Stainless Insights in China from December 23rd to December 27th.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,020 | 0 | 0.00% |

| Foshan | 2,060 | 0 | 0.00% | ||

| Hongwang | Wuxi | 1,915 | -4 | -0.23% | |

| Foshan | 1,940 | -6 | -0.30% | ||

| 304/NO.1 | ESS | Wuxi | 1,845 | 0 | 0.00% |

| Foshan | 1,865 | -6 | -0.32% | ||

| 316L/2B | TISCO | Wuxi | 3,410 | -6 | -0.17% |

| Foshan | 3,480 | -22 | -0.66% | ||

| 316L/NO.1 | ESS | Wuxi | 3,245 | -6 | -0.18% |

| Foshan | 3,260 | -19 | -0.62% | ||

| 201J1/2B | Hongwang | Wuxi | 1,220 | -12 | -1.11% |

| Foshan | 1,185 | -11 | -1.02% | ||

| J5/2B | Hongwang | Wuxi | 1,090 | -11 | -1.12% |

| Foshan | 1,090 | -11 | -1.12% | ||

| 430/2B | TISCO | Wuxi | 1,130 | 0 | 0.00% |

| Foshan | 1,130 | -6 | -0.54% |

TREND || Long and Short Positions Contend, Stainless Steel Fluctuates.

Last week, Wuxi market stainless steel spot prices rebounded slightly. On the macro front, expectations for a US Federal Reserve interest rate cut within 25 years cooled down, while domestic proactive fiscal policies and loose monetary policies boosted market sentiment. The overall macro picture is intertwined with both long and short positions. As of last Friday, the main stainless steel contract price increased by US$5.5/MT from last week to US$1910/MT.

300 Series: Futures and Spot Prices Rebound Simultaneously.

Last week, 304 spot market prices rebounded slightly. As of Friday, the mainstream base price of cold-rolled four-foot 304 in Wuxi area was reported at US$1875/MT, and the hot-rolled price was reported at US$1850/MT, both up US$7/MT from last Friday. After rebounding last week, the market maintained range-bound fluctuations. At the beginning of the week, futures prices rebounded from low levels, coupled with the release of positive statements by the Ministry of Finance, which improved market sentiment. The market rose above US$1920/MT, and the simultaneous rebound of futures and spot prices drove an increase in market restocking demand. Downstream buyers entered the market collectively for purchases, and transactions improved, effectively reducing low-priced resources. In the second half of the week, prices remained stable, market willingness to maintain prices increased, acceptance of high-priced resources was insufficient, downstream merchants maintained just-needed purchases, and market arrivals increased during the week, coupled with the inflow of cancelled warehouse warrants into the market, resulting in a slight increase in inventory.

200 Series: Prices Run Weakly.

Last week, 201 prices mainly ran weakly, with cold-rolled 201J2 reported at US$1060/MT; cold-rolled 201J1 reported at US$1185/MT, and hot-rolled 201J1 quoted at US$1170/MT. During the week, the prices of cold-rolled 201J/J2 and hot-rolled 201J1 were all lowered, traders offered discounts for shipments, and low-priced resources emerged in the market; however, the consumption side lacked confidence in the future market, mostly held orders and waited, and purchases were still mainly based on immediate needs. The overall transaction atmosphere was relatively quiet, and inventory continued to accumulate.

400 Series: Hot-Rolled Prices Weaken.

Last week, 430 prices ran weakly and stably. As of Friday, the Wuxi market cold-rolled 430 was quoted at US$1135/MT, flat compared with last Friday's quotation; the state-owned hot-rolled 430 was quoted at around US$1065/MT, down US$14/MT from last Friday's quotation.

INVENTORY || Weak Supply and Demand, Inventory Accumulates 2.4 Thousand Ton.

The total inventory at the Wuxi sample warehouse up by 2,371 tons to 572,060 tons (as of 26th December).

The breakdown is as followed:

200 series: 487 tons up to 52,500 tons,

300 Series: 3,983 tons up to 398,947 tons,

400 series: 2,099 tons down to 120,613 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Dec 19th | 52,013 | 394,964 | 122,712 | 569,689 |

| Dec 26th | 52,500 | 398,947 | 120,613 | 572,060 |

| Difference | 487 | 3,983 | -2,099 | 2,371 |

300 Series: Accelerated Digestion of Warehouse Warrants, Slight Increase in Inventory.

Last week, Wuxi market's 300 series inventory accumulated 0.40 million tons (cold-rolled accumulated 0.28 million tons, hot-rolled decreased 0.12 million tons) to 39.90 million tons. 1.3 million tons of futures warehouse warrants expired, and the cancelled warehouse warrants were converted into spot goods for digestion, and the market's spot resources were replenished, and the spot inventory of 300 series cold and hot rolling slightly increased. It is expected that the subsequent inventory may slightly increase.

