Stainless Insights in China from December 16th to December 20th.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,020 | -1 | -0.07% |

| Foshan | 2,060 | -1 | -0.07% | ||

| Hongwang | Wuxi | 1,920 | -12 | -0.69% | |

| Foshan | 1,945 | -3 | -0.15% | ||

| 304/NO.1 | ESS | Wuxi | 1,845 | -1 | -0.08% |

| Foshan | 1,870 | -1 | -0.08% | ||

| 316L/2B | TISCO | Wuxi | 3,415 | -22 | -0.67% |

| Foshan | 3,505 | -36 | -1.06% | ||

| 316L/NO.1 | ESS | Wuxi | 3,250 | -22 | -0.70% |

| Foshan | 3,280 | -36 | -1.13% | ||

| 201J1/2B | Hongwang | Wuxi | 1,235 | 0 | 0.00% |

| Foshan | 1,200 | -1 | -0.13% | ||

| J5/2B | Hongwang | Wuxi | 1,100 | -1 | -0.14% |

| Foshan | 1,100 | -1 | -0.14% | ||

| 430/2B | TISCO | Wuxi | 1,130 | 0 | 0.00% |

| Foshan | 1,135 | -1 | -0.14% |

TREND || Decline in US Interest Rate Cut Expectations Weakens Market Confidence.

Last week, Wuxi market stainless steel spot prices fluctuated and fell, and industry speculation was weak. Stainless steel futures prices continued to decline and hit new lows. Steel mill opening quotations were flat, agents lowered prices for shipments, and actual transactions were not good. The Federal Reserve cut interest rates by 25 basis points, but hawkish remarks led to a decline in subsequent interest rate cut expectations, market sentiment deteriorated, commodity markets were under pressure, downstream merchants' confidence was frustrated, their willingness to purchase was insufficient, most held orders and waited, and inventory slightly accumulated. As of last Friday, the main stainless steel contract price fell by US$24/MT from the previous week to US$1905/MT.

300 Series: Futures and Spot Prices Decline, Weak Transactions Lead to Inventory Accumulation.

Last week, 304 spot market prices showed mixed ups and downs. As of Friday, the mainstream base price of cold-rolled four-foot 304 in Wuxi area was reported at US$1870/MT, down US$20/MT from last Friday; the hot-rolled price was reported at US$1840/MT, down US$7/MT from last Friday. Last week, the market continued to fall and hit new lows, and the basis difference between futures and spot prices narrowed significantly, resulting in insufficient market confidence. The current off-season demand is weak, market agents mainly lower prices for shipments, but downstream willingness to take goods is poor. The inquiry atmosphere within the week was average, actual transactions were sluggish, and inventory slightly accumulated. On Thursday, the Federal Reserve made hawkish remarks, which are expected to reduce interest rate cut expectations in 2025, and futures and spot prices further declined.

200 Series: Market Looks at Things Pessimistically, Traders Make Concessions for Shipments.

Last week, 201 prices were mainly weakly stable, with cold-rolled 201J2 reported at US$1065/MT base price; cold-rolled 201J1 reported at US$1205/MT, and hot-rolled 201J1 quoted at US$1180/MT.

400 Series: 430 Price Runs Under Pressure.

Last week, 430 prices ran weakly and stably. As of Friday, the Wuxi market cold-rolled 430 was quoted at US$1135/MT, and the state-owned hot-rolled 430 was quoted at around US$1080/MT, both of which were flat compared with last week's quotation. Currently, 430 prices are at a low point for the year, and the shortage of some cold-rolled product specifications in the market has not been alleviated. Downstream replenishment mentality at low prices has increased, and spot market inventory has slightly decreased.

