Yellen spoke about overcapacity in China's green energy industries and long before her speech, Beijing had noticed the oversupply problem in the steel industry. On April 3rd, Beijing announced that the regulation on steel production will continue in 2024. This news led to an increase in stainless steel prices after the Qingming holiday, on April 7. The spot price of stainless steel 304 was partially raised by US$42/MT. In 2021 and 2022, Beijing ordered the steel sector not to increase production. The result was that, if you still remember, the prices of stainless steel went sharply during the two years. Of course, there were many reasons contributing to the frantic increase, but the drop in supply certainly was one key cause. What are your opinions? To know more specific analysis and news, please keep reading our Stainless Steel Market Summary in China.

TREND|| Steel mills show strength in maintaining the price despite the market is flooded with supply.

From April 1st to April 3rd, the mainstream quotation for cold-rolled 4-foot mill-edge stainless steel 304 in Wuxi was US$1950/MT, while the price for hot-rolled coil was US$1925/MT. The 316L variety was affected by a significant drop in molybdenum prices and its own weak demand performance, continuing to be under pressure. On April 3rd, the price of hot-rolled 316L coil dropped US$3360/MT-US$3375/MT, and the most traded price of coil from major steel mills was US3405/MT-US$3415/MT. The mainstream price of 316L cold-rolled material was reported at US$3475/MT-US$3500/MT for trimmed coils.

Last week, the spot price of 201 in the Wuxi market mainly saw a slight increase. As of Thursday, the mainstream base price of 201J1 cold-rolled material in Wuxi rose to US$1330/MT, an increase of US$7/MT compared to last Friday; the mainstream base price of J2/J5 cold-rolled material rose to US$1245/MT, an increase of US$14/MT compared to last Friday; the price of 201J1 five-foot hot-rolled material remained at US$1315/MT, unchanged from last Friday.

In terms of spot market in Wuxi, the quotation for cold-rolled stainless steel 430 is around US$1245/MT-US$1255/MT; the quotation for hot-rolled stainless steel 430 is around US$1135/MT, both unchanged from last week.

Recent steel mills still have strong price sentiment, and the market price remains firm. Due to the high cost of orders, metal businesses before the festival also have a certain mentality of holding up prices and are unwilling to sell at a low price. However, the overall market supply is greater than demand, and there is no good news to boost, and the industry sentiment is still weak.

After the Qingming Festival, on April 7, due to the government's proposal to regulate crude steel production again, which may reduce the supply of stainless steel, coupled with the price increase and price limit of steel mills, the spot price of stainless steel 304 was partially adjusted by US$42/MT.