200 Series: Weak Market Transactions, Slowed Digestion of Low-Priced Resources.

In this period, the 200 series inventory accumulated 0.05 million tons to 5.25 million tons (of which cold-rolled increased by 0.02 million tons and hot-rolled increased by 0.03 million tons). With the approaching New Year's Day holiday, the hoarding demand of some merchants became prominent, and the inventory slightly accumulated.

400 Series: Continued Market Shortages, Third Consecutive Week of Inventory Decline.

Last week, the arrivals of JISCO’s cold-rolled resources continued to decrease, and the market's available resources were scarce, accelerating the reduction of cold-rolled inventory.

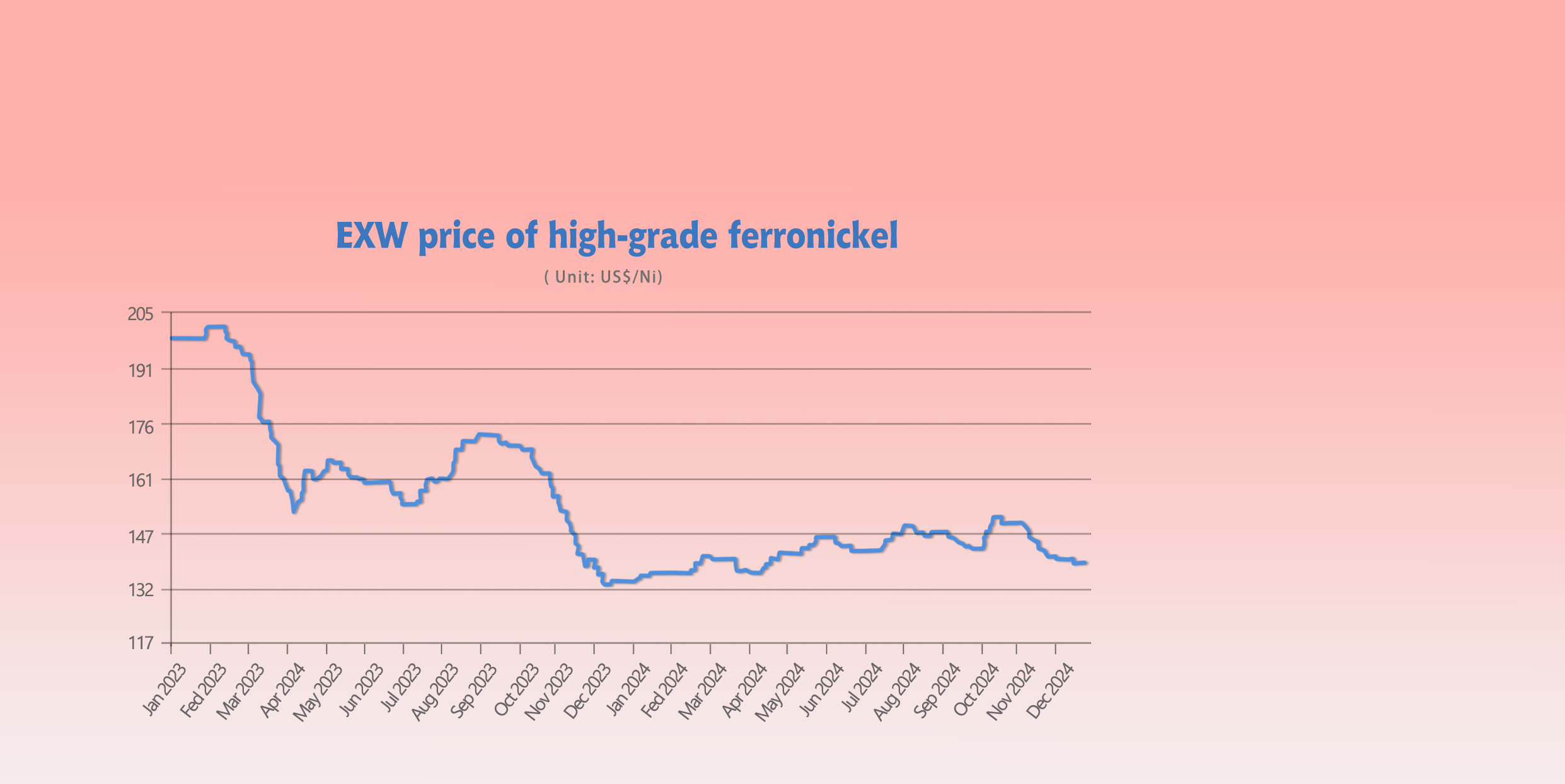

RAW MATERIAL || Sluggish Market Transactions, Nickel Pig Iron Prices Under Pressure.

Last week, the ex-factory price of high-nickel pig iron ran weakly and stably, reporting US$132.3/nickel point as of Thursday, flat compared with last Thursday. Last week, Shanghai Nickel stopped falling and rebounded. As of Thursday's close, the main Shanghai Nickel contract closed at US$17519/MT, up US$506/MT from last Thursday, an increase of 2.98%. Recently, nickel prices have fluctuated between 120,000 and 130,000, with cost support below. Nickel supply has increased, but downstream demand has entered the off-season, and there is insufficient upward momentum. It is expected that nickel prices will maintain fluctuating operation in the short term.

Recently, nickel pig iron prices have been under pressure, and market transactions have been sluggish. Domestic nickel pig iron plants are operating at a loss, and production driving force has weakened. The tight supply of Indonesian nickel ore has eased, and with the commissioning of new capacity, nickel pig iron supply has steadily increased. Domestic nickel pig iron imports increased significantly in November. According to customs data, in November 2024, domestic nickel pig iron imports were 882,700 tons, an increase of 27.77% month-on-month and an increase of 29.83% year-on-year.

Among them, nickel pig iron imports from Indonesia were 855,400 tons, an increase of 27.86% month-on-month and an increase of 35.8% year-on-year. Stainless steel is in the industry's off-season, prices fluctuate at low levels, steel mills are operating at a loss, and raw material purchases have decreased. It is expected that nickel pig iron prices will operate under pressure in the short term.

