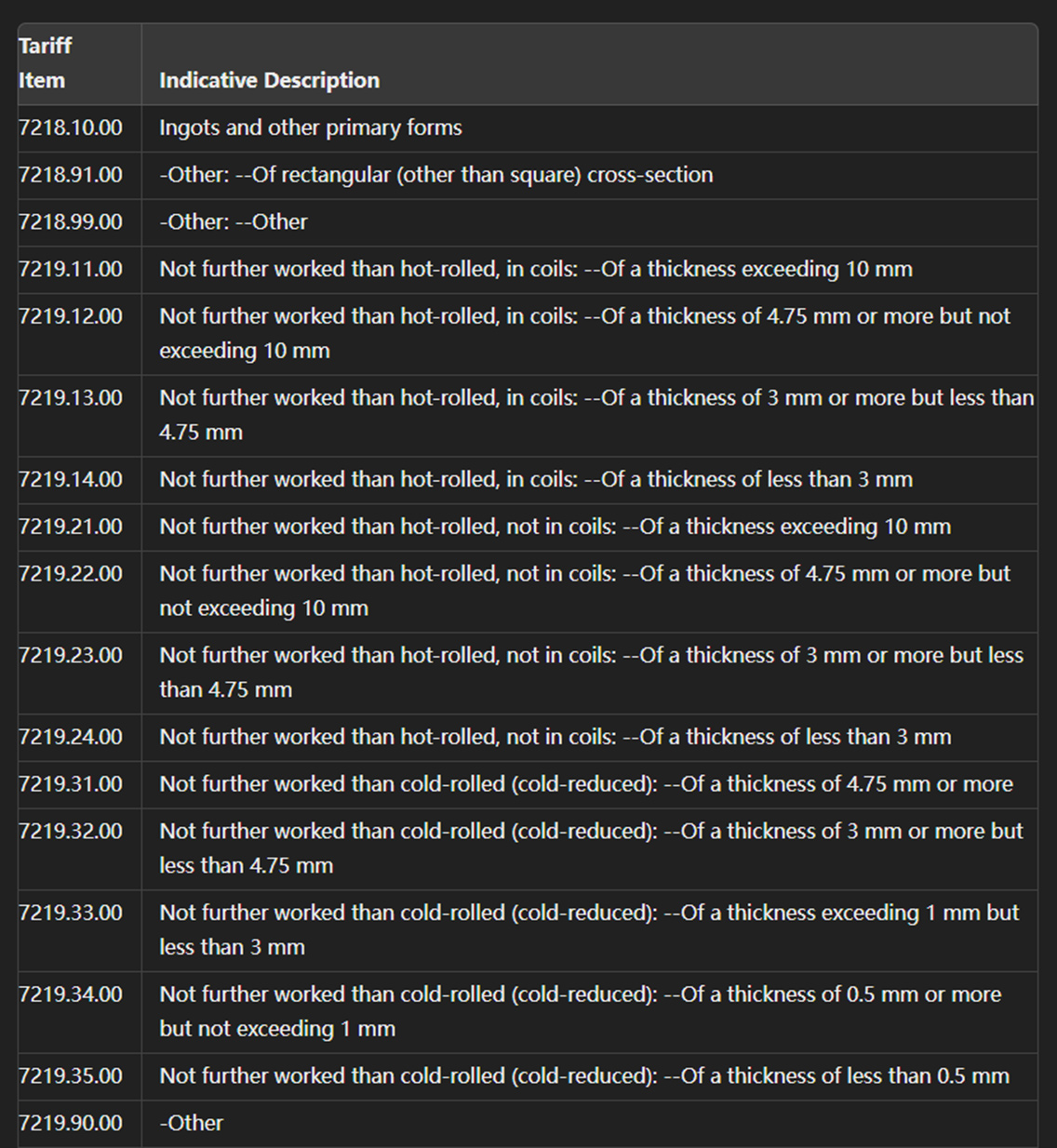

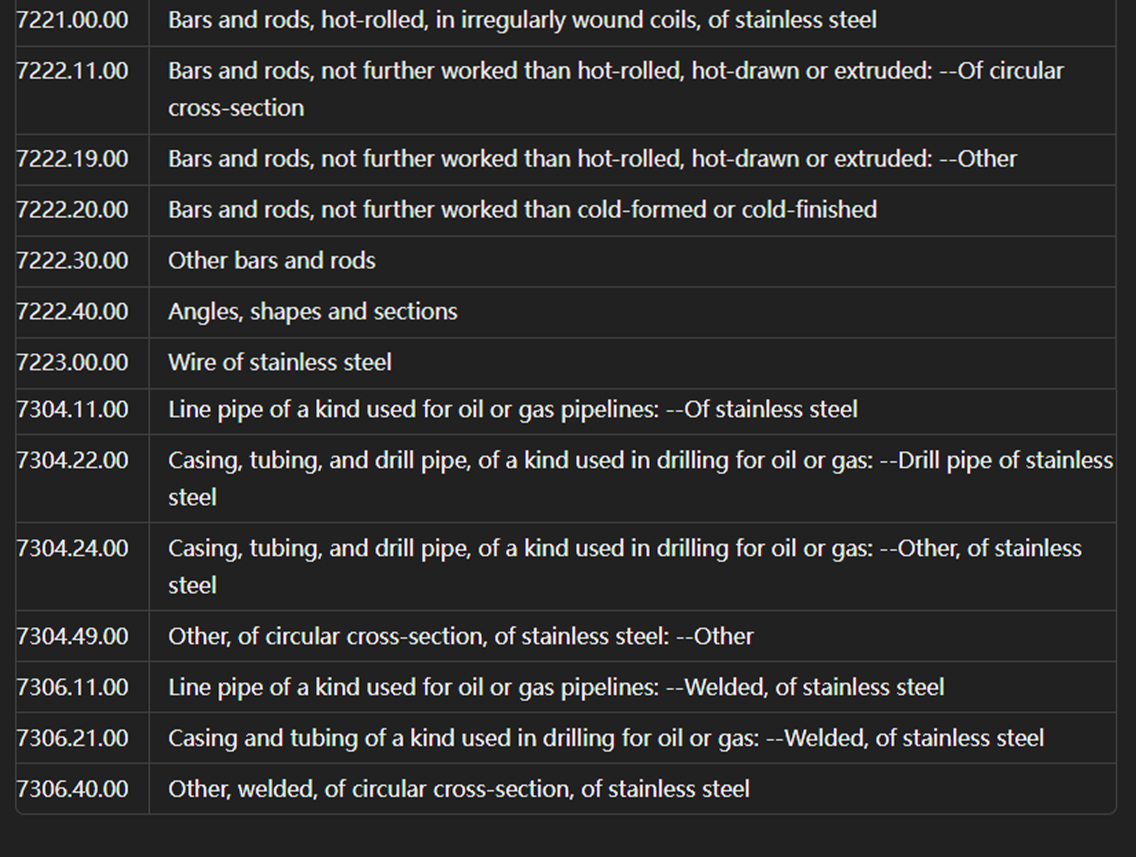

Canada announces 25% tariff on most Chinese stainless steel products.

Canada has announced that, starting October 1 of this year, it will impose a 100% tariff on electric vehicles manufactured in China. Additionally, beginning October 15, a 25% tariff will be applied to steel and aluminum products originating from China.

The stainless steel products affected include mainly cold-rolled and hot-rolled sheets, bars, wire rods, angles, sections, special shapes, seamless pipes, and welded pipes, covering the vast majority of stainless steel products. The initial list of stainless steel-related goods subject to the tariffs is as follows.

