The stainless steel market lost control when the regulation on price went loose. Similar to the chaotic world currently. Only prices of the stainless steel 400 series maintained steadily last week. 200 and 300 series both headed down because of higher inventory and a policy change. The market was shaken last Wednesday morning when news broke that Tsingshan would be relaxing price controls on cold-rolled 201J2 products. This led to a wave of price cuts by traders, and downstream customers adopted a wait-and-see attitude, resulting in sluggish trading and weak market sentiment. Inventory was also climbing up, but the market price seesawed because of the strong ore costs. It is predicted that in the short term, the stainless steel prices will remain weak, but there has no much space to rock down. Based on China's export volume in January and February, the global stainless steel demand looks to be fixed. The total exports from January to February were 675,000 tons, increased by 9.25% compared with the same period last year. And stainless steel tube and profile products export increased by over 30% YoY. If you are interested in the specific prices, trends and relative dynamics of the industry, please roll up to read our Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,130 | -18 | -0.90% |

| Foshan | 2,170 | -18 | -0.88% | ||

| Hongwang | Wuxi | 2,040 | -11 | -0.58% | |

| Foshan | 2,040 | 0 | 0.00% | ||

| 304/NO.1 | ESS | Wuxi | 1,960 | -17 | -0.90% |

| Foshan | 1,970 | -13 | -0.68% | ||

| 316L/2B | TISCO | Wuxi | 3,605 | -62 | -1.74% |

| Foshan | 3,675 | -69 | -1.90% | ||

| 316L/NO.1 | ESS | Wuxi | 3,445 | -59 | -1.75% |

| Foshan | 3,495 | -56 | -1.64% | ||

| 201J1/2B | Hongwang | Wuxi | 1,390 | -22 | -1.73% |

| Foshan | 1,385 | -21 | -1.63% | ||

| J5/2B | Hongwang | Wuxi | 1,300 | -22 | -1.86% |

| Foshan | 1,395 | -25 | -2.09% | ||

| 430/2B | TISCO | Wuxi | 1,250 | -10 | -0.86% |

| Foshan | 1,250 | -7 | -0.61% |

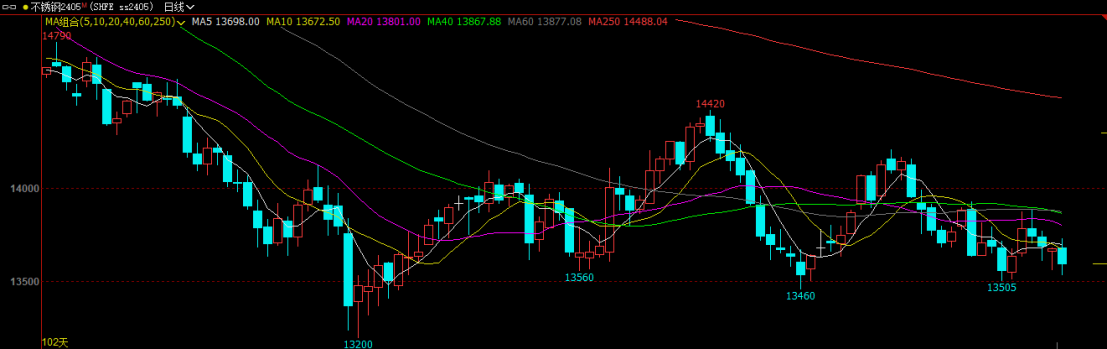

TREND|| Downward Spiral Amidst Policy Changes and High Inventory.

The stainless steel market experienced a turbulent week with prices for most grades falling, except for 400 series which held steady. Market sentiment remained weak due to a combination of factors, including policy changes by major producers, high inventory levels, and subdued demand from downstream sectors.

300 Series: Prices Slide on Weak Demand and High Inventory.

Prices for stainless steel 304 fluctuated during the week but ultimately ended lower. By Friday, the mainstream base price for cold-rolled 304 in Wuxi had fallen by US$7/MT to US$1985/MT, and hot-rolled prices dropped by US$14/MT to US$1950/MT.