SUMMARY || Raw Material Side Runs Weakly and Stably, Stainless Steel Prices Fluctuate at Low Levels.

Stainless steel prices fluctuated last week. Macro confidence is insufficient, and domestic policy pronouncements are stimulating, but the implementation process is slow, and stainless steel prices fluctuate at low levels. Last week, stainless steel spot prices fell slightly. Stainless steel is currently still in a state of oversupply, and downstream consumption demand is still mainly for replenishment on demand, and terminal demand is difficult to increase. Subsequent attention should be paid to steel mill production schedules and demand-side performance, the stimulus intensity and implementation of domestic macroeconomic policies. It is expected that stainless steel will fluctuate in the future market.

300 Series: The Ministry of Finance released positive policies to boost market sentiment, and transactions improved during the week. The growth rate of steel mill production schedules has slowed down, and imported resources have declined, and supply-side pressure has eased. Affected by weak off-season demand and long holiday expectations, some steel mills may start production reduction plans one after another. It is expected that the short-term 304 cold-rolled spot price will maintain fluctuations.

200 Series: Fluctuations in the disk surface have made the market cautiously wait and see. After the main 201 quotation was lowered, there was more room for profit in actual transactions. Inventory continues to accumulate, and overall supply is still at a high level. However, as macro sentiment continues to heat up, steel mills have successively released maintenance and production shutdown plans. Under the influence of multiple factors, the short-term 201J2 price may maintain stable operation.

400 Series: Last week, the price of high-chromium at the raw material end followed the steel bidding price and fell slightly, and the cost support of 400 series stainless steel gradually moved down. At present, the shortage of some cold-rolled products in the market has not been alleviated, and traders' willingness to maintain prices has become stronger; in addition, the spot market inventory has been reduced for three consecutive weeks, and the short-term supply and demand contradiction has been alleviated. Under the game between long and short positions, it is expected that the 430 price will run weakly and stably in the short term.