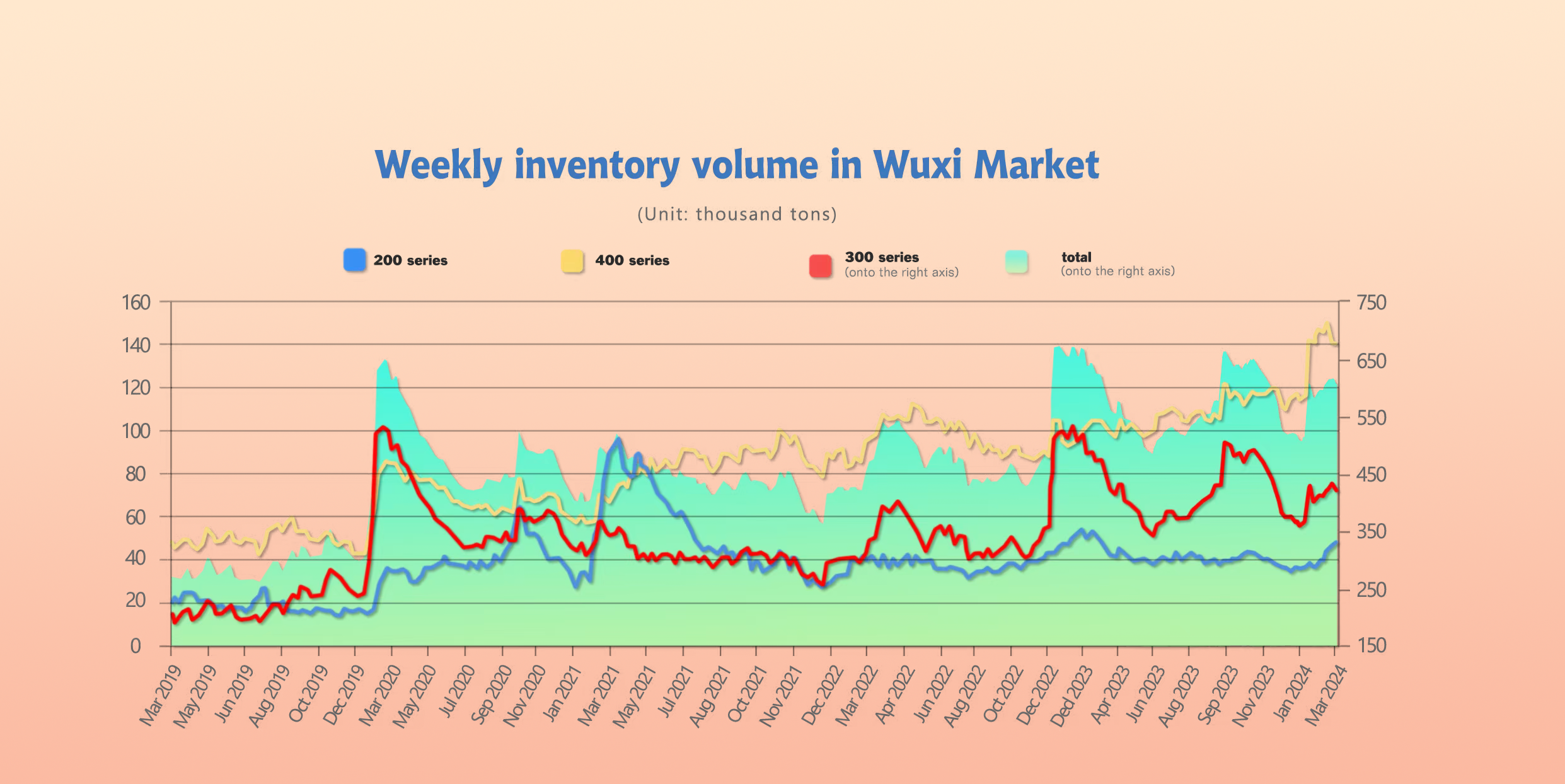

INVENTORY|| Market stock turns to decline finally.

The total inventory at the Wuxi sample warehouse downed by 10,642 tons to 603,523 tons (as of 4th April).

the breakdown is as followed:

200 series: 2,121 tons up to 47,659 tons,

300 Series: 12,170 tons down to 416,754 tons,

400 series: 593 tons down to 139,110 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| March 28th | 45,538 | 428,924 | 139,703 | 614,165 |

| April 4th | 47,659 | 416,754 | 139,110 | 603,523 |

| Difference | 2,121 | -12,170 | -593 | -10,642 |

300 Series: Transactions Improve, Inventory Shows an Inflection Point!

The registered warehouse warrant increased, and some steel mills concentrated on delivery of agents at the end of the month, and the social inventory decreased compared with the previous month. As the cost continues to decrease, the steel mills continue to be in a state of loss, and the subsequent production may be reduced. It is expected that the inventory will continue to be destocked next week, and the subsequent production of steel mills and the recovery of market demand will continue to be monitored.

200 Series: Inventory continues to Increase.

During last week, market sentiment has been repaired due to the rebound of futures. There is no sign of production reduction in steel mills in April, the supply pressure still exists, and the market digestion capacity is still weak, which may lead to the continued accumulation of inventory in the future. The focus in the future will be on the production of steel mills and the arrival of goods in the market.

400 Series: Hot-rolled 430 Destocking Significantly.

The market quotation of 430 cold-rolled was weak and stable last week. At present, the inventory pressure of traders is relatively high, and they actively destocked to recover funds. Due to the high cost of raw materials, steel mills have different degrees of losses, and the willingness to increase prices has continued to strengthen. However, downstream purchases are still mainly based on demand. In view of the current high inventory of the 400 series, it is expected that the price will be weak and stable in the short term.

