WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,295 | 17 | 0.81% |

| Foshan | 2,325 | 17 | 0.80% | ||

| Hongwang | Wuxi | 2,220 | 9 | 0.42% | |

| Foshan | 2,230 | 25 | 1.19% | ||

| 304/NO.1 | ESS | Wuxi | 2,135 | 9 | 0.44% |

| Foshan | 2,155 | 13 | 0.65% | ||

| 316L/2B | TISCO | Wuxi | 4,070 | 44 | 1.12% |

| Foshan | 4,070 | 32 | 0.82% | ||

| 316L/NO.1 | ESS | Wuxi | 3,880 | 32 | 0.86% |

| Foshan | 3,870 | 35 | 0.94% | ||

| 201J1/2B | Hongwang | Wuxi | 1,350 | 3 | 0.24% |

| Foshan | 1,370 | 4 | 0.35% | ||

| J5/2B | Hongwang | Wuxi | 1,230 | 3 | 0.26% |

| Foshan | 1,240 | 6 | 0.52% | ||

| 430/2B | TISCO | Wuxi | 1,245 | 0 | 0.00% |

| Foshan | 1,250 | 0 | 0.00% |

TREND | Stainless Steel Prices Change with the Nickel Market

Stainless steel futures prices fell weakly last week. At the beginning of the week, stainless steel prices fell back after hitting a high and continued to move lower; on Friday, prices dropped on heavy volume, ending the phased upward trend. Starting next week, most downstream sectors will enter the Spring Festival holiday, and overall transactions are weak. On the demand side, attention should be paid to the intensity of domestic macro policy implementation. The main stainless steel futures contract closed at US$2053/MT last week, with a weekly price drop of 3.97% and a weekly high of US$2058/MT; stainless steel spot prices fell by US$22/MT. There were many disturbances in the macro news during the week, causing huge market volatility, and stainless steel followed nickel prices down sharply at the end of the week.

Stainless steel 300 Series: Futures and Spot Prices Consolidate Weakly, Market Enters "Spring Festival Seasonal Inventory Accumulation Channel"

Last week, cold and hot rolled stainless steel 304 prices first fell and then rose. As of Friday, the mainstream base price for four-foot cold rolled stainless steel 304 in the Wuxi area was reported at US$2170/MT, down US$14/MT from last Friday; the price for private hot rolled was reported at US$2125/MT, down US$14/MTfrom last Friday. At the beginning of the week, supported by price hikes from private steel mills and the upward adjustment of Indonesian nickel ore prices, the overall sentiment for futures and spot remained firm. However, after the middle of the week, SHFE nickel retreated simultaneously, and profit-taking positions exited the futures market; the spot market followed the market by offering small discounts. Cold rolled stainless steel prices once fell to the US$2170/MT. Downstream acceptance of high prices was limited, and as the Spring Festival approached and restocking demand came to an end, the market exhibited "prices without transactions" characteristics, with only small orders for rigid demand restocking and overall flat trading.

Stainless steel 200 Series: Prices Fluctuate Narrowly, Inventory Accumulates After Transactions Weaken

During the week, stainless steel 201 prices were mainly stable. After a slight correction in the market, market transactions tended toward cautious observation. Last week, cold rolled stainless steel 201J2 prices moved toward around the US$1200/MT, with some low-priced resources reported at the US$1195/MT for shipment. There was no significant increase in arrivals from steel mills, downstream restocking reached its end, and the holiday mood gradually intensified. Coupled with the market retreat, market transaction volumes were at a low level. Previously arrived resources were difficult to digest quickly, and both stainless steel 201 cold and hot rolled inventories accumulated during the week.

Stainless steel 400 Series: Costs Push Upward as Supply Tightens, Prices Run Mainly Strong

Last week, stainless steel 430 prices remained stable with a leaning toward strength. As of Friday, state-owned cold rolled stainless steel 430 quotes in the Wuxi spot market were US$1250/MT, and state-owned hot rolled quotes were US$1120/MT, both unchanged from last Friday's quotes. During the week, arrivals of Jiuquan Steel resources continued to decrease, and marketable resources were limited. Additionally, the mindset of traders to offer discounts for shipments to recoup funds at the end of the year increased, and market transaction activity was acceptable, resulting in a continuous trace de-stocking of spot market inventory.

Summary

Stainless steel prices fell weakly last week. Social inventory increased again, downstream demand in the traditional off-season is limited, and the willingness to restock is low. Raw material prices performed firmly, providing some support for stainless steel, while warehouse receipts increased again. In the future, it is necessary to monitor subsequent policy support at the macro level, as well as steel mill production plans and changes in raw material prices.

Raw Material | Chrome Ore Maintained an Upward Trend in January

In January 2026, both domestic and international chrome ore prices rose significantly.