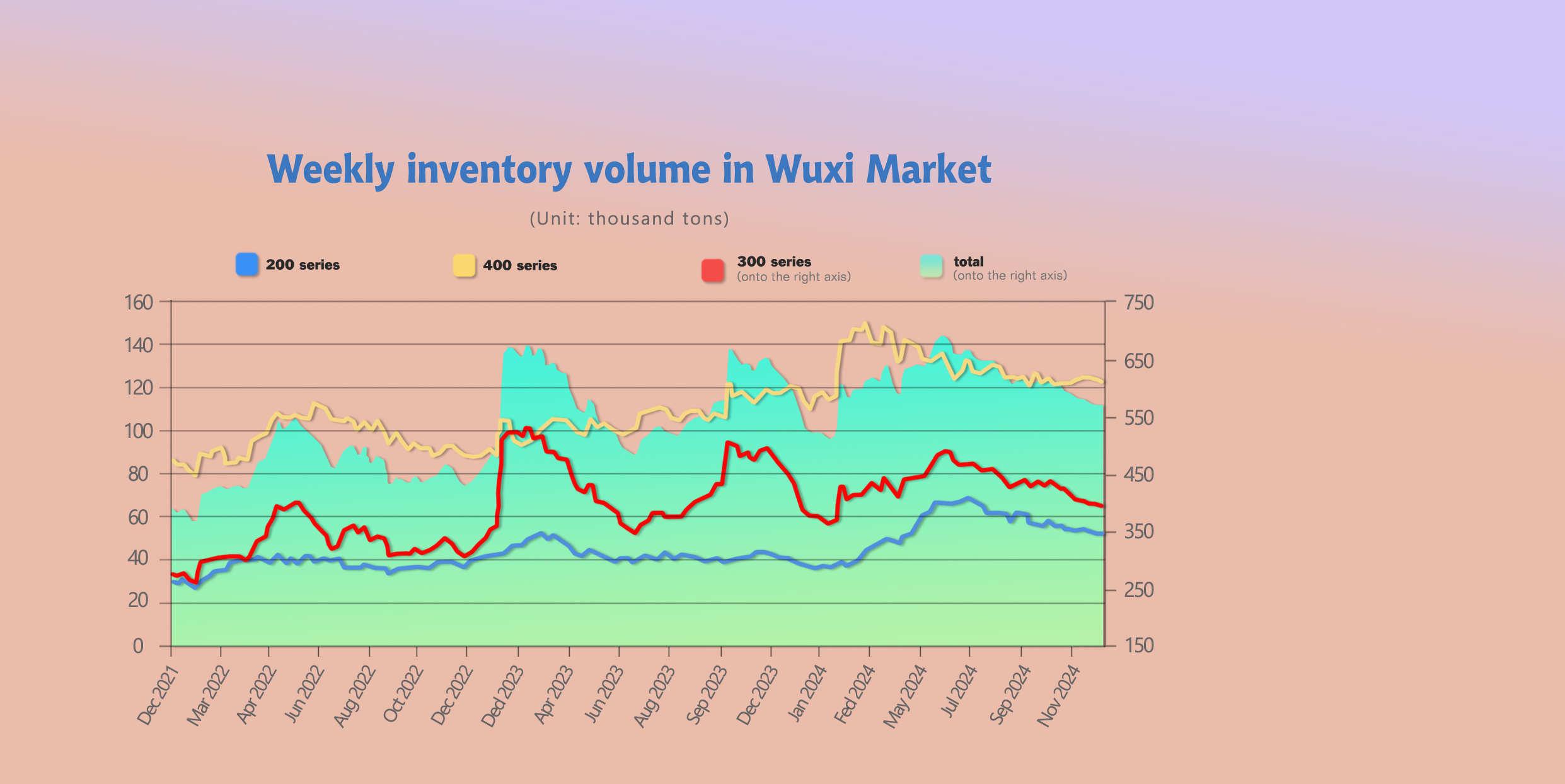

INVENTORY || Slow Inventory Reduction During Off-Season.

The total inventory at the Wuxi sample warehouse up by 1,128 tons to 569,689 tons (as of 19th December).

The breakdown is as followed:

200 series: 27 tons up to 52,013 tons,

300 Series: 2,105 tons up to 394,964 tons,

400 series: 1,004 tons down to 122,712 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Dec 12th | 51,986 | 392,859 | 123,716 | 568,561 |

| Dec 19th | 52,013 | 394,964 | 122,712 | 569,689 |

| Difference | 27 | 2,105 | -1,004 | 1,128 |

300 Series: Uneven Arrivals of Cold and Hot Rolling, Slowdown in Inventory Reduction.

Last week, Some specifications of Tsingshan hot-rolled products were out of stock, and coupled with low valuations, terminal restocking intentions increased, and hot-rolled inventory slightly decreased. During the week, futures and spot prices fell steadily, market panic spread, current demand was weak, and coupled with increased arrivals of Tsingshan cold-rolled products, cold-rolled inventory increased significantly.