Initially, prices rose at the beginning of last week due to the higher bidding price for high-chromium in April by Tsingshan, a major producer. However, as nickel prices reversed course and fell, coupled with high spot price and warehouse inventory levels, market sentiment turned bearish.

200 Series: Prices Drop AfterTsingshan Abandons Price Controls.

Prices for stainless steel 201 saw a significant decline last week. By Friday, the mainstream base price for cold-rolled 201J1 in Wuxi had fallen by US$42/MT to US$1335/MT, cold-rolled J2/J5 prices dropped by US$28 to US$1250/MT, while hot-rolled prices remained unchanged at US$1335/MT.

The market was shaken on Wednesday morning when news broke that Tsingshan would be relaxing price controls on cold-rolled 201J2 products. This led to a wave of price cuts by traders, and downstream customers adopted a wait-and-see attitude, resulting in sluggish trading and weak market sentiment.

400 Series: Can 430 Prices Hold Steady Amidst Rising Inventory?

Guidance prices for 430 cold-rolled stainless steel from TISCO and JISCO increased by US$7/MT to US$1470/MT and US$1590/MT, respectively. However, in the Wuxi market, mainstream prices for cold-rolled 430 products fell by US$7/MT to US$1250/MT to US$1255/MT, while hot-rolled prices remained unchanged at US$1135/MT.

It is understood that the ability of 430 prices to remain stable remains uncertain as inventory levels continue to rise.

Looking Ahead: Challenges Persist for Stainless Steel Market.

The stainless steel market faces a number of challenges in the near future, including high inventory levels, weak demand from downstream sectors, and volatile raw material prices. Market participants will be closely monitoring policy changes from major producers and economic developments to gauge the future direction of the market.