In the domestic chrome ore spot market, the price of the main variety, 40–42% South African lumpy ore, rose to US$8.3/MT, with a cumulative increase of US$7.2 in January; the futures price rose to around 297 USD/ton, a cumulative increase of 34 USD/MT in January, an increase of 12.93%. The price of 40–42% Turkish lumpy ore rose to US$9/MT, a cumulative increase of US$0.58/MT in January; the futures price rose to US$310/ton, a cumulative increase of 35 USD/ton in January, an increase of 12.73%.

From the supply side, chrome ore imports have continued to grow recently. Customs statistics show that in December 2025, China imported a total of 2.8247 million tons of chrome ore, an increase of 16.37% month-on-month and 41.81% year-on-year, setting another record high. Since the second half of 2025, domestic chrome ore imports have continued to climb, especially in the fourth quarter when the growth rate of imports accelerated significantly. Chrome ore imports increased by a large margin for three consecutive months from October to December, with a cumulative import volume of 7.473 million tons, a significant year-on-year increase of 2.2257 million tons, a growth rate of 42.42%.

From the perspective of domestic demand in China, high-chromium production has remained at a high level of over 800,000 tons since the second half of 2025. High-chromium production saw a leap in growth in the fourth quarter; cumulative high-chromium production from October to December reached 2.593 million tons, a year-on-year increase of 454,600 tons, a growth rate of 21.26%.

Overall, the continuous high production of domestic high-chromium has expanded the demand for chrome ore, driving the accelerated growth of chrome ore imports. As the Spring Festival approaches, high-chromium production enterprises have concentrated on stockpiling ore before the holiday, further increasing chrome ore demand. Coupled with the strengthening mindset of chrome ore traders to support prices, chrome ore prices have climbed step by step under the influence of multiple factors. At present, the Spring Festival travel rush has started and the holiday is imminent; high-chromium production enterprises are gradually slowing down their raw material procurement and stockpiling, and the upward momentum for chrome ore prices is weakening. It is expected that chrome ore prices will run mainly stable before the Spring Festival.

Nickel: January's Rise Increases Stainless Steel Production Costs by US$29-US$44/MT

In the nickel market, nickel prices showed a volatile upward trend this month, with the core driving forces coming from changes in Indonesian nickel ore policies and macro sentiment. Frequent adjustments to the Indonesian RKAB policy have formed certain restrictions on nickel ore exports, leading to enhanced expectations of tight global nickel ore supply and driving nickel-iron prices higher. At the same time, the escalation of overseas geopolitical conflicts and favorable macro policies have further boosted nickel price trends. The strong performance of nickel prices directly increased stainless steel production costs, especially for 300-series stainless steel, where the cost pressure is more obvious due to higher nickel content. It is estimated that the rise in nickel prices this month caused 300-series stainless steel production costs to increase by approximately US$44/MT, significantly squeezing the profit margins of steel mills.