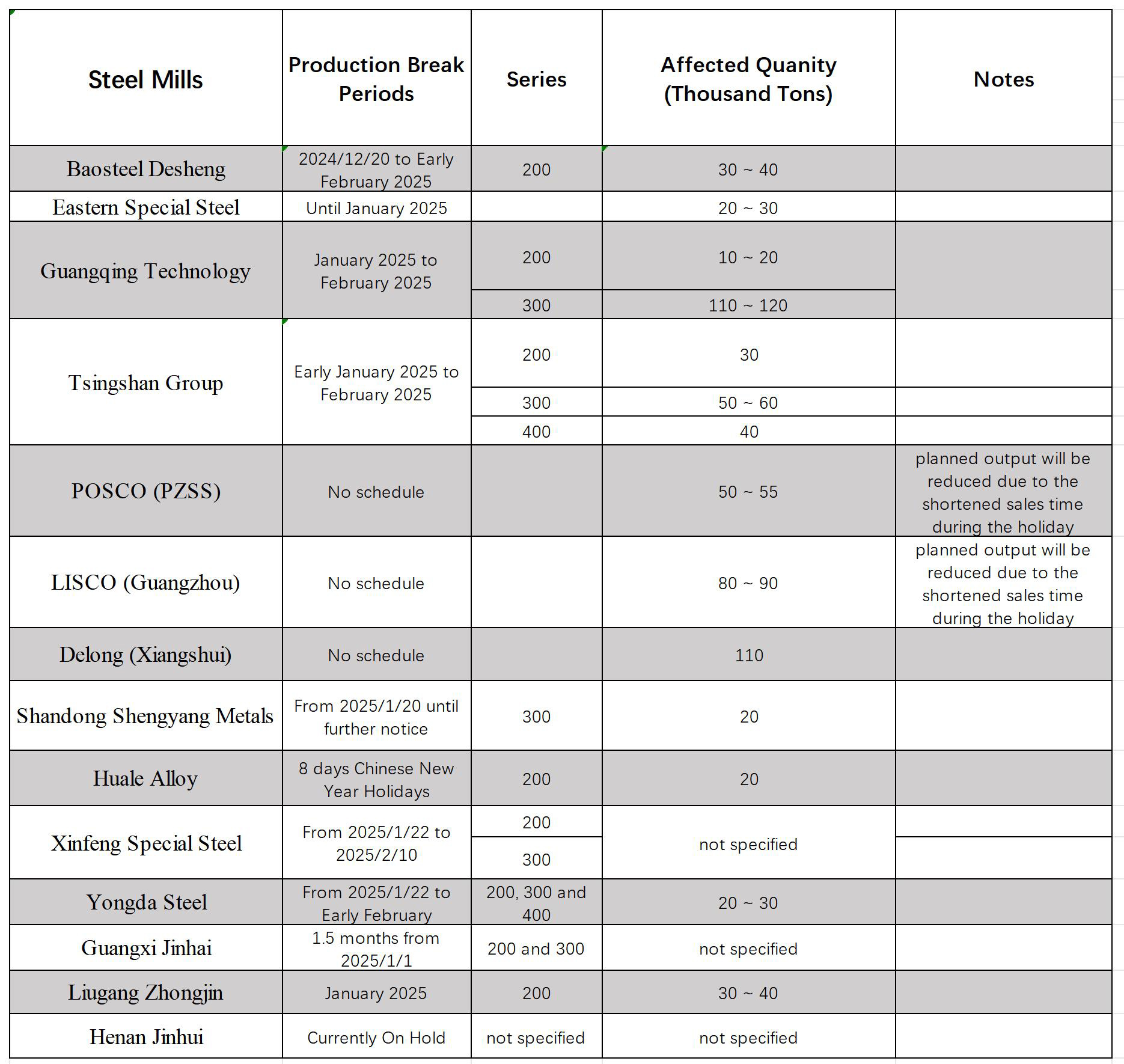

MACRO || Impact of Chinese New Year Shutdowns on Stainless Steel Production.

Chinese New Year of 2025 falls on January 29th, and most of the factories will start the holiday at least one week earlier. So far as we know, according to the data, the stainless steel production volume can be reduced by 705 kilotons during the haul because of the Chinese New Year.