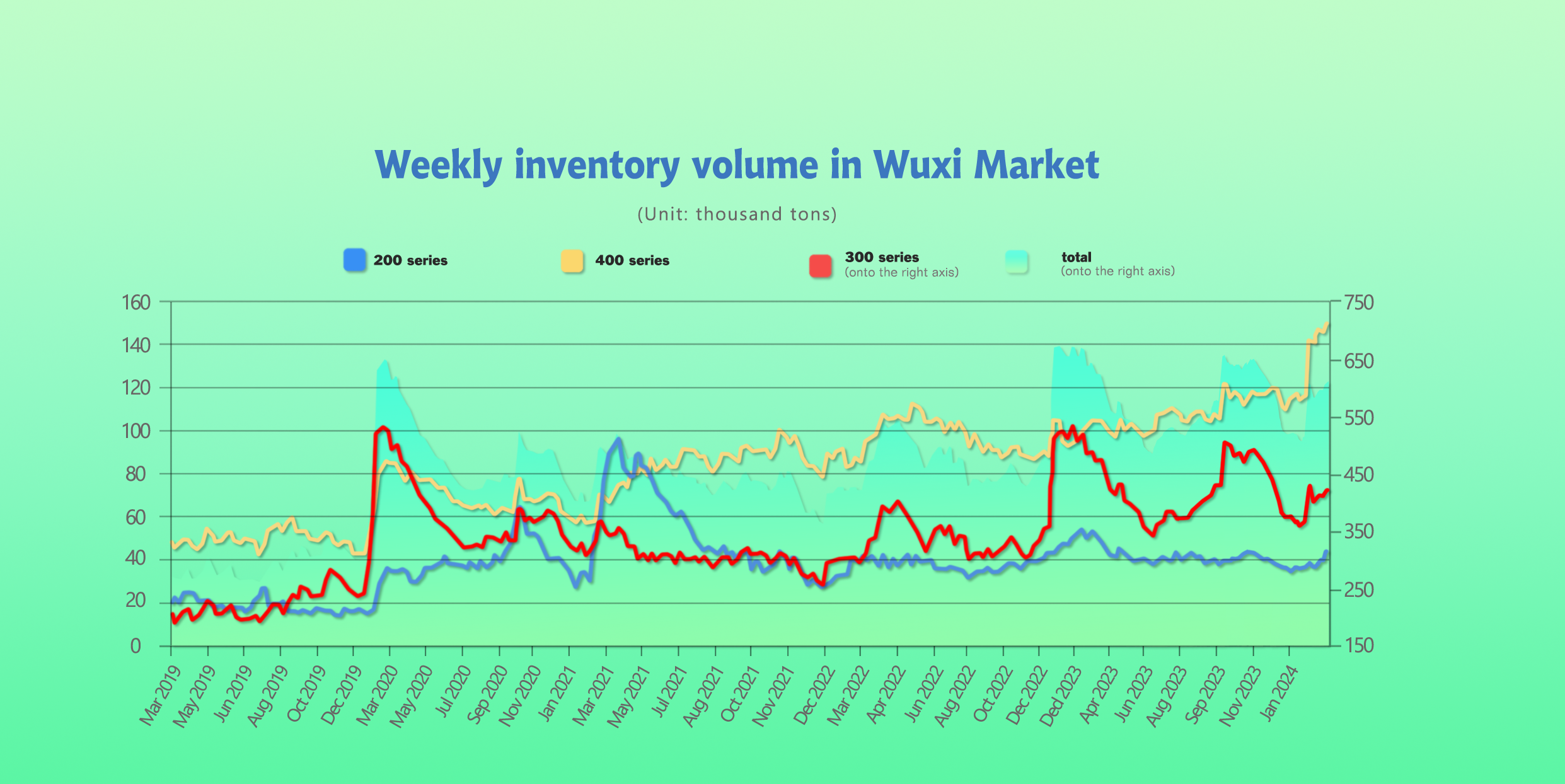

INVENTORY|| fourth consecutive growth for 201 inventory.

The total inventory at the Wuxi sample warehouse lifted by 2,596 tons to 519,546 tons (as of 21st March).

the breakdown is as followed:

200 series: 3,675 tons up to 43,076 tons,

300 Series: 9,331 tons up to 417,774 tons,

400 series: 4,002 tons up to 148,961 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| March 14th | 39,401 | 408,443 | 144,959 | 592,803 |

| March 21st | 43,076 | 417,774 | 148,961 | 609,811 |

| Difference | 3,675 | 9,331 | 4,002 | 17,008 |

300 Series: Inventory Levels Continue to Rise.

Both cold-rolled and hot-rolled inventories increased, with hot-rolled inventory showing a significant increase. Arrivals of hot-rolled resources have been increasing recently, leading to a gradual increase in hot-rolled inventory during the week. Market demand is currently relatively weak, and steel mill production capacity is gradually being released. Spot and futures prices are fluctuating and exploring the bottom. It is expected that inventory will continue to accumulate next week.

200 Series: 201 Inventory Increases for the Fourth Consecutive Week.

Market prices have continued to fall, and downstream customers have been purchasing on demand with a "buy on rise, not on fall" mentality. Arrivals from various steel mills have increased steadily, and insufficient market demand has led to inventory accumulation.

400 Series: Inventory Continues to Accumulate.

There were arrivals from steel mills during the week, but market shipments were poor, and steel mills' pre-positioned inventory accumulated.

Raw Material|| Prices to Remain Stable in the Short Term.

Nickel prices surge and fall back.

Last week, Shanghai nickel prices surged and fell back, with the lowest price falling to US$19240/MT. As of Thursday's close, the main SHFe nickel contract closed at US$19605/MT, down US$ from last Thursday, a decrease of 1.64%.

According to customs data, China's total nickel pig iron import volume in January-February 2024 was 1.6257 million tons, a year-on-year increase of 53.07%. Among them, the import volume of nickel pig iron from Indonesia was 71.5636 million tons, a year-on-year increase of 63.9%.

At present, the import volume of nickel pig iron remains high, and the domestic supply of nickel pig iron is still in oversupply. Stainless steel prices are running weak, and steel mills are losing money, putting pressure on the raw material end.