200 Series: Supply and Demand Pattern Repairs, Inventory Runs Temporarily Stable.

The 200 series inventory increased slightly. Cold-rolled inventory reduction was mainly for Hongwang resources, and hot-rolled inventory accumulation was mostly for Beigang resources. During the week, cold-rolled 201 traders offered discounts of US$7/MT for shipments, and downstream speculative restocking demand became prominent; 201 hot-rolled traders had a stronger mentality to maintain prices, and inventory slightly accumulated.

400 Series: Reduced Market Arrivals, Slight Inventory Reduction.

Arrivals of JISCO and Steel cold-rolled resources continued to decrease, and the market's available resources were relatively small. The shortage of some cold-rolled specifications in the market has not been alleviated, and coupled with the fact that the current 430 spot price is at a low point for the year, downstream replenishment mentality at low prices has increased, and cold-rolled inventory has significantly decreased.

Currently, supply continues to remain at a high level, and demand is difficult to improve significantly during the traditional consumption off-season. The overall supply and demand fundamentals pressure remains unchanged. It is expected that inventory may slightly accumulate next week. Subsequent focus should be on steel mill production schedules and market transaction conditions.

RAW MATERIAL || Sluggish Market Transactions, Nickel Pig Iron Prices Under Pressure.

Last week, Shanghai Nickel continued to decline. As of Thursday's close, the main Shanghai Nickel contract closed at US$17012, down US$939/MT from last Thursday, a decrease of 5.23%.

Nickel pig iron prices ran weakly, and market transactions were sluggish. Domestic nickel pig iron plants are operating at a loss, and production driving force has weakened. The tight supply of Indonesian nickel ore has eased, and with the commissioning of new capacity, nickel pig iron supply has steadily increased. Recently, stainless steel has fluctuated at low levels, steel mills are operating at a loss, some steel mills have production reduction and maintenance plans, and coupled with the fact that stainless steel is in the industry's off-season, raw material demand has weakened. In the short term, nickel pig iron prices are running under pressure.

SUMMARY || Steel Mills Continue to Exert Pressure on Raw Materials, Spot Market Prices Fluctuate Weakly.

Recently, the bottom support of raw material prices has increased, but steel mills still have procurement plans to exert downward pressure on raw material prices, and steel mill demand in January and February has decreased. Therefore, the raw material market will still maintain a weak pattern in the short term. This has also led to the maintenance of cautious sentiment in the stainless steel market, and pessimistic expectations have not changed. This week, the fluctuation and decline of stainless steel futures dragged down the spot market trend, and spot prices further explored low points. From a cost perspective, the downward space of stainless steel is relatively limited. However, the short-term pattern of weak price fluctuations is difficult to change.

300 Series: Slight Decline on the Cost Side, Steel Mills' Loss-Making Status Continues. Steel mill output continues to increase, but the overall growth rate has slowed down, and supply-side pressure has eased. Affected by weak demand and inventory pressure, some steel mills may start production reduction plans. Under the game between long and short positions, it is expected that the short-term 304 cold-rolled spot price will fluctuate.

200 Series: This week, steel mills lowered the opening price of cold-rolled 201J2, the market sentiment is pessimistic, traders offer discounts for shipments, and transactions are mainly based on low-priced resources. Under the influence of multiple factors such as reduced steel mill production schedules in December and weak raw material support, cold-rolled 201J2 may continue to run weakly and stably.

400 Series: Steel mill production schedules in December are still at a high level, stainless steel supply continues to maintain at a high level, and demand is difficult to improve significantly during the traditional consumption off-season. The overall supply and demand fundamental pressure remains unchanged. The price of high-chromium at the raw material end has stopped falling and stabilized, and cost support still exists. Under the intertwined influence of long and short positions, it is expected that the 430 price will run weakly and stably in the short term.