Raw Materials: Ferromolybdenum Prices Fall Rapidly, High Chromium Rises.

Ferromolybdenum prices have fallen rapidly recently. The bidding price of Tsingshan on Monday fell to US$29,840/MT, and the bidding price of Baosteel on Tuesday fell to US$28,995/MT-US$29,280/MT. At present, the cost inversion of Ferromolybdenum is relatively serious, and the price of raw molybdenum concentrate continues to press down. The price of 45-50% molybdenum ore has fallen to US$560/MT. It is expected that the bottom support will gradually increase as the price falls to around US$28,290/M. It is understood that steel mills will continue to suppress prices in the short term, and the Ferromolybdenum market will continue to show pressure. The latest Ferromolybdenum bidding price of Tsingshan is US$28435/MT(cash price), with a quantity of 320 tons.

Recently, the long-term contract price of high-carbon ferrochrome for April 2024 of Beigang New Materials was determined to be US$1375/MT (VAT, EXW), an increase of US$70/MT compared with the previous month.

With the rising price of high-chromium raw materials, the production cost of stainless steel is high and difficult to fall. After the continuous decline of stainless steel prices, the recent loss of steel mills has become more and more obvious. Taking the stainless steel cold-rolled market as an example, the market prices of 304 and 430 are both significantly lower than the cost, and only 201 has a small profit margin.

Some industry insiders said that compared with the same period in previous years, the demand for stainless steel has been seriously insufficient recently, the market transaction has been weak, and the oversupply of stainless steel has made it difficult for the price to change. It is also the reason why most steel mills are hesitant to price the procurement of high-chromium raw materials in April.

Judging from the recent market feedback, the total output of stainless steel in April is not expected to decrease significantly, or it will be mainly reduced slightly. There is still demand for high-chromium raw materials. In view of the recent increase in the output of high-chromium, the price of high-chromium is expected to remain stable and weak in the short term.

MACRO|| China will continue to regulate steel production in 2024.

This was announced by the National Development and Reform Commission (NDRC), without specifying the timing or scope of the restrictions, Reuters reports.

According to a statement by the NDRC, the regulator, together with the National Bureau of Statistics, the Ministries of Industry and Information Technology, Ecology and Environmental Protection, and Emergency Management, will work with relevant parties to manage production this year.

The departments will work to promote the development of the steel industry with a focus on energy conservation and carbon reduction, and will collect equipment information from steel producers across the country.

In 2021 and 2022, Beijing ordered the steel sector not to increase production to limit carbon emissions in one of the most polluting industries. This resulted in a 3% y/y drop in production in 2021 and a 2.1% y/y drop in 2022, which contributed to a decline in iron ore imports.

Despite the fact that the Chinese authorities have not made any public statement on the maximum level of steel production in 2023, last year’s production volumes remained unchanged compared to the previous year, amounting to 1.02 billion tons.

Earlier, 15 major producers of long products in China called on the authorities to take measures to limit the output of their respective products amid falling steel prices. Prices for long products have fallen sharply amid continued weakness in China’s real estate and infrastructure sectors, which has led to losses and reduced margins for local producers of the relevant products.

Earlier, the China Iron and Steel Association (CISA) called on steel mills to reduce production intensity to meet customer needs and balance supply and demand. The steelmakers were asked to take into account steel sales and business performance.