According to market news, Bambang Suswantono, Acting Director General of Minerals and Coal at the Indonesian Ministry of Energy and Mineral Resources, said at a parliamentary meeting on Tuesday that the country plans to build seven nickel smelters this year, which has led to the surge and fall of nickel prices. It is expected that nickel pig iron prices will remain weak and stable in the short term.

High-chromium prices rise and supply increases.

The mainstream EXW price of high-chromium is US$1350 - US$1375/50 reference ton, up US$28 from last week.

While high-chromium prices have risen, coke prices have fallen, and the loss-making situation of enterprises has improved significantly. The production enthusiasm of factories has increased, and high-chromium output is expected to increase significantly.

In the future, the supply of high-chromium will increase, and the upward momentum of high-chromium prices will weaken in the later period. However, due to the fact that the steel tendering of major steel mills in April is not yet over, and there is still demand for downstream procurement, high-chromium prices will mostly remain stable in the short term.

Summary|| Stainless Steel Prices to Fluctuate Limitedly in the Short Term.

Overall, the stainless steel market is facing multiple challenges in the short term, including high inventory levels, weak demand from downstream sectors, and volatile raw material prices.

300 series: Wide range of fluctuations below the cost line.

At present, the inventory and warehouse pressure in the spot market is high, the approval process of nickel mines is accelerating, and the prices of nickel and nickel pig iron are showing signs of loosening. It is expected that the spot price of 304 cold rolled will fluctuate widely below the cost line in the short term.

200 series: Weak shock

The increase in steel mill production plans, inventory accumulation, and Tsingshan's relaxation of price control measures have all had a negative impact on the trend of 201. In the absence of a significant improvement in the market, it is expected that the price of 201 stainless steel will still mainly fluctuate weakly in the short term.

400 series: Weak and stable operation.

The long-term contract purchase price of high-carbon ferrochrome for Tsingshan Group in April was US$1375/50 reference ton (EXW price, VAT included), a significant increase of US$70/50reference ton from the previous month. The cost of steel mills has further increased, and the raw material cost support is strong. The willingness of steel mills to increase prices is relatively strong.

In view of the current high inventory level, downstream customers are purchasing on demand. It is expected that the price of 430 will remain weak and stable in the short term.

Chinese Stainless Steel Imports and Exports Both Increased in January-February.

Imports

China's stainless steel imports in January 2024 were 233,000 tons, down 13.12% from the previous month but up 54.92% year-on-year. In February 2024, China's stainless steel imports were 222,400 tons, down 4.55% from the previous month but up 18.77% year-on-year. The cumulative imports from January to February were 455,400 tons, an increase of 34.88% compared with the same period last year.

Exports

China's stainless steel exports in January 2024 were 417,000 tons, up 24.29% from the previous month and 14.28% year-on-year. In February 2024, China's stainless steel exports were 258,000 tons, down 38.13% from the previous month but up 2.01% year-on-year. The cumulative exports from January to February were 675,000 tons, an increase of 9.25% compared with the same period last year.

Net Exports

China's net exports of stainless steel were 184,000 tons in January, up 173.4% from the previous month but down 14.22% year-on-year. In February, China's net exports of stainless steel were 35,600 tons, down 80.65% from the previous month and 45.78% year-on-year. The cumulative net exports from January to February were 219,600 tons, a decrease of 21.62% compared with the net exports of the same period last year.