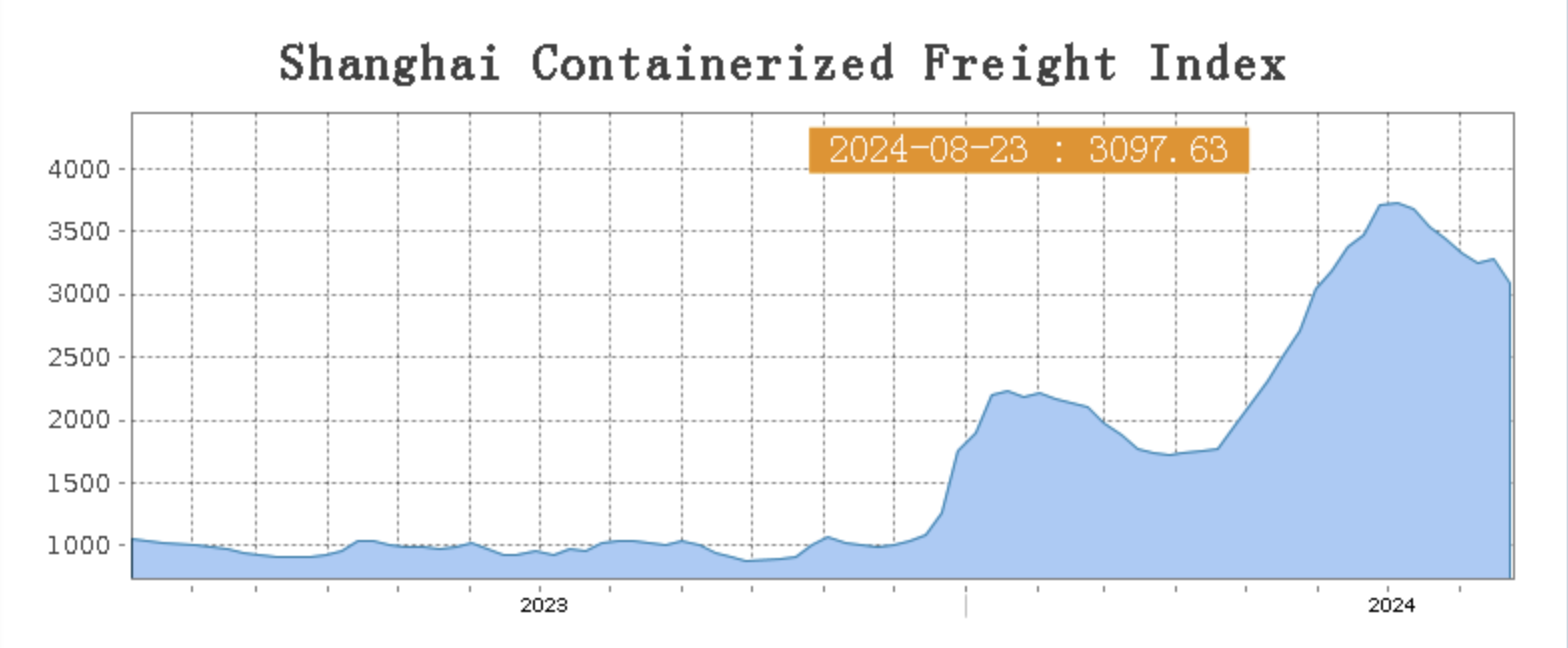

SEA FREIGHT || Freight Rates slid on Various Routes.

This week, the Chinese export container shipping market continued its adjustment trend. The lack of further growth in transportation demand led to a decline in freight rates on most routes, dragging down the composite index.

Last week, the Chinese export container shipping market remained generally stable, with freight rates on major ocean routes fluctuating. The composite index experienced slight fluctuations. On 23rd August, the Shanghai Containerized Freight Index dropped by 5.6% to 3097.63.

Europe/ Mediterranean:

The EU's final decision to impose anti-subsidy duties on electric vehicles exported from China will have a significant impact on future Sino-European trade and the Asia-Europe shipping market. Recently, there have been signs of weakening transportation demand, and market freight rates have continued to adjust.

On 23rd August, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$4400/TEU, which dropped by 4.6%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$4523/TEU, which decreased by 2.6%.

North America:

This week, transportation demand was weak, and the supply and demand fundamentals lacked support. The market failed to sustain last week's price increase trend, and freight rates declined.

On 23rd August, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$5955/FEU and US$8546/FEU, both reporting an 9.5% and 8.1% growth accordingly.

The Persian Gulf and the Red Sea:

On 23rd August, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 7.9% from last week's posted US$1969/TEU.

Australia/ New Zealand:

On 23rd August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$2072/TEU, a 8.4% lift from the previous week.

South America:

On 23rd August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$7562/TEU, an 2.2% drop from the previous week.