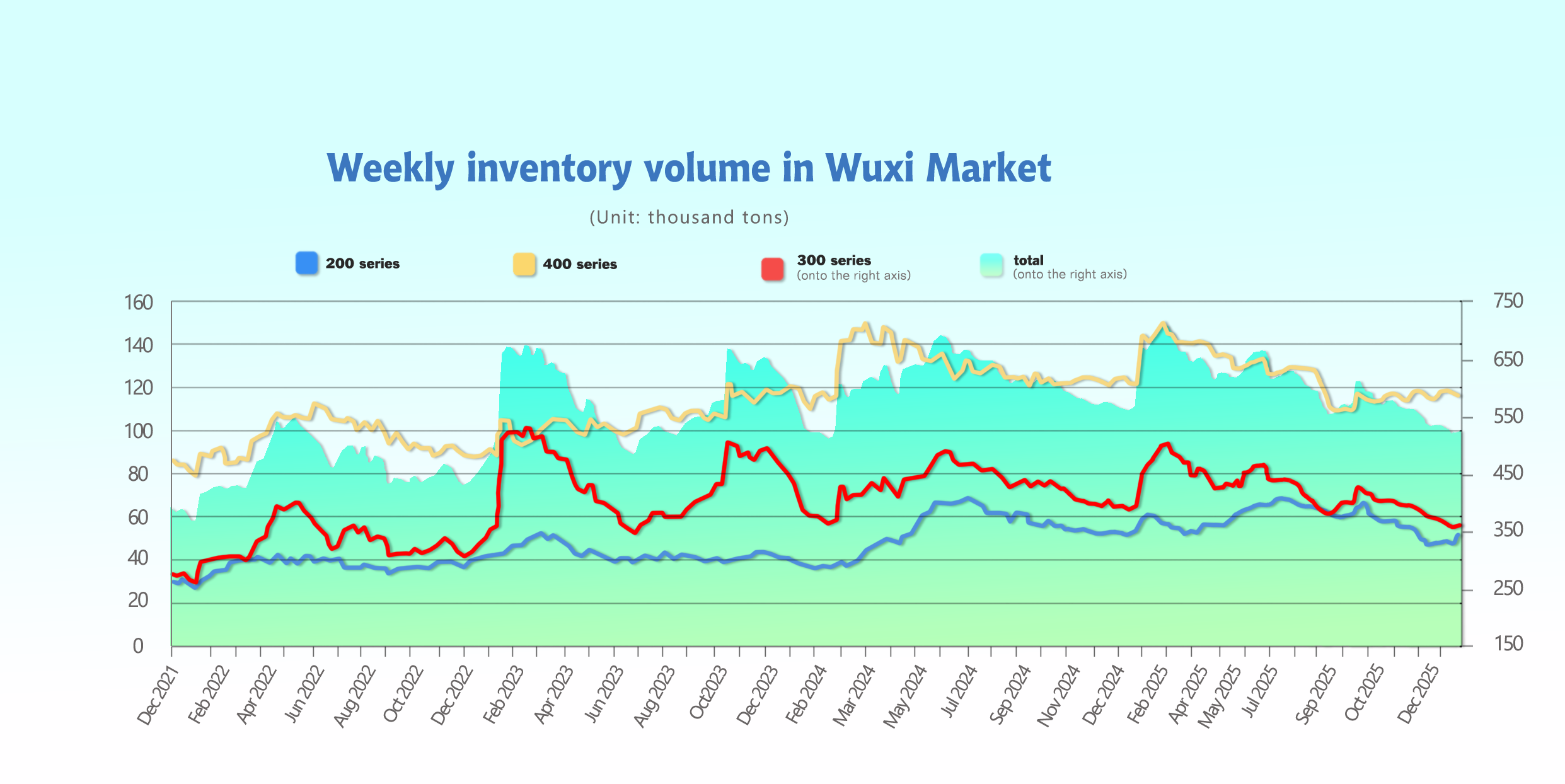

Inventory | Holiday Approaches, 300 Series to Reduce Production by 485,000 Tons

Reported on January 29, statistics show that the total inventory of sample warehouses in Wuxi for this period increased by 6,400 tons month-on-month. During the week, leading steel mills concentrated their arrivals, and downstream restocking entered the final stage; inventories of the 2-series and 3-series accumulated rapidly, with a significant increase in hot rolled. For the 4-series, the rise in high-chromium raw material prices supported costs, market trading activity improved, and inventory saw a trace de-stocking.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Jan 22nd | 46,857 | 356,137 | 117,089 | 520,083 |