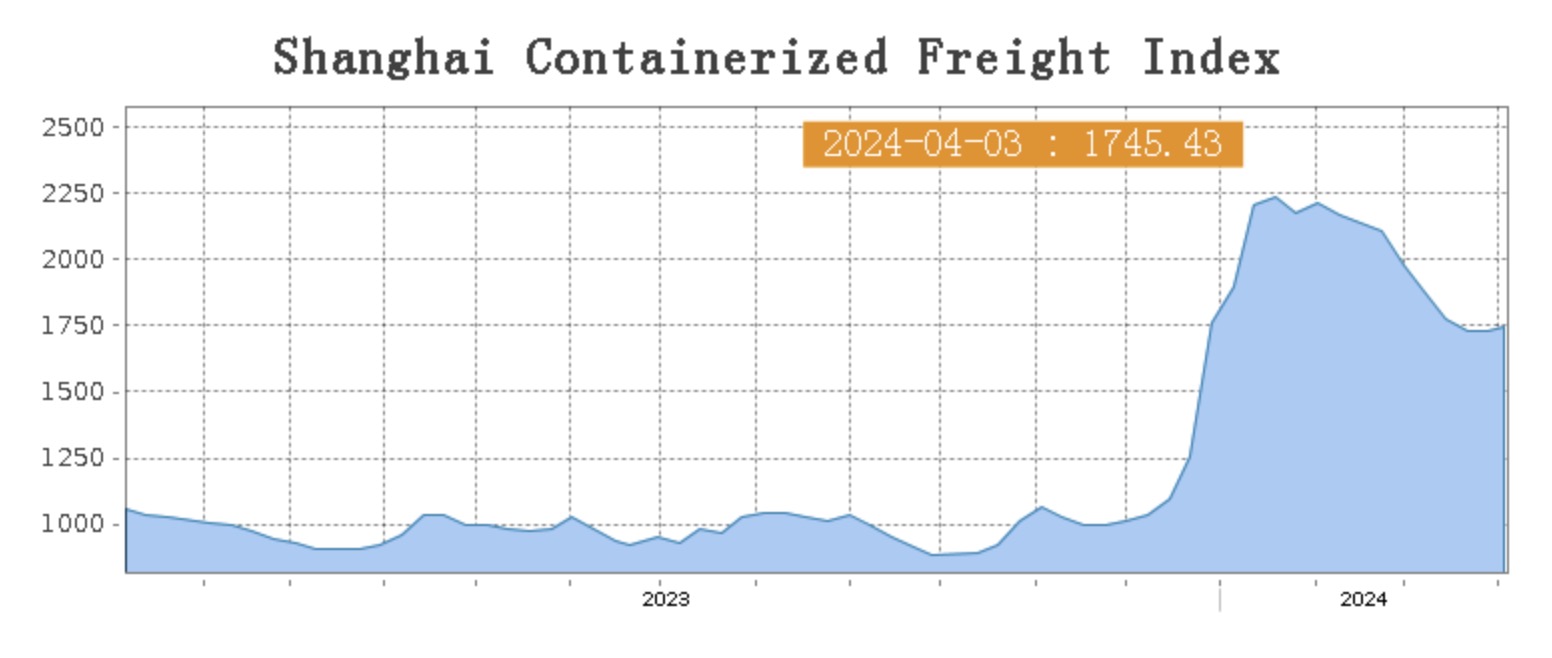

Sea Freight|| Market Remains Relatively Stable.

Chinese economy remains positive. The Caixin China General Manufacturing PMI (S&P Global) has developed positively for the fifth month in a row and the Caixin has risen to its highest level in ten months at 51.1 points. This indicates a further recovery in the Chinese economy, which can also look forward to a significant increase in orders from abroad.

China’s Containerized Freight market continued to be interrupted by the regional fluctuation. On 3rd April, the Shanghai Containerized Freight Index rose by 0.8% to 1745.43.

Europe/ Mediterranean:

On 3rd April, the the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1997/TEU, which rose by 0.2%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3014/TEU, which increased by 0.2%.

North America:

High inflation rate and high interest rates continued to interrupt the recovery plan of freight rate, but the new contract season in North America could shortly boost the freight rate.

On 3rd April, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$3308/FEU and US$4359/FEU, reporting a 2.9% and 2.0% fall accordingly.

The Persian Gulf and the Red Sea:

On 3rd April, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf jumped by 11.6% from last week's posted US$1894/TEU.

Australia/ New Zealand:

On 3rd April, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$701/TEU, a 11.7% fall from the previous week.

South America:

On 3rd April, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$3082/TEU, an 10.5% growth from the previous week.