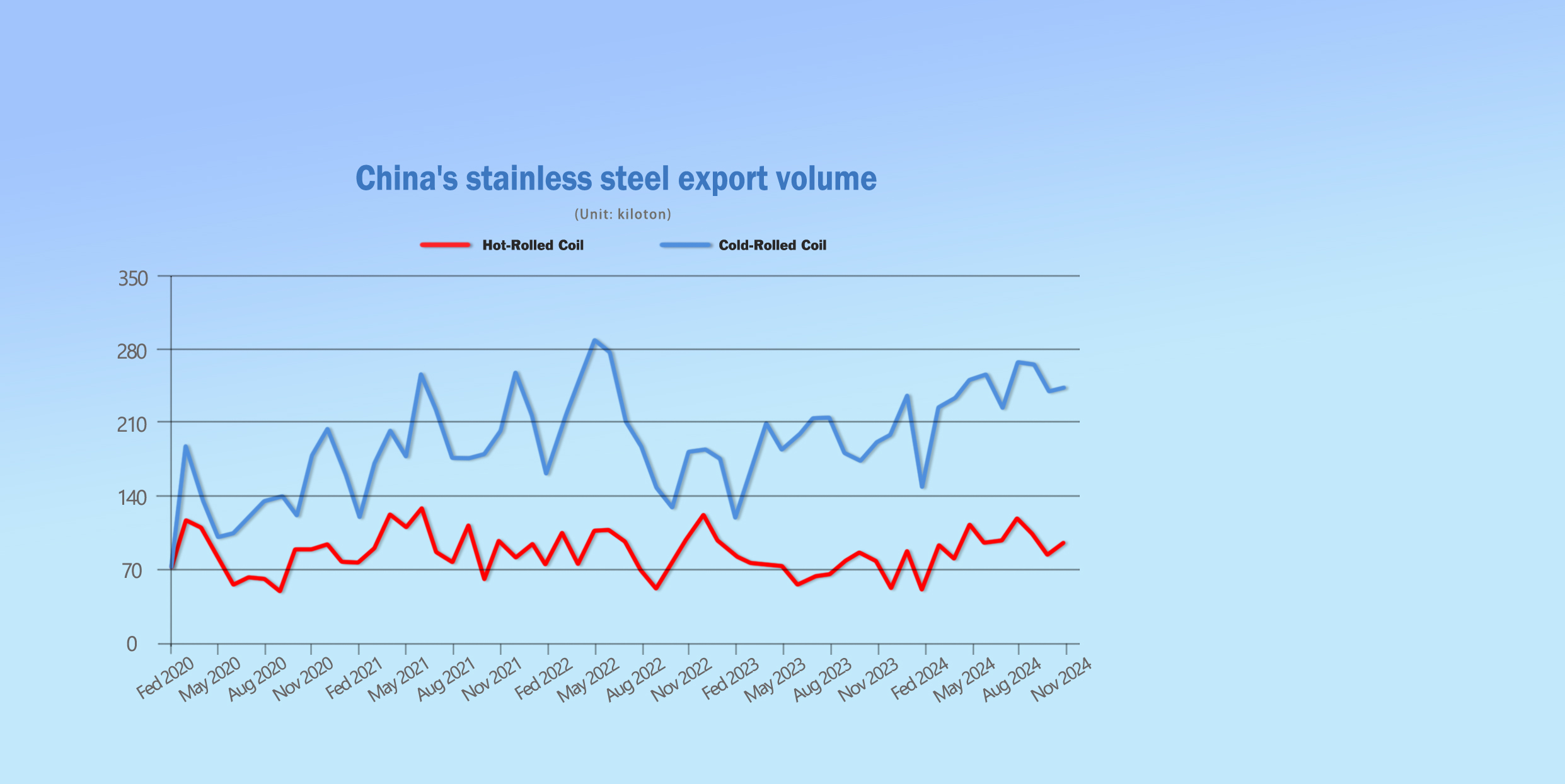

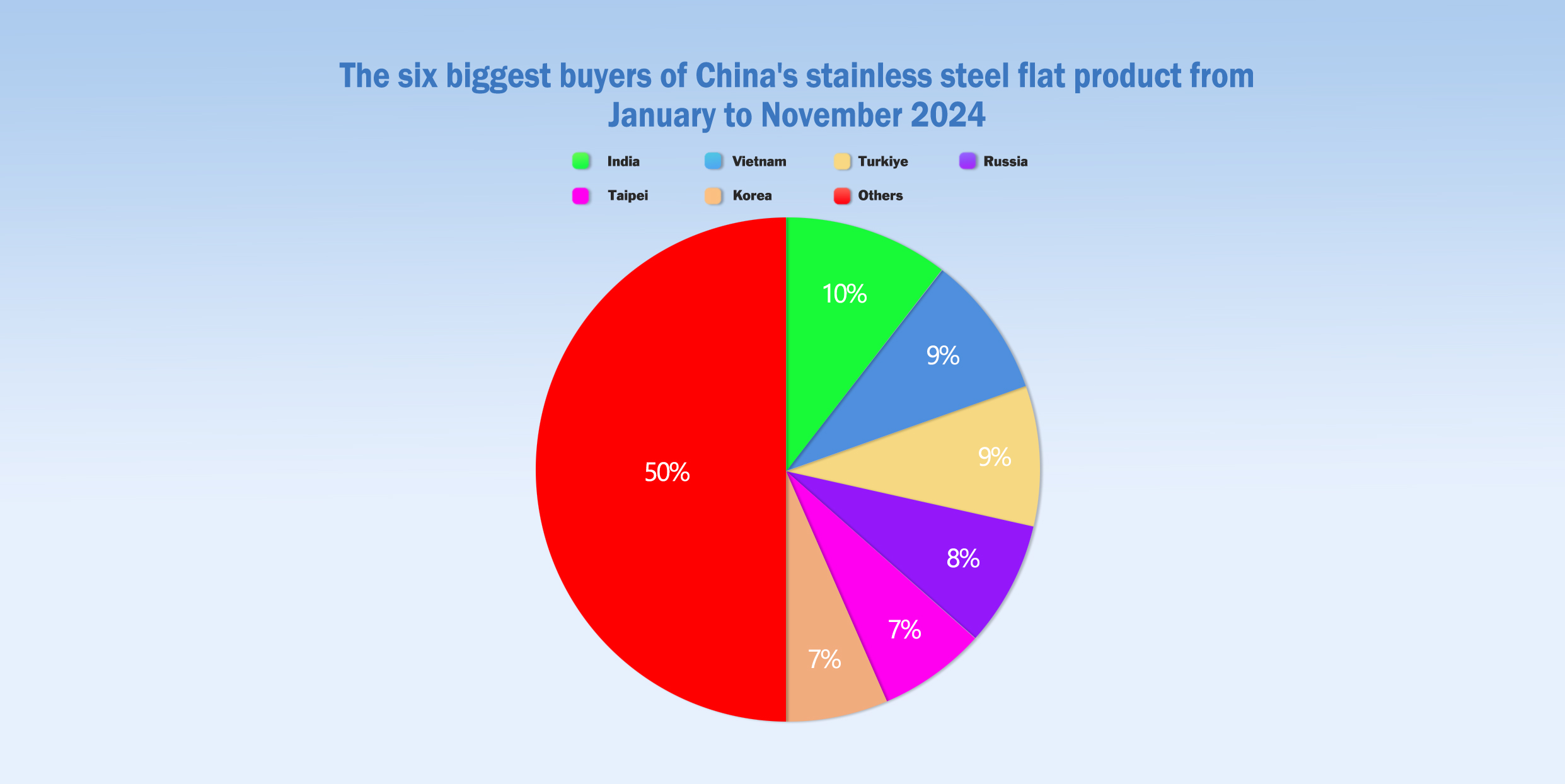

EXPORT|| China’s stainless steel flat product export yoy lifted 26.5%.

In November 2024, China's domestic stainless steel coil (coil width ≥ 600mm + strip width < 600mm) exports were approximately 338,300 tons, an increase of 4.79% month-on-month and an increase of 26.53% year-on-year.

From January to November 2024, the cumulative export volume of domestic stainless steel coil (including coil (width ≥ 600mm) and strip (width < 600mm)) was approximately 3,592,900 tons, an increase of 751,100 tons year-on-year, with a growth rate of 26.43%.

In November 2024, the export volume of stainless steel coil from mainland China to the top ten regions was approximately 206,400 tons, accounting for approximately 61%. From January to November 2024, the cumulative volume was approximately 2,228,200 tons, accounting for approximately 62%.