| Jan 29th | 51,461 | 360,266 | 114,729 | 526,456 |

| Difference | 4,604 | 4,129 | -2,360 | 6,373 |

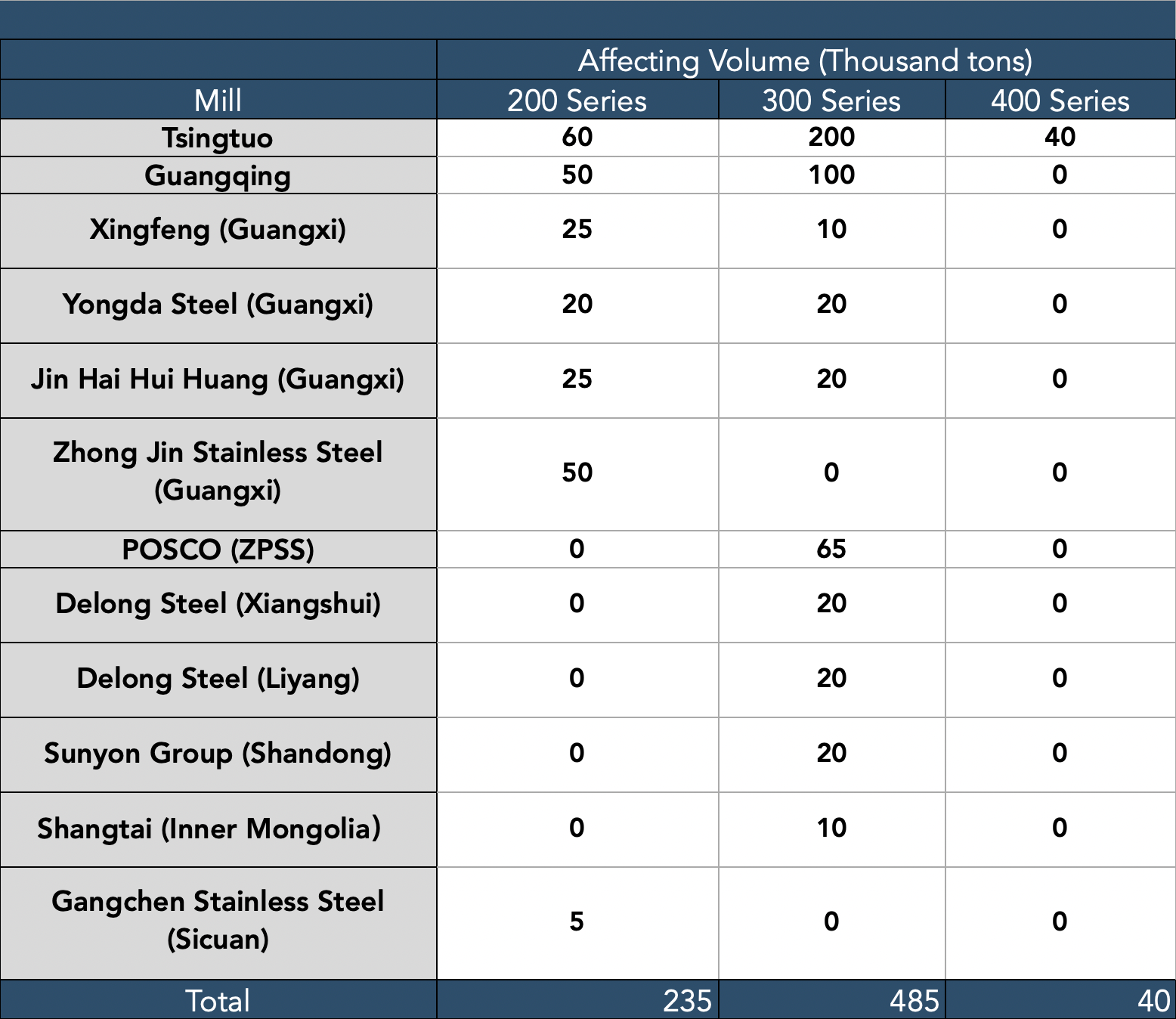

Production Cuts: According to statistics, a total of 12 stainless steel crude steel production enterprises will undergo production cuts and maintenance around the Spring Festival in January and February 2026. This production cut directly led to a local contraction in the supply of stainless steel plates, strengthening the market's expectation of a supply-side contraction. This formed a certain positive support for spot prices and, to some extent, alleviated the pressure of downward price movement at the end of the month.

OUTLOOK | Stainless Steel Prices Under Pressure and Volatile in February and March

In the short term (February–March), stainless steel prices will maintain a volatile and weak trend. Core repressive factors include: first, the continuous pressure of domestic stainless steel inventory and the return of resources due to blocked exports will further intensify the domestic oversupply situation ; second, as the Spring Festival holiday approaches, downstream demand will shrink further, and traders have an urgent need to recoup funds, leading to a strong willingness to actively lower prices for shipments, which will suppress prices ; third, macro risk-aversion sentiment has not yet subsided, and a short-term rebound of the US dollar along with geopolitical uncertainties may further affect futures market sentiment and drag down price trends. At the same time, there are certain positive supports: first, expectations of steel mill production cuts are strengthening, and some mills are joining the ranks of production cuts due to profit squeezes, alleviating supply pressure ; second, the prices of raw materials such as nickel and chromium remain strong, and cost support still exists, which will limit the downward space for prices. It is expected that short-term stainless steel prices will fluctuate within the range of US$2037/MT-US$2154/MT. After the Spring Festival, as downstream demand gradually recovers, prices may see a phased rebound

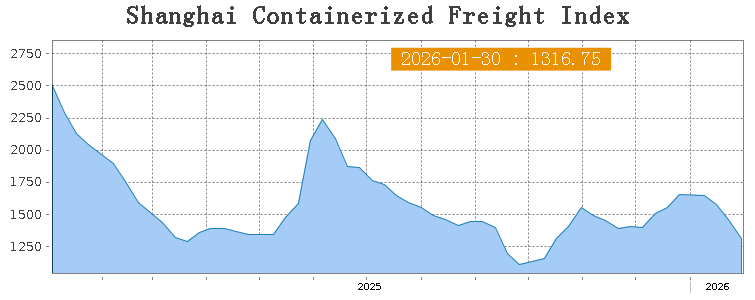

SEA FREIGHT | Freight Rates Continued a Downward Trend

On January 30th, the Shanghai Containerized Freight Index (SCFI) fell 7.4% at 1316.75 points.

Europe/ Mediterranean:

On January 30th, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1418/TEU, which decreased by 11.1%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$2424/TEU, which was downed by 12% from previous week.

North America:

On January 30th, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1867/FEU and US$2605/FEU, reporting 10.4% and 10% loss accordingly.

The Persian Gulf and the Red Sea:

On January 30th, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf plunged 22.6% to US$997/TEU.

Australia & New Zealand:

On January 30th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand decreased by 15.5% to US$870/TEU.

South America:

On January 30th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports fell by 1.9% to US$1131/TEU.