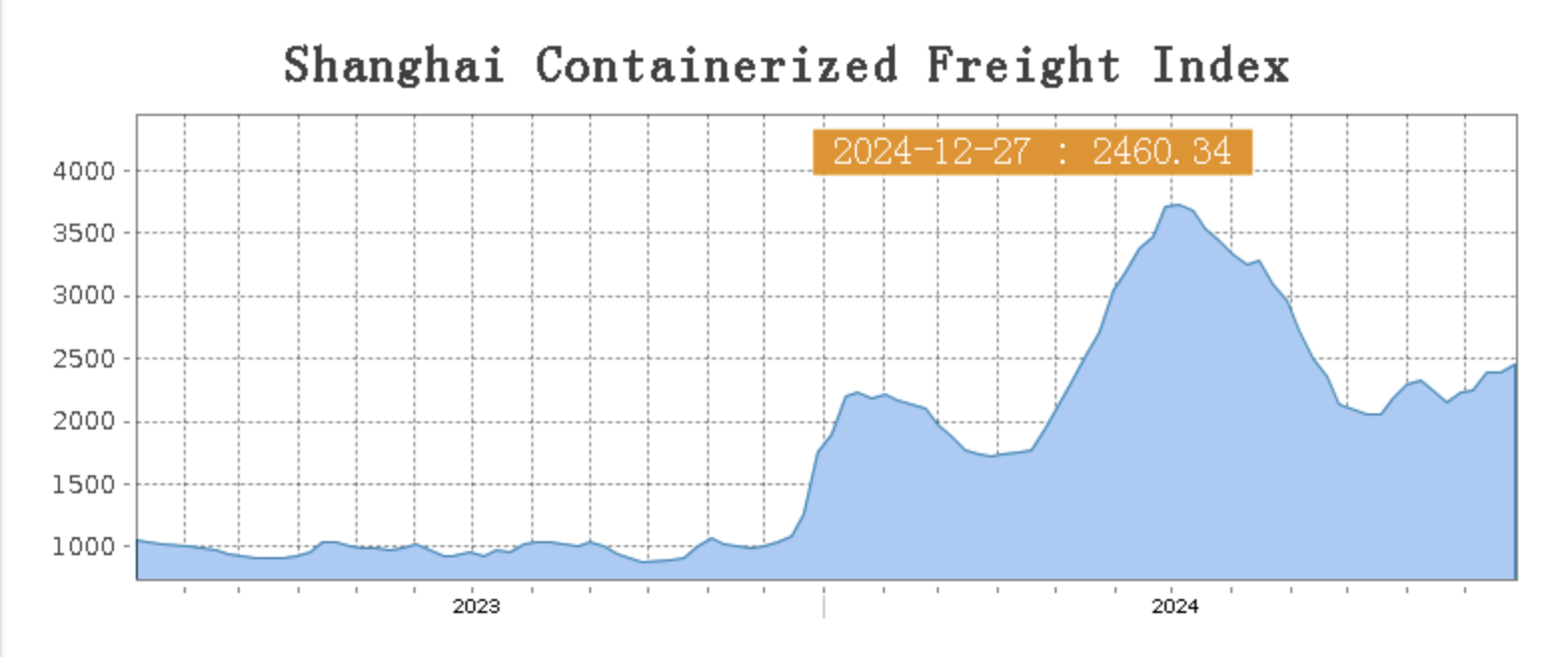

SEA FREIGHT || Divergent Trends in the Shipping Market, Freight Rates Fluctuate.

Last week, the cargo volume in China's export container shipping market was generally stable, and freight rates on some long-haul routes fluctuated, with the composite index rising slightly.

On 27th December, the Shanghai Shipping Exchange released the Shanghai Containerized Freight Index (SCFI) at 2460.34 points, up 2.9% from the previous week.

Europe/ Mediterranean:

On 27th December, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2962TEU, which increased by 0.6%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3780/TEU, which rose by 1.3%.

North America:

There are market expectations of a strike at US ports, and freight rates have fluctuated upwards to some extent from time to time. However, the market has not observed the support of actual cargo volume, and the subsequent trend needs further observation.

On 27th December, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$4581/FEU and US$6074/FEU, both reporting a 9.1% and 7.7% growth accordingly.

The Persian Gulf and the Red Sea:

On the Persian Gulf route, the ongoing local tensions continued to support the transportation market, and spot market booking prices continued to rise.

On 27th December, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 1% from last week's posted US$1444/TEU.

Australia/ New Zealand:

On 27th December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1952/TEU, an 8.1% increase from the previous week.

South America:

On 27th December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$5468/TEU, an 2.2% up from the previous week.