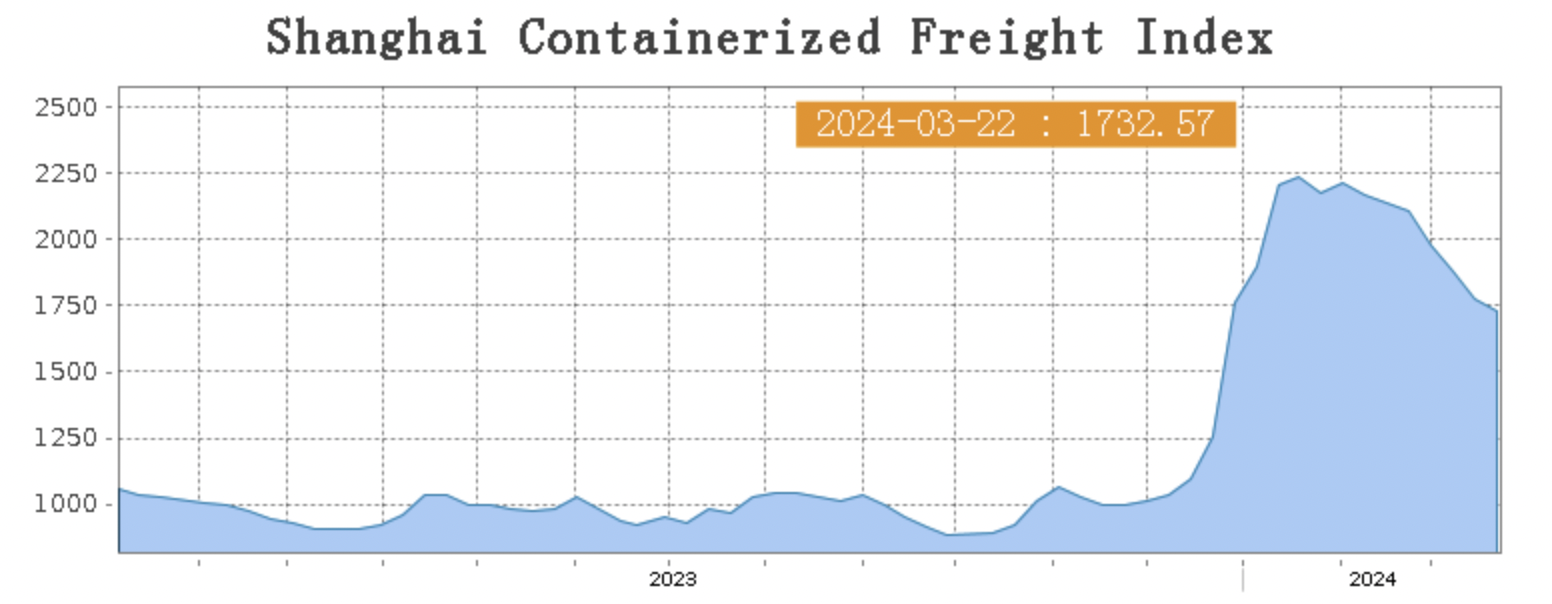

Sea Freight|| Shipping Market Holds Steady, Freight Rates Drop.

China’s Containerized Freight market continued to be interrupted by the regional fluctuation. On 12th January, the Shanghai Containerized Freight Index fell by 2.3% to 1732.57.

Europe/ Mediterranean:

With the implementation of measures such as airlines increasing the number of flights, the impact of the previous geopolitical situation on the freight line has gradually subsided, and the European shipping market prices have continued to fall. However, with the gradual stabilization of market cargo volume, the overall supply and demand relationship remains balanced.

On 22nd March, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1943/TEU, which dropped by 1.4%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$2887/TEU, which decreased by 3.0%

North America:

The freight rate trend of the container shipping market has continued to decline since the beginning of February this year, and the market lacks further impetus for growth. Last week, the loading rate of each flight ranged from 90% to 95%, and some flights were full. In order to improve the loading rate, airlines still mainly rely on price cuts to attract cargo, and the spot booking prices of the freight line continue to fall.

On 22nd March, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$3621/FEU and US$4842/FEU, reporting a 4.1% and 7.8% spike accordingly.

The Persian Gulf and the Red Sea:

As the destination market has entered Ramadan, and considering the transportation cycle, some post-festival demand has already started in the market. On 22nd March, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf rose by 6.6% from last week's posted US$1503/TEU.

Australia/ New Zealand:

On 22nd March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$822/TEU, a 9.4% slide from the previous week.

South America:

On 22nd March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2550/TEU, an 0.8% growth from the previous week.