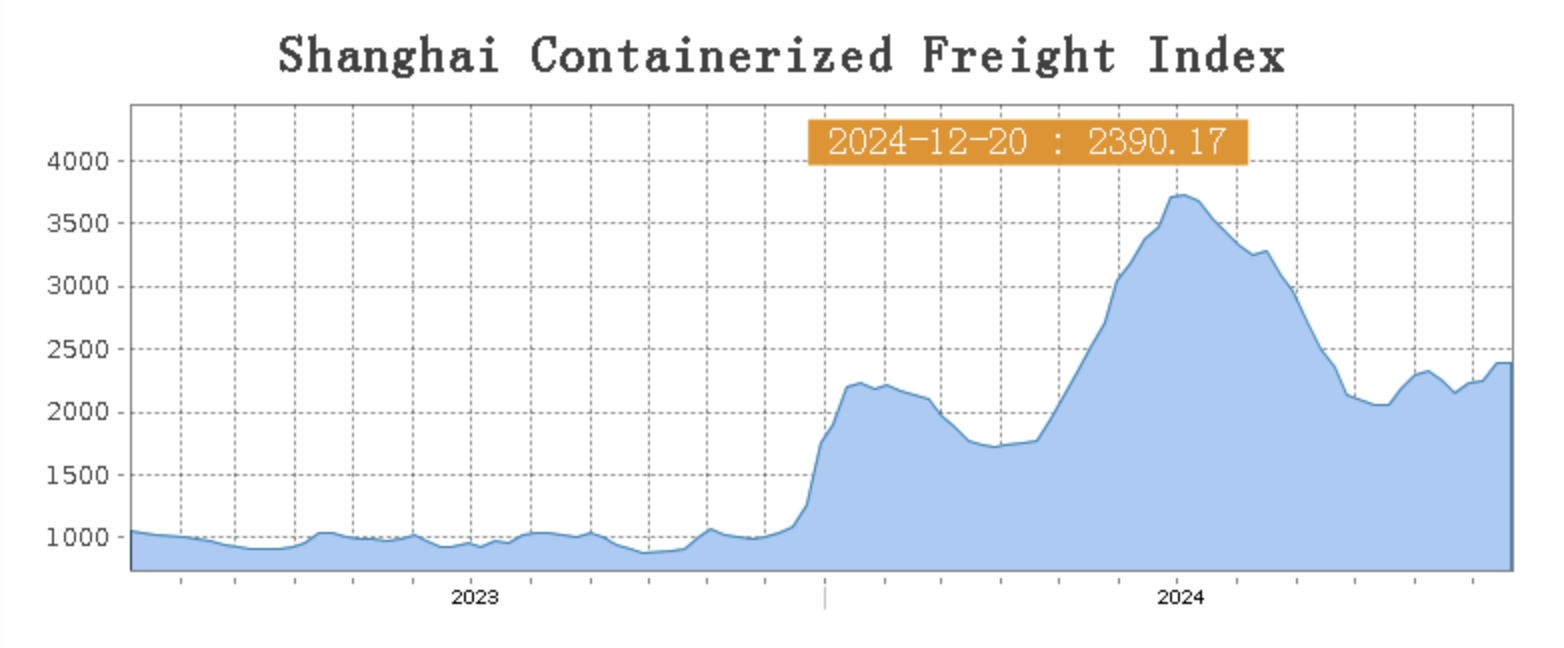

SEA FREIGHT || Divergent Trends in the Shipping Market, Freight Rates Fluctuate.

Last week, China's export container transport market was generally stable, with different routes showing differentiated trends due to their respective supply and demand fundamentals. The composite index rose.

On 20th December, the Shanghai Shipping Exchange released the Shanghai Containerized Freight Index (SCFI) at 2390.17 points, up 0.2% from the previous week.

Europe/ Mediterranean:

On 20th December, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2946TEU, which slid by 0.6%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3733/TEU, which droped by 0.3%.

North America:

On 20th December, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$4198/FEU and US$5642/FEU, both reporting a 4.3% and 2.7% rose accordingly.

The Persian Gulf and the Red Sea:

On the Persian Gulf route, the ongoing local tensions continued to support the transportation market, and spot market booking prices continued to rise.

On 20th December, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 5.2% from last week's posted US$1429/TEU.

Australia/ New Zealand:

On 20th December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1952/TEU, a 1.6% increase from the previous week.

South America:

On 20th December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$5351/TEU, an 4.6% decrease from